Summary:

- Apple is a great company with phenomenal cash flow, which it uses for dividends and share buybacks.

- The company’s total shareholder yield is just over 3%, primarily due to buybacks, which use up almost all the company’s cash.

- Despite the company’s strength, slowing growth and a lofty valuation make it a poor investment.

- We’re not surprised Berkshire Hathaway is selling more at this lofty valuation to raise cash.

David Trood

Apple (NASDAQ:AAPL) remains consistently one of the largest publicly traded companies in the world, with a market cap ~$3.4 trillion. One of the company’s largest shareholders, Berkshire Hathaway, announced that it was continuing to sell stock. As we’ll see throughout this article, while Apple remains a cash flow machine, it simply doesn’t have the profits to justify its valuation.

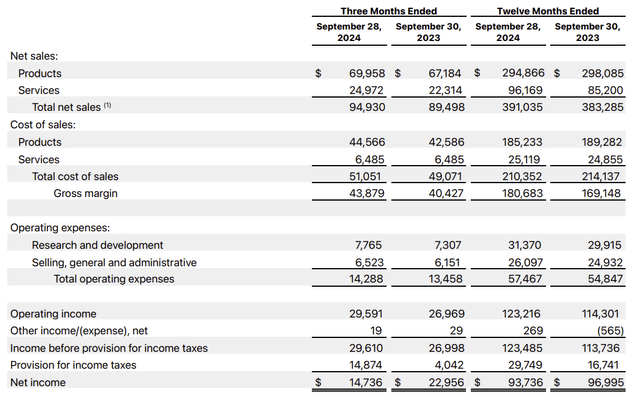

Apple 3Q 2024 Results

Apple has some growth YoY in the quarter; however, it’s clear that the company’s pace of sales growth has slowed down.

The company saw $94.9 billion in net sales, up from $89.5 billion in the prior quarter. The company saw ~6% growth in sales, however, and cost of sales increased by ~4%. That enabled the company’s margins to grow slightly, resulting in ~8% growth in the company’s gross margin. Operating expenses in both R&D and SG&A increased.

At the end of the day, the company saw $29.6 billion in income, pre-income taxes, with an extra high quarterly impact after the company lost regulation and was forced to give Ireland an extra $14 billion. That resulted in slightly lower net-income, but normalizing it, the company’s net income would have been ~$10 billion higher.

That is ~7% YoY net income growth.

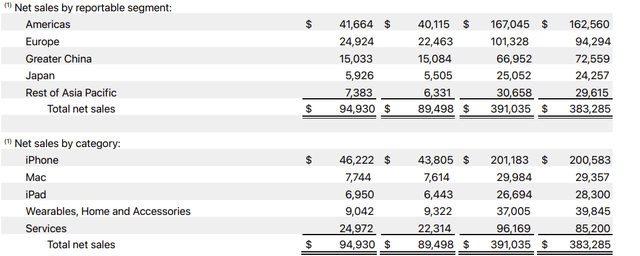

Apple Segment Performance

The company has had a lot of variance within its segments.

The company has seen strength in the Americas and Europe. However, the company has seen a lot of struggle in what was once a growing market, China. That’s not particularly surprising, China is pushing hard towards homegrown products. As the U.S. continues to put sanctions on Chinese products, reciprocation is not surprising.

The company saw respectable strength in its iPhone business, but for the first three quarters of the year, growth was modest. Similarly, iPad declined for the first 9 months of the year and Mac remained roughly flat. The company’s services business continues to be a strong bright spot in the portfolio, and this is a source of growth for the company.

Apple’s Lacking Catalysts

It’s worth noting while the company’s service business is outperforming, in our view, Apple has minimum catalysts for future growth.

The Apple Vision Pro, a product in development for years that was supposed to be a game changer, has seen rumored incredibly weak sales. As a result, the rumor is that Apple has cut production substantially, and is focusing on a cheaper version. How that pans out remains to be seen, but with sales forecasts dropping, the original version seems to be dead on arrival.

The company’s products are mature and they’re incredibly popular. Most people we talk to expect to replace their Mac or iPhone with another one every few years. However, with potential upgrade cycles increasing, we expect revenue strength to be lower. That can be seen in the company’s <1% YoY growth in trailing 9 month iPhone sales.

A lack of catalysts means we expect the company’s net income growth to slow down and the company to revert towards a more normal valuation.

Apple Shareholder Returns vs. Market

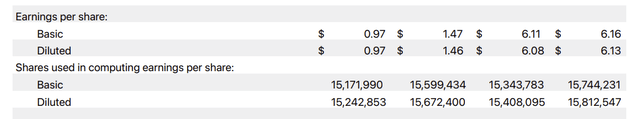

Apple has a minor dividend of <0.5%, and the primary source of the company’s returns are through share buybacks.

While the company had a large cash pile, that was regularly reduced through share buybacks, especially while the company had a much lower valuation. For a YoY 3-month period, the company managed to reduce its outstanding share count from 15.67 billion to 15.24 billion. The company spent almost $100 billion to do so, virtually its entire profits.

In doing so, the company managed to reduce its share count by 2.7%. Here-in lies the risk for Apple. The company trades at a P/E of almost 37, well above its 2010s average of trading in the teens (10-20). That means it’s hard for the company to generate returns of more than just a few percentage points. The company’s size makes it difficult to continue scaling effectively.

With no new major catalysts, we expect the company to continue underperforming the market.

Thesis Risk

The largest risk to our thesis is that Apple has a strong moat and an impressive history of execution. The company has also done a great job with launching strong auxiliary products that complement its existing ones well, such as the Apple Watch and AirPods. New success in products, such as a cheaper Vision Pro, could provide a strong boost.

Conclusion

Apple has continued to perform well given its massive scale. The company is a cash flow machine with a lofty valuation to match, and the company has spent more on buybacks than any other company in existence at this point. The company’s outstanding share count has declined almost 50% since it first started this policy.

Despite that success, Apple remains overvalued both historically and based on its ability to drive returns. At a shareholder yield of just over 3%, and minimal growth, we see the company as a poor long-term investment. Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated, and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.