Summary:

- Although shares have Tesla have rebounded some, the company has plenty of fundamental issues, especially when it comes to the competitive environment.

- The business continues to lose market share, and the stock is incredibly expensive at this time.

- The firm makes for a “strong sell” candidate based on these issues and others, such as a robotaxi plan that is unlikely to bear fruit.

Sven Piper

Over the past five years, electric vehicle manufacturer Tesla, Inc. (NASDAQ:TSLA) has been one of the best performing companies out there. Its share price has skyrocketed by 1,131% during this window of time. However, those who follow my work closely, know that I have not been all that big a fan of the business. This does not mean that I have been consistently bearish. Back in 2018, I wrote an article wherein I discussed the potential that the company had to grow into the robotaxi market. Even though shares were outrageously expensive at the time, I said that the business could see strong fundamental performance if things went well there.

But since the middle of 2023, I have been far more pessimistic. In addition to shares being overvalued, I have been concerned about the competitive landscape of the electric vehicle market. A rise in the number of models currently offered, not only in the US, but also abroad, is making it difficult for everybody in this space to perform well. But that isn’t terribly surprising to me. I have long known that the automotive space has been difficult for companies to participate in. However, in July of this year, I finally downgraded the stock from a “sell” to a “strong sell.” This was based not only on fundamental and competitive challenges, but also on worries about the firm’s leadership.

Since then, the stock has risen by 13.9% while the S&P 500 (SP500) is up 6%. Some of this improvement seems to be warranted as, when the company announced financial results for the third quarter of the 2024 fiscal year, it came out with bottom-line figures that should be considered impressive. But looking deeper into the business, we see where the strength lies and where the weaknesses are. Add on top of this how shares are valued today, and a continued decline in its market share, and I do think that the “strong sell” rating I assigned it earlier this year will play out.

Some improvements

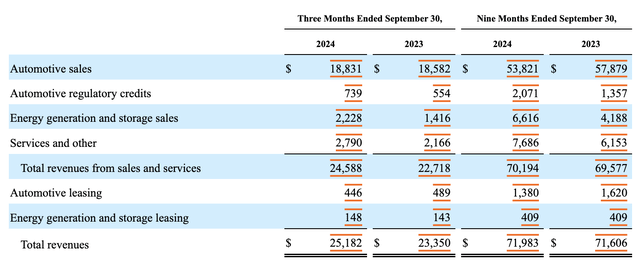

When talking about the fundamental performance of Tesla, the best place to start off would be results for the most recent quarter, which would be the third quarter of the 2024 fiscal year. At first glance, things were actually positive. Revenue totaled $25.18 billion. That happens to be 7.8% above the $23.35 billion reported one year earlier. However, it’s important to look at where this growth came from. Where did not come from, at least not much, it was on the automotive side of things. Overall revenue for this time did grow, but only to the tune of 2%. However, if we strip out regulatory credits that the company added, then sales would have increased by just 1.1%.

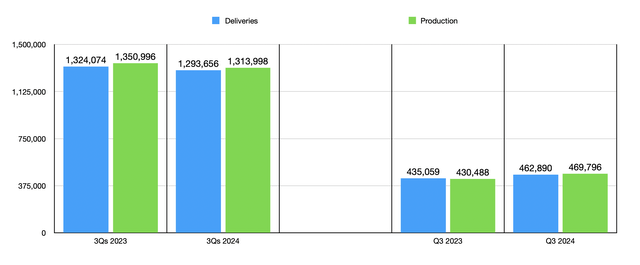

This growth for the company was the result of a rise in the number of vehicles delivered from 435,059 last year to 462,890 this year. That’s an improvement of 6.4%. Management does not break down pricing figures. But they did acknowledge that this growth in deliveries was offset by a change, not only and product mix, but also by a decrease in the average selling price of the firm’s vehicles.

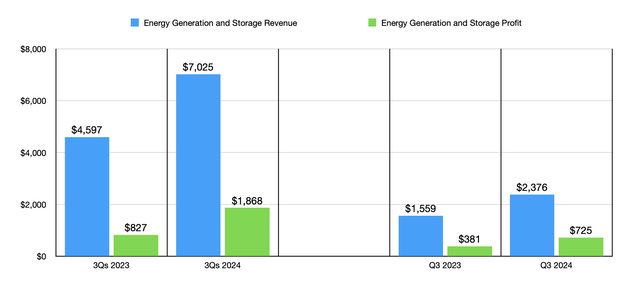

The real growth for the company came from non-core operations. Its Energy Generation and Storage segment saw a jump in revenue from $1.56 billion to $2.38 billion. That’s an increase of 52.4% year over year. The company benefited during this time from an increase in deployments of both its Megapack and Powerwall products on a year-over-year basis. For those not familiar, Megapack is a battery that provides customers with energy storage and support in the furtherance of stabilizing the power grid and with the hopes of reducing or preventing power outages. The Powerwall is essentially a smaller version of this that serves as a home battery that provides backup and protection for customers during an outage.

