Summary:

- Advanced Micro Devices, Inc. is making significant strides in software development with its ROCm stack and AI capabilities, aiming to close the gap with Nvidia’s CUDA.

- Its acquisition of Silo AI enhances its AI expertise, potentially positioning it as a viable alternative to Nvidia in AI solutions.

- The successful launch of AMD’s MI300X AI accelerator and its adoption by major hyperscalers like Microsoft, Meta, and Oracle bolster its growth prospects.

- The company must improve its free cash flow to justify its current valuation.

JHVEPhoto

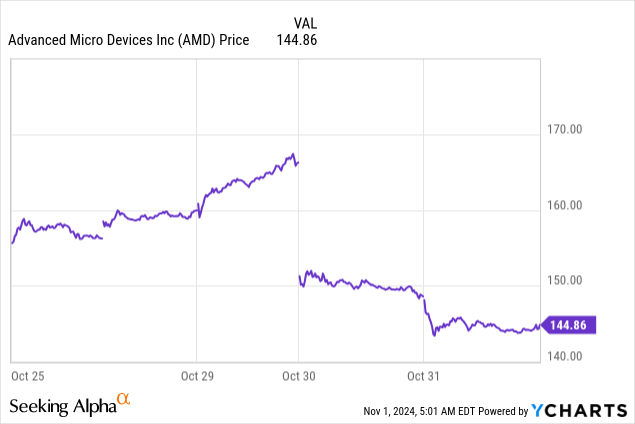

My buy recommendation of Advanced Micro Devices, Inc. (NASDAQ: AMD) on September 9, 2024, has advanced by 3.60% compared to the S&P 500’s (SPX) 3.91% rise. The company reported its third-quarter 2024 earnings on October 29. Although the results were OK, investors seem to be requiring the company to outperform expectations. The stock dropped around 12% in reaction to the report on October 30 and dropped a further 3% on Halloween to $144.86.

However, investors should not give up on the stock so soon. The company has made significant progress in carving out space in the Artificial Intelligence (“AI”) infrastructure market alongside Nvidia (NVDA). Over the last year, AMD has taken essential steps to close the gap with its larger rival by creating a viable replacement for Nvidia’s CUDA framework and purchasing several companies with competitive AI software offerings.

This article will discuss the progress AMD has made in developing software. It will also examine the company’s fundamentals from its third-quarter earnings, valuation, risk, and why AMD is still a buy.

Software Progress

The core strength of Nvidia’s moat is its software, specifically CUDA. Introduced in 2006, CUDA makes it easier for developers to write parallel code to use NVIDIA Graphics Processing Units (“GPUs”) processing power for general-purpose computing tasks. CUDA has a substantial lead over other software for GPUs and has become a standard for GPU acceleration, especially in fields like machine learning, AI, and high-performance computing. CUDA has a massive developer base, which the company built up for almost two decades, making it difficult for competitors to establish competing software in the same way software companies had difficulties establishing a competing operating system for personal computers against Microsoft’s (MSFT) Windows.

A significant reason AMD has lagged Nvidia in sales of its GPUs to AI infrastructure providers like Amazon’s (AMZN) AWS, Microsoft’s cloud unit Azure, and Alphabet’s (GOOGL, GOOG) Google Cloud Platform is that Nvidia’s GPUs were easier to work with because the company tightly integrated CUDA into its GPUs. For some time, CUDA only worked with Nvidia GPUs. That may no longer be the case, as Spectral Compute invented Scale, a way for CUDA to work with non-Nvidia chips like AMD’s. However, Scale is not open source, and Spectral Compute could potentially monetize it in the future by selling it to users instead of offering it as a free license like it does today.

AMD has tried since 2016 to establish a software stack named ROCm for developers to write parallel code for AMD GPUs. Yet, that effort failed to catch on enough to impact Nvidia for several reasons. However, AMD now seems earnest about establishing RoCm. AMD’s Chief Executive Officer (“CEO”) Lisa Su said the following at the Goldman Sachs Communacopia And Technology Conference (emphasis added):

What do I believe we’ve done the best over the last, let’s call it, nine months or so, it’s really been the progress on software. That was always a big question around how hard is it to get people into the AMD ecosystem. And we’ve just made tremendous progress with our overall ROCm software stack. We’ve now worked with some of the most challenging and largest models, and we’ve seen them get performance, in some cases, with certain workloads even better than the competition, which is exciting. And then we’re continuing to build out the entire infrastructure of what we need.

