Summary:

- Tesla, Inc.’s automotive sales are resilient vs. amidst a challenging backdrop in the industry. The rollout of affordable models in H1 FY25 are a key volumes catalyst.

- Margin performance is at local highs but is likely to revert a bit, driven by fluctuations in the nature of energy business projects and lower average selling price pressures.

- Valuations are at a premium, driven by full self-drive and Optimus expectations. I believe this is acceptable, contingent on the timelines of robotaxis and FSD rollout being intact in FY25.

- The relative technicals vs. the S&P 500 point bullish after a false breakout down. The ratio prices are basing and forming a support, indicating readiness to move up over the coming months ahead.

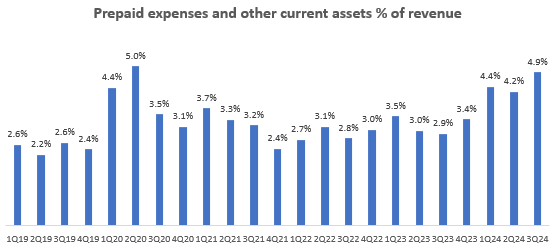

- Prepaid expenses have been creeping up over the past few quarters, eroding cash flow conversion. This is something I am monitoring; a common oversight is for investors to focus on margin movements but ignore erosion in working capital intensity.

Maja Hitij/Getty Images News

Performance Assessment

I’ve had a strong bullish view on Tesla, Inc. (NASDAQ:TSLA) since my last update in late September 2024. This investment is yet to yield major returns as it has lagged the S&P 500 (SPY, SPX, IVV, VOO) slightly so far:

Performance since Author’s Last Article on Tesla (Seeking Alpha, Author’s Last Article on Tesla)

I still hold Tesla in my portfolio since I remain bullish on the stock:

Thesis

Since my last update on the stock, Tesla has had a full self-drive (“FSD”) and Optimus update on October 10, which broadly disappointed the market due to a perceived lack of specific data on monetization of the robotaxi vision. The stock fell 11% after this event. However, the Q3 FY24 earnings release was received more positively as the stock rallied up to 28% in 3 days after that.

- Automotive deliveries and sales are resilient amid a challenging backdrop

- Margin performance is likely to revert a bit

- Valuations are at a premium driven by FSD and Optimus expectations

- Technicals point bullish after a false breakout down

- Prepaid expenses creep up are a working capital monitorable.

Automotive deliveries and sales are resilient amid a challenging backdrop

I had previously anticipated rate cuts to boost demand. This seems to still be in-play:

a helpful macro trend is, if there’s a decline in the interest rates, thishas a massive effect on the automotive demand. For the vast majority of people, the demand is driven by the monthly payment. Can they afford monthly payment? So I think most likely, we’ll see a continued decline in interest rates, which helps with the affordability of vehicles.

– CEO Elon Musk in the Q3 FY24 earnings call.

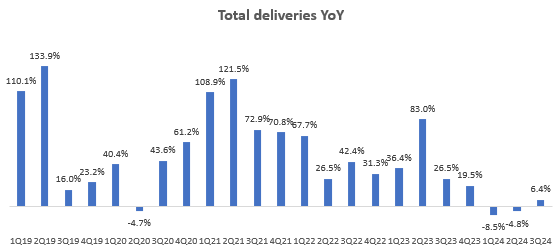

Tesla’s total deliveries grew 6.4% YoY, outperforming the broader industry, which has seen YoY declines:

Total deliveries YoY (Company Filings, Author’s Analysis)

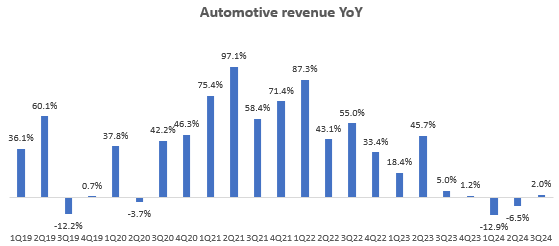

Over the next 6 months, the introduction of affordable Tesla models ($30,000 and below price points) in H1 FY25 is expected to boost automotive sales growth again by 20-30%:

Automotive revenue YoY (Company Filings, Author’s Analysis)

Hence, my assessment is that Tesla is holding well in sales performance so far, with further upside catalysts ahead in the next half-year.