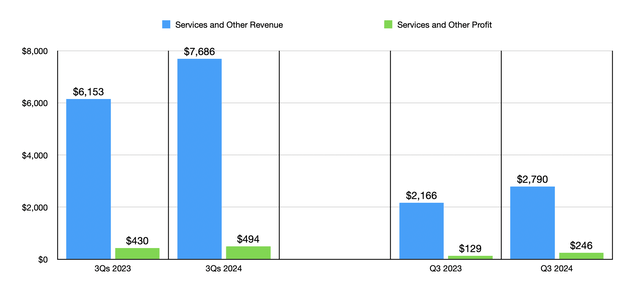

The business also saw growth under the Services and other category, with revenue shooting up 28.8% from $2.17 billion to $2.79 billion. Higher non warranty maintenance services and collision revenue, used vehicle revenue, paid Supercharging revenue, insurance services revenue, and part sales revenue are all included under this category. And according to management, these all increased on a year-over-year basis.

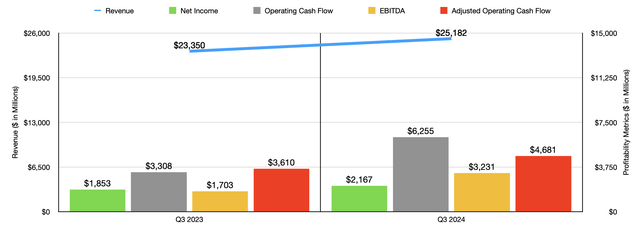

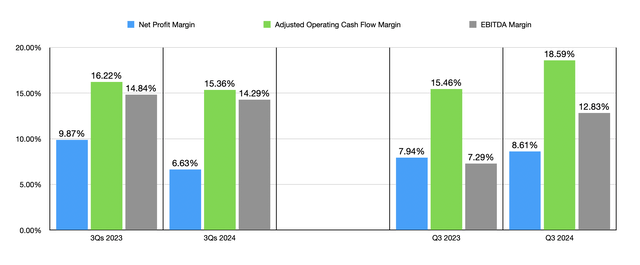

With revenue rising, profitability for the company also got better. Net income expanded from $1.85 billion to $2.17 billion. This is where things get rather interesting to me. In my most recent article about Tesla, I discussed the troubles the business was facing from a margin perspective. Year over year, it’s a net profit margin, it’s adjusted operating cash flow margin, and its EBITDA margin were all down. I attributed this to increased competition in the electric vehicle market that caused companies to have to compete more on price. And as the 800 pound gorilla in the room, Tesla was all but guaranteed to take a hit.

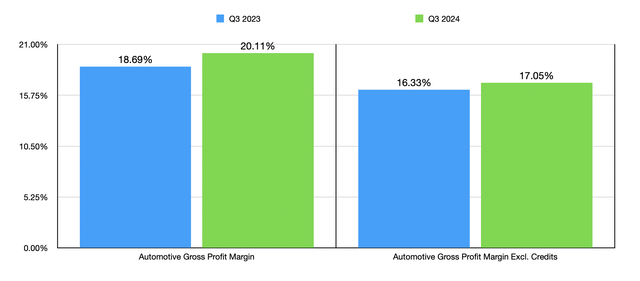

The growth in net profit for the business translated to an increase in net profit margin from 7.94% to 8.61%. But digging deeper, I found that this was really just the result of the two parts of the company that I already detailed that were performing exceptionally well. We don’t have net profit data on a unit-by-unit basis. But we do have gross profit in that form. And if we focus just on the automotive side of the business, we would have seen an improvement in gross profit margin from 18.69% to 20.11%. However, if we strip out the regulatory credits that the business received, then this profit margin would have inched up only slightly from 16.33% to 17.05%.

To be fair, this improvement is great to see all the same. While the company had to cut prices to remain competitive, it did benefit from a reduction in the average combined cost per unit of its vehicles. It also saw an increase in FSD (Full Self-Driving) revenue that helped to push profitability higher. For those not familiar, FSD is a subscription-only software package consisting of advanced driver assistance features that the company charges $99 per month for. While this might not sound like much, when applied to a large fleet of vehicles, it does add up. During the third quarter of this year, the company recognized $326 million of FSD revenue for its Cybertruck. According to one estimate, the company could book around $1 billion worth of FSD and FSD-related deferred revenue over the next year.

