Summary:

- Apple reported top and bottom line beats for Q4, but Services revenue and revenue in China lagged estimates.

- Weak current quarter guidance has analysts lowering expectations for an iPhone 16 supercycle.

- Apple’s valuation remains rather high against large cap tech peers.

Michael M. Santiago

Last week, we received fiscal fourth quarter results from Apple (NASDAQ:AAPL) for its September ending period. There have been high hopes that the launch of Apple Intelligence, the company’s new set of artificial intelligence features, could spark a supercycle in iPhone sales for the iPhone 16. While the company reported decent results for the Q4 period, its current quarter guidance suggested the ultra bull case has a few cracks in it.

Previous coverage on the name

When I last looked at the technology and service giant, Apple had just finished holding its Glowtime event in September. Thanks to the usual set of leaks regarding product launches and features, the iPhone launch event fell a bit flat with investors. The smartphone got some nice upgrades over the prior year’s model, and pricing wasn’t raised as some thought it could be, but a protracted rollout of Apple Intelligence into 2025 was a bit disappointing.

At that time, I was a bit neutral on Apple shares. While I continued to like the long-term story for the company, I was not a fan of the stock’s forward-looking valuation. I thought expectations for an iPhone supercycle basically led to more room for a downside surprise than an upside one. Since that article, Apple shares have risen by about 1.8%, but this figure has trailed the S&P 500’s gain of 4.3%.

The fiscal Q4 report

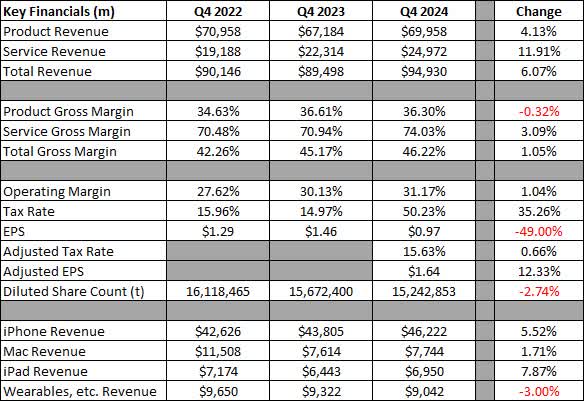

Apple is showing some modest growth at the moment, but it is not growing its top line by double digits percentage wise like some of its mega cap peers. In the table below, you can see how the key results for the quarter stacked up against the prior two fiscal Q4 periods. The change column represents the year-over-year change from Q4 2023 to Q4 2024, while changes in margins and tax rates are the actual percentage difference between the two periods. Apple recorded a more than $10 billion tax charge to settle a long-running tax dispute in Europe during the quarter, so the quarter’s tax rate and earnings per share are shown on both a reported and adjusted basis.

Apple Q4 Results (Company Earnings Releases)

Overall, Apple beat by about half a billion dollars on the top line and 4 cents on the bottom line when you used the adjusted EPS figure. Unfortunately, the company did report key revenue misses on both the Services side, by over a full percentage point of growth, and by nearly $800 million for China revenues. The good news here is that gross margins were slightly ahead of estimates. Eventually, Apple could end up topping 50% gross margins as the services segment becomes a larger share of the revenue mix, but a lot of the spending there is on the operating side. Apple continues to produce gigantic profits and cash flow, allowing for the greatest capital return plan we’ve ever seen.

Despite the top and bottom line beats, Apple shares declined by 1.33% on Friday. The pullback was mainly due to guidance because on the conference call, management said it was looking for low to mid-single digit revenue growth in the current period, fiscal Q1 2025 that ends in late December. When I hear that, I generally think growth will be in a range of 2% to 6%, and the street was at 6.7% going into Thursday’s report.

The somewhat disappointing guidance has led analysts to a mixed view of the iPhone 16 launch. The recent rollout of Apple Intelligence will be key to sales of the smartphone in the current quarter, they say, but guidance implies a smartphone sales supercycle is not likely to start in this period. It’s also possible that US consumers are waiting to see the results of this year’s elections to determine how strong the economy might be moving forward. I was a bit surprised at the iPhone 16 reveal event that pricing wasn’t hiked, so perhaps Apple management thinks the consumer is a bit stretched currently.

A look at Apple’s valuation

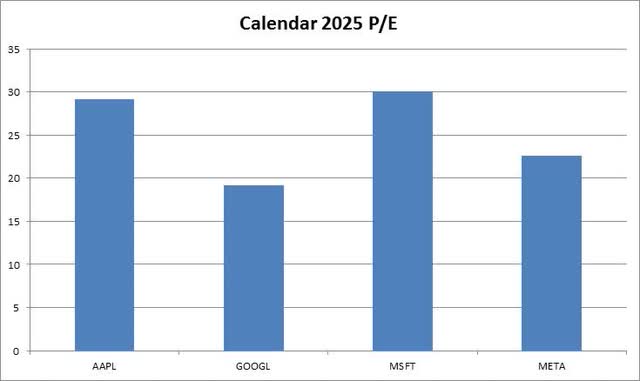

There are a couple of ways to look at things here. The first thing I like to look at is the price-to-earnings ratio. As the chart below shows, Apple trades at a little more than 29 times its calendar 2025 street expected earnings (fiscal year does end in September). That number is a hair below peer Microsoft (MSFT), but Apple is only expected to show about half of the revenue and about two-thirds of the earnings growth, in percentage terms. Furthermore, Alphabet (GOOG, GOOGL) and Meta Platforms (META), which are growing about the same as Microsoft, are trading at much more reasonable valuations.

Calendar 2025 P/E (Seeking Alpha)

In terms of the analyst community, things have held relatively steady since my last article. On the hopes of artificial intelligence fueling some sales boom, Apple shares are a little less than $20 below the average price target on the street. That’s mostly a reflection of the street hiking its targets quite a bit in the last couple of months, as during the early summer period, the stock was trading at a low to mid-teens dollar amount above the average target price.

Final thoughts and recommendation

In the end, Apple’s report last week was a bit mixed. While the company beat on the top and bottom lines overall, services and China revenue were a bit light. The company issued softer than expected guidance for the all important holiday quarter, leading many to believe that Apple Intelligence won’t lead the iPhone 16 to a sales supercycle right away.

Given last week’s report, I’m going to keep my hold rating on the stock. I still like the long-term story, with some growth and a huge capital return plan, but the valuation is a bit high for my liking at the moment. With expectations likely to come down in the near term, I don’t see a major upside case for the time being. Perhaps once the company’s AI features are rolled out to more countries, we can see if there is a strong sales impact, at which time I would be willing to take another look at my rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.