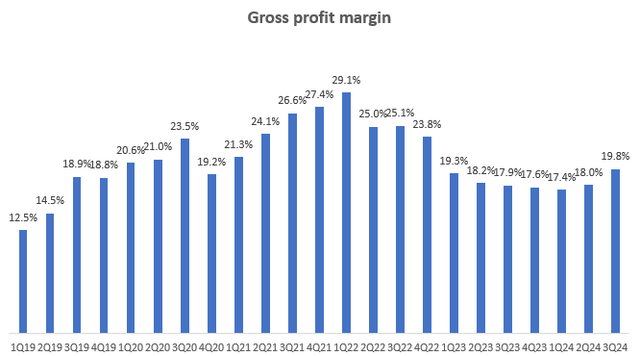

Margin performance is likely to revert a bit

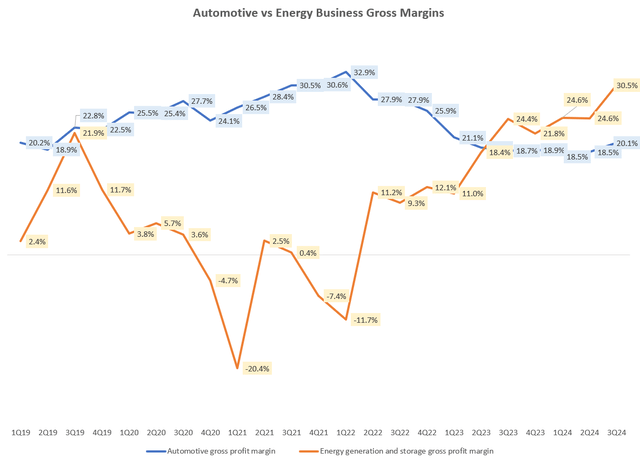

Tesla saw a meaningful +180bps jump in gross margins in the latest quarter:

Gross profit margin (Company Filings, Author’s Analysis)

This is driven by gross profit margin uptick in both automotive (80.6% of gross profit mix) and energy business lines:

Automotive vs Energy Business Gross Margins (Company Filings, Author’s Analysis)

However, management commentary suggests that the current gross profit margin levels may revert down a bit:

Energy margins in Q3 were a record at more than 30%. This is a function of mix of projects being deployed in the quarter. Note that there will be fluctuation in margins as we manage through deployments and our inventory.

– CFO Vaibhav Taneja in the Q3 FY24 earnings call, Author’s bolded highlight.

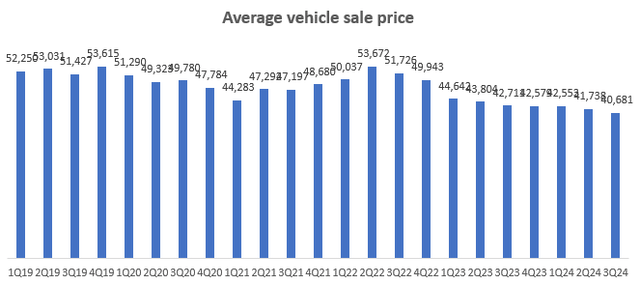

On the automotive side, Tesla’s average vehicle sales price has been ticking down, driven primarily by financing incentives:

Average vehicle sales price (Company Filings, Author’s Analysis)

This is one of the factors expected to weigh down on margins in Q4 FY24. Thus, I anticipate the gross profit margin profile in Q4 and beyond to revert toward the 19.0% levels. I am still baking in some improvement as the company has been making structural progress on lowering the cost per vehicle.