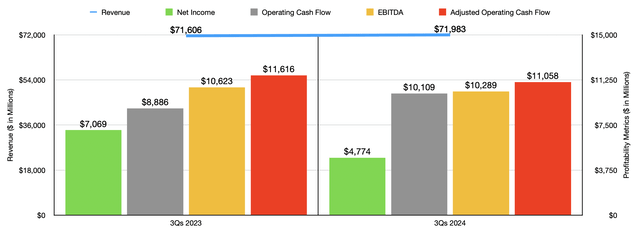

Features like this will certainly help the company in the near term. But as with just about anything else in the automotive market, you can expect a commoditization effect as time goes on. This will eventually push all the players to offer this kind of functionality for cheap or free. But it could take several years to get to that point. Meanwhile, Tesla is likely to benefit from it. Naturally, the increase in profits for the company also brought with it higher cash flows. Operating cash flow nearly doubled from $3.31 billion to $6.26 billion. If we adjust for changes in working capital, however, we get a smaller increase from $3.61 billion to $4.68 billion. And finally, EBITDA for the business expanded from $1.70 billion to $3.23 billion.

In the chart above, you can see the financial performance for the first nine months of 2024 compared to the same time in 2023. Even as the number of deliveries for the company dropped year over year from 1.32 million to 1.29 million, revenue increased. But that was the result of the other factors that applied to the third quarter on a standalone basis. Profitability declined from $7.07 billion to $4.77 billion. And except for operating cash flow, all the company’s other profitability metrics worsened during this window of time. This shows that while the third quarter might have been good for the company, this year is still looking rough. Year over year, margins have contracted, and that’s even after factoring in the robust third quarter.

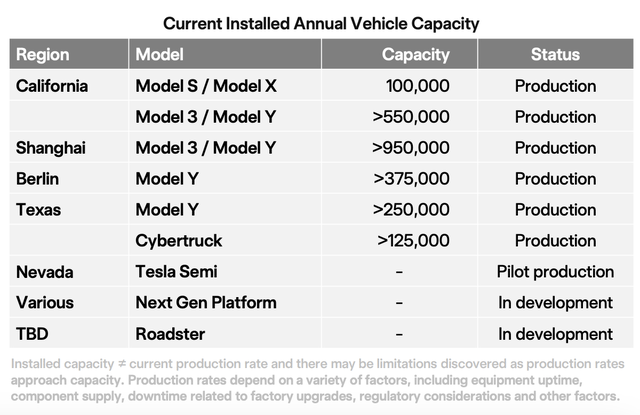

When it comes to the rest of this year in its entirety, we don’t really know what to expect. Management did say that overall deliveries this year should be slightly above what they were last year. This suggests a strong quarter to finish out 2024, with current estimates of 515,000 units being produced. It is no secret that management has been working hard toward increasing production capacity. As of the end of the third quarter, overall capacity is about 2.35 million vehicles annually. That’s up from 2.225 million annually at the same time last year if we exclude the 125,000 units worth of capacity associated with the Cybertruck that was only in pilot production last year. In pilot production right now would be the company’s semi facility in Nevada. Current estimates call for that location to result in an annual output of around 50,000 Tesla Semi trucks. It will also be responsible for producing enough batteries for 1.5 million light-duty vehicles each year.

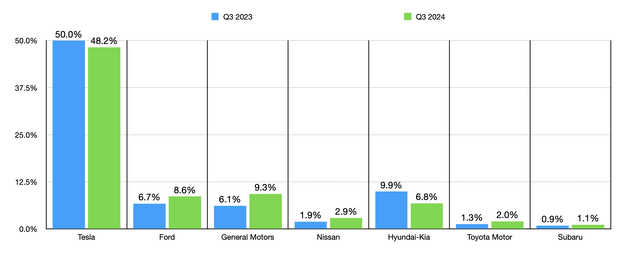

According to third-party estimates, if Tesla can deliver around 1.85 million vehicles this year, then next year it might be capable of producing around 2.2 million to 2.4 million vehicles. This sounds exciting. But the fact of the matter is that this comes at a time when the business is already losing market share. In the US specifically, during the third quarter, Tesla produced around 48.2% of all electric vehicles that ended up being sold. This makes it far greater than any of its rivals, with the next largest being General Motors at 9.3%. But this is down from 50% at the same time in 2023. During the same window of time, General Motors (GM) has grown from a market share of 6.1% to the 9.3% that I already mentioned. Ford (F) has seen an increase from 6.7% of the market to 8.6%. And a slew of other companies have captured respectable chunks of the overall market.