AMD is also attempting to catch up to Nvidia in AI, an area that Nvidia’s CEO Jensen Huang has focused on since 2012 when it powered the AlexNet neural network, which some call the birth of deep learning. AMD purchased Silo AI on August 12, the largest private AI lab in Europe. The press release announcing the acquisition states:

Silo AI brings a team of world-class AI scientists and engineers to AMD experienced in developing cutting-edge AI models, platforms and solutions for large enterprise customers including Allianz, Philips, Rolls-Royce and Unilever. Their expertise spans diverse markets and they have created state-of-the-art open source multilingual Large Language Models (LLMs) including Poro and Viking on AMD platforms. The Silo AI team will join the AMD Artificial Intelligence Group (AIG), led by AMD Senior Vice President Vamsi Boppana.

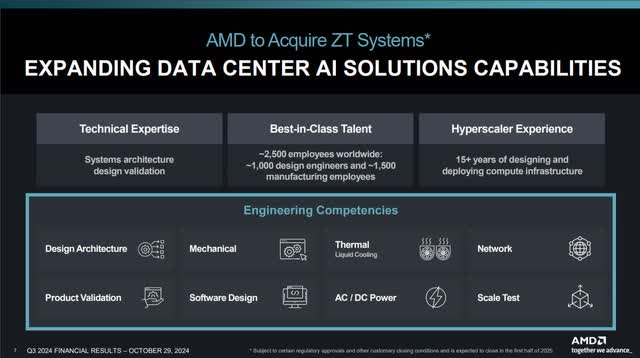

The company followed that up by buying another AI company, ZT Systems, on August 19. AMD stated the purpose of acquiring the company in its press release:

“ZT Systems, a leading provider of AI and general-purpose compute infrastructure for the world’s largest hyperscale providers, brings extensive AI systems expertise that complements AMD silicon and software capabilities.”

ZT Systems will help AMD design, validate, and bring new AI chips to market much faster.

AMD Third Quarter Investor Presentation.

AMD is starting to gain traction with these software initiatives. CEO Su said during the company’s third-quarter 2024 earnings call:

On the AI software front, since launching MI300 10 months ago, we have expanded functionality at every layer of the ROCm stack and increase the number of models that run out of the box on Instinct accelerators to more than 1 million, enabling customers to get up and running as fast as possible with maximum out-of-the-box performance. With the release of ROCm 6.2 last quarter, MI300x inferencing performance has improved 2.4x since launch, and training performance has increased 80%. We are working closely with a growing number of marquee Cloud and Enterprise customers to fine-tune their specific inferencing workloads for MI300 with many customers seeing 30% higher performance compared to competitive offerings, and we continue to expand our work with the open-source community, broadening support for key frameworks like JAX, libraries like vLLM and hardware-agnostic compilers like Triton.

CEO Su also announced that the company was able to get several critical open-source AI software technologies to support ROCm, including Meta Platforms’ (META) Llama, SGLang, and Alphabet’s (GOOGL)(GOOG) TensorFlow. Bullish AMD investors are optimistic that the company can narrow the gap between AMD and NVIDIA and become an open software alternative to NVIDIA’s AI solutions.

Company fundamentals

The Data Center unit is AMD’s locomotive, producing 52% of its revenue in the third quarter. It’s no secret that market demand for chips capable of running the most advanced AI workloads in the cloud and enterprise drives growth in the Data Center business. AMD has become the only significant viable alternative for GPU-based accelerators to Nvidia and appears to be approximately a year behind in shipping equivalent chips. AMD recently started manufacturing its next-gen Instinct MI325X GPU in substantial quantities to compete with Nvidia’s H200 Hopper. AMD plans to begin shipping those chips in the first quarter of 2025. Meanwhile, Nvidia will start shipping a more advanced chip, Blackwell, in the fourth quarter of this year.

AMD CEO Su discussed how far the company was behind in AI GPU-based chips on the third quarter earnings call:

I think MI300, when we launched it was behind H100, H100 was in the market for a longer time. And we have with our accelerated road map actually closed a good part of that gap. I think MI325 is a great product. It’s going to compete very well with H200 and the MI350 series will compete very well with Blackwell.

