Summary:

- Palantir’s Q3’24 earnings exceeded expectations, driven by strong AI demand, leading to a raised FY 2024 outlook and 30% Y/Y revenue growth.

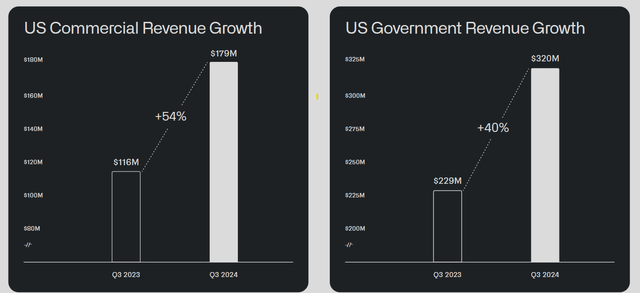

- Palantir’s U.S. commercial revenues surged 54% Y/Y, with U.S. government revenues up 40% Y/Y, highlighting robust AI product adoption.

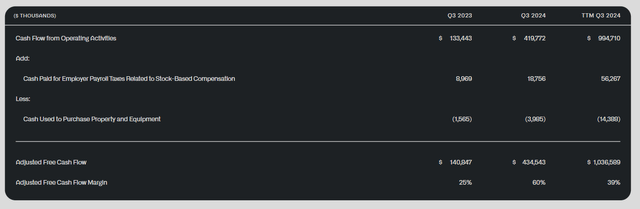

- The analytics company also saw a significant expansion in its free cash flow margin.

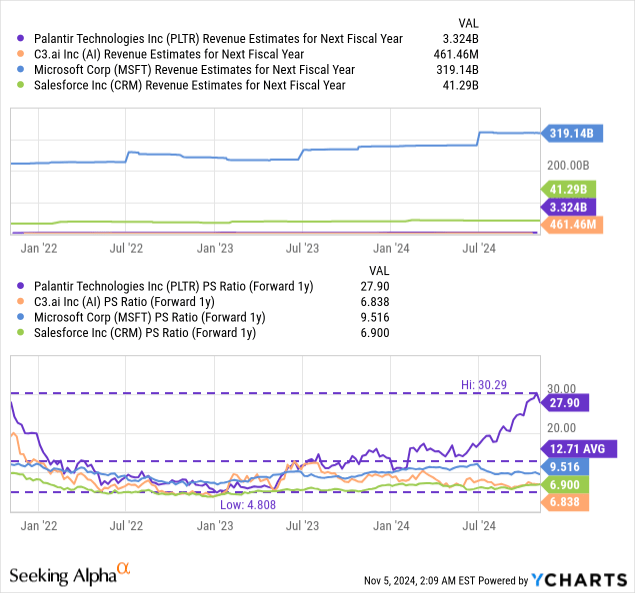

- Insider stock sales and a high valuation at a 28X forward price-to-revenue ratio remain concerns.

- Despite impressive earnings and growth, PLTR’s valuation concerns justify a sell rating at this point.

MF3d/E+ via Getty Images

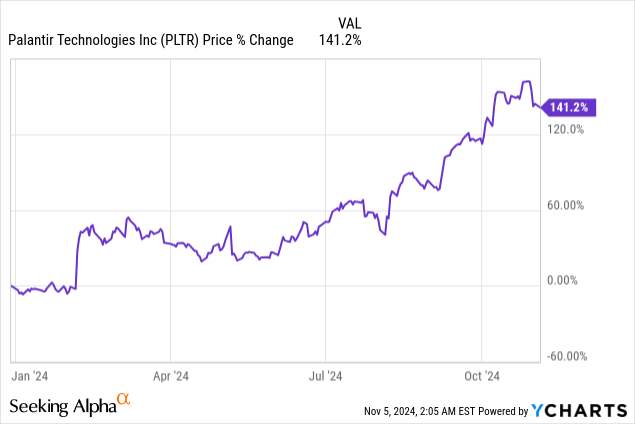

Palantir (NYSE:PLTR) reported better-than-expected earnings for Q3’24 on Monday, topping both EPS and top-line estimates due to strong tailwinds for AI adoption, in both of its core businesses. The earnings report caused shares of the firm to soar 14%. Palantir also raised its outlook for FY 2024 due to growing demand for artificial intelligence-supported software solutions. While the earnings release was great and the company also benefited from strong customer acquisition and free cash flow growth, I believe the firm’s very stretched valuation and growing optimism are concerns here, and I am taking profits here.

Previous Rating

I downgraded shares of Palantir in September – Surging Insider Sales Are A Red Flag – to hold after it was reported that insiders at the company continued to sell a ton of their shares. While some of those insider sales may have been pre-planned, selling shares into the recent strength was a warning signal for me nonetheless. Palantir did report solid Q3 earnings on a number of fronts – especially customer acquisition and free cash flow – and the company revised its outlook for FY 2024 higher. Due to persistent valuation concerns, I don’t believe shares currently have an attractive risk profile.

Palantir Beat Estimates by a Decent Margin

Surging AI demand from both government and commercial customers explains Palantir’s exceptionally strong earnings release for the third fiscal quarter. Palantir earned $0.10 per share in adjusted earnings in Q3, beating the consensus estimate by $0.01 per share. The top line, which is about equally driven by government and commercial businesses, came in at $725.5M, surpassing the average prediction by $22M.

