Summary:

- Exxon Mobil Corporation is a great company with a fantastic portfolio of low-cost assets.

- The company is continuing to pay a respectable growing dividends and buyback stock, but returns are capped by FCF.

- With short-term price concerns and long-term demand concerns, the company’s yield isn’t high enough to justify investing.

CHUNYIP WONG

Exxon Mobil Corporation (NYSE: NYSE:XOM) aka ExxonMobil recently reported Q3 earnings, as the company has sat around all-time highs for several years. The company’s share price has effectively remained stagnant for the past two-years as the company has continued to pay a dividend at ~3.3%. As we’ll see throughout this article, ExxonMobil has fantastic assets, but it can’t justify its valuation.

ExxonMobil 3Q 24 Earnings

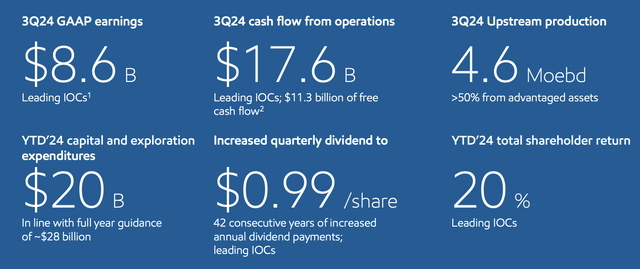

ExxonMobil had strong earnings and cash flow in the quarter, showing its strength.

ExxonMobil Investor Presentation

The company had almost $18 billion in CFFO and increased its dividend to $3.96 / year. The company’s upstream production is a massive 4.6 million barrels / day supported by the company’s closed acquisition of Pioneer Natural Resources. The company has continued to investigate ~$7 billion in cash per quarter, with $11.3 billion in FCF.

Annualized, that’s a ~8% FCF yield. It’s not too bad in an expensive market, but with weakness in oil prices it’s not remarkable.

ExxonMobil Integrated Portfolio

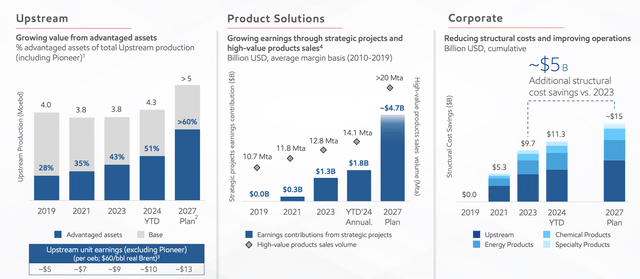

The company has a strong integrated portfolio, and it’s supported by growth, including from its upstream portfolio.

ExxonMobil Investor Presentation

The company’s 2027 target is >5 million barrels / day (1.8 billion barrels / year) at ~$13 / barrel in margin @ $60 / barrel Brent. That’d imply ~$23 billion in annual upstream earnings. With Brent (CO1:COM) just under $75 / barrel subtracting the company’s tax rate, that’d be ~$40 billion in annual upstream earnings at current prices.

The company is focused on growing high-value assets with increased sales from high-margin assets. By 2027 the company expects that to mean almost $5 billion in annual earnings on an average margin basis. Combined with reduced corporate costs and the company expects overall margins for its business to be strong.

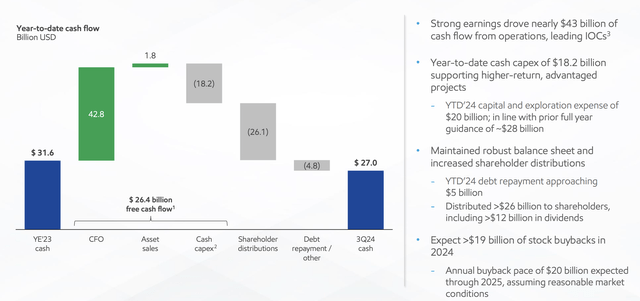

ExxonMobil Cash Utilization

The company’s cash utilization YTD is visible below.

ExxonMobil Investor Presentation

The company generated a massive $42.8 billion in CFO, which should annualize at ~$57 billion. The company has had expenses for CAPEX of ~$20 billion YTD, with $18.2 billion in cash. The company’s guidance is ~$28 billion for the full year, which means the company has ~$7 billion in additional cash to spend. From there, the company has spent almost $5 billion paying off debt.

Additionally, the company distributed $26 billion to shareholders, with an annual buyback pace of >$19 billion in 2024. The company has done an impressive job of reducing its outstanding share count and plans an annual pace of ~$20 billion. That will line up with ~$16 billion in annual dividends. It’s a very respectable annual return rate that puts the company at ~7%.

Long-Term Demand

While the company’s ordinary cash flow is strong, our concern for the company is in the long term, where we want a lower ratio for earnings given the risk.

