Summary:

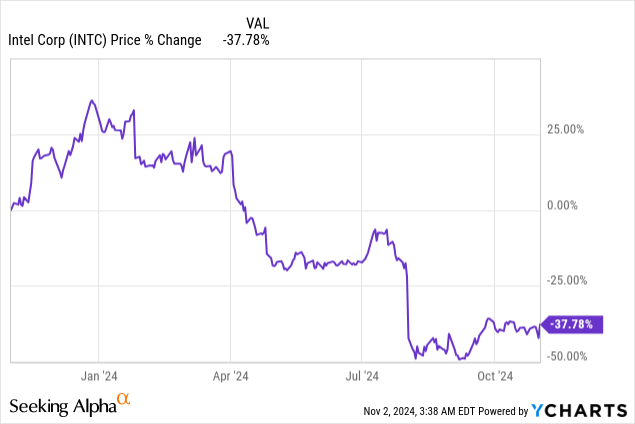

- Intel reported worse-than-expected Q3 results, driven by non-recurring charges. The top line beat estimates, however, and the Q4 outlook is solid.

- Intel has likely seen the worst already, with a $16.6B quarterly loss in Q3.

- Sentiment is so strained, that despite $18.5B in impairment and restructuring charges, Intel’s share price rallied 8% after earnings.

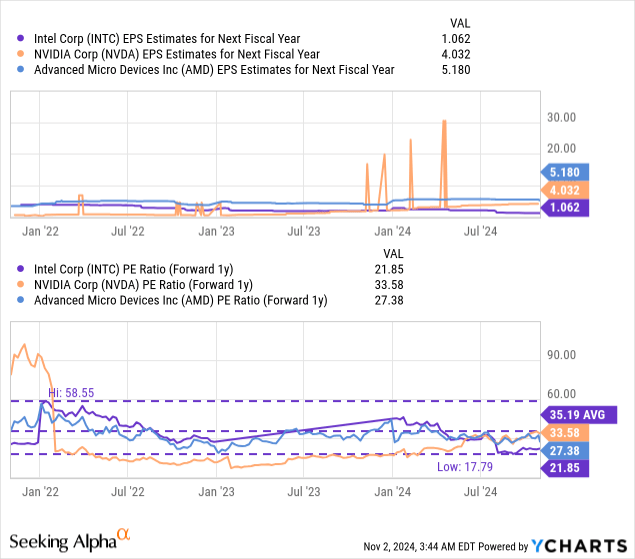

- INTC stock is trading at a FY 2025 P/E ratio of 22X, which is significantly below its longer-term historical average P/E ratio.

JHVEPhoto

Intel’s (NASDAQ:INTC) shares surged 8% after the chipmaker submitted its earnings scorecard for the third fiscal quarter on October 31, 2024. Intel missed EPS estimates due to a painful restructuring that was announced in the previous quarter. Intel reported a loss of $16.6B in Q3’24 which included material impairments totaling $18.5B, but the chipmaker also submitted a better than expected outlook for Q4, causing some optimism on the part of investors. I believe that Intel’s business has potential in the long term, but a strategic solution for the chipmaker becomes increasingly likely. Intel’s shares are trading well below the historical average P/E ratio and while risks are high here, so is the potential reward.

Previous rating

I rated shares of chipmaker Intel a strong buy ahead of the Q3 earnings release — Intel’s Revival May Be Here Sooner Than You Think — as the company had the opportunity to surprise the market due to low expectations after it announced a $10B restructuring in the last quarter. In my last work on Intel I suggested that Intel has strategic options to solve its problems which included a potential sale of its non-core businesses Altera or Mobileye while Intel retained a chance to compete better in the AI accelerator segment going forward, due to the launch of the Gaudi 3 AI accelerator in Q3’24.

The outlook for Q4 was solid and the company reported one-time impairment charges which should not affect Intel’s long-term performance. While Intel clearly remains riskier than NVIDIA (NVDA), I believe Intel has a number of options that could drive a share price revaluation.

