Summary:

- Rivian shares are down 21% due to supply chain issues and demand problems, leading me to downgrade to a “hold” rating.

- The Volkswagen deal is crucial, with $2 billion in performance-based funding at stake, pivotal for Rivian’s long-term viability.

- Rivian’s Q3 earnings report will be critical in assessing their ability to navigate losses and secure further funding.

- Despite challenges, Rivian’s potential lies in its partnership with Volkswagen, which could help scale European EV sales and improve IP licensing.

RoschetzkyIstockPhoto

Co-Authored By Noah Cox and Brock Heilig.

Investment Thesis

Rivian (NASDAQ:RIVN) shares are unfortunately down roughly 21% since I last wrote on the EV company in early August. A big reason for this drop-off has been the series of painful transformations the EV maker has been undertaking. Unfortunately, the company is now being plagued with supply chain issues in the middle of this. Add both of these on top of the overall demand problems the EV industry is facing.

To be clear, my tone surrounding the EV company has changed significantly since August, and I am now in a ‘wait and see’ holding pattern. For most of the last year, I have been quite bullish on Rivian. I am downgrading shares to “hold” because I am no longer sure the company is doing enough in order for them to navigate the billions in annual losses and pull off a successful turnaround. They just have a lot to do to make it work.

With this, I am data-dependent, and I am cautiously optimistic going into the earnings on November 7th. A good quarter from Rivian could lead me to become bullish again on the EV company. I am a hold for now because I think the company has a lot of potential. They just have to execute. I need to see that this quarter.

Why I’m Doing Follow-Up Coverage

Personally, I have almost always been a fundamental investor (vs. technical trader). I have always seen Rivian from this angle, and my goal has always been to look at the core business when deciding what the fair value of the EV company is. Since my last piece of coverage, Rivian’s operations have faced a series of setbacks. Coupled with poor supply chain issues, and I believe this has resulted in a more cloudy outlook for the company going forward. This has made me less optimistic about the company for the future.

While the company recently got a $1 billion cash infusion from Volkswagen, this is not enough on its own to create a game-changing boost to offset the risks that currently surround the company. Rivian needs serious scale in order to make their business work (their unit economics). The company currently loses well over $1 billion a quarter.

Further funding from Volkswagen is performance-based. If the EV upstart does not hit these performance targets, they will not get further funding. The purpose of this follow-up coverage is to show the stakes of this upcoming earnings report. This is our best chance to view how the EV company is operating and assess the odds of them getting more funding. This funding is key to the long run viability of the company.

VW Deal Is Make Or Break

While old news, I believe the deal that Rivian and Volkswagen signed in late June will prove to be a big turning point for the EV company in 5 years. As reported by The Atlantic, VW plans on investing $1 billion directly in Rivian $1 billion into a joint venture, plus another potential $3 billion later on if certain benchmarks are met.

VW is investing $1 billion up front in Rivian itself, another $1 billion later this year in the joint venture (which will focus on developing software and electronics for EVs), and a further $2 billion if certain financial goals are met, plus an additional $1 billion loan to Rivian down the line, The Atlantic reported.

Despite this potential major cash boost that Rivian may receive, the company is still falling short in many areas. As reported earlier this year, Rivian lost more than $38,000 on every vehicle delivered in Q1 of this year. The company currently has $7.87 billion in cash.

In essence, the company loses roughly $1.5 billion a quarter (so at current rates, the company has about 5 quarters of funding on hand). The Volkswagen deal is critical for them to scale from here. It will likely be hard for the company to get funding from other external sources without serious improvements to gross margins from here.

For the September quarter, the company produced 13,157 vehicles and delivered 10,018 vehicles. Unfortunately, the company cut its annual vehicle production guidance to 47,000 to 49,000 vehicles for 2024. This would represent an 8,000-10,000 vehicle production decline from 2023.

