Summary:

- Altria Group, Inc.’s strong financial performance, new product traction, and compelling valuation support a “Strong Buy” rating, with a safe 7.6% forward dividend yield.

- Recent earnings showed positive revenue and EPS surprises, with NJOY and on! nicotine pouches demonstrating significant growth and consumer satisfaction.

- The “Optimize & Accelerate” initiative aims to streamline operations and achieve $600 million in cost savings, reinforcing Altria’s robust fundamentals.

- Despite Wall Street’s cautious stance, Altria remains attractively valued with substantial upside potential, even under conservative discount rate assumptions.

BalkansCat

Investment thesis

My previous bullish thesis about Altria Group, Inc. (NYSE:MO) aged well as the stock delivered a 9% total return since early August, outpacing the broader U.S. equity market. Recent developments are quite positive for Altria’s investors, and that is the reason I am still bullish. Altria demonstrates strong financial performance, its new products are gaining traction, and the valuation is still compelling. Altria’s generous 7.6% forward dividend yield is safe, in my opinion. All in all, I reiterate a “Strong Buy” rating for MO.

Recent developments

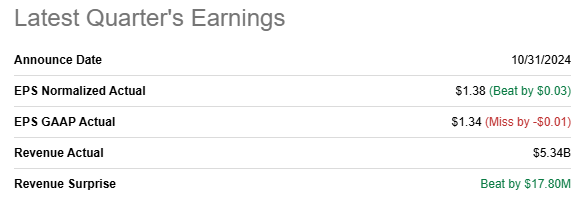

Altria released its latest quarterly earnings on October 31, when the company delivered positive revenue and adjusted EPS surprises. Revenue grew by 1.3% YoY, which was the first quarter since FQ2 2023 when Altria delivered positive YoY revenue dynamic. Another positive sign is that the adjusted EPS expanded from $1.28 to $1.38 on a YoY basis.

Seeking Alpha

Since Altria is a dividend stock that offers a very generous 7.6% dividend yield, I recommend readers to pay attention to MO’s robust balance sheet. The $23 billion net debt has been stable for several consecutive quarters, and it does not look like a big issue compared to Altria’s $91 billion market cap. Altria’s stellar profitability is another source of optimism when we speak about dividend safety. The management is quite efficient in cost control, which I see from the slight gross and operating margins expansion delivered in Q3 2024. Therefore, I believe that Altria’s dividend is rock-solid and is well-positioned to demonstrate modest growth over the long term.

Compiled by the author

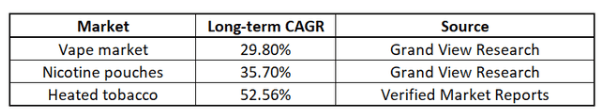

It is a widely known fact that as people are becoming more health-conscious, the consumption of traditional tobacco products is in a secular decline. However, as customer preferences are shifting, new product categories emerge. In the above table, I have compiled data about projected growth rates for categories where Altria’s young offerings are gaining momentum.

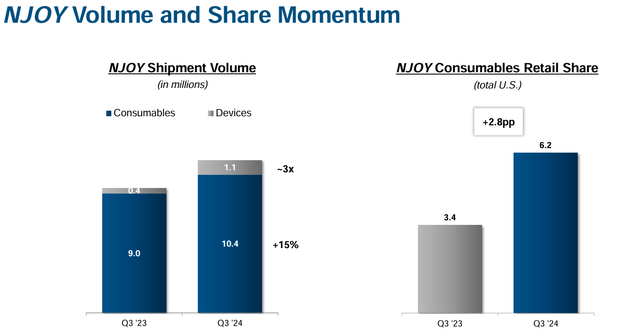

Among Altria’s emerging products, the e-vapor offering NJOY is one of the most well-known. Altria is well-known for its ability to build iconic brands [like Marlboro], and NJOY’s performance in Q3 across key metrics suggests that this young star has the potential to become a new icon. Consumables shipment volume increased by 15% and device shipments nearly tripled on a YoY basis, which underscores the brand’s growing customer acceptance and loyalty.