Intel’s impairment charges cause EPS miss, company submits solid Q4 guidance

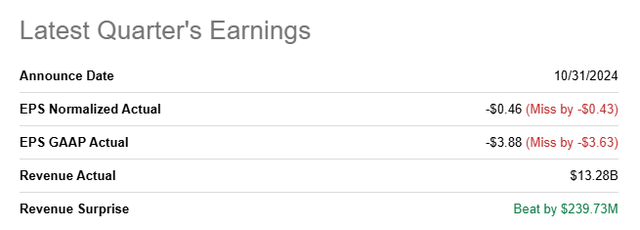

Intel managed to submit a reasonably solid earnings sheet given the circumstances: the chipmaker generated $(0.46) in adjusted earnings in the third fiscal quarter, which missed the consensus estimate by $0.43 per-share. The top line was reported at $13.3B, which was $240M better than the average prediction.

Seeking Alpha

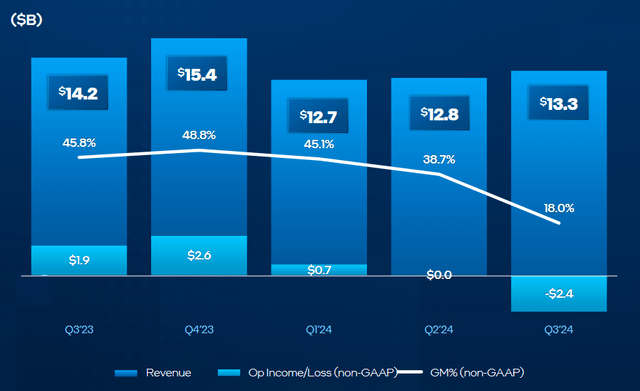

Intel generated $13.3B in revenue in the third fiscal quarter, showing a decline of 6% year-over-year. Client Computing Group revenues were reported at $7.3B and were 7% lower than in the year-earlier period. However, Data Centers, a key source of growth for all chipmakers, generated $3.3B in revenues, showing a 9% year-over-year increase. Intel guided for $12.5-13.5B in revenues in the previous quarter, meaning the drop in revenues was expected and priced into Intel’s shares ahead of the earnings release.

Intel

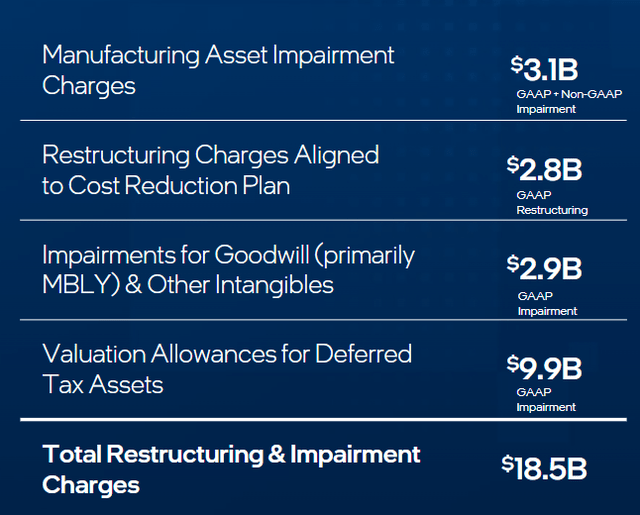

Most importantly, the $10B cost restructuring which was announced in the last quarter led to a significant amount of (non-recurring) impairment and restructuring charges in Q3’24… which resulted in a significant EPS miss. In total, the chipmaker recognized a loss of $16.6B for the third fiscal quarter which included total impairments of $18.5B, including $2.9B in direct restructuring charges. Impairment charges mainly affected the company’s Mobileye division which is offering companies autonomous driving technology as well as Intel Foundry. The good news here is that Intel likely recognized most of its impairment and restructuring charges, which tend to be non-recurring. In other words, Intel has a good chance to see an EPS recovery in the fourth quarter, which is exactly what caused shares of Intel to pop 8% on Friday.

Intel

The outlook for the fourth-quarter was better than expected, however. Intel sees $13.3-14.3B in revenue in Q4’24 which would show a year-over-year decline of up to 14%. At the mid-point, Intel is expected to see a Y/Y top line drop of ~10%. In terms of earnings, the chipmaker expects to be profitable, and Intel beat consensus expectations here by $0.04 per-share.