What the AMD CEO didn’t say was that the company plans to release its MI350 series chips in the second half of 2025, so Nvidia has a lead of somewhere between six months to one year. By the time AMD ships MI350, Nvidia will likely start shipping the B300 series, the Blackwell upgrade. Nvidia also plans to ship Rubin, its next-generation chip after Blackwell Ultra, in 2026. AMD has appeared to position its MI400 series, due in 2026, to close the last gap with Nvidia. Whether AMD does catch its rival soon, it should at least build a significant business as a reliable second source for GPU AI accelerators.

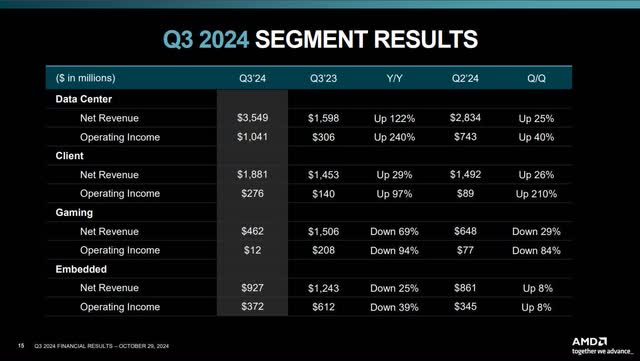

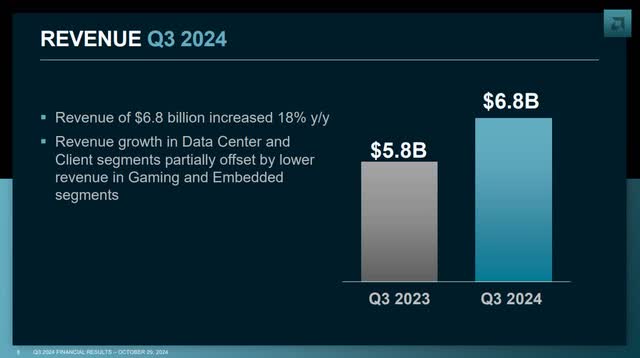

AMD’s Data Center segment’s third-quarter 2024 revenue increased by 122% year over year and 25% sequentially to $3.549 billion, beating analysts’ estimates of $3.475 billion. AMD Instinct MI300 data center GPU shipments and AMD EPYC CPU sales growth drove revenue growth. The company launched MI300 in November 2023.

Data Center’s operating income rose 240% to $1 billion in the third quarter of 2024. Chief Financial Officer (“CFO”) Jean Hu attributed the operating income growth to “higher revenue and operating leverage.” The Data Center segment operating margin expanded 10 points year over year to 29%.

AMD Third Quarter Investor Presentation.

The other segment that outperformed during the quarter was the Client segment, comprised of CPUs (Central Processing Units) and APUs (Accelerated Processing Units) for notebooks, desktops, and commercial workstations. Third-quarter 2024 revenue in this segment grew 26% sequentially and 29% over last year’s third quarter to $1.9 billion on the back of robust demand for Zen 5 Ryzen processors, the latest AMD CPU microarchitecture. The company uses Zen 5 Ryzen processors in two new client platforms: Ryzen AI 300 Series processors (For AI computing) and Ryzen 9000 Series processors (For desktops).

The Gaming and Embedded segments held the company’s total revenue and profitability back. The Gaming segment supplies chips to Microsoft (MSFT) and Sony Group (SONY) for their game consoles. Both companies launched a new console generation in 2020. Since console generation usually lasts six to seven years, some believe Sony will introduce PS6, and Microsoft will release a new Xbox Series around 2026 or 2027. Typically, gaming console sales start to peter out in year four of a console generation, negatively impacting AMD’s revenue. As a result, AMD’s third-quarter 2024 gaming segment revenue has declined 29% quarter over quarter and 69% over the previous year’s comparative quarter to $462 million. The Gaming segment’s operating income was down 96% to $12 million. The Gaming segment’s operating margin shrank 12 points to 2%.

