Summary:

- Google’s Q3 beat EPS by $0.27 and revenue by $2.05B. YouTube revenue over $50B; Cloud grew 35% YoY. Upgraded to Strong Buy; expecting 385% EV growth in 10 years.

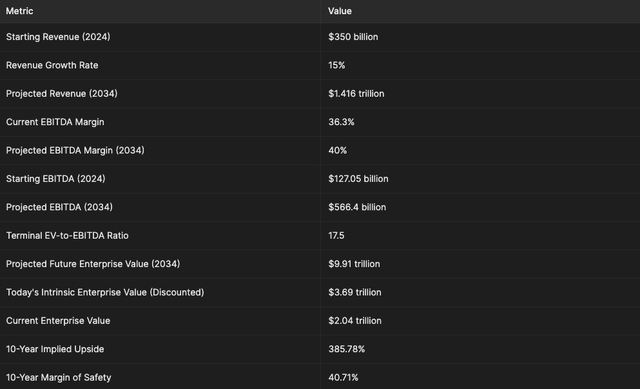

- Valuation: WACC 10.38%; projecting 15% revenue CAGR to $1.416T by FY34. EBITDA margin expanding from 36.3% to 40% – FY34 EBITDA of $566.4B. Applying EV/EBITDA multiple of 17.5 for terminal value.

- AI rivals like ChatGPT threaten Google Search; Gemini lags. GOOG must enhance AI capabilities. Despite risks, diversification, and investments in AI and YouTube support a Strong Buy rating.

gremlin/E+ via Getty Images

In my Q3 earnings preview of Google (NASDAQ:GOOGL) (NASDAQ:GOOG), I outlined a $190+ 12-month price target. Since that analysis, the stock has already gained 4.4% in price. Q3 results were excellent, and I’m upgrading my rating to a Strong Buy in this analysis amid the company’s very appealing valuation. According to my 10-year, growth-oriented, sentiment-adjusted discounted EBITDA model, the company’s enterprise value will appreciate by 385% over the next 10 years, with a 40% margin of safety.

Q3 Earnings Review

Firstly, the headline data is that Google beat the normalized EPS consensus estimate by $0.27, with a year-over-year growth of over 15%. It also beat the consensus revenue estimate by $2.05 billion. I congratulate management on an excellent quarter-investors can continue to buy Google stock, benefiting from a stable outlook, prudent management, a reasonable valuation, and several areas of compounding growth to capitalize on.

In the earnings call, management highlighted growth from YouTube, where combined ad and subscription revenue exceeded $50 billion in the past four quarters for the first time. The company has historically been heavily reliant on Google Search ad revenue, but YouTube’s growth is offering a valid diversification from this, providing much-needed resilience to the Google investment thesis during this time of AI disruption to traditional Internet search engines. Subscription revenue from YouTube TV, NFL Sunday Ticket, and YouTube Premium is more predictable than ad revenue, which is more prone to fluctuate based on market conditions. YouTube is certainly a potentially undervalued growth segment of Google’s total operating conglomerate.

However, YouTube was not the company’s strongest growth segment in the report. Instead, this (unsurprisingly) went to Google Cloud revenue, which delivered 35% year-over-year growth. In an effort to further reinforce the return on investment of this AI-led segment, CFO Anat Ashkenazi highlighted ongoing cost reengineering efforts related to the company’s capital expenditures, which were $13 billion in the quarter. Cloud revenue is expected to continue growing, particularly due to enterprise AI adoption and efficiencies-Ashkenazi anticipates increased capital expenditures next year to support data centers and tensor processing units, though with lower growth rates seen from 2023 to 2024. Therefore, semiconductor AI players will continue to benefit, and given the current growth rates of demand from Big Tech companies for data center expansion, it will likely be 2027 or 2028 when we see a significant decline in this demand, based on my analysis.

Management also gave focus to Waymo in the earnings call, which is now operating autonomous vehicles in San Francisco, Phoenix, and Los Angeles with additional cities planned. It has achieved a milestone of 150,000 paid rides weekly. I am bullish on Waymo, but I think Tesla (TSLA) is a dark horse here that will be late to the race but will have dominated in the final analysis. Google should be careful that it doesn’t invest too heavily in a segment where it is unlikely to be the leading player in the long run. This is why I am much more bullish on Google’s YouTube and Cloud segments than the smaller opportunity offered by Waymo. Even though Google is also unlikely to be the AI leader, with the title already garnered by Microsoft (MSFT), it’s going to be an AI leader-the same cannot be said for being an autonomous driving leader in the next 20 to 30 years, given the scale of Tesla’s autonomous vehicle operations likely at that time.