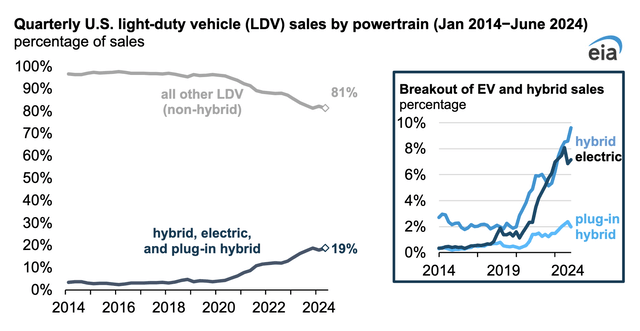

It is true that the electric vehicle market continues to grow, though. Now, the number of new vehicles sold in the US this year should only climb from about 15.5 million last year to around 15.7 million this year. However, data provided by the EIA (Energy Information Administration), admittedly only through the second quarter of this year, shows that all types of electric vehicles now account for 18.7% of the overall industry. That compares favorably to the 17.8% reported at the same time last year. And according to CarEdge, the number of units sold in the third quarter ended up being 10.6% greater than what was experienced in the third quarter of 2023.

Of course, the electric vehicle market is still very much focused on big spenders. In fact, the so-called “luxury” market of vehicles accounted for 73.8% of all battery electric vehicles, 8.3% of hybrids, and 29.2% of all plug-in hybrids, during the most recent quarter for which data is available. That’s why Tesla and other competitors are racing to get lower-cost models out there. But with those will come lower margins, in all likelihood.

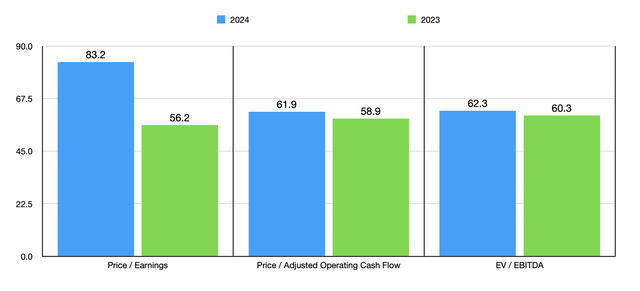

Because of this, I suspect that even as the revenue generated by Tesla grows, especially if much of that growth comes from vehicle sales, overall profit margins will probably contract eventually. However, it is too early to know whether this will come to fruition and the full impact it will have if it does. When it comes to valuing the company, the best thing to do is to look at how shares are priced at the moment. In the chart above, you can see how the stock is valued using projected figures for 2024 and historical results for 2023. These are astronomical figures, especially for a company that I would consider to no longer fit the “high growth” category of opportunities out there. But in all honesty, even if these profit and cash flows were double, it would be difficult to justify anything better than a soft “sell” rating. After all, as illustrated by the table below, major car producers with a big presence in the US trade at multiples significantly lower than what Tesla would be going for even if its profits and cash flows doubled.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

|

Tesla |

83.2 | 61.9 | 62.3 |

| Ford | 10.8 | 3.0 | 14.5 |

| General Motors | 5.5 | 3.1 | 6.2 |

| Stellantis (STLA) | 2.9 | N/A | 1.1 |

Some investors might be optimistic about other opportunities that exist when it comes to Tesla. In the past, I have been cautiously optimistic about the robotaxi potential of the company. But in early October, shares of the company dropped 8% in a single day after failing to impress investors and analysts with plans centered around this technology. But this vehicle, known as the Cybercab, won’t begin production until 2026. And in all honesty, that is long overdue compared to previous timelines provided by Tesla’s CEO, Elon Musk. The first time he made a promise, he stated that Tesla’s robotaxi network was going to be released in April 2019. That is forever ago in the technology industry.

If this was still a largely unexplored industry, I think there could be some optimism here. However, as I detailed in a prior article, this space is already being focused on by other companies that, frankly, have more robust balance sheets than what Tesla could hope to have. Specifically, Waymo, which is owned by Google parent Alphabet (GOOG, GOOGL), recently celebrated hitting the milestone of providing 150,000 paid autonomous trips in a single week. This marks a significant increase compared to the 100,000 trips in a single week that the company confirmed occurred back in August. Likely, by the time Tesla rolls out its network, companies like Waymo will already have an insurmountable advantage.

Takeaway

All things considered, I believe that Tesla is one of the riskier prospects on the market at this point. The recent quarter showed some improvements on the bottom line. But this was really the result, for the most part, of non-core operations and automotive regulatory credits. Competition is increasing in this industry and the business itself is losing market share. Even if the company had doubled the profits and cash flows than it currently does, I struggle to imagine how it could make for even a decent prospect. Add on top of this concerns about its robotaxi ambitions, and I believe that there are certainly better candidates that can be had at this time. For all of these reasons and more, I’ve decided to keep the company rated a “strong sell” for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!