The company’s Embedded segment comprises revenue from Autos, industrial automation applications, and networking. This segment’s revenue has suffered since the auto and industrial markets are in an inventory correction that could last another year or two. CFO Jean Hu said about the Embedded segment performance:

Embedded segment revenue was $927 million, down 25% year over year as customers continue to normalize their inventory levels. Revenue increased 8% sequentially as demand improved in several end markets. Embedded segment operating income was $372 million, or 40% of revenue, compared to $612 million, or 49% a year ago.

Investors should not expect AMD to replicate Nvidia’s revenue growth performance entirely because it has a more extensive business in other segments outside the data center.

AMD Third Quarter Investor Presentation.

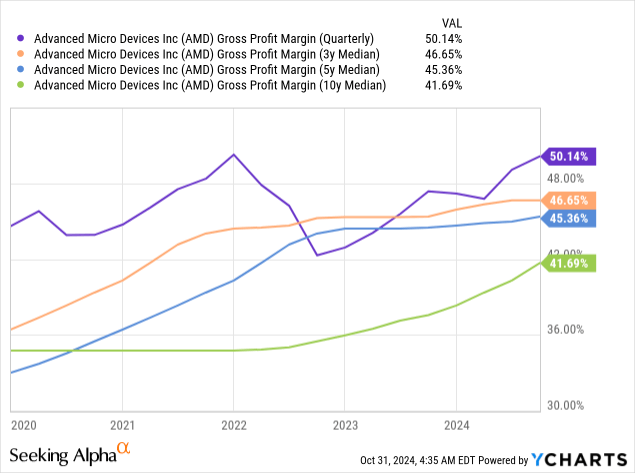

The following chart shows that except for the tech downturn due to rising interest rates, AMD’s GAAP (Generally Accepted Accounting Principles) gross market has risen well above its three-, five-, and ten-year gross margin median to 50%, a margin expansion of 3 points over the third quarter of 2023. Still, since OpenAI introduced ChatGPT and created a larger total addressable market in the data center, AMD’s gross market has had an upward trajectory. CFO Hu said about the gross margins on the earnings call, “[Non-GAAP] Gross margin was 54%, up 250 basis points year-over-year, primarily driven by higher data center segment revenue.”

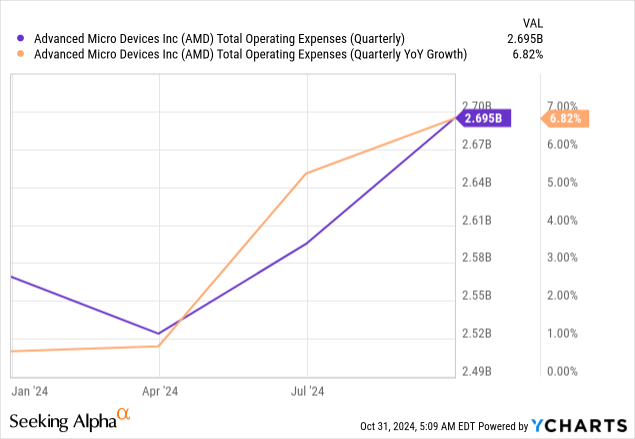

AMD’s third-quarter 2024 GAAP operating expenses rose 7% year over year to $2.7 billion due to continued investment in research and development (R&D) and sales and marketing. Non-GAAP operating expenses were up 15% over last year to $1.96 billion.

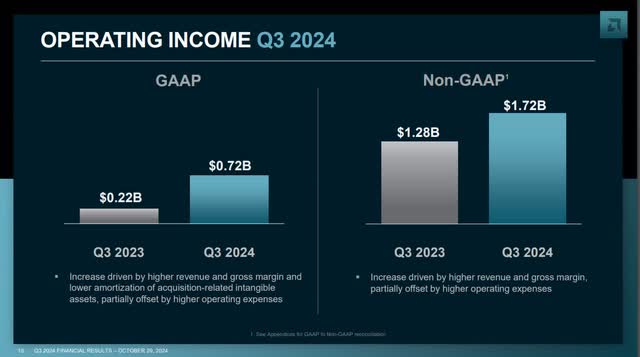

The company’s GAAP operating income ballooned 223% year-over-year to $724 million. GAAP operating margins expanded seven points to 11%. Non-GAAP operating income was $1.7 billion, up 34% over the previous year’s third quarter. Non-GAAP operating margins were 25.2%, up three points over the previous year’s third quarter. Analysts expected non-GAAP operating margins of 25.5%, so there was a slight miss.

