Summary:

- Steep revenue drop in H1 2024 and high cash burn from operations fuel the current pessimism around this stock.

- The stock trades near historic lows with a high short interest of 27.8%.

- New partnerships and a shift to leasing could stabilize cash flow and improve revenue in the second half of 2024. However, I don’t expect a major improvement in profitability.

- Institutional interest is rising, and new contracts and partnerships, particularly in green hydrogen, look quite promising.

- Despite dire Q1 and Q2 results, my strong buy rating revolves around a potential shift in investor sentiment. A catalyst could be the approval of the $1.66 billion DOE loan.

Gri-spb/iStock via Getty Images

Plug Power Inc. (NASDAQ:PLUG) is among the 50 most shorted equities in the US.

The sheer decline in the share price since mid-2021 reflects the pessimism surrounding this stock.

The latest earnings showed dire results, with Q1 and Q2 revenue falling over 40% YoY, and a 67% decline in gross profit for the most recent quarter.

The company is set to release its Q3 earnings in just a few days. Therefore, I considered reviewing some of the key factors that readers should watch for in this upcoming report.

With the stock trading near historic lows and short interest at 27.8%, the pessimism could be fully priced in.

I will advance in this introduction that my strong buy rating is not based on significant improvements in profitability or operating cash flows. As a matter of fact, I don’t expect a short-term recovery in the fundamentals of the company (aside from a slight improvement in revenue in the next quarters from the recognized sales of electrolyzer systems).

My bull thesis revolves around a shift in investor sentiment.

I believe there are several factors that could contribute to this shift; the main one being the approval of the $1.66 billion loan from the DOE.

This additional capital could support the development of three plants under construction (one of them is bound to be ready before the end of this year). Additionally, management mentioned future plans for six additional sites to produce green hydrogen.

However, before I present my bull thesis, I would like to start with all the factors that could break it apart.

As a side note to the reader, this is Taleb’s via negativa approach.

Challenges, Risks, And Headwinds

Let’s start dinner with dessert.

The income statement looks terrible, with Q1 and Q2 revenue declining by over 40% YoY. The decline in gross profit is even more pronounced, with a 67% decline in the last quarter.

Both operating and net income have declined as well, while the number of outstanding shares has increased by 23% YoY.

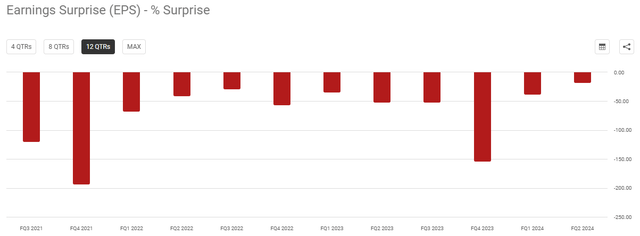

As a matter of fact, the company has been missing earnings consecutively every quarter since (at least) Q3 2021.

Understanding The Revenue Decline

A closer look at the latest 10-Q shows revenue from fuel cell systems sales declining by $59 million YoY.

The main driver seems to be a decrease in the volume of GenDrive units sold, with 725 units in Q2 2024, while in the same period last year, the company sold 2,680.

On top of that, earlier this year, the company shifted its pricing model from traditional PPAs to a more complex third-party leasing model. The goal here was to improve cash flows and reduce the company’s need to finance customer equipment directly.

However, this led to a slowdown in initial deployments for some customers during the first half of the year, as they had to establish relationships with third-party financing providers.

Nevertheless, management expects the new leasing model to stabilize in the second half of the year, leading to a revenue increase in the material handling business, by 1.75x to 2x compared to the first half of the year.

Additionally, in Q2 2024, there was a delay in revenue recognition for delivered electrolyzer systems. It seems that over $50 million worth of electrolyzer sales were delivered in the past quarter, but not recognized due to pending final documentation and training requirements. Management expects this revenue to be recognized in the second half of 2024.

Significant Decline in Operational Cash Flow

The cash flow statement looks as terrible as the income statement.

The company’s operating cash flow for H1 2024 was negative $422 million, with a net loss of $558 million.

If we look below at the YoY variation in operating and free cash flow, it seems that the company has been improving in the last two quarters.

It seems that the company received most of the cash associated with the electrolyzer systems deployments in H1 this year through milestone payments. This happened despite the delays in revenue recognition that I’ve already discussed above.

It seems that operating cash flow could improve in the second part of the year, as the management emphasized during the last earnings call on reducing its inventory levels by the end of the year, targeting a reduction of $200 million to $250 million.

As a side note, at the end of Q2 2024, the company recorded $940 million in total inventories, with $228 million in finished goods.

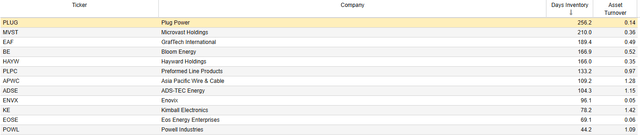

When compared to some of its industry peers (notice not all of them are competitors), the company has the highest days inventory value and one of the lowest asset turnover ratios.

The Balance Sheet Doesn’t Look Good Either

If we look at the evolution of net debt in the last years, we can see a steep increase, from negative values back in 2021 to a positive net debt of $630 million at the end of the last quarter.

