Summary:

- Dell’s AI-driven server sales are booming, positioning its ISG segment as a high-growth area in the AI data center market.

- Rising free cash flow enables increased share buybacks and dividends, reinforcing Dell’s financial stability and commitment to shareholder returns.

- Despite a 75% YTD gain, Dell’s stock trades at a discount, but further growth may require rethinking its declining PC segment to focus on AI.

Janis Abolins

Investment Thesis

Dell Technologies Inc. (NYSE:DELL), was not so long ago seen as part of these iconic household brands that are now declining hardware companies, significantly underperforming its software and chip peers in recent years. However, the AI revolution is behaving in waves and the narrative around Dell Technologies seems to have changed.

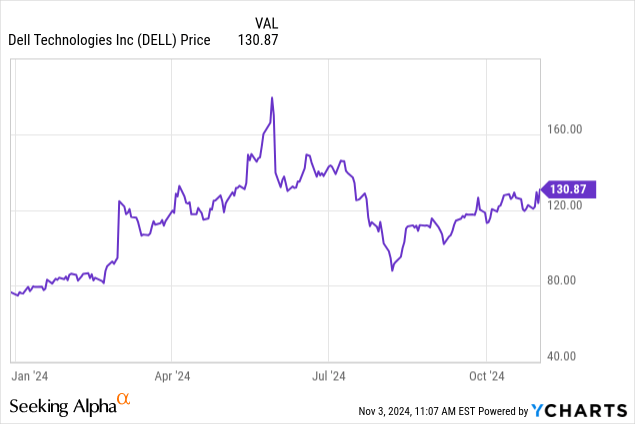

The rise of AI stocks started with generative AI software application stocks such as Adobe Inc. (ADBE), then moved to the chips powering those applications like NVIDIA Corp. (NVDA). It is now about to reach the AI servers manufacturer. Dell’s AI data center servers sales are booming since one year and have completely changed the narrative of the stock’s fundamentals. Trading at a forward PE below 17x, I believe the stock has room to run in the next few quarters.

The stock is already up 75% year-to-date – half of which was achieved in the third quarter alone, potentially hinting to an acceleration in the stock rise. But for the stock to continue running higher, management needs to significantly restructure and dynamize its declining PC business (perhaps by integrating its AI advances into the PCs) or shift the business model away from the PC business, which is dragging on its performance. The stock is for this reason, for now, rated a “Buy” and not a “Strong Buy”.

Business and Sector Overview

Dell’s global revenue is geographically well diversified, with about half of it generated in the US and the other half abroad. 55% of this global revenue is generated within the Client Solutions Group (CSG) which sells PCs, monitors and workstations. While it gained market share in both commercial PCs (from 15.5% in 2012 to 25.2% in 2022) and monitors (from 12.8% to 21.6%), revenue of CSG has been on the decline with a 5.5% revenue drop in 2023 and another 12% YoY drop in the second quarter of this year. Management tabled 2% CAGR in the TAM until 2027 (primarily PCs) which is even lower than US or global GDP growth rates. It is clearly a sector in stagnation, where Dell is managing to gain market share but insufficiently to reverse the revenue growth path since the end of the COVID quarantine.

The other business segment, Infrastructure Solutions Group (ISG) generates 38% of Dell’s global revenue and is well positioned to win in the AI race. From data storage to AI servers to cloud services, Dell could likely find new growth catalysts within ISG. It is already a market leader in external RAID storage. The AI segment within ISG has 18% CAGR TAM potential until 2027, primarily driven by AI services over hardware. Dell’s flagship server PowerEdge XE 9680 sales increase by 23% YoY in Q2.

The next earnings report relative to Q3 is at the end of this month, on November 26th, and the business performance and potential strategic shifts by the management will be closely monitored by Wall Street.

Financials

From a financial perspective, the change in fundamentals has yet to be reflected. Indeed, revenue declined 14% in FY2024 relative to FY2023 and EPS also declined 6%, primarily due to higher costs and supply chain disruptions in the PC market, combined with a stagnating demand for hardware driven by a slowdown of the Chinese consumer. On the other hand, the adjusted free cash flow rose a whopping 266% from $1.5 bn to $5.6 bn, showing an increased efficiency in business operations and a significantly lower cost of revenue basis as AI services prove to be a lower cost profitability center than Dell’s hardware.