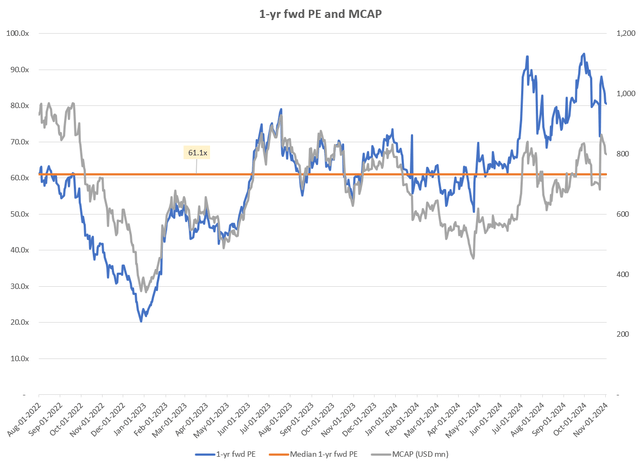

Valuations are at a premium driven by FSD and Optimus expectations

Tesla stock currently trades at a 1-yr fwd P/E of 80.6x, which corresponds to a 32% premium to the recent median 1-yr fwd P/E of 61.1x:

1-yr fwd PE and MCAP (Capital IQ, Author’s Analysis)

I posit that bullish expectations on FSD and Optimus growth vectors are the key determinants of the premium valuation. On FSD, the bullishness seems to be driven by expectations of full autonomy for the existing vehicle fleet in 2025:

There’s no need to wait for a robotaxi or a Cybercab to experience full autonomy. We expect to achieve that next year with our existing vehicle line.

– CEO Elon Musk in the Q3 FY24 earnings call.

On the Optimus humanoid, Musk noted a massive improvement in movement dexterity and expressed confidence in scalability to high-volume production.

Now, I think it is prudent for any investor to downgrade the timelines of the Tesla CEO’s comments, as Musk has a notorious reputation of pushing timelines. Still, I believe a modest relative valuation premium is acceptable at this stage. A key monitorable for it remaining so it would be approvals for the roll-out of ride-hailing services in Texas and California next year.

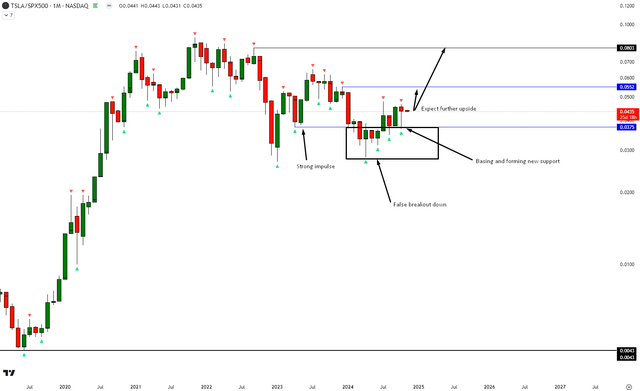

Technicals point bullish after a false breakout down

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

Relative Read of TSLA vs. SPX500

TSLA vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

TSLA stock relative to the S&P500 has posted a false breakout below a strong up-thrust. The ratio prices have stabilized, basing and forming a new support level. I anticipate further expansion toward the upside over the coming months.

Prepaid expenses creep up is a working capital monitorable

One thing that has caught my eye is a steady creep up in prepaid expenses and other current assets as a % of revenue:

Prepaid expenses and other current assets as % of revenue (Company Filings, Author’s Analysis)

From prior levels, this is leading to a 200bps detraction in the cash flow conversion profile of the company. I could not find a specific explanation for these movements. However, it is something I am monitoring for further erosion. I believe a common investing oversight is to focus on margin erosion but miss cash flow conversion erosion effects.

Takeaway & Positioning

Tesla’s automotive sales performance seems to be holding up well relative to the broader industry. My earlier thesis about demand drivers from increased affordability remains intact. Furthermore, the introduction of affordable models in H1 FY25 is a key volume catalyst.

Margins performance has hit a local high in Q3 FY24. However, this is likely to revert down a bit, driven by fluctuations in the energy business and low average selling price headwinds in the automotive business.

Valuations are at a 32% premium to 1-yr fwd PE levels. I believe this is acceptable so long as the FY25 timelines of robotaxis and ride-hailing services roll-out in Texas and California remain intact.

Technically, vs. the S&P 500, TSLA is basing after a false breakout to the downside. I anticipate it to outperform the broader market over the coming months.

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P 500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to more than a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.