Intel

The path forward for Intel

Intel does have a number of catalysts in its business which could help drive a share price revaluation over the next twelve months, in my opinion:

- Intel is set to lay off approximately 16,500 people, which should lead to long-term cuts to its operating expenditures and improve the company’s profitability profile

- Intel likely recognized most impairment/restructuring charges in Q3’24 which should both clear the way for higher operating income and margins going forward

- Intel stated on the earnings call that it no longer expects to reach its $500M revenue target for the Intel Gaudi 3 AI accelerator due to slower than expected customer up-take. However, Gaudi 3 sales just started in Q3 and the company needs more time to ramp up shipments. With companies demanding more GPUs than can be produced right now, Intel should be able to benefit from growing demand for AI accelerators in FY 2025. One aspect that could help Intel here is that Nvidia’s Blackwell GPU is in short supply, which could lead companies to go for AMD (AMD)’s and Intel’s accelerators instead. Therefore, I generally see a favorable shipment trajectory for Intel’s AI accelerators in FY 2025

- Intel’s shares are overly cheap and have both higher than average risks and rewards.

Intel’s valuation

Intel’s shares are significantly cheaper than its rivals in the chip business, and there are very good reasons for this: Intel has been asleep in the Data Center market and lost out to companies like Nvidia and AMD.

AMD just reported Q3’24 earnings (which the market didn’t like), but which were not bad at all considering that the company had its second consecutive quarter of triple-digit Data Center top line growth. I aggressively bought the drop for shares of AMD after earnings.

Currently, shares of Intel are valued at a forward price-to-earnings ratio of 22X, which is significantly below the chipmaker’s historical P/E ratio of 35X. The industry group average price-to-earnings ratio currently stands at 28X. The main reason for the valuation discrepancy between Intel and its chip making rivals is that Intel’s business is getting pulled in too many different directions at once. Intel has a foundry business that competes directly with other fabs run by Taiwan Semiconductor Manufacturing Company (TSM), but this segment is losing a ton of money as well (it had negative operating income of $5.8B in Q3’24).

In my last work on Intel, I calculated a fair value in the neighborhood of $34/share — based off of a fair value P/E ratio of 30.0X. Since Intel’s estimates have now dropped in response to the Q3’24 earnings report, I am slightly adjusting my fair value estimate downward, to $31/share (-$3/share). However, I believe the fundamental situation is better than investors think it is and could further improve once Intel is moving on from its restructuring.

Intel is still a very capable chipmaker and likely will decide, as I asserted earlier, to sell some non-core assets in order to streamline its business and sharpen its focus. Even a divestiture of the foundry business, in my opinion, is not out of the question. In the longer term, I see a significantly higher fair value as the company is resetting its operating portfolio and should see considerable momentum in its Client Computing Group (which sells processors) and its Data Center business.

Risks with Intel

Intel has lost quite a bit of investor confidence in the last couple of months, but the situation is not as dire as some may believe. Once Intel’s restructuring is complete (which I expect to last about 12-18 months), the chipmaker may return to stronger growth, driven by its investments in the Data Center segment. What would change my mind about Intel is if the company were to see continual restructuring expenses and if Gaudi 3 AI accelerator sales disappointed in FY 2025. A weakening operating income trend, especially in CCG, would be another negative for me as well.

Final thoughts

Intel’s third-quarter earnings release was actually not that bad, and it could indicate that the worst is already behind Intel: the chipmaker embarked on a comprehensive restructuring in Q3’24 which caused a $16.6B quarterly loss, driven by impairment and restructuring charges. This led to a massive EPS miss. However, restructuring expenses tend to be non-recurring, which indicates that investors should see improving operating performance in the quarters ahead. Intel also announced that it would lay off more people, which should support the chipmaker’s profitability profile.

As the company restructures its business, shipments and sales of Intel’s Gaudi 3 AI Accelerator are set to grow, so there could be some positive impulses here in the Data Center business going forward as well. In the longer term, I am not ruling out a strategic solution for Intel’s problems, which may include a break-up, spin-off or even an outright sale of some of the company’s non-core businesses to another company.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC, NVDA, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.