Summary:

- Palantir Technologies reported strong Q3 earnings, with 30% revenue growth and a 10% earnings beat, driving a 13% share price increase.

- U.S. revenue growth outpaced international, driven by deep-pocketed customers and strong demand for AI services, enhancing PLTR’s growth momentum.

- Despite impressive growth and margin improvements, the Company’s high valuation at 100x earnings raises concerns about future share price appreciation.

- Potential risks include competition, government spending cuts, and shareholder dilution, leading to a neutral rating despite positive business performance.

JHVEPhoto

Article Thesis

Palantir Technologies Inc. (NYSE:PLTR) reported its third-quarter earnings results on Monday afternoon. The company beat estimates easily and saw its shares jump following the earnings release. With its AI exposure and strong momentum, Palantir Technologies could deliver compelling results in the foreseeable future, but investors should consider the stock’s valuation before buying.

Past Coverage

I have written about Palantir Technologies Inc. in the past here on Seeking Alpha, with my past coverage being available here. Since my last article on the tech company is from roughly one year ago, it is time for an update — and Monday’s quarterly earnings report is a good reason to update my thoughts on the company.

What Happened?

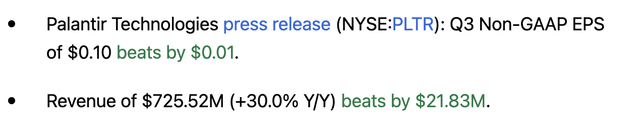

Palantir Technologies Inc. reported its most recent earnings results, for its fiscal third quarter, on Monday, following the market’s close. The headline numbers can be seen in the following screencap:

Palantir Technologies earnings release (Seeking Alpha)

We see that the company was able to grow its revenues by a very attractive 30%, which was a couple of percentage points more than what was expected. The company also beat the bottom-line estimate by 10%.

The market reacted very favorably to this earnings release, with Palantir Technologies trading up 13% at the time of writing. Shares likely will remain volatile in the next couple of days.

Palantir Technologies’ Q3: Strong Performance

Delving into the details of the earnings report, we see that the company saw its business growth accelerate, which is, of course, great news for investors. While Palantir grew its revenue by 21% in Q1 and by 27% in Q2, revenue growth accelerated further to 30% during the most recent quarter. Normally, one would expect a growth company like Palantir Technologies to experience a bit of a decline in its growth rate over time, as maintaining a high relative growth rate becomes harder and harder as a company grows. The fact that PLTR is experiencing the contrary of that — its relative growth rate is actually accelerating — is a noteworthy outlier. To me, this suggests that Palantir’s customers are extremely interested in PLTR’s offerings, likely especially the AI services the company provides, and that growth is more “supply constrained,” allowing PLTR to grow its business faster as it scales up its operations.

Growth was heavily weighed towards the US, with US revenue growth coming in at 44% compared to the previous year’s quarter, easily beating the growth rate of the international business. This is not very surprising — deep-pocketed customers are oftentimes located in the US, both in the commercial/enterprise field and when it comes to government customers. No country has a military budget that is anywhere close to the US military budget, for example. With big spenders being located in the US, and with them allocating more and more money towards Palantir’s services, the company can grow its US business at a highly attractive pace. The fact that Europe is, overall, achieving weaker economic growth compared to the US likely also plays a role in the fact that PLTR’s US business is growing faster than the non-US business. A growing portion of Palantir’s revenues being generated in the US means that currency movements become less impactful over time, which is a good thing.

Palantir Technologies keeps adding new customers at a highly attractive pace, with the customer count growing by almost 40% during the most recent quarter, relative to one year earlier. Oftentimes, customers do small deals with Palantir initially, and if those work out well, they increase their business with Palantir. Adding new customers at a strong pace could thus allow Palantir to grow its revenue very nicely in the future when it does more and more business with these customers. This requires that Palantir’s customers are happy with the outcome of their cooperation, of course, but at least in the past, that hasn’t been a problem.

Business growth and revenue growth are important, but earnings growth is even more important over the long run. We should thus also look at how Palantir Technologies’ margins are developing. Luckily, things are looking very well here: The company achieved an adjusted EBITDA margin of 39%. While one can argue whether all adjustments in the adjusted EBITDA metric make a lot of sense (such as share-based compensation being added back), that this metric improved by a massive 800 base points compared to one year earlier suggests that Palantir benefits massively from operating leverage. Palantir can grow its margins at a very nice pace as it ramps up its operations. Thus, it would not be surprising if Palantir’s earnings continue to grow somewhat faster than its revenues in the foreseeable future. Significant pricing power in an environment where many customers want AI services likely also played a role in the big margin jump over the last year.

Looking at Palantir Technologies’ operating margin, we see steep improvements as well, with GAAP income from operations rising by an explosive 180% compared to the previous year’s quarter. Clearly, margin improvements are primarily explained by operational progress and not by adjustments the company makes when reporting non-GAAP results, as GAAP profit growth is even more pronounced compared to adjusted profit growth.

On a per-share basis, Palantir Technologies earned $0.10 during the quarter, or $0.40 annualized. For a company that is valued at $41 per share, that is not a lot of money, though, which gets us to the next point — Palantir’s valuation.

A roughly 100x earnings multiple is quite high, even for a fast-grower like Palantir. One can argue that the company has always been expensive, but the fact that Palantir trades at more than twice the earnings multiple of Nvidia (NVDA) — which is also growing very fast — indicates that Palantir could be overvalued today. If massive future growth is already priced into PLTR’s share price today, then shares may not rise much (or at all) even if that growth materializes over the coming years. According to YCharts, Palantir’s enterprise value to EBITDA multiple is in the 80s, which is very high as well. Surely, Palantir deserves a premium valuation due to its market position and strong business growth, but that does not necessarily mean that the current valuation is justified. After all, if Palantir traded at 50x earnings, it would trade with a premium valuation as well.

Risks To Consider And Takeaway

No investment is risk-free, and that naturally also holds true for Palantir Technologies. The following potential risks could be of relevance for an investment in PLTR: While Palantir Technologies seems well-positioned in the market it addresses for now, there is some minor risk that competitors will overtake the company tech-wise at some point in the future. Tech companies with very deep pockets would theoretically be able to spend massively on talent and tech to enter Palantir’s markets and to gain market share. I do not think this is very likely, but it’s a possibility. Palantir Technologies’ business with state actors such as the Department of Defense also is a potential risk, as there is no guarantee that spending will continue at the pace we have seen in the past. This is especially if the government were to become more conscious about budget deficits. This is another risk that I do not deem especially large, but a potential risk investors may want to keep an eye on.

Dilution is not a risk per se, but an ongoing headwind for shareholders, as their position in Palantir Technologies declines over time, all else equal, due to PLTR’s rising share count, which shouldn’t be ignored.

Looking past these risks, Palantir Technologies looks strong fundamentally: It keeps growing at a very nice pace and its margins are improving.

There are many things to like in Palantir’s Q3 earnings report, but I’m still not very bullish on the company. After all, at a 100x earnings multiple and an EV to EBITDA ratio in the 80s, Palantir Technologies seems like it is priced for perfection. I thus prefer other fast-growing companies such as Alphabet (GOOG, GOOGL), which is trading at a way lower valuation. I give Palantir Technologies a neutral rating today.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!