Summary:

- Alibaba stock has substantially appreciated.

- This is due to expectations of the Chinese government’s stimuli and the company’s buybacks.

- However, BABA stock still does not look overvalued.

maybefalse/iStock Unreleased via Getty Images

A lot of time has passed since my last article about Alibaba (NYSE:BABA). Since the publication of my January 2024 article, BABA stock has risen by about 50% versus the S&P 500’s gain of just 20%. Most of the gains were due to the expectations of the Chinese government’s stimuli but also due to Alibaba’s stock buybacks. Let me go into more detail here.

My previous analysis of Alibaba’s stock

In my previous analysis of Alibaba’s stock, I wrote that the company faced challenges due to the COVID-19 pandemic and Chinese government regulations. At the same time, BABA stock’s valuations were also low, and all the risks were considered.

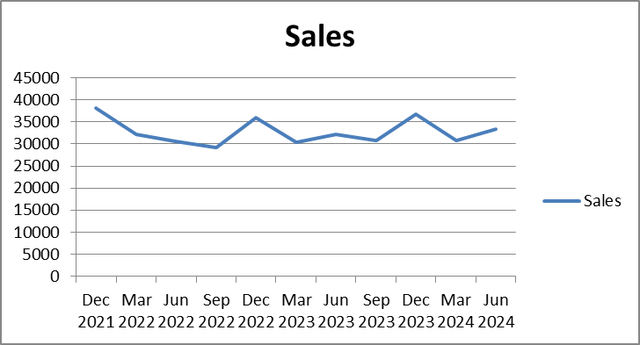

Despite negative news and regulatory pressures, Alibaba’s sales and gross profit figures have remained stable.

Among the upside factors I mentioned were opportunities in artificial intelligence (AI), chip design, content strategies, and the evolving landscape of streaming and TV.

Among the downside risks I mentioned were Alibaba’s being a Chinese company, American investors’ concerns about the country’s accounting standards, and US-China relations.

So, why has Alibaba’s stock appreciated since the publication of my last article?

Alibaba news

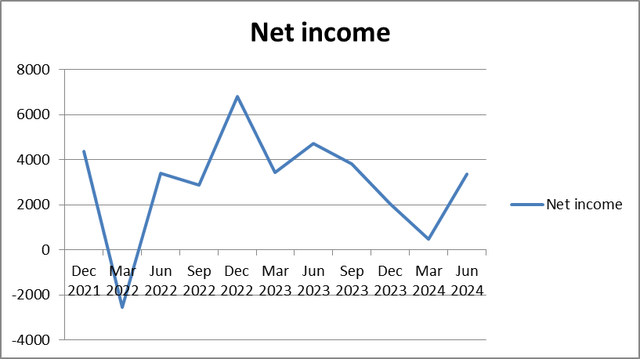

Neither the revenue nor the net profit has increased dramatically since my January article.

Alibaba’s sales and net profit figures (in $ million)

|

Dec 2021 |

Mar 2022 |

Jun 2022 |

Sep 2022 |

Dec 2022 |

Mar 2023 |

Jun 2023 |

Sep 2023 |

Dec 2023 |

Mar 2024 |

Jun 2024 |

|

|

Sales |

38172 |

32182 |

30679 |

29119 |

35922 |

30316 |

32272 |

30789 |

36680 |

30728 |

33470 |

|

Net income |

4376 |

(2542) |

3382 |

2872 |

6802 |

3443 |

4719 |

3814 |

2051 |

466 |

3356 |

Source: Prepared by the author based on Seeking Alpha’s data

Prepared by the author based on Seeking Alpha’s data

Prepared by the author based on Seeking Alpha’s data

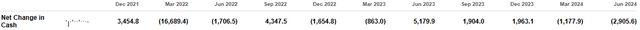

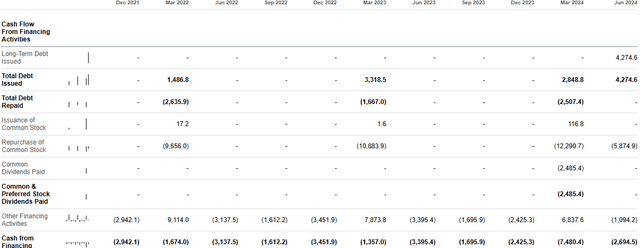

At the same time, as I have mentioned above, BABA stock has risen by almost 50%. What made the company’s shares appreciate that much? Well, in my view, this was partly due to investors’ expectations of the Chinese government’s stimuli. I will talk about these a bit in the next section. But most of this stock price surge, in my opinion, was due to the massive stock buybacks. Here is an excerpt from the company’s cash flow statement.