Palantir’s revenues surged 30% year-over-year in the September quarter due to what the company is saying is persistently high demand for Palantir’s AI products. Total quarterly revenues of $725.5M also exceeded the company’s Q3’24 outlook of $697-701M and the 30% growth rate achieved in the third quarter marks a return to Palantir’s earlier projection for long-term annual top-line growth of 30% or more. It should be noted that Palantir saw a 3 PP revenue growth acceleration in the third quarter, which has been supported especially by growth in the U.S. commercial segment.

Palantir’s U.S. commercial revenues increased a massive 54% year-over-year in the last quarter and reached $179M while U.S. government revenues, which represent the largest block of revenues for the analytics company, came in at $320M in Q3’24 (+40%). As the company has said, the main reason for this strong growth in both segments is the growing adoption of Palantir’s artificial intelligence products, especially AIP, which is Palantir’s artificial intelligence platform that is integrated with the company’s Foundry software platforms.

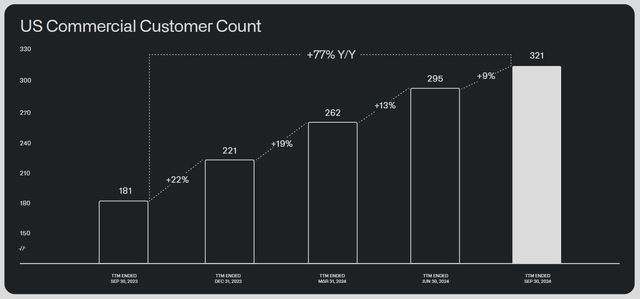

The U.S. commercial segment is still by far the most promising for Palantir, while the government segment is still the biggest in terms of total dollar revenue contributions. The main reason behind Palantir’s surging top line is that Palantir has real customer acquisition momentum and is very effective in luring new customers to its software analytics platform. In the most recent quarter, Palantir added another 26 clients to its U.S. commercial business, showing 77% year-over-year growth. Total commercial customers at the end of the September quarter reached 498, showing 51% Y/Y growth, while total customers (including government clients) hit 629 (+39% Y/Y), a record in the business. This growth is fundamentally driven by a growing customer base in the U.S. commercial business and Palantir has seen a major upswing in free cash flow as a result.

Massive Free Cash Flow Upswing

I mainly follow three metrics when it comes to Palantir: 1) Top-line growth, 2) Customer acquisition momentum, and 3) Free cash flow. In terms of the latter, free cash flow, Palantir is seeing a fundamental improvement in its situation compared to just one year ago. In the third quarter, the software analytics company generated $434.5M in free cash flow, showing 208% growth. Again, during that same period, the company’s revenues only grew 30%, so the free cash flow ramp is significant. This ramp in free cash flow is reflected in higher margins as well: As of the end of the September quarter, Palantir’s free cash flow margins have soared to a massive 60% compared to 25% in the year-earlier period.

Palantir Revises its Guidance For FY 2024

Palantir now expects to have full-year revenues of $2.805B to $2.809B compared to an earlier guidance range of $2.742B to $2.75B. The revenue guidance for Q4’24 is $767-771M, implying a quarter-over-quarter growth rate of 6%.

Palantir’s Valuation

After Palantir obviously had an impressive third quarter, a lot of readers may ask why my rating on the software analytics company is now a sell. The main reason for this downgrade, in addition to my previously stated concerns about the company’s insider sales, is Palantir’s valuation.

Palantir is exceptionally expensive, not only with regard to its own historical valuation but also in the context of other AI/software companies that offer similar AI/analytics/platform services. Palantir, as of October 9, 2024, is valued at a forward price-to-revenue ratio of 27.9X which is a very rich multiplier to play for any company, including for one that is growing its revenues at 30%. The historical average P/S ratio is 12.7X which means shares are currently trading a massive 120% above this average.

Palantir has achieved significant growth in the last year, there is no doubt about this. However, this growth is more than priced into Palantir’s valuation at this point. In my last work on Palantir, I stated that I saw a fair value of ~$30-31 per share for Palantir, given a historical P/E ratio of 55X and a consensus FY 2027 EPS of $0.57 per share.

EPS estimates are trending up, and I believe it is possible for Palantir to achieve 25% annual EPS growth in the next three years given the strength of the underlying AI adoption trend. In FY 2024, the software analytics company is expected to earn $0.36 per share. Compounding this EPS figure at 25% annually over the next three years calculates to a projected FY 2027 EPS of $0.70 per share. Applying the same historical P/E ratio of 55X calculates to a fair value of $38.50 per share. The current price is $47, so shares are now more than fully priced and very expensive on both a revenue and earnings basis.

Risks with Palantir

The biggest risk with Palantir, as I see it, is a potential slowdown in AI-related spending, especially in the commercial sector, which is a major driving force for Palantir’s top-line growth. Palantir is doing well here, however, and there is a risk that by selling into the strength, investors may miss out on additional upside. What would change my mind about Palantir is if the company were to see a continual escalation in its free cash flow and customer acquisition growth.

Final Thoughts

The best time to sell is when investors are getting greedy. To be clear, Palantir did deliver an impressive earnings sheet for the third quarter that showed that AI is turning out to be a potent catalyst for top-line growth. The return to a 30% revenue growth rate in Q3’24 was impressive as well, and so was the expansion of Palantir’s free cash flow margins. Despite these fundamental improvements in the business setup amid growing demand for the company’s AI products, I am just not comfortable with the valuation and surging enthusiasm at this point, and I have previously also stated that I wasn’t comfortable with insiders accelerating their stock sales at such a high valuation. With shares of Palantir now trading at a massive 28X forward revenue multiplier and way above my earnings-based fair value estimate of $38.50/share, I have decided to sell and change my rating to sell accordingly.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.