Summary:

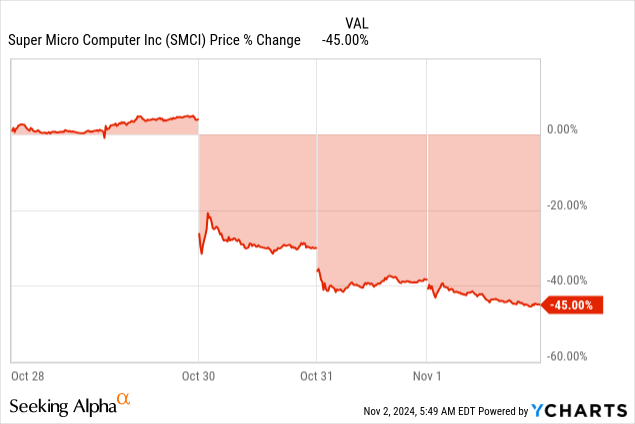

- SMCI’s stock fell over 45% following governance issues and auditor EY’s resignation, highlighting significant risks.

- Ernst & Young cited concerns over SMCI’s “integrity and ethical values,” heightening scrutiny on financial controls and governance.

- Scenarios range from appointing a Big Four auditor and timely filing to regulatory scrutiny and potential NASDAQ delisting.

- A loan amendment with Cathay Bank grants SMCI until Dec. 31 to file financials but requires $150M in cash reserves.

- SMCI’s ongoing issues suggest a wait-and-see approach until governance is improved, and a credible auditor is appointed.

peshkov

Investment Thesis

Since our last coverage of Super Micro Computer, Inc. (NASDAQ:SMCI), the investment landscape has changed considerably. While our initial thesis highlighted SMCI’s strong position in AI infrastructure and its significant revenue potential from GPU sales, recent events have introduced substantial risks.

Our prior thesis was based on SMCI’s robust technical indicators, revenue projections, and competitive product offerings in the rapidly expanding AI market. However, unexpected internal control issues and the resignation of its auditor, Ernst & Young (EY), have fundamentally altered the company’s risk profile. Following the announcement, SMCI’s stock plummeted more than 45%, marking its worst decline on record. The outcome remains highly unpredictable, with potential regulatory implications and considerable volatility likely to persist.

We have highlighted five possible scenarios to help navigate through the crisis, assigning probabilities and expected outcomes to each. Each scenario possesses a different set of paths that this situation might take for SMCI, but of course, the probability of scenario #2 and scenario #3 occurring is comparatively higher. However, only the best-case scenarios offer enough upside potential, while on the downside, the risks in worst-case scenarios are considerable. This watch-and-wait approach, again, is best until SMCI cleans up its governance issues, appoints a credible auditor, and cleans up the filing delays.

Loan Modifications, Extended Deadlines: Financial Flexibility in the Face of Reporting Difficulties

The resignation of EY as auditor for SMCI has brought to light some key concerns about the company’s governance and internal controls. In the resignation letter, EY specifically mentioned concerns about the “integrity and ethical values” of the management and audit committee of SMCI due to concerns over their independence from the CEO.

After EY resigned and continued financial reporting issues, SMCI announced an amendment to its loan arrangement with Cathay Bank, providing that much-needed liquidity in this period required high scrutiny. The amendment was disclosed shortly after EY’s departure, extended through Dec. 31, 2024, and the deadline for SMCI to file its audited financial statements for the fiscal year ended Jun. 30, 2024, which had been Oct. 28, 2024. The deadline for reporting its balance sheet and income statement for the fiscal quarter ended Sept. 30, 2024, also was extended to Dec. 31.

This amendment grants the much-needed breathing room for SMCI to sort out its internal control problems and finish its 10-K filing. Notably, the amendment adds a new covenant requiring SMCI to maintain at least $150 million of unrestricted cash, a protection reflecting Cathay Bank’s requirement for added security given the financial uncertainty surrounding the borrower. Although SMCI has remarked that it does not expect material changes in the results for fiscal 2024, the delay and departure of EY hit the investors with questions about the reliability of the financial reporting at the company.

