Summary:

- Overambitious Promises: Tesla’s plans for RoboTaxis and humanoid robots face major regulatory, tech, and timeline hurdles, casting doubt on near-term feasibility.

- Recent financials show slowing automotive growth, heavy reliance on regulatory credits, and a challenging competitive landscape.

- Tesla’s stock trades at significantly inflated multiples, which don’t align with its current growth rates or financial performance.

- Rivals like BYD and Waymo have achieved substantial growth and are now competing directly with Tesla in EV and autonomous technology.

- Given Tesla’s track record of missed timelines and reliance on ambitious tech projections, its stock valuation carries considerable risk for investors.

juliannafunk

Tesla (NASDAQ:TSLA) has consistently positioned itself as a company of the future with promises of autonomous RoboTaxis, advanced humanoid robots and cost effective electric vehicles that are set to revolutionize the world. While this vision is certainly grand, my view is that Tesla is highly unlikely to meet its ambitious timelines or deliver on many of these promises in the near future. Tesla’s recent “WE Robot Event” event and Robo taxi unveiling reveal several red flags including impractical design choices and regulatory hurdles. Moreover, Tesla’s stock is currently overvalued by several key metrics especially when compared to both traditional automakers and leading tech companies.

Tesla has managed to capture immense investor excitement when it first announced in mid-July 2024 that they are planning to make a fully unsupervised RoboTaxi but this excitement has inflated its valuation far beyond what its current or even near future fundamentals can justify. In particular Tesla’s grand claims around full self-driving (FSD) technology and RoboTaxi services are concerning because regulatory and technological barriers make these claims feel more like distant dreams rather than imminent realities.

In my view, Tesla is at a pivotal moment in its history. The recent unveiling of its autonomous technologies and ambitious plans for robo-taxis and humanoid robots has reignited investor excitement. But the question remains: can Tesla deliver on its promises?

The company’s long-term potential is undeniable but there are significant risks and challenges that could hinder the realization of its grand vision. For investors, the question isn’t whether Tesla will continue to innovate, but whether its stock price reflects realistic expectations for the near to medium-term future. In my opinion it does not.

Tesla’s Core Business Reality and Future Promises

Tesla’s Q3 2024 financial results reveals a concerning divergence between the company’s slowing core business performance and management’s increasingly ambitious future projections. This disconnect becomes particularly apparent when examining the automotive segment’s performance metrics against CEO Elon Musk’s bold claims about future growth and technological achievements.

The automotive division, which generates approximately 80% of Tesla’s total revenue, is showing clear signs of maturation and competitive pressure. While total automotive sales grew by a modest 2% YoY to $20 billion in Q3 2024 compared $19.63 billion in the same period a year earlier, this was largely driven by a significant 33% increase in regulatory credits to $739 million. When we strip out these regulatory credits which are essentially high margin government subsidies that may diminish as competitors expand their EV offerings, the core automotive business appears to be stagnating.

The underlying delivery metrics paint an even more concerning picture. Tesla managed to increase Model 3 and Model Y deliveries by only 13,975 units YoY representing anemic growth for what was once a hyper growth company. This slowdown becomes more worrying when we consider that these are Tesla’s mass-market vehicles designed to drive volume growth. The company has been forced to implement aggressive price reductions throughout 2024 to maintain even this modest growth level significantly impacting average selling prices and margins.

The weakness in Tesla’s core business extends beyond just deliveries. Automotive leasing revenue, an important indicator of consumer demand and financing flexibility, declined by nearly 9% YoY to $446 million in Q3. This drop suggests that even with more attractive financing options, Tesla is struggling to maintain its historical growth trajectory. The overall revenue growth of 8% not only missed consensus expectations but was achieved primarily through regulatory credits and price cuts rather than organic demand growth.

Yet, against this backdrop of slowing core business metrics CEO Elon Musk continues to make increasingly ambitious projections. His latest forecast of 20-30% vehicle delivery growth in 2025 is particularly optimistic given current trends. To achieve this Tesla would need to dramatically accelerate from its current growth rate which has slowed to just 2% YoY growth in Q3 2024. This projection becomes even more challenging when we consider that Tesla’s EBITDA growth has shrunk by 12.38% YoY suggesting underlying operational challenges. With automotive revenues growing at just 2% compared to competitors like BYD achieving 20.57% growth, and EBITDA showing significant contraction, Tesla’s premium valuation becomes increasingly difficult to justify.

These factors collectively paint a picture of a company whose future promises are becoming increasingly disconnected from its current operational reality. While Tesla remains an innovative force in the automotive industry the gap between its ambitious projections and actual execution capabilities is widening, creating significant risk for investors at current valuation levels.