AMD Third Quarter Investor Presentation.

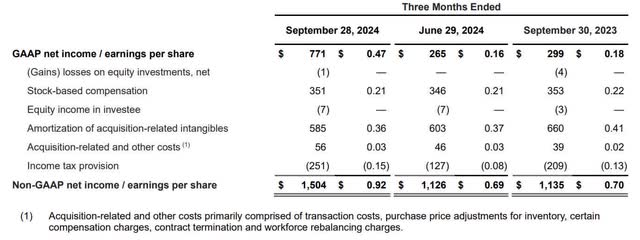

AMD’s GAAP earnings-per-share (“EPS”) was $0.47, beating analysts’ estimates by $0.06. Non-GAAP EPS was $0.92, which aligns with analysts’ non-GAAP EPS estimates. The company’s GAAP to non-GAAP net income/earnings per share reconciliation shows why management prefers to give non-GAAP guidance.

AMD Third Quarter Earnings Release.

The company’s recent acquisitions have resulted in non-cash acquisition costs that make apples-to-apples comparisons to previous quarters on a GAAP basis challenging. Acquisition-related costs are one-time costs. Acquisition-related intangibles are assets like patents, trademarks, intellectual property, copyrights, and other intangible items that lose value over time. The company will amortize the loss of value of these acquired intangible assets over their useful life, which appears as the amortization of acquisition-related intangibles on the above reconciliation. Income tax provisions can change based on many factors, including tax law and the jurisdictions the company chooses to operate. Some of these items can fluctuate significantly from quarter to quarter and be challenging to forecast, which is likely why management prefers providing guidance in non-GAAP metrics.

The second-largest net income expense after amortization of acquisition-related intangibles is stock-based compensation (“SBC”), which is 5.15% of third-quarter revenue and 6.10% of 2023 annual revenue—reasonable for a mature tech company.

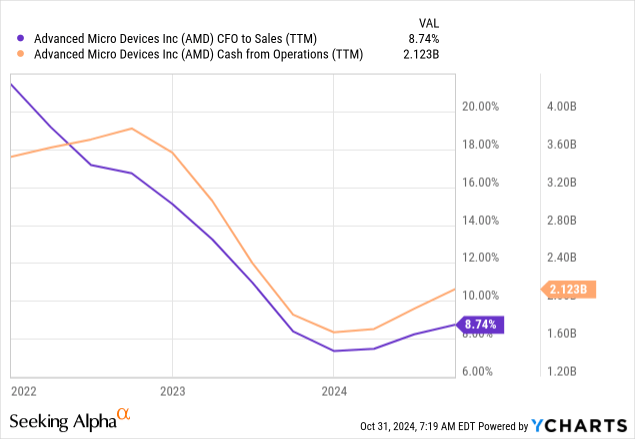

AMD’s trailing 12-month (“TTM”) cash flow from operations (“CFO”) to sales appears to have bottomed at the beginning of 2024 and is now 8.74%. I would like to see this number return to above 20%, as it would likely positively impact free cash flow (“FCF”) as long as the company maintains top-line growth and keeps the capital expenditure (“CapEx”) growth rate lower than the CFO growth rate. Third quarter 2024 TTM CFO was $2.12 billion.

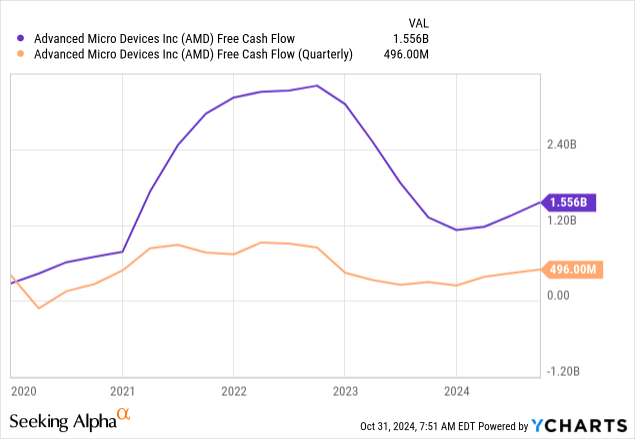

The company generated a quarterly FCF of $496 million, a disappointing 58% below analysts’ consensus estimates of $1.181 billion. Considering the company’s post-earnings price performance, this FCF performance returned to haunt it during the Halloween season. People who use FCF to value the stock may have lowered the valuation they are willing to buy or hold, possibly accounting for the stock price retreat after the earnings release. Its third-quarter TTM FCF was $1.556 billion.