Path Forward: 5 Scenarios That Could Define Its Future

Given SMCI’s current challenges, we have outlined five possible scenarios for how its situation might unfold, offering investors insights on potential value impacts:

-

Best-Case: Big Four Auditor Appointment, Timely Filing [(Best-Case Scenario – 15%) Upside Potential: 40-50%]: SMCI appoints a Big Four auditor (Deloitte, PwC, or KPMG) and files its 10-K by the Dec. 31 deadline, avoiding further regulatory issues and restoring market confidence. This outcome would likely drive stock recovery, as investors would view SMCI’s actions as credible steps toward transparency and governance improvements.

-

Moderately Positive: Mid-Tier Auditor, Timely Filing [On-Time Filing (Moderately Positive Scenario – 35%) Upside Potential: 25-35%]: If SMCI secures a reputable mid-tier auditor, like BDO or Grant Thornton, and meets the Dec. 31 deadline, it would still protect its NASDAQ listing. This scenario could stabilize SMCI’s stock, enabling gradual recovery if the company shows ongoing governance improvements.

-

Neutral to Negative: Smaller Auditor, Delayed Filing [(Neutral to Negative Scenario-25%) Upside Potential: 10-15%]: In this scenario, SMCI appoints a smaller auditor but files late into early 2025. A smaller firm might accept the engagement yet provide less investor confidence. The delay could lead to NASDAQ imposing stricter compliance measures, likely resulting in prolonged stock volatility.

-

Negative: No Auditor Appointment, Missed Filing Deadline [(Negative Scenario – 15%) Downside Potential: -15% to -20%]: Failing to secure an auditor and missing the December deadline puts SMCI at high risk of NASDAQ delisting, potential legal actions, and escalating regulatory costs. This outcome would hurt stock liquidity and investor access, likely leading to a sharp decline in value.

-

Worst-Case: Temporary Auditor and Extended Investigation [(Worst-Case Scenario – 10%) Downside Potential: -25% to -40%]: SMCI appoints a temporary auditor but fails to address governance issues, triggering an SEC investigation. Further scrutiny and potential financial restatements would worsen existing lawsuits and risk severe penalties, significantly damaging SMCI’s value and reputation.

Investor Outlook: Navigating Uncertainty Amid Regulatory and Financial Risks

The timeline extensions of the financial filings and modification of its loan agreement with SMCI buy some time but little to assuage the underlying concerns about governance. For investors, the road ahead has yet to become less risky. It will take a long process to bring on board a new auditor, particularly under the shadow of EY’s departure, as any successor is bound to conduct an extensive risk assessment. This could be forcing it to seek mid-tier or small firms because no other Big Four entity is likely to grant an audit to SMCI, considering reputational and compliance risk. This may raise other concerns about audit quality.

Investors should closely monitor SMCI’s upcoming business update call on Nov. 5, during which management will respond to EY’s concerns and plan to appoint a new auditor. However, the stock’s volatility will continue until SMCI resolves these issues. The risk of delisting remains if SMCI cannot meet NASDAQ’s reporting deadlines, and the amended loan covenants suggest that Cathay Bank is already preparing for potential challenges.

For current investors, a cautious approach is warranted. Monitoring the findings of SMCI’s Special Committee and assessing how the company addresses governance and internal control issues will be essential. Those considering new positions may prefer to wait until a new auditor is appointed, and financial reports are filed. Although SMCI has enjoyed growth in the AI infrastructure market, the governance and reporting issues overshadow its future performance. The next few months will be critical in determining whether SMCI can restore investor confidence and stabilize its financial standing.

Takeaway

Given SMCI’s current governance and financial reporting challenges, the stock now carries substantial downside risks and limited upside potential. While the scenarios could stabilize the company, including appointing a reputable auditor and meeting filing deadlines, these paths are uncertain, and any missteps could result in further regulatory actions or even delisting. Investors should consider holding off on new positions until SMCI resolves its governance issues, appoints a credible auditor, and reestablishes reliable financial oversight. For now, a wait-and-see approach is prudent until greater clarity emerges.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.