In the company’s cash flow statement, there is the “cash flow from financing activities” section. According to this section, the company’s buybacks have increased dramatically in the past two quarters. Stock buybacks artificially raise the demand for the shares while making the stock price surge. However, these stock buybacks also made the company’s net change in cash negative, which is rather a disadvantage for the company’s cash flow statement and balance sheet.

Chinese stimuli

According to the World Bank, despite multiple headwinds, China’s economy expanded by 5% in the first two quarters of 2024. Among the positive factors were consumer spending on services, exports, and investment in manufacturing and public infrastructure. At the same time, growth was uneven. Its momentum has been slowing down since the second quarter. Since then, the Chinese economy has been facing decreasing inflation and weak business confidence. There is also an ongoing property market downturn, which continues to negatively affect economic activity levels. To support growth and balance risks, the authorities have hinted at economic stimuli.

This situation made many investors expect that the Chinese government would stimulate China’s economy. According to Reuters’ report, the Chinese authorities are considering the 10-trillion-yuan (about $1.4 trillion) stimulus package, an amount that economists have said in recent weeks they expect the Chinese government to agree on.

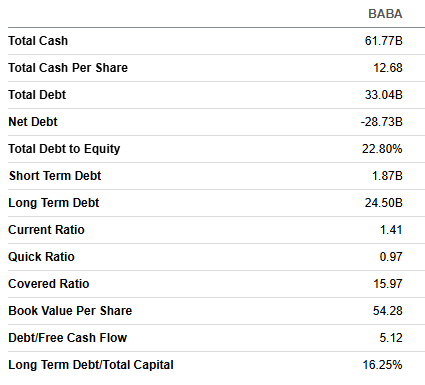

Alibaba’s fundamentals and valuations

Alibaba’s balance sheet metrics look impeccable. Its net debt (cash-debt) is negative, meaning it has more cash than debt. Its debt-to-equity ratio is just paltry 22.80%, meaning the company has more assets than liabilities. BABA is also able to pay interest on its debt more than 15 times. The only problem seems to be the company’s quick and current ratios. Ideally, they should be no less than 1.50 or even 2. But overall, BABA’s balance sheet looks strong.

Seeking Alpha

Alibaba’s profitability ratios are also impressive. In fact, BABA’s net profit margin compares well to Amazon’s (AMZN). Its EBITDA margin is even higher than Amazon’s. And of course, Alibaba is much more profitable than its close Chinese peer JD.com (JD).

|

Gross Profit Margin |

48.04% |

37.90% |

9.18% |

|

EBIT Margin |

9.00% |

14.03% |

3.07% |

|

EBITDA Margin |

17.22% |

18.58% |

3.86% |

|

Net Income Margin |

7.35% |

7.38% |

2.81% |

|

Levered FCF Margin |

9.79% |

15.04% |

3.06% |

|

Return on Equity |

21.93% |

5.67% |

10.81% |

|

Return on Assets |

8.60% |

3.91% |

3.38% |

|

Return on Total Capital |

9.22% |

6.32% |

5.77% |

|

Cash From Operations |

107.95B |

23.52B |

10.19B |

|

Revenue Per Employee |

– |

636.18K |

– |

|

Net Income Per Employee |

29,127.21 |

48,715.99 |

8,275.09 |

|

Asset Turnover |

1.17 |

0.53 |

1.76 |

Source: Prepared by the author based on Seeking Alpha’s data

As can be seen from the table below, Alibaba’s stock is much cheaper than Amazon’s and only slightly more expensive than JD.com. But it is quite explainable. Amazon enjoys a much longer operational history. It is larger than BABA. Moreover, investors are much more willing to buy AMZN shares due to the fact they may perceive American companies to be more reliable than China’s. JD.com is the second-largest online retailer in China after Alibaba. Moreover, it is not as profitable as BABA. That is why it is fair for Alibaba to trade at higher multiples than JD.