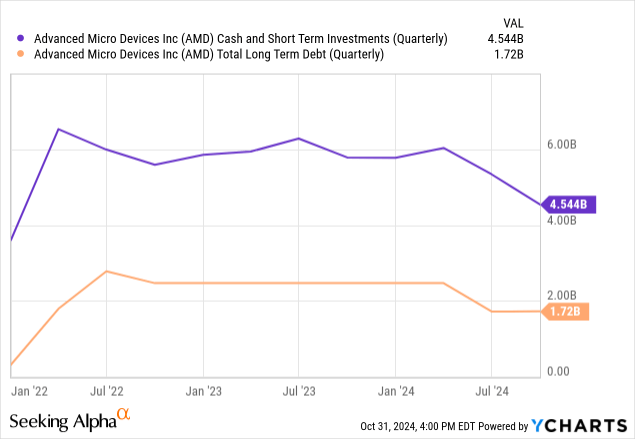

At the end of the third quarter of 2024, AMD had $4.544 billion in cash and short-term investments and $1.72 billion in long-term debt. The company’s debt-to-equity is 0.04, making it less vulnerable to economic downturns and interest rate hikes. Its debt-to-EBITDA ratio is 0.36, meaning the company can cover its debt obligations.

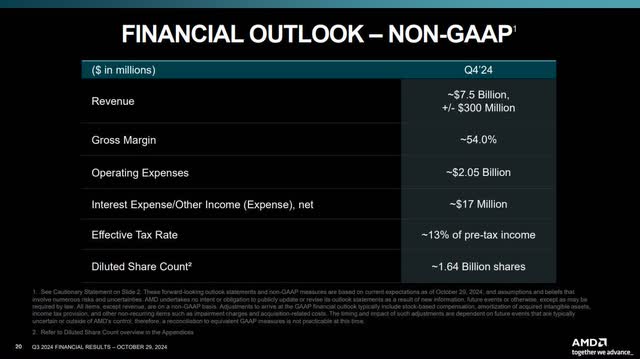

If AMD’s fourth quarter 2024 revenue hits $7.5 billion, the midpoint of guidance, the stock will rise 20.96% year-over-year. However, the market was looking for more. Analysts’ consensus revenue estimate was $7.54 billion, or 21.61% year-over-year revenue growth. Its fourth quarter non-GAAP gross margin guidance was 54%, slightly below analysts’ estimates of 54.1%.

AMD Third Quarter Investor Presentation.

The market has become increasingly impatient with AMD’s failure to meet expectations. Seeking Alpha published an article recently that stated,

“By this time in the game, AMD should be at least meeting guidance expectations, but in reality they should be surpassing guidance,” Victor Dergunov, investing group leader of The Financial Prophet, said on Wednesday in a conversation with Rena Sherbill, Seeking Alpha’s director of content programming, and Joe Albano, investing group leader of Tech Cache, at the Election 2024 investing summit.”

Since some of the company’s valuation metrics suggest overvaluation, AMD can’t afford to miss consensus analysts’ expectations.

Valuation

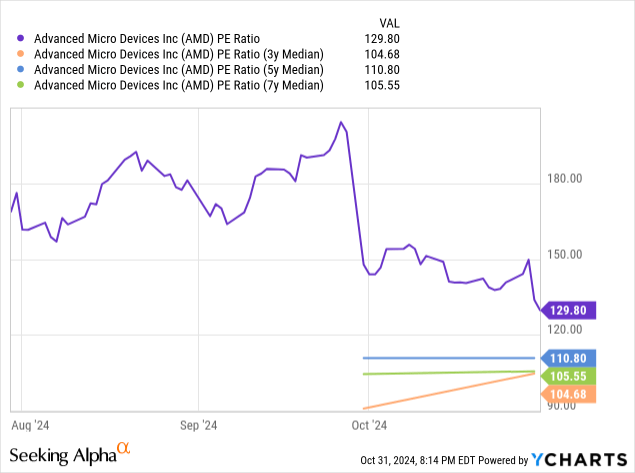

The last time I wrote about the stock, its price-to-earnings (P/E) ratio was 162.92. Although AMD’s P/E ratio has since dropped to 129.80, it’s still well above its three-, five-, and seven-year median. Some might call this stock overvalued.