Tesla’s Cybercab and Robovan Are Still Years If Not A Decade Away

Tesla’s recent Robo taxi unveiling showcased a futuristic two seater autonomous vehicle with impressive features including wireless inductive charging and a proposed price tag of under $30,000. While these features sound promising, I’m skeptical about the practicality and feasibility of delivering such a vehicle in the near future. One of the main concerns I have is the lack of a manual override system raising safety questions that are bound to complicate regulatory approvals. Additionally, Tesla has consistently delayed its timeline for full autonomous driving pushing back promises year after year.

While Tesla’s robo-taxi is visually striking with scissor doors and a minimalistic design the lack of essential features like a steering wheel or manual override raises serious safety concerns. The event also lacked key specifications such as range, battery size, or charging capabilities beyond the concept of inductive charging. This leaves me questioning whether Tesla has a clear path forward in delivering a fully autonomous fleet at a scale that can compete with companies like Waymo which is already conducting 100,000 paid rides per week in major U.S. cities. Tesla promises that the vehicle will never require manual intervention but in a world where full autonomy is still a work in progress this seems overly optimistic.

In my view, the timeline issue is the most glaring problem. Elon Musk’s claim that Tesla will start production of these vehicles by 2027 feels overly optimistic. Based on past performance including Tesla’s inability to meet price targets for the Model 3 or the Cybertruck, I believe that it will be several more years, if not a decade before the Robo taxi vision becomes a reality.

Another reason for my skepticism is Tesla’s history of overpromising and under delivering. Remember when Tesla promised a $35,000 Model 3? While that price point was briefly achieved it was quickly discontinued and the base price for a Model 3 is now significantly higher near $42,490. Similarly, the much hyped Cybertruck was initially priced at around $39,900 but today you’d be lucky to find one for under $95,000. I wouldn’t be surprised if the Robo taxi follows a similar path. While Musk’s $30,000 price tag might be technically possible in a distant future I doubt Tesla will be able to meet that price point within the next few years especially considering the rising costs of manufacturing. Moreover the advanced technology in the Robo taxi such as inductive wireless charging and scissor doors will likely drive up costs making a $30,000 price point even more unlikely.

There are significant regulatory hurdles. As of now Tesla has not begun the process of obtaining regulatory approvals for fully driverless vehicles in key markets like California. Without these approvals the prospect of a fully autonomous fleet by 2027 as Musk suggests, feels more like a distant dream. Even if Tesla manages to bring these vehicles to market the competition is already miles ahead. Waymo and GM’s Cruise have been conducting paid rides in urban areas dealing with real world challenges that Tesla’s robo-taxi hasn’t yet faced.

Optimus: The Humanoid Robot That’s Not Ready Yet

Tesla’s humanoid robot, Optimus, was another highlight of the event. Musk envisions a future where these robots will live in our homes, perform household chores and even become companions. The problem? We are nowhere near that reality. Tesla’s unveiling of the Optimus humanoid robot drew much attention, but this is another example of Tesla pushing futuristic concepts without fully developed technology.

During the event Optimus was showcased serving drinks and interacting with guests. But upon closer inspection it was revealed that the robot was being remotely controlled by Tesla employees, not operating autonomously as some might have believed. While the robot’s movements were smooth and lifelike, the technology behind it is still far from the kind of AI-driven autonomy that Musk envisions.

Tesla has yet to prove that Optimus can operate autonomously. While the concept is enticing robots that assist with daily tasks in households and businesses the reality is far off. Even in its current state Optimus is impressive but the gap between what Tesla showed and what is required for a fully autonomous household robot is massive. The event painted a picture of a high-tech future that Tesla wants to lead but I think it’s important to stay grounded in what the company can actually deliver in the near term. Given the slow pace of robotics development I believe the potential for Optimus to become a significant revenue driver for Tesla is still a decade away.

Tesla Is Severely Overvalued

As said earlier Tesla’s valuation metrics are alarming when compared to both the broader sector and its key competitors even when compared to tech giants that are driving significant revenue growth and are overvalued due to AI Boom Companies Like NVDA MSFT and GOOGL.

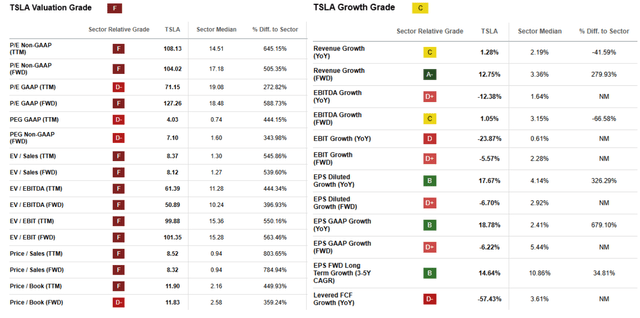

Currently Tesla trades at a Forward P/E ratio GAAP of 127.26 compared to the sector median of just 17.18, reflecting a massive 588% premium. This disconnect is alarming to me because Tesla’s growth rate does not justify such a high multiple, when Revenue growth YoY has slowed down to just 1.28% and its EBITDA growth has contracted by 12.38%.