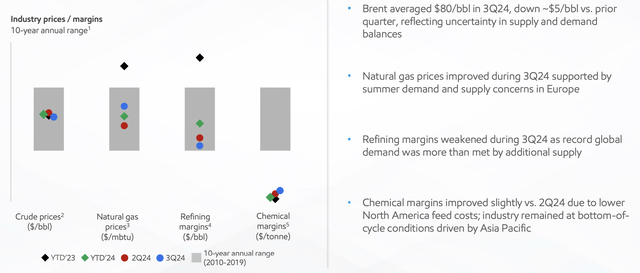

ExxonMobil Investor Presentation

The company saw average Brent for the quarter ~$80 / barrel, down $5 / barrel YoY. Oil, natural gas, and refining margins have all been reasonable YoY. However, chemical margins have remained weak and outside of average. Margins improved slightly but with slower economic recovery in Asia-Pacific we don’t see any recovery anytime soon.

ExxonMobil Investor Presentation

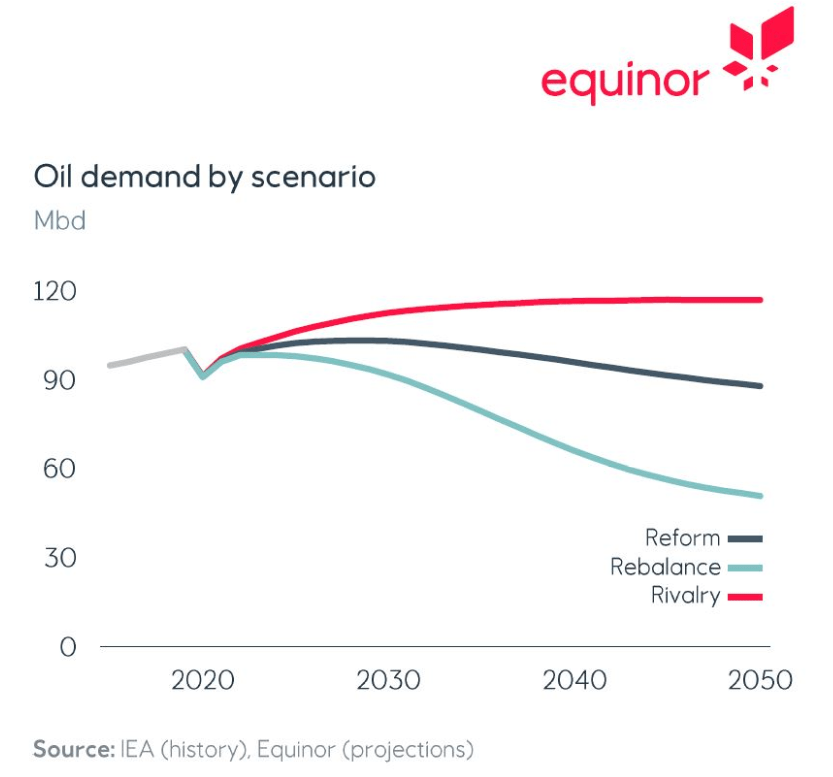

At the same time, we’re concerned about where long-term demand will be. More specifically, now that renewables are cheaper than oil and natural gas in some scenarios, and nuclear power is being supported again, we expect oil demand to peak. How that pans out remains to be seen exactly, but as seen from major Equinor (EQNR), there are several scenarios where demand could peak.

Our View

That’s concerning because it changes the dynamics of the market, especially if producers are focused on driving production that might be less worthwhile someday. The decline in price after it came out that Israel wouldn’t be destroying Iranian oil infrastructure indicates the market is impatient as well. Brent prices of ~$75 / barrel aren’t particularly exciting for ExxonMobil.

While current news is that the OPEC+ production hike could be delayed even further, prices could remain stable for longer. However, it’s worth noting that oil demand isn’t particularly impressive and could slow down further, with weak economies in China etc. At the same time, OPEC+ has caused price collapses before to maintain market share.

With U.S. production hitting records, and growth forecast to continue, we wouldn’t be surprised by future retaliation by OPEC+. Prices remaining weak during OPEC+ production cuts is already a concern. The takeaway here is we don’t think current oil prices are unreasonable, but we also don’t expect sustained prices at $100+ / barrel. That could hurt ExxonMobil’s long-term cash flow growth as it hits limits on growth from its existing assets.

With demand for the assets and profits even more question in the next 20–30 years, an 8% yield, in our view, isn’t enough to justify the risk with the company’s oil centered portfolio.

Thesis Risk

The largest risk to our thesis is that ExxonMobil is working to cross 5 million barrels / day in low-cost production. Instability in the Middle East, cutting out Russia, or anything else that cuts supply and improves prices could substantially help the company’s ability to generate profits and therefore shareholder returns.

Conclusion

ExxonMobil has a phenomenal portfolio of assets and the company is a great company. It’s built up a strong portfolio as an integrated oil company, and the company is building up its existing assets with the Pioneer Natural Resources acquisition and overall efficiency. However, the company’s FCF is ~8% as oil prices remain weaker.

Going forward, we expect demand to remain stagnant or declined, with the risk of a recession augmenting the downside. ExxonMobil is doing minimal things to prepare itself for an oil-free world, with demand in 20–30 years more questionable. The company’s FCF yield doesn’t justify investing in our view, making it a poor investment at this time.

Please let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.