The company’s one-year forward price/earnings-to-growth (“PEG”) is 0.51 (One forward P/E of 28.57 divided by analysts’ estimated EPS growth). Generally, investors consider a PEG ratio below 1.0 a sign of an undervalued stock. They will allow a growth stock like AMD to reach a PEG ratio of 2.0 before considering it overvalued.

If it sold at a PEG ratio of 1.0, the stock price would be $289.85, up 101% from the October 31, 2024, market closing price of $144.07. Suppose AMD sold at a PEG ratio of 2.0; the stock price would be $579.69, up 302%. These numbers suggest that the market potentially undervalues AMD’s EPS growth one year out. However, investors shouldn’t automatically believe that the stock price will jump 100% by the end of 2025. Remember how I said the company’s FCF may come back to haunt it?

The following is AMD’s reverse discounted cash flow (“DCF”), which I am using to determine what the October 31 closing price implies about the stock’s cash flow growth rate over the next ten years. This reverse DCF uses a terminal growth rate of 4% because the company should grow cash flow above the GDP (Gross Domestic Product) long-term growth average once it exceeds the forecast period. I use a discount rate of 9%, which is the opportunity cost of investing in AMD, reflecting a lower-than-average risk level. This reverse DCF uses a levered FCF for the following analysis.

AMD Reverse DCF

|

The third quarter of FY 2024 reported Free Cash Flow TTM (Trailing 12 months in millions) |

$1156 |

| Terminal growth rate | 4% |

| Discount Rate | 9% |

| Years 1 -10 growth rate | 34% |

| Current Stock Price (October 31, 2024, closing price) | $144.07 |

| Terminal FCF value | $22.441 billion |

| Discounted Terminal value | $189.585 billion |

| FCF margin | 6.4% |

If it can maintain an average FCF margin of 6.4% over ten years, AMD would need to keep an average annual revenue growth rate of 34% to justify the October 31 stock price. That seems a reach, as the company has only produced an average annual revenue growth of 15.64% over the last ten years. Let’s assume that AMD can maintain revenue growth of 15.64% over the next ten years; it would need to keep an average FCF margin of 18.64%, translating to $4.531 billion in FCF to justify the October 31 closing price. Is that even doable, since AMD has only maintained a median FCF margin over the last ten years of 2.1%? Bullish AMD investors hope that what AI has done for Nvidia will also help AMD. Nvidia’s median FCF margin in the previous ten years is 27.49%. So, as the number two GPU AI accelerator provider, AMD should achieve an average 18.64% FCF margin over the long term.

The company’s third-quarter revenue growth of 18% and its guidance for fourth-quarter revenue growth of 20.96% is above the revenue growth rate AMD needs to achieve over the next ten years to justify the October 31 stock price. AMD entered the year launching its first competitive AI chip, the MI300, and expected only $2 billion in Data Center GPU business revenue in 2024. The company has since upped that number to $5 billion, so it has gained significant traction. Considering the insatiable demand for AI chips, it likely can produce high revenue growth rates for quite a while. CEO Su said on the third quarter earnings call,

“In the Data Center alone, we expect the AI accelerator TAM [total addressable market] will grow at more than 60% annually to $500 billion in 2028.”

So, AMD will have captured only 1% of its 2028 GPU AI data center TAM if it hits its forecasts of $5 billion at the end of 2024. Assuming continued market share growth in the Data Center and Embedded and Gaming segments bouncing back over the next year or two, an average annual revenue growth rate of 15.64% over the next ten years is aggressive but achievable.

However, the FCF woefully underperformed what is required. At the current valuation, this stock is highly susceptible to revenue misses or FCF coming in below expectations. The market has built significant FCF growth assumptions into the stock price, and even with a favorable PEG ratio, without FCF improvement, the stock will be unlikely to achieve a one-year forward PEG ratio of 1.0.