If we look at total debt, we can see that it remained relatively flat over this period. Therefore, the increase in net debt is due to a steep decline in cash and equivalents, from $135 million at the end of December 2023 to $62 million by the end of June 2024.

I’m concerned because the company has been using its cash to cover daily operations (as mentioned in the previous section about cash outflow) and to fund investment projects, like the development of three new hydrogen production plants.

With free cash flows at negative $360 million and operational cash flow at negative $254 million, there is a high chance that the company has issued shares in Q3.

As a side note, they have been issuing a significant amount of shares in Q1 and Q2. This dilution could continue into the second half of the year if the company doesn’t secure the $1.7 billion loan facility with the U.S. Department of Energy.

Why I Believe In This Stock

Once the downside is clear, let’s look now at the upside.

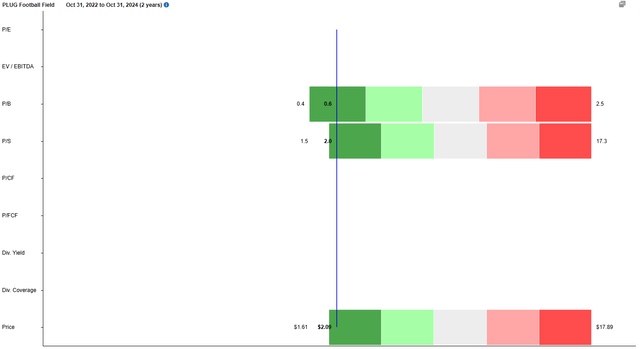

I’ll start with the share price. At the time of writing this article, it is trading slightly above $2, following a decline from $70 back in mid-2021.

In my view, considering the 97% share price decline since 2021, the pessimism is almost entirely priced in.

Additionally, the short interest is at 27.8%, with 7.13 days to cover.

Let me be clear.

With the share price trading at a similar price as a pack of chewing gums, any positive improvement or announcement could lead to a shift in investor sentiment.

As an extra, the high short interest could lead to a further increase in the share price as short sellers exit their positions. However, I am not betting on a short squeeze.

Simply, my bull thesis is based on a shift in shareholder sentiment.

Below, I include several factors that could shift the current pessimism around this stock to a more positive outlook.

The first one, and I believe this is a decent catalyst, is the final decision from the Department of Energy on the $1.66 loan.

If the company secures this amount, it can advance its plans for six additional green hydrogen plants in 2025, without further diluting its shares.

Currently, there are three plants in progress:

- The New York plant: expected to produce 45 TPD upon completion. It is projected to be operational by the end of 2025.

- The Texas plant: designed to produce over 50 TPD of green hydrogen. Expected to be ready by the end of 2025.

- The Louisiana joint venture plant: anticipated to add 15 TPD of liquid hydrogen capacity and planned to be operational before the end of 2024.

Additionally, the Georgia (15 TPD) and Tennessee (10 TPD) facilities have already ramped up operations, with Tennessee achieving a high operational uptime of 93%.

Another positive factor is the binding agreement with Allied Green Ammonia in Australia to supply 3 GW of electrolyzer capacity. The delivery of Plug’s electrolyzer system is anticipated by the end of 2026.

The company has already secured a contract with a BP-Iberdrola joint venture in Spain to supply 25 MW of PEM electrolyzer. Additionally, the company is working with Carreras Grupo Logistico to implement Spain’s first hydrogen-powered logistics site. This project includes switching forklifts to hydrogen fuel cells.

Another positive factor is the announcement of a contract to provide technical support for 25 MW of PEM electrolyzers in a Portuguese green methanol project.

Finally, the company launched an equipment leasing platform, aiming to secure over $150 million through a combination of debt leverage and customer financing. As an initial step, the company has already entered into three sale and leaseback transactions totaling approximately $44 million with GTL Leasing.

Institutional and Insider Activity

A quick look at the latest 13G/D filings reveals that Norges Bank took a new position in the company on October 10, owning 7.95% of the company.

If we look now at the 13Fs, during Q2 2024, the company has seen a 28% increase in the amount of shares owned by 13F filers. Additionally, the put/call ratio declined by 23%.

Recently, Vontobel Holding and the Bank of New York Mellon Corp increased their position in the company by over 1 million shares, each.

The recent insider activity doesn’t show any negative signs (like a cluster of insiders selling shares at the same time). However, I remain disappointed with the lack of insider buying activity.

Valuation

Unsurprisingly enough, the valuation ratios of the company are really close to the 5-year minimum.

When compared to some of its industry peers (notice not all of them are direct competitors), the company doesn’t look to be overvalued.

Conclusion

After putting every factor together, my rating for this stock is a Strong Buy, mainly due to the asymmetrical upside opportunity.

Let me be clear and direct.

I am not expecting a significant improvement in net income or cash from operations. As a matter of fact, I expect the company to keep burning cash until (at least) the end of 2025, when the new (massive) plants in New York and Texas will be fully operational.

Can there be delays in this timeline? Absolutely yes. That’s why buying OTM calls expiring in Jan 26′ might not be a good idea.

As a matter of fact, my strong buy rating considers a longer timeframe, of 2-3 years.

Naturally, there are some risks to my bull thesis, with the biggest one being the possibility of not securing the $1.66 billion loan from the DOE. If this is the case, I wouldn’t be surprised to see a massive share offering by the company.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.