Summary:

- Intel’s “5 nodes in 4 years” roadmap and restructuring aim to improve profitability, though substantial revenue growth seems unlikely in the near to mid term.

- Q3 results showed a 6% YoY revenue decline and non-GAAP EPS of -$0.46, indicating no recovery from the mid-2022 revenue decline.

- Foundry, Mobileye, and AI businesses could offer some revenue growth over time.

- Despite potential profitability improvements, the reorganization’s early stage suggests no immediate rush to invest in Intel stock.

JHVEPhoto/iStock Editorial via Getty Images

Investment Thesis

As Intel (NASDAQ:INTC) is nearing the completion of its “5 nodes in 4 years” roadmap, this will substantially improve its economics. Combined with its ongoing restructuring and other cost-saving measures, this positions Intel for achieving decent profitability over time, which should lift the share price. On the other hand, substantial revenue growth currently seems unlikely, especially in the near to mid term.

Background

In previous coverage, Intel’s busy September was discussed. It included three major product launches, as well as some other business updates. Overall, it was noted that Intel had substantially increased its competitiveness, while the reorganization is a major step to allow it to return to improved profitability, which the current share price isn’t taking into account.

Q3 results

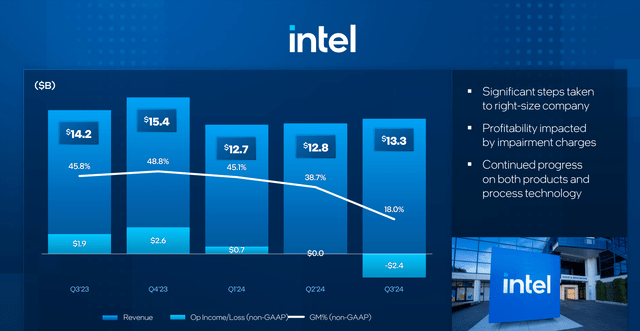

Revenue of $13.3B was down 6% YoY and non-GAAP EPS was -$0.46. At its peak, Intel recorded revenue on the order of $20B, so this indicates it is not recovering at all from the decline that started in mid-2022 through Q1 2023. Last year, Intel had expected material revenue growth in the second half, but it was already known since Q2 this wasn’t going to happen, hence the restructuring instead.

Gross margin of 18% (non-GAAP) was impacted by nearly $20B in total charges, although only the reorganization one of $2.2B will have to be paid in cash. During the call, it was noted the Q4 guide of 39.5% gross margin was quite clean. This is still far from the historical range between 50-70%, and the 2030 goal of 60%. But as it isn’t valued anymore as a 60% gross margin company, that shows exactly the investment opportunity.

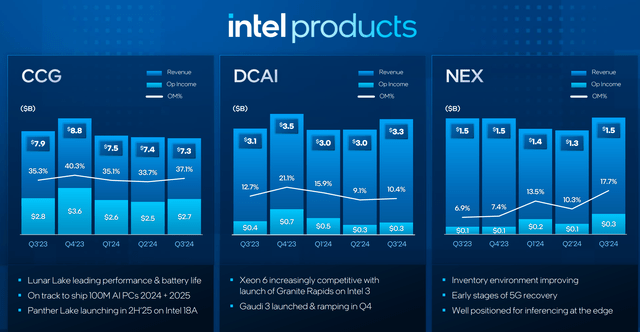

CCG was down 7%, DCAI was up 9%, NEX was up 4%. Overall, Products revenue was down 2%, while Foundry was down 8%. Other revenue was down 28%, mostly due to Altera revenue down 44%, although it was noted Agilex revenue would be up over 3x in 2024.

For Q4, Intel expects $13.8B revenue and non-GAAP EPS of $0.12.

Business updates

These were discussed in previous coverage. Intel launched its next-gen Xeon 6 (Granite Rapids) on Intel 3 with double the core count and performance. Nevertheless, no specifics regarding market share (besides maintaining and growing) or revenue growth were discussed. Intel further launched Gaudi 3, although on the earnings call it was noted the $500M revenue target would not be achieved.

On the PC side, Intel launched Lunar Lake. Intel said it had increased its volume expectations by 3x due to the increasing importance of the AI PC category. As this was originally intended as quite niche, high-end product, with on-package memory that is included at 0% gross margin in the price, and with all tiles manufactured at TSMC (TSM) (which might result in further Foundry fab underutilization in 2025), Intel noted that gross margin expansion in 2025 might be limited.

Longer-term, Intel confirmed that Lunar Lake is a one-off product, so further products won’t have the on-package memory. In addition, as known, Panther Lake in H2’25 will be mostly (over 70% of its silicon was confirmed) manufactured by Intel on its 18A process. Again, though, ramping products takes many quarters, so the financial benefit likely won’t show up materially until somewhere into 2026, likely the second half. Nevertheless, this is consistent with the reorganization to more quickly improve profitability given the lack of revenue growth.

Lastly, In October, Intel launched Arrow Lake for the desktop, manufactured on TSMC N3B, improving its power efficiency.

On the Foundry side, Intel added Amazon (AMZN) AWS as a new major foundry customer, and Intel announced two other (unnamed) new 18A customers as well.

Valuation

P/E valuation make little sense currently. Price to book might be more apt, as Intel is trading near or below book value currently.

Perhaps the most sensible metric would be to compare the market cap to the hypothetical FCF or EPS or operating income, based on Intel’s long-term target of 60/40 gross/operating income and 20% FCF margin. To that end, Intel is trading at about 10x adjusted FCF, which might also approximate the P/E value.

Given the lack of revenue growth and that it will take many years to actually achieve those profitability targets, one might conclude Intel is a sell or hold. On the other hand, given that it does have three potential growth businesses with foundry, Mobileye and AI, some revenue growth over time should be possible. During the earnings call, Intel provided 3-5% as a target, with potential for 7-9%.

For example, if the foundry business becomes material as Intel continues to expect ($15B revenue by 2030), and this growth also results in larger multiple like 15-20x, then this might roughly double the stock price in 5-10 years.

Risks

The main risk from the beginning was the potential lack of revenue growth. This risk has materialized and is being managed, as evidenced by the reorganization, which follows the previous, smaller reorganization from 2023.

Investor Takeaway

Although the case for structural revenue growth (once the target was $100B) has been dwindling for some time, at the current stock price just the improvement (recovery) in profitability should be enough to achieve a reasonable return on investment. Some of its efforts like Mobileye, foundry and AI continue to provide the possibility of some revenue growth.

Still, given that the reorganization has only just started, and given the increase in Lunar Lake volume as one of its mainstream products into 2025 (a high-end part with 0% margin memory included manufactured pretty much entirely by TSMC), there is likely no rush to get a position into the stock, as it remains to be seen if the $10B cost reduction target for 2025 will be sufficient to lift the stock beyond its current price. Hence, this remains a multi-year investment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.