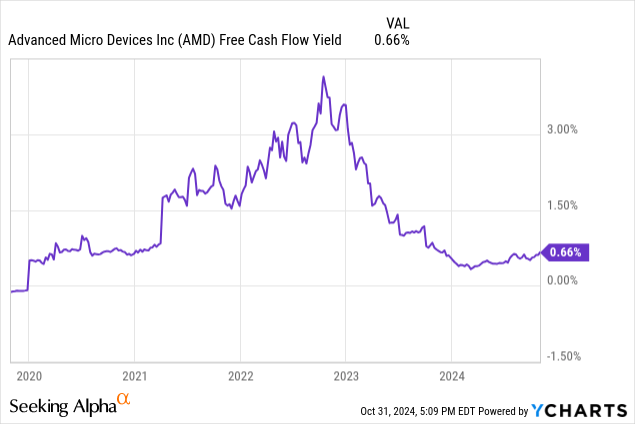

FCF yield is a company’s FCF divided by its market capitalization. You can use this metric to determine whether the market undervalues or overvalues a stock. Generally, the market may undervalue the stock when a company’s FCF yield is at the high end of its range. Alternatively, the market may overvalue a stock when the FCF yield is at the lower end of its range. According to that rule, the market may overvalue the stock at an FCF yield of 0.66%. The market capitalization doesn’t necessarily need to shrink for the FCF yield to rise. Suppose AMD grows its FCF faster than its market capitalization; the FCF yield could increase to the point where investors may consider it fairly valued or undervalued. Investors need to see AMD’s FCF grow substantially, or the stock price might have difficulty appreciating from the current levels.

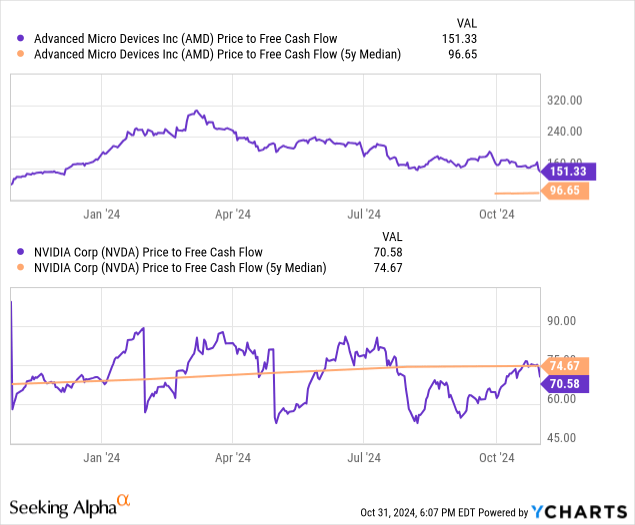

AMD’s price-to-FCF is 151.33, well above its five-year median. Additionally, the company trades well above Nvidia’s price-to-FCF of 70.58. In comparison to its median, some investors may consider Nvidia as undervalued.

The above chart suggests that either AMD’s price needs to come down or it must grow FCF faster than it did in the current quarter.

Risks

Despite AMD’s recent improvements to ROCm and its recent AI software acquisitions, Nvidia has established CUDA as an industry standard with an extensive developer ecosystem behind it. Additionally, Nvidia has had almost a decade’s head start in developing a suite of AI tools covering generative AI, data analytics, inference, conversational AI, vision AI, cybersecurity AI, and more. AMD will likely need to invest significantly to catch up to Nvidia in these areas, which could cause it to miss either profitability or FCF expectations built into the stock price.

AMD remains a buy

Despite Nvidia’s first-mover advantage in AI software, AMD’s situation is not all doom and gloom. ROCm is open-source, which can help build a community of developers relatively quickly. Additionally, the open-source movement often fosters innovation rapidly due to its collaborative nature. AMD can benefit from the open-source innovations with ROCm without spending as much on R&D as the company would have if ROCm were proprietary. With ROCm, the company now believes it has the GPU architecture that can outperform Nvidia’s GPU architecture with specific AI workloads, particularly those that benefit from high memory bandwidth.

Suppose you are an aggressive growth investor who believes that AMD will become a solid second choice for Nvidia’s GPU AI accelerators. You may want to consider investing in AMD. The stock remains a buy, especially if it pulls back further.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.