Summary:

- Dell is well-positioned to capture market share in data center rack solutions due to Super Micro’s structural issues, as customers may move project backlogs away from the latter.

- Dell’s Infrastructure Solutions Group, fueled by surging AI demand, has become a powerhouse, growing 80% and now contributing nearly half of Dell’s total revenue.

- Stable margins and eased competition could improve the Company’s profitability in high-demand AI infrastructure.

- DELL’s valuation shows a potential 16-17% upside, with continued AI growth and competitive advantages justifying a Buy rating.

bjdlzx/E+ via Getty Images

Investment Thesis

No other data center rack solutions provider stands to be in a better position to gain from Super Micro’s (SMCI) recent woes than Dell Technologies (NYSE:DELL).

Any market or category that has anything to do with AI infrastructure today will most probably be expected to post strong double-digit CAGR growth over the next 3 years, at least as large technology companies and enterprises are leading global efforts to rapidly upgrade and scale their data center infrastructure.

The data center rack solutions market category is one such technology market, and Dell, along with Super Micro, were leading players in this space locked in a zero-sum game for the top position to be the dominant player.

However, with Super Micro Computer cornered into firefighting structural issues in its books, Dell now has its road clear to march on and win project backlog from its peer.

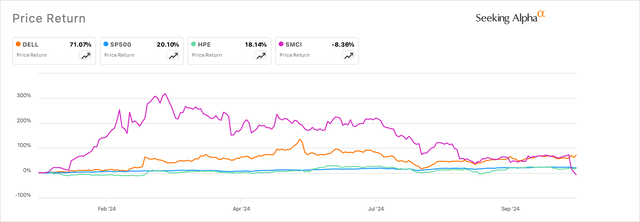

Exhibit A: Dell is now clear to take control of market share from its peer, Super Micro Computer. (Seeking Alpha)

Dell’s management team is dead set on grabbing the opportunity and has already pointed towards revenue acceleration through the remainder of the year, making this a strong candidate in investors’ portfolios.

I recommend buying Dell Technologies.

Dell’s Infrastructure Pivot Can Grow Further Amid SMCI’s Woes

Dell Technologies has, for many years, become synonymous with the manufacture and sale of PCs. The unfortunate trend that has dragged the heels of the Round Rock, Texas-based company is the contracting global sales of PCs.

Consolidated sales for the company had been slowing quickly through 2022, which then began contracting at a double-digit pace through 2023. The concern among investors was plausible given that the company’s CSG segment (Client Solutions Group) accounted for 62% of the company’s consolidated sales in 2022. Dell’s CSG segment includes sales of PCs and related products and services to Commercial and Consumer customers. Unfortunately, the revenue in this segment began contracting quickly as demand for PCs kept shrinking.

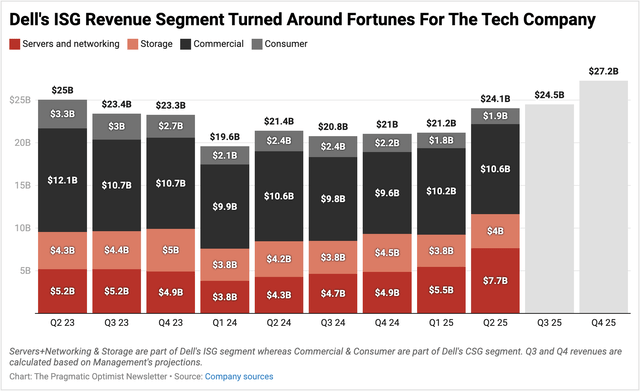

But as can be seen in Exhibit B below, the company’s ISG segment (Infrastructure Solutions Group) has quickly taken up the mantle to lead Dell through another growth renaissance as it caters to the robust demand for scaling AI infrastructure in the enterprise data center.

Exhibit B: Dell’s revenue segments indicate the hyper growth seen in its ISG segment that caters to the AI data center. (Company sources)

Dell’s ISG segment, which includes Servers & Storage and Networking products, has been growing at an 80% rate and now accounts for 47% of the company’s revenues, as seen above.

The hypergrowth seen in the ISG group is purely due to the robust demand among different Dell’s customer cohorts that include hyperscalers such as Microsoft (MSFT), Meta Platforms (META), etc., Tier 2 partners, CSPs or Cloud Solution Providers, other enterprises, and sovereign entities. The company also sees AI workloads evolving quickly, which changes the nature of demand for the AI data center with aspects of packing more density, higher scalability, and greater efficiency.

According to management’s views in the recent Communcacopia conference, these new AI workloads are creating higher degrees of customization for architecting newer designs of the AI data center, and management has accordingly projected revenues accordingly, as noted in Exhibit B above.

Per management’s commentary in the conference, Dell’s AI infrastructure revenue, which was “essentially 0%” a year ago, has now led to almost $9.5 billion worth of sales and $6.5 billion worth of shipments. According to management’s Q2 report, “AI server backlog remains healthy at $3.8 billion.”