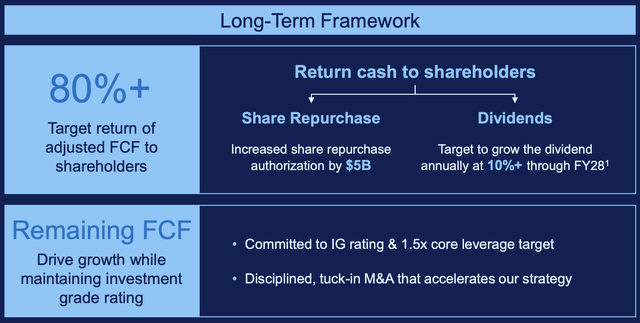

Long-Term Framework (Dell Investor Relations)

The adjusted FCF figure is important. Indeed, management announced that 80%+ of adjusted FCF is to be returned to the shareholders through share repurchases and dividends. Management announced a $5 bn increase in share repurchase authorization and also the target to increase dividend payments by 10% every year through FY2028. The dividend payment was already increased this year by 20%. This should help boost the current 1.3% dividend yield (under pressure due to high stock price increase). Wall Street and Dell shareholders are liking these shareholder friendly measures.

Additionally, Dell’s balance sheet is quasi pristine with $15.1 bn core debt (down 18% from FY2023) and a 1.5x core leverage (down from 3.2x in FY2020). This gives the company sufficient leeway for a potential business strategy shift with greater investment in the AI segment.

Valuation

From a valuation perspective, the stock of Dell is attractively priced, especially given the rosy outlook. With FCF expected to reach $7.67 bn by January 2025 and EPS to reach $9.38 from the current $7.13, it appears that the market is still lagging behind in readjusting the valuation to the change in fundamentals despite a 75% uptick in stock price YTD.

Indeed, the stock is currently trading at a P/E non-GAAP TTM of 18x and FWD of 16.6x. This is respectively 25% and 30% below sector median. From a P/S perspective, the contrast is even starker, with a cheap valuation of 1x relative to the sector’s 3x median. From a price to FCF perspective, given the expected improvement by Dell for next year, the stock is trading at 12x, well below the sector’s 21x (44% discount).

The stock is trading expensively compared to the peers it used to be compared with, in particular HP Inc. (HPQ) and Hewlett Packard Enterprise Company (HPE), both trading at around P/E non-GAAP FWD 10-11x. A comparison with those peers may not be as relevant as Dell is now midway between them and the AI stocks trading north of 20x.

Strictly from a metric perspective, the stock appears to be trading at a 30-40% discount, placing the stock price target at $170-180 from the current $130 level. This is conditional of course to a clear and confirmed business shift towards AI and an efficiency improvement in the CSG segment that has been dragging the overall group towards revenue stagnation, while ISG has been roaming in the opposite direction by boosting its cash position.

Risk Factors

The main risk factor is Dell’s inability to capitalize on a continued basis on AI. Note that Q2 was a one-time improvement in data serves as the main competitor in the segment, Super Micro Computer Inc. (SMCI) had its fair share of struggles. Larger, better capitalized competitors (hyperscalers) could potentially eat up market share from Del in the AI race and significantly impact the promising ISG rise.

Another risk is closely related to management. Michael Dell is the CEO since his return in 2007. Top management might stubbornly stick and overinvest into segments that defined Dell since decades as a PC-maker and miss the opportunity to move somewhat away from the low-profitability CSG business towards the much more promising, high-growth AI market addressed by ISG.

Bottom Line

Dell’s fundamentals seem to have drastically changed this year and has turned this iconic household name into, potentially, an actor of the AI revolution with high-quality data servers, cloud and storage solutions. Despite a 75% stock price rise fueled by improved free cash flow, a better outlook, share repurchases and dividend payment increases, it is likely that the stock is still priced too cheap relative to the sector – especially given the much improved growth prospects of the company.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.