That said, I’m fond of Google’s diversified approach to operations. The tech conglomerate is a vast ocean of growth investments, and its “Other Bets” are worthwhile in the same way that a higher-risk venture portfolio is valuable to a vast investment firm or the outright companies that Berkshire Hathaway (BRK.A) (BRK.B) owns are to Warren Buffett. Google really is a special company, with special management and an enduring future ahead of it. After Q3 results, the company is a resounding Strong Buy.

10-Year Valuation Analysis

While I have been known to provide 12-month price targets, moving forward, I will also be periodically providing sentiment-adjusted discount models that take into account a reasonable holding period I consider valid for each specific investment. In the case of Google, I think it is a valid 10-year or more allocation.

Alphabet’s weighted average cost of capital, or WACC, is 10.38%, calculated by weighing the cost of equity at 10.506% and the cost of debt at 1.0119%, adjusted for the tax rate of 15.82%, with equity at 98.68% and debt at 1.32% of the total capital structure. I will be using the WACC for my discount rate.

Google has a five-year revenue growth rate of nearly 18%, but this is somewhat lower-at 14.4%-at this time. Given the company’s investment in AI at present and its success with YouTube, as well as the implementation of robust recurring revenue strategies, I do not see it as unlikely that the company will sustain a 15% average annual revenue growth rate over the next 10 years. With a starting total annual revenue of $350 billion for FY24, the company will have a total revenue of $1.416 trillion approximately at the end of FY34.

Looking at the company’s EBITDA margins, I expect these to expand, not least because the company will likely benefit from a leaner workforce from AI integrations facilitating widespread automation across its operations (we’ve already seen this with its advertising business). The company currently has an EBITDA margin of 36.3, but I estimate this will rise to approximately 40% by 2034. This indicates the starting 2024 full-year EBITDA will be $127.05 billion, and the full-year 2034 EBITDA will be $566.4 billion.

Google Workforce Decline & Automation Growth Scenario (Author’s Graph)

Given that the company’s 10-year median EV-to-EBITDA ratio is 17.5, this is what I will be using for my terminal multiple to incorporate sentiment analysis into my 10-year, growth-oriented intrinsic enterprise value estimate.

Google 10-Year Discounted EBITDA Calculation (Author’s Calculations)

AI Engine Risk Analysis

To my mind, both from research and anecdotal experience, the greatest risk to the long-term growth thesis for Google is that novel AI engines like ChatGPT and Perplexity are currently threatening it. While I have made the argument previously that the company has a moat in non-professional use cases with Google Search, I expect that as users become more sophisticated with using AI tools, the market reach will extend to even casual users who would usually opt for Google Search to navigate the Internet. Therefore, I consider this a latent and very real existential threat to Google over the long term. While YouTube is certainly in a powerful position, Google Search is vulnerable. Management should be looking to dramatically increase the company’s capabilities with its AI engines-from personal experience and hearing reviews from others, Gemini simply lacks the utility and breadth of experience that ChatGPT and other AI models currently command. This is a very difficult problem for Google to combat, especially as OpenAI has the luxury of being dominantly focused on AI development, while Google’s diverse nature creates certain conflicts of interest and scattered managerial intention. Therefore, I do not think ChatGPT should be underestimated here; it could very much dethrone Google over the long term as the leader in Internet navigation.

Conclusion

While the technology landscape is undeniably being disrupted, it seems highly likely to me that Google is going to endure for the long term. In fact, I would go as far as to say that Google will be looked back at as one of the most significant companies of the 21st century. Its moat in Internet navigation may be under threat, but management is calmly reinvesting the company’s resources into AI development while making pivotal strides in developing YouTube into the Internet’s dominant all-purpose video content site. With an implied 385% upside from my 10-year enterprise value estimate and a robust margin of safety when discounted back to present-day value, Google is a Strong Buy after Q3 earnings and at today’s price.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.