I strongly suspect Super Micro’s large customers as well as its suppliers would want to escape the scrutiny that they may be subject to after having business transactions with the company and would be looking to move their project backlog and contracts to Super Micro’s peers. Dell’s go-to-market presence and its supply chain partnerships put the company in a position of strength to benefit from customers moving their project backlog out of Super Micro.

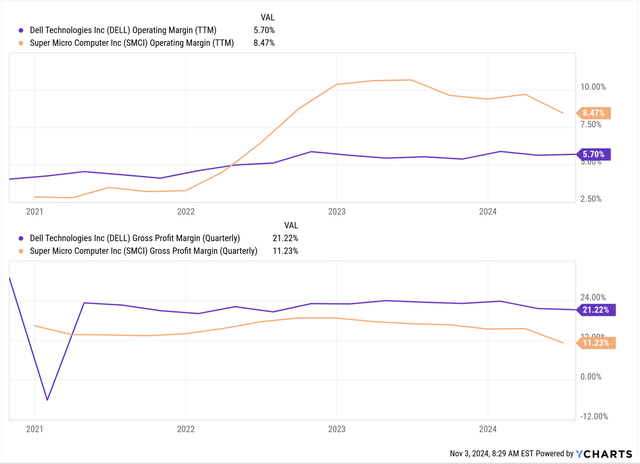

Moreover, unlike Super Micro’s “margin headwind“ that their management alluded to at the Communcacopia conference, Dell is actually able to keep their margins relatively stable and see smaller headwinds to their operating leverage, unlike Dell’s peer.

Exhibit C: Dell’s margin profile is relatively more stable as compared to its peer. (YCharts)

With demand set to scale over the next twelve months, I expect Dell to revise their margin profile as pressure eases off. My reason for expecting this of Dell’s management is that the company would be selling its products and services in a higher demand environment, allowing the company to benefit from beneficial pricing strategies in such environments.

Moreover, with the competitive pressures now marginally expected to ease due to Super Micro’s troubles, I expect Dell to boost its margin targets over the next few months.

Dell Has Double-Digit Room To Deliver Returns To Investors

So far, Dell’s management expects to finish its FY25 annual year by delivering revenues worth ~$97 billion, growing 10% at the midpoint of its guidance range. Markets expect the company’s top-line growth to slow to ~9% through FY26, but I suspect the company will see a boost in revenues for two reasons: broader demand for AI data center rack infrastructure and winning over project backlog from its peers. This suggests Dell should be growing its revenues closer to the 9% range.

On the operations side of the business, management runs its business at a 5-6% operating margin range, while gross margins have been in the 22-23% range. Management has cited “competitive pressures” as one of the reasons to see some headwind in margins in previous earnings calls. But again, with some competitive pressures easing, I expect there will be improvement in the margin outlook soon. Dell should be adding about 20 basis points of GAAP operating margins through FY25 and FY26, which points to ~13-14% growth in GAAP operating margins.

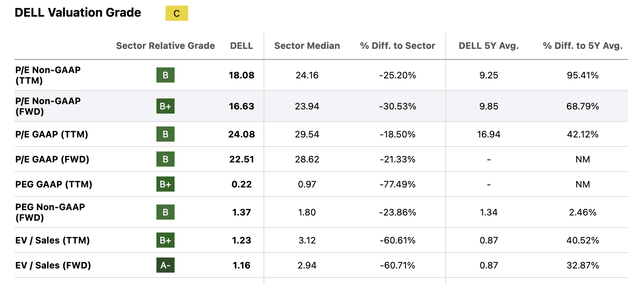

Dell is currently valued at ~22.5x forward earnings or 16.6x forward earnings on an adjusted basis. With the 13-14% earnings growth expected, it should be valued in excess of 25x, but management sees ~$1.4 billion in interest expenses, which are a headwind to Dell’s earnings.

Therefore, after accounting for growth rates and interest expenses, I believe Dell should be valued at ~19-20x forward earnings on an adjusted basis, which implies about 16-17% upside over the next 12-15 months.

Exhibit D: Dell’s valuation multiples look very attractive as the company stands today (Seeking Alpha)

Risks & Other Factors To Look For

The rack infrastructure space is a cutthroat business that involves fierce competition, and players such as Dell and Super Micro have in the past resorted to discounting, thus hurting margins. With Super Micro now focused on cleaning up its house affairs, I have mentioned that Dell can be a winner here, but if broader demand dynamics deteriorate, Dell’s margins would get more affected.

On the topic of margins, Dell’s CSG group is still looking for the elusive top-line and bottom-line growth. But the PC refresh cycle is still to be seen, despite the release of AI PCs this year. Per Counterpoint’s research, Dell’s PC shipments have not yet been positive for the year, which may put more pressure on its top-line growth as well as its margins.

Takeaway

In my opinion, Dell’s potential to scale its revenue exceeds its projections, which are not yet projected in its guidance. This should give investors enough reason to expand the company’s valuation premium, which today sits at attractive levels and offers room to expand.

The broader demand dynamics for AI data center infrastructure space continue to shape up for the better, further improving the prospects of Dell.

I recommend a Buy rating on Dell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in DELL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.