Summary:

- Starbuck’s U.S. operation is likely to take longer than expected for a sustained turnaround as Q3 investment in products and marketing has yet to bear fruit.

- China remains a wild card and both the management and consensus may be underestimating the competitive intensity in China.

- Avoid SBUX until meaningful stabilization in the U.S. operation.

Nastasic/E+ via Getty Images

Starbucks (NASDAQ:SBUX) reported Q4FY24 results that were largely in line with Street expectations, given that the key operating metrics were pre-announced (see our report).

Key metrics continue to show weakness across the board. The U.S. SSSg decline of -6% was largely driven by a -10% decline in traffic, while the +4% price hike offered a partial offset; the International SSSg decline of -9% was driven by a -4% decline in transactions and -5% in ticket size; finally, the China comp decline of -14% was driven by both a -6% decline in transactions and a -8% decline in ticket size.

We remain bearish on SBUX, given that the turnaround in the U.S. will likely take longer than expected and that China is unlikely to see a stabilization in the SSSg trend in the foreseeable future due to the hyper-competitive environment.

A key factor behind this stock is that both the fast money and the long-only managers want to see at least some improvements in the U.S. operating metrics before they get comfortable with the story. The reality is that the U.S. is likely to see prolonged challenges despite the elevated store investment and marketing. In addition, the weakness in China is adding further pressure on the overall thesis, and we expect the stock to remain pressured for the rest of the year until there are visible signs of a sustained turnaround in the U.S.

In the U.S., the near-term investment in menu innovation and marketing is simply not working, as indicated by the -10% decline in traffic during Q4. Although SBUX has invested in expanded product offerings and marketing to draw traffic into the stores, demand weakness in both loyalty and non-loyalty customers was evident, and this places the new CEO, Niccol, in a difficult spot regarding how to address this issue.

During the call, Niccol mentioned the need to return to the core and listed a few key improvements, including staff count, bringing back the condiment coffee bar, simplifying the menu, increasing investment in Siren equipment, and improving the algorithm for mobile ordering. While we take comfort in knowing that Niccol understands the fundamental challenges faced at the store level, we are cautious about the timing and magnitude of the improvement, given that SBUX has over 16k stores across the U.S. alone and driving consistent store efficiency across the country is likely to take more time rather than a simple CEO change.

China is a different story, and Niccol offered limited incremental insights beyond the existing narrative of “… elevated discounting given the highly promotional environment and lower sales of high ticket items impacted by consumer sentiment.” It is worth noting that, besides Niccol, this is the same management that cited “business is also strong” in China when the price war was just getting started a year ago. By stating the obvious and perhaps having yet to spend time in China, Niccol’s comment makes us wonder how much Niccol truly understands the magnitude of competition in China.

We can look into Luckin’s Q3 reporting to get some clues and our conclusion is that the competitive environment in China is unlikely to abate any time soon.

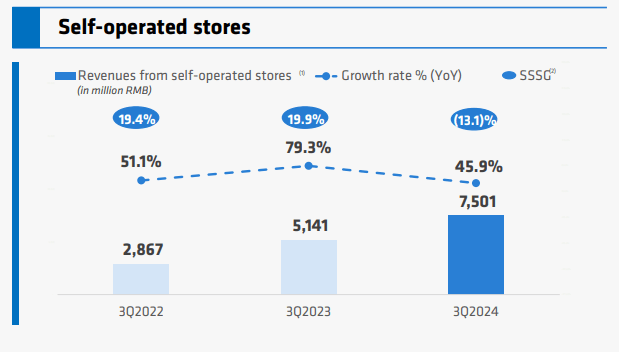

Luckin reported a -13.1% SSSg decline over the quarter, an improvement from the -20% SSSg decline over the prior two quarters while holding on to a 20%+ store-level operating profit. The improvement in SSSg gave investors incremental confidence in the stock, and this sent the shares higher 10% following the print.

Luckin Coffee

However, the competitive dynamic in China’s coffee segment has not changed much as we are more concerned about the ongoing competitive environment in China given low-cost leaders such as Mixue, which is pricing its coffee beverage at RMB 6 per cup, and Cotti Coffee, which plans to stick with the RMB 9.9 strategy for at least another three years while aiming to expand its store count to 40,000 in China.

The hyper-competitive environment in China, coupled with consumption downgrade and a weak macro is one of key reasons for Luckin to explore overseas expansion to offset the domestic weakness (see our report)

In other words, as long as SBUX or Luckin lack the pricing power in China’s coffee war, their SSSg metric will likely see further volatility ahead and investors may be disappointed at the quarterly surprises.

One area that warrants investor attention is Cotti’s recent store expansion strategy. Cotti has partnered with convenience store MYJ, which has approximately 35,000 locations across China, Wallace Burger chain, which has 20,000 locations, and Suning Electronics, which has over 10,000 locations. The plan is to have a Cotti location across all its partner stores, driving brand awareness and taking market share from brands such as SBUX and Luckin.

One concept is to utilize a simplified storefront within established locations to minimize rental and expedite footprint. Notably, a simplified storefront takes one or two weeks to set up, vs. a conventional storefront takes around one to two months.

Cotti Coffee’s simplified storefront (Cotti Coffee)

In conclusion, we are bearish on SBUX, given that the U.S. turnaround is likely to take longer than investors anticipated and that suspending FY25 guidance reflects this sentiment. However, China remains a wild card, and we believe that it could see more downside risks given the macro backdrop and the intense competitive environment.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.