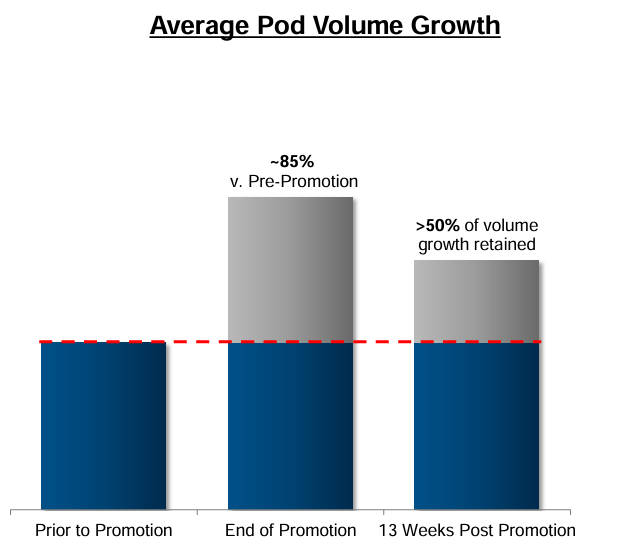

Altria’s Q3 earnings presentation

There are a few other solid NJOY trends. The Net Promoter Score improved by around 20 percentage points so far in 2024 compared to 2023. This indicates enhanced consumer satisfaction and brand equity. Another indication of the improving NJOY consumer satisfaction is the fact that more than half of the increased volume was retained post-promotion.

Altria’s Q3 earnings presentation

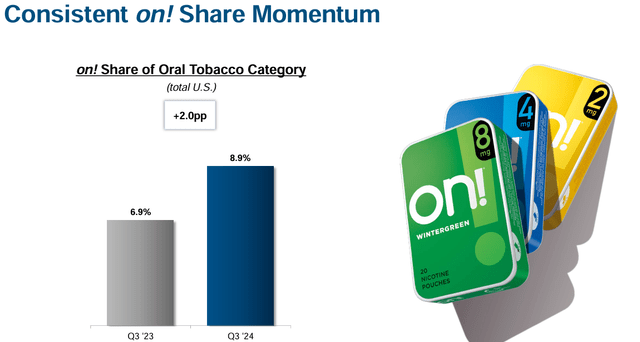

Oral tobacco is another promising product category where Altria is expanding its footprint. The company’s on! nicotine pouches brand demonstrated strong momentum in Q3 with a 46% YoY growth in shipment volumes. According to the earnings call, such an impressive growth was largely fueled by repeat purchases, which is also a strong indication of consumer satisfaction and increasing brand loyalty. As a result, the brand’s market share has expanded notably on a YoY basis.

Altria’s Q3 earnings presentation

Finally, the heated tobacco category. Altria’s strategic partnership with Japan Tobacco for the Ploom device in the heated tobacco category is another potential growth driver. Altria plans to file a combined PMTA MRTP for the Ploom device during the first half of 2025, which demonstrates strong commitment to expand into this promising category as well.

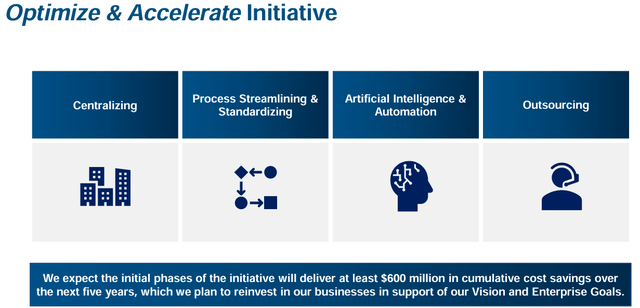

Altria’s fundamental strength is not only limited to its young products gaining traction. The launch of the “Optimize & Accelerate” initiative is aimed at streamlining the company’s operations by leveraging more automation in processes, which will highly likely help in driving costs down. This initiative is expected to deliver at least $600 million in cumulative cost savings over the next five years, which Altria plans to reinvest in its businesses to support its vision and enterprise goals.

Altria’s Q3 earnings presentation

To conclude this part, I think that Altria’s fundamentals are rock-solid. The company is quite successful in rebuilding its product portfolio to address secular shifts in consumer preferences, which we see in young products rapidly gaining momentum. The balance sheet is healthy, and the management looks firmly committed to keeping costs under control, which makes a solid 7.6% forward dividend yield quite safe.