Overall, we can safely say that BABA trades at reasonable multiples compared to its peers.

|

AMZN |

BABA |

JD |

|

|

P/E Non-GAAP (FY1) |

39.35 |

11.13 |

10.51 |

|

P/E Non-GAAP (FY2) |

32.09 |

9.95 |

9.72 |

|

P/E Non-GAAP (FY3) |

25.66 |

9.07 |

8.86 |

|

P/E Non-GAAP (TTM) |

39.91 |

11.54 |

10.83 |

|

P/E GAAP (FWD) |

39.42 |

15.98 |

12.81 |

|

P/E GAAP (TTM) |

44.57 |

25.76 |

14.93 |

|

PEG Non-GAAP (FWD) |

1.84 |

1.10 |

0.81 |

|

PEG GAAP (TTM) |

0.19 |

NM |

0.33 |

|

Price/Sales (TTM) |

3.20 |

1.86 |

0.42 |

|

EV/Sales (FWD) |

3.15 |

1.50 |

0.33 |

|

EV/Sales (TTM) |

3.31 |

1.61 |

0.35 |

|

EV/EBITDA (FWD) |

14.70 |

7.48 |

7.54 |

|

EV/EBITDA (TTM) |

19.25 |

8.66 |

8.99 |

|

Price to Book (TTM) |

8.27 |

1.81 |

1.96 |

|

Price/Cash Flow (TTM) |

18.12 |

9.49 |

5.84 |

Source: Prepared by the author based on Seeking Alpha’s data

Alibaba’s upcoming earnings report

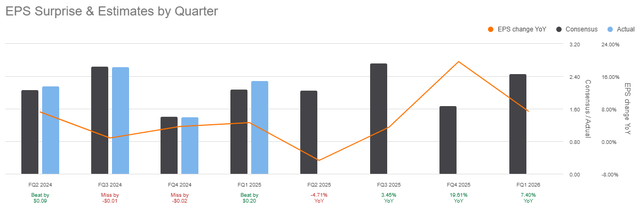

Alibaba will report its next quarterly earnings on November 15, 2024.

According to analysts’ forecasts, the GAAP EPS will total $1.56, slightly higher than the earnings reported for the latest quarter. However, this will be a substantial decrease from the $2.16 EPS reported for the same period a year ago.

As mentioned above, in the recent couple of years Alibaba showed neither excellent growth nor declining earnings. It seems likely that the same will happen this time. I will be more interested to hear the management’s press conference. In particular, I would like to see the management’s growth outlook and any further stimuli for the company’s future sales and earnings growth. Also, I would like to know any news of the Chinese government’s regulatory pressures. However, given the Chinese economy’s slowdown, it seems more likely the local authorities would rather support the high-tech sector, including Alibaba.

Upside risks

Alibaba is going to celebrate Singles’ Day soon. It is the largest online shopping event in the world, and it is the day BABA records very high sales. Traditionally, after this day, BABA stock appreciates.

As mentioned above, Alibaba will be here to gain from additional economic stimuli. Soft macroeconomic statistics in China mean the government has to support the economy. Apart from lower interest rates, it would also mean fiscal stimuli to support both consumers and businesses in spending more. Consumer demand is crucial for companies like Alibaba.

Finally, Alibaba’s stock is also relatively inexpensive.

Downside risks

Alibaba is a Chinese company, which means that it substantially relies on China-based consumers. The macroeconomic fundamentals in China, however, are not ideal, to say the least. Moreover, US-China tensions may escalate, thus hurting China’s economy and investors holding Chinese stocks.

Also, Alibaba operates in the high-tech sector, which is crucial for China. The relevant authorities may further intervene and pressure the tech sector the way it was at the end of 2020 and 2021.

Conservative American investors may also prefer to buy stocks of US-based, heavily overvalued high-tech companies. After all, they may perceive American accounting and auditing regulations as more reliable and transparent than Chinese ones.

Conclusion

Apart from the long-awaited economic stimuli, Alibaba’s stock buybacks also made the company’s shares surge. At the same time, Alibaba stock still remains relatively inexpensive. However, despite these positive factors, investors may be reluctant to buy Alibaba’s shares due to the fact it is a Chinese-based company, the risk of the Chinese government’s interventions, and the general recession risk.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.