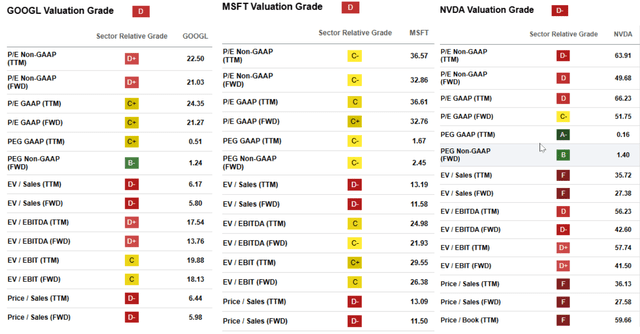

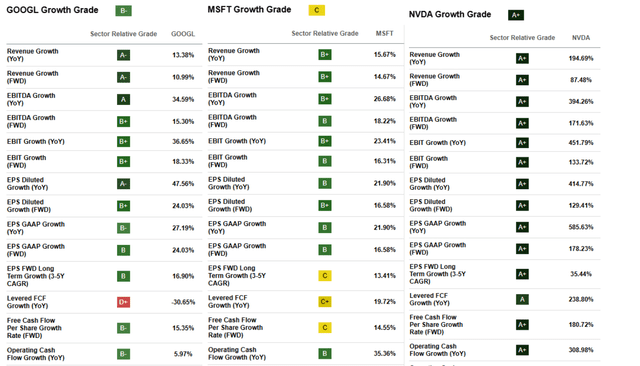

Some people might argue that Tesla is not a car company, it’s an AI and tech company Okay, For instance, Alphabet’s Waymo and GM’s Cruise both have operational robo-taxi services, yet they don’t face the same level of stock price inflation. Alphabet’s (GOOGL) P/E forward ratio is around 21.27, a far more reasonable figure given its autonomous driving progress. Similarly NVIDIA (NVDA), which provides Operational Systems and GPUs autonomous vehicle technology, has a forward P/E ratio of 51.75 which is still expensive but more justifiable considering its outsized revenue growth of 194.69% YoY. Tesla’s 1.28% revenue growth pales in comparison. Tesla is trading at an EV/EBITDA (TTM) of 61.39 compared to the sector median of 11.28. Additionally, Tesla’s P/S ratio of 8.52 is 803% higher than the sector median.

It’s as if the market is valuing Tesla as not just an automaker but as a tech company, an AI leader and an energy company all rolled into one. These elevated metrics suggest that investors are pricing in an extraordinary amount of future growth that I believe is unlikely to materialize at the projected pace. Tesla’s gross profit margin TTM of 18.23% and net income margin of 13.07% are respectable but still lag behind tech companies like NVIDIA and Microsoft(MSFT), which boast margins in the 50-60% range. This shows that while Tesla is a leader in the EV space, its profitability is not yet at the level of the most dominant technology companies, making its tech like valuation harder to justify.

Tesla’s major competitor which elon musk himself acknowledge that they produce best electric vehicles after tesla In terms of revenue growth BYD outpaces Tesla with a 20.57% YoY increase suggesting that Tesla faces stiff competition not only from American rivals but from international players as well

What Could Go Wrong?

While Tesla’s future looks promising on the surface there are significant risks that investors need to consider. One major risk is the regulatory environment. Autonomous vehicles are still a hotly debated topic and gaining the necessary approvals to put fully self-driving cars on public roads will be a monumental challenge for Tesla. As of now Tesla hasn’t even begun the process of securing regulatory approvals in key markets like California where both the DMV and Public Utilities Commission will need to sign off on such services.

Tesla is facing stiff competition on multiple fronts. In the autonomous vehicle space Waymo and Cruise have a significant head start with Waymo conducting 100,000 paid rides per week in cities like San Francisco and Los Angeles. Baidu’s Apollo Go has facilitated over 7 million robo taxi rides in China By the time Tesla’s robo-taxi hits the road, the market may already be saturated.

If Tesla fails to deliver on its Robo taxi and AI promises we could see a significant correction in its stock price. In fact many analysts have warned that Tesla’s current valuation leaves little room for error. Tesla’s product announcements often hinge on future technology that is not yet market-ready. The Optimus robot for instance was heavily featured at the recent event but its real-world functionality is still highly limited. Betting on these futuristic developments to drive growth is risky particularly when Tesla’s core products (like the Model 3 and Model Y) are facing increasing competition.

Tesla has always been a visionary company and I applaud the ability to think big. However, I believe investors should approach Tesla with caution. The company’s history of overpromising and its current overvaluation make it a risky investment at this point. While the Robo taxi and AI projects are exciting I’m not convinced Tesla will be able to deliver on these promises within the stated timelines and the market is overvaluing these future ambitions.

In my opinion, Tesla’s stock is currently overvalued and I recommend investors consider other opportunities in the tech or EV space that offer better value for their money. While I remain optimistic about the long-term potential of Tesla’s technology I don’t believe the company can meet its ambitious goals in the near term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.