Valuation update

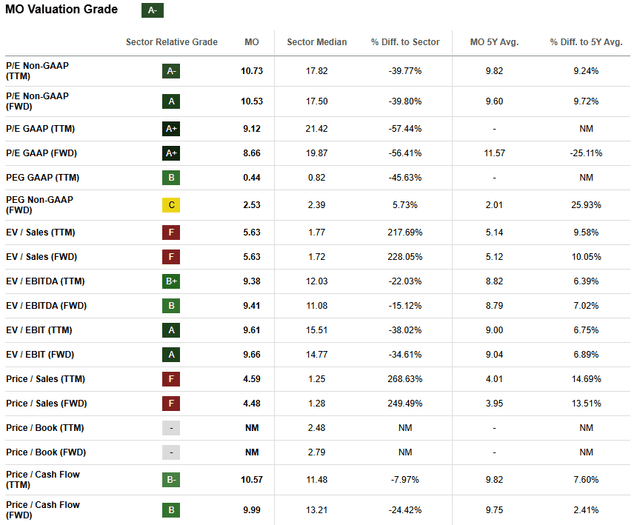

MO share price grew by around 35% over the last 12 months, and the YTD performance is also quite close, with a 33% rally. Altria’s valuation ratios look quite attractive compared to the sector median and historical averages. On the other hand, current multiples are mostly slightly higher compared to historical averages.

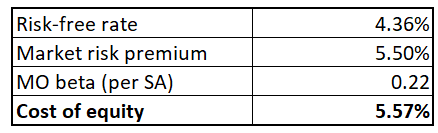

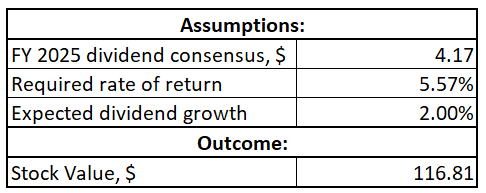

The dividend discount model [DDM] is a good tool to figure out the fair share price of a dividend champion like Altria. The DDM starts with calculating the required rate of return, which is the company’s cost of equity. This one is figured out easily as the CAPM formula is widely known, and the input data is easily available on the Internet. MO’s cost of equity is 5.57%.

Author’s calculations

Since I am figuring out the stock’s target price for the next 12 months, I take the FY2025 dividend estimate from consensus as my primary assumption. A 2% dividend growth rate appears to be prudent as it aligns with the U.S. historical inflation averages. The fair stock value is almost $117, which is more than two times higher compared to the current share price.

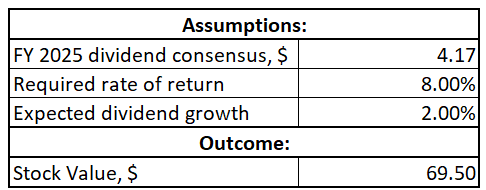

Author’s calculations

This might be too good to be true, and the reason is that the discount rate I used above is quite soft. On the other hand, even when I apply an aggressive 8% discount rate, the stock is still around 30% undervalued with a $70 fair value. Therefore, I believe that Altria is still extremely attractively valued.

Author’s calculations

Risks update

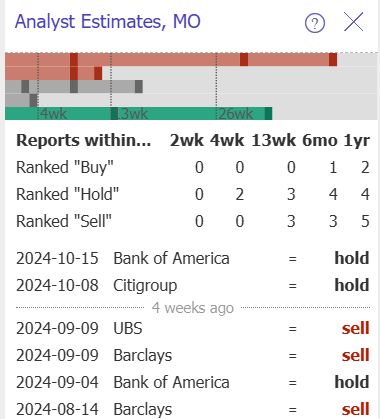

It appears that prominent Wall Street analysts do not share my optimism around Altria. As shown below, there were only “hold” and “sell” ratings from Wall Street analysts over the last few weeks. Therefore, there might be some fundamental flaws that I might be missing. On the other hand, even Wall Street analysts can be wrong occasionally.

TrendSpider

The upcoming U.S. presidential election adds a layer of uncertainty. According to some analysts, tobacco companies might face elevated risks of adverse shifts in the legislation if Kamala Harris takes over the White House. Since the latest news suggests that Harris is ahead in early voting, there is a risk for Altria.

From the business perspective, my readers should be aware of the fact there are loads of illegal products in the U.S. e-vapor market. Thus, the company’s ability to thrive in this domain largely depends on legal actions from the U.S. authorities to identify and ban illegal players. Since there are thousands of illegal vapes flooding the market, there is a substantial risk that some of them might stay in the market for longer and weigh on Altria’s ability to gain market share.

Bottom line

To conclude, Altria’s stock is still a “Strong Buy.” Recent developments are extremely bullish from the fundamental perspective, and MO’s generous dividend yield remains quite secure. Moreover, the stock is very attractively valued with a substantial upside potential.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.