Earnings Preview

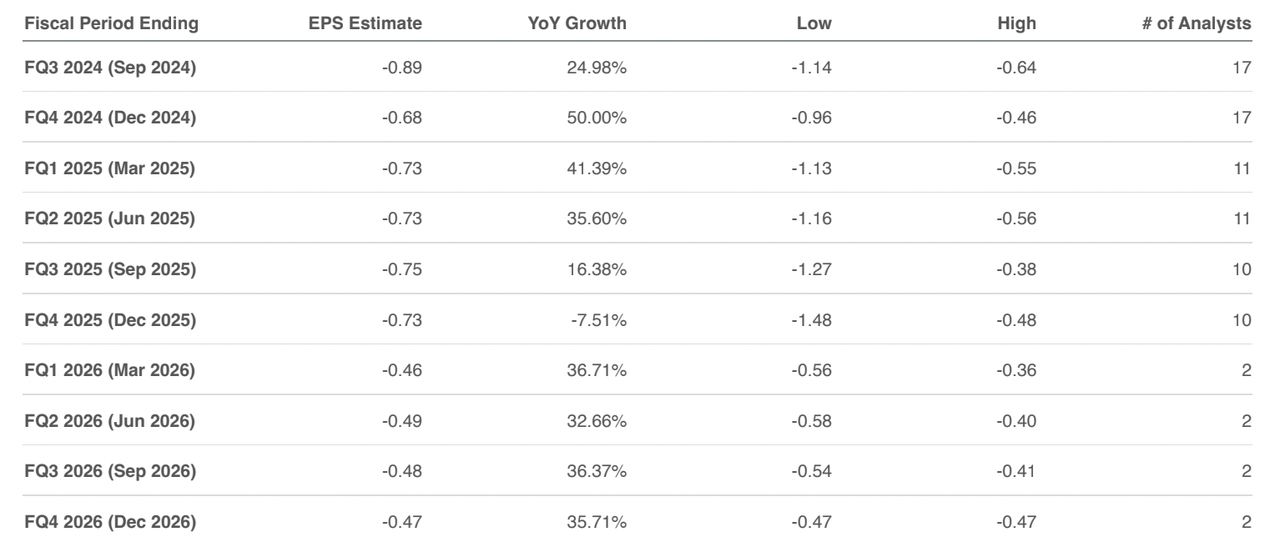

Heading into earnings on Thursday, Rivian’s Q3 EPS estimate is coming in at a loss of $0.89/share, according to 17 analysts. While this would represent YoY growth of 24.98%, this would still imply roughly $900 million in quarterly losses (if the EV maker met expectations).

By Q4, Rivian’s EPS estimate is a loss of $0.68, which would be a 50% YoY reduction in losses. After this, losses continue for the foreseeable future. I personally want management to address this on the earnings call.

Quarterly EPS Estimates (Seeking Alpha)

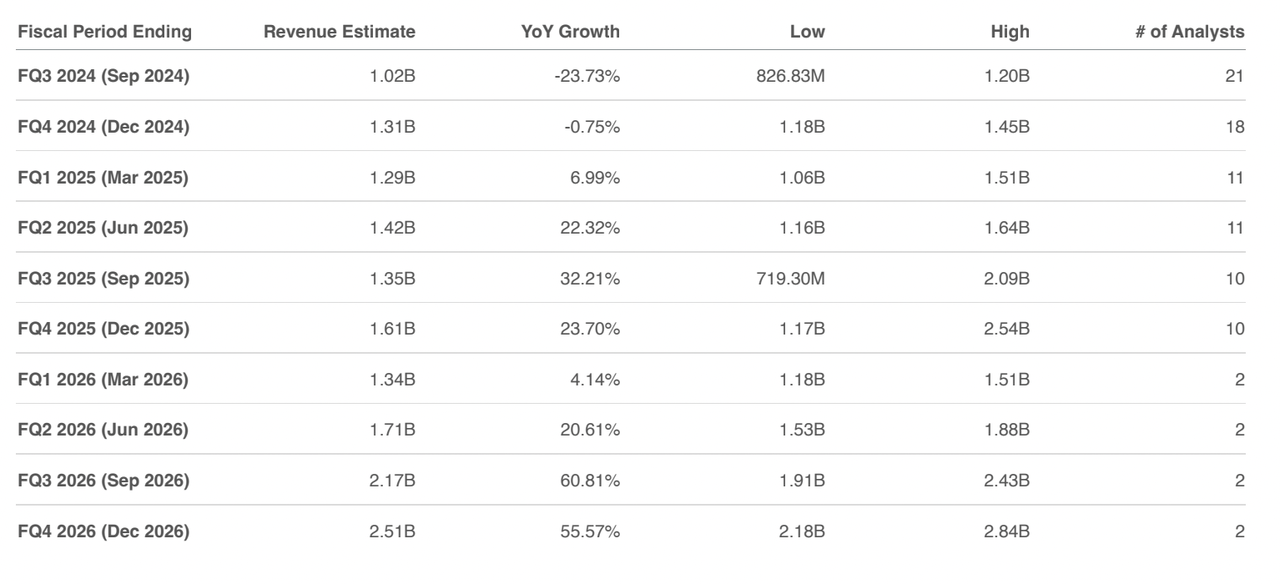

On the revenue side, Rivian is expected to see Q3 revenue of $1.02 billion, which would unfortunately represent a YoY drop of 23.73%. The company is focusing on cost cuts, but still needs revenue growth in order to hit the right scale. I’ll be looking on the earnings call for commentary by management on how they plan to bridge this.

Over the long run, revenue is supposed to perk up and record strong growth. But it depends on figuring out supply chain issues today.

Quarterly Revenue Estimates (Seeking Alpha)

Rivian CFO Claire McDonough recently joined Mark Delaney of Goldman Sachs at the bank’s technology conference to discuss their deal with Volkswagen and the upcoming earnings report. During the call, McDonough was optimistic that the partnership will result in positives for both companies.

One of the advantages of the Volkswagen technology joint venture that we have is the components of what’s included in that, which is our electrical hardware in our software stack. A part of the advantage of focusing on those core technologies is the extensibility and scalability of the way that we built those technologies, which can now be applied to a much larger spectrum of vehicles in the market.

For me, I will be closely watching the supply chain issues that have arisen this quarter. Figuring these out means scaling production and revenue, which helps the EV maker hit targets so they can get further investments from Volkswagen. McDonough also discussed these supply chain issues at the same conference.

…as I mentioned some of the supply chain challenges that we’ve had it impacts the rate in which we’re now building a product as a whole and how that plays into the diversity of offering that we can provide to consumers and sort of feedback into it, so that the teams are focused as I mentioned on continuing to drive and increase our order rates and increase brand awareness as a whole, so that we can continue to drive towards our outlook.

The company knows the problems they have and is trying to fix them. This is why I am not a sell. I need to see results on this call, however, in order to be back to a buy or strong buy on the EV firm.

Valuation

Rivian’s forward price-to-sales ratio of 2.21 is currently well above the sector median of 0.93, or a 138.39% premium. This is while growth for revenue is set to come in at a 1,460.67% premium to the sector median over the next 12 months (50.54% YoY growth). To be clear, if Rivian lives up to this growth, that would be fantastic. I am not sure if they will, however. That’s why I am a hold right now on shares.

The company still needs to accelerate their turnaround and perform well above the sector median in many other areas before this valuation premium can be validated at this point. Rivian also needs to secure the more than $2 billion up for grabs performance-based money from Volkswagen before I can be confident in a price-to-sales number that is this high.

Until then, this number looks a little expensive. I don’t want to comment on what the fair value should be on shares until we get the earnings results, though.

After earnings are reported on November 7, I will definitely be taking another look at the fair value.

Bull Thesis

In my opinion, the bull thesis for Rivian lies in the initial agreement it signed with Volkswagen in June. The deal “will permit Volkswagen to license Rivian’s vehicle and software architectural intellectual property, helping the German carmaker improve networking and architecture on its future vehicles,” according to Counterpoint.

Volkswagen is currently in the midst of cutting thousands of jobs in Germany and scaling back their factories due to business not being strong enough. According to Reuters, Volkswagen will soon lay off tens of thousands of workers and shut down three factories.

While Volkswagen is struggling overseas, Rivian can help. EV sales are increasing rapidly in Europe. In essence, Volkswagen needs an intellectual property deal to help scale their European EV sales. Rivian can help Volkswagen scale quickly.

As I mentioned, EV sales are increasing in Europe, which is a huge opportunity for VW. At the same time, