Summary:

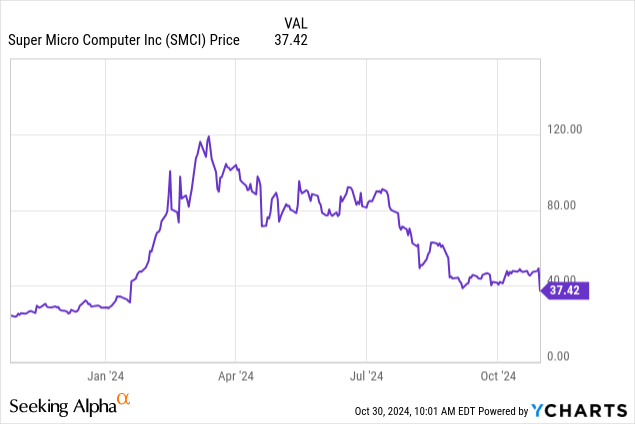

- Super Micro Computer stock was down 25% last Wednesday (Oct. 30).

- The company reported that its auditor has resigned.

- This is yet another sentiment anchor weighing on the stock.

quantic69

Super Micro Computer (NASDAQ:SMCI) is crashing Wednesday as the company’s ongoing saga after delaying the filing of its 10-K has culminated in its auditor resigning. With the company’s earnings report scheduled for just one week from today, this is a blow for investors hoping financial results would take the spotlight. I continue to rate SMCI a Sell.

SMCI is down nearly 25% after investor fears over a 10-K filing delay and a Department of Justice probe appear to have worsened in the wake of a filing by the company stating that its auditor, Ernst & Young LLP (“EY”) has sent the Super Micro board a letter of resignation. I encourage everyone to read the filing, as it has some pretty interesting tidbits that investors ought to know. This quote from EY is particularly relevant:

We are resigning due to information that has recently come to our attention which has led us to no longer be able to rely on management’s and the Audit Committee’s representations and to be unwilling to be associated with the financial statements prepared by management, and after concluding we can no longer provide the Audit Services in accordance with applicable law or professional obligations.

What exact “information” came to EY’s attention that prompted them to resign isn’t stated and, from later in the filing, Super Micro states that it too did not receive that information from EY.

For the SMCI bulls who were hoping this would blow over with a prompt 10-K filing and a re-focus on the company’s earnings release next week, this is certainly disappointing news. The potential good news, if you can call it that, is Super Micro doesn’t anticipate this causing issues for previous fiscal years and had the following statement:

[Super Micro Computer] does not currently expect that resolution of any of the matters raised by EY, or under consideration by the Special Committee, as noted below, will result in any restatements of its quarterly reports for the fiscal year 2024 ending June 30, 2024, or for prior fiscal years.

While this is a hopeful takeaway, the company did say in the filing that “as of the date of this Current Report on Form 8-K, the Review remains ongoing and final findings and recommendations have not yet been communicated to EY or the Board,” meaning whatever the internal audit might turn up, if anything, hasn’t actually been communicated yet so it’s a possibility that there could be restatements of financials depending on what, if anything, an independent review finds. Considering EY resigned while auditing specifically the fiscal year ending June 30, 2024, it’s certainly possible that changes to previously reported earnings results could occur after the conclusion of the audit.

In my previous article on SMCI, I claimed the good news related to server shipments and financial results would be more than offset by bearish sentiment from the DoJ probe and other related news, and this is yet another example of what I expected. That article can be read here. The stock jumped a couple of weeks ago on a report of higher-than-expected server shipments and now drops all the way back down and then some as its auditor resigns. This is not a buy-and-hold stock right now — if you’re looking to swing trade on potential news then go right ahead, but I continue to recommend investors with a long-term horizon stay away from SMCI until these issues are sorted out.

Many of the recent articles on Seeking Alpha have recommended Buy and Strong Buy on the expectation that operating results will ultimately win out. And they may be right. I expect we’ll see even more in the coming weeks, as shares are now “cheaper” than ever. But until these issues hanging around the stock are resolved, I expect downward pressures to persist, and I think investors should prepare for a bumpy ride.

We are likely to see short interest rise again after this latest filing, which will add to the stock’s volatility and should increase investor caution. Going forward, I continue to expect stock gains from the ongoing AI revolution to be muted for SMCI even if sales impress. As I said in my previous piece, I think shares are dead money and until the company finds a new auditor, makes its 10-K, and the DoJ probe resolves without major incident, SMCI is a Sell.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.