Summary:

- Meta had strong earnings as DAP grew, driving top-line and bottom-line growth for the company.

- The company is using an aggressive share buybacks with its cash to drive substantial shareholder returns.

- The company’s Reality Labs losses are disappointing and simply not worth it, but the company continues to see sufficient cash flow.

The Good Brigade

Meta Platforms (NASDAQ: NASDAQ:META) recently announced earnings, as the company’s share price bounces near all-time highs and a market capitalization of more than $1.4 trillion. That’s despite the company’s Reality Labs losses approaching $20 billion annualized. As we’ll see throughout this article, the company is begrudgingly worth investing in, but please kill Reality Labs.

Meta Revenue

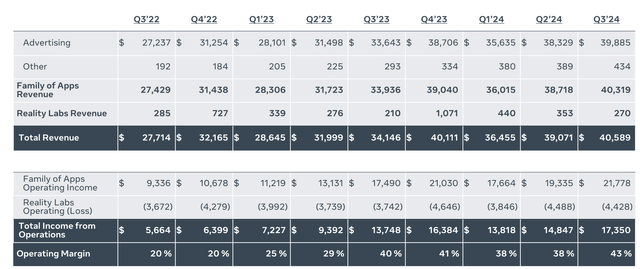

Meta has managed to continue succeeding in its core advertising business as revenue has continued to go up.

The company saw more than $40 billion in revenue for the quarter, or more than $160 billion annualized. From there the company’s annualized operating income crossed $80 billion, showing the value of its margins. However, the company’s Reality Labs losses have continued to push up near new records, with total income at more than $65 billion.

That puts the company at a P/E of ~22 which implies just under 5% annual returns. Meta has recently moved into shareholder returns with a dividend at ~0.35% and a $50 billion annualized buyback. The company has managed to reduce its outstanding shares, but its lofty valuation will make it more difficult for that to happen.

Still, the company has had continued income growth YoY and strength in its revenue. That’s despite the $10 billion loss the company saw from Apple’s algorithm and privacy changes. The company’s ability to continue its revenue growth in a challenging environment, and remain competitive with its largest peers, shows its financial strength.

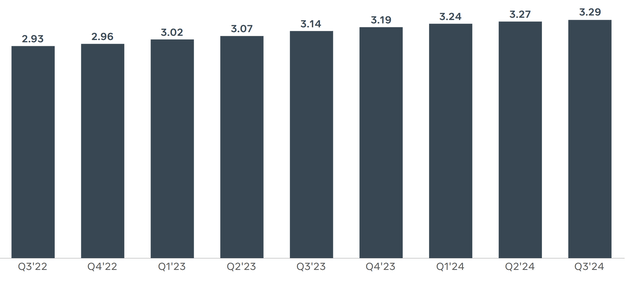

The company has managed to grow its DAP. YoY the company has grown from 3.14 billion to 3.29 billion DAP which is ~5% growth. That’s with the company having access to more than 40% of the population in the world as a DAP. The company’s ability to grow is partially capped by the population; however, we expect the company to remain a dominant social network and grow.

Meta Expense Breakdown

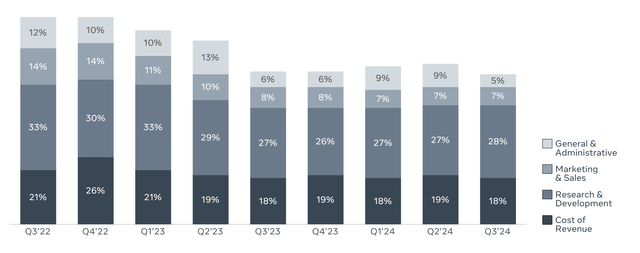

The company has also reduced its expenses substantially after scaring itself about where they were going, starting a year of efficiency.

As a result, the company’s costs have gone down substantially. The company’s expenses as a % of revenue were 58% in the most recent quarter, a substantial improvement from 80% 2-years ago. While that’s enabled the company’s profits to virtually double as a result, it doesn’t, in our view, excuse the continued cost of Reality Labs.

It’s also worth noting that the company is ramping up capex on artificial intelligence, already being one of the largest spenders. While artificial intelligence has strong synergies with its core advertising business as well, the company is expecting ~$39 billion in 2024 capex and significant growth into 2025.

Those exact numbers remain to be seen, however, and peer Google, for example, argues that now is an “invest more” portion of AI that will flatten out. However, high capex expectations are $55 billion in 2025-2026, which could have a big impact on financials.

Meta FCF and Returns

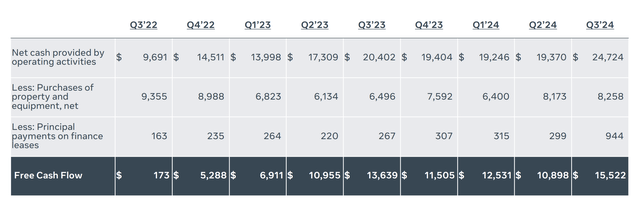

At the end of the day, Meta’s ability to drive shareholder returns is based on FCF.

The company generated more than $15 billion in FCF in the most recent quarter, a 4.5% FCF yield. The company has continued to drive that towards shareholder returns with its buybacks. Combined with dividends, the company needs continued growth to drive long-term returns. However, with double-digit returns, the company is a valuable investment.

That’s because the company will be able to increase its shareholder returns from current levels.

Mark’s Voting Shares and Reality Labs

Despite Mark Zuckerberg’s net worth of less than $200 billion, versus Meta’s $1.5 trillion market cap, Mark Zuckerberg’s extra voting equity gives him more than 50% of the voting power. That is important to him continuing to run the company in the way that he deems fit, which continues the massive investments in Reality Labs.

The company’s annualized losses here are more than $16 billion. Those losses have also increased YoY. For a company earning ~$65 billion annualized after the losses, it’s around a 20% hit to profits. We think that’s a net hit to Meta, but more importantly, Mark Zuckerberg’s outsized control is a net loss in our view.

Specifically, while we commend the success of Meta so far, founding the company doesn’t always mean you are the optimal person to carry it forward. We think Meta could do much better by focusing on its core investments.

Wapi Capital

Alternatively, if the company wants to invest heavily in “moonshots” it needs to take a page from Google’s strategy. Alphabet as a holding company has numerous “other bets” including some we’ve discussed here. However, the Alphabet’s losses here are $1.5 billion annually instead of $16+ billion with much more diversification.

The much lower cost and better management on a bet positions the company much better for success from any specific bet.

Thesis Risk

The largest risk to our thesis is that Meta is a leader in artificial intelligence. The company is also a leader in headset vision devices. While these are minor markets now and the company is losing billions, that could change, which could enable the company’s profits to expand dramatically, making it a more valuable investment.

Conclusion

Meta is a company that has a massive portfolio of social networks that continue to generate hefty cash flow. The company has launched a massive buyback portfolio and has continued to reduce its outstanding share count. At the same time, the company has managed to continue generating double-digit YoY growth.

The company has a 4.5% FCF yield that it can comfortably afford, and we expect it to continue growing that FCF and generating shareholder returns. The company is losing way too much money with Reality Labs, and we think it’s over-investing in alternative bets as a result of Mark Zuckerberg’s ownership. As a result, we think Meta is begrudgingly a good investment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.

![OC] The 3-year growth CAGRs and scale of Alphabet's, Meta's, and Amazon's advertising revenue streams: : r/dataisbeautiful](https://static.seekingalpha.com/uploads/2024/11/4/saupload_the-3-year-growth-cagrs-and-scale-of-alphabets-metas-and-v0-4jg4gvsz4fzc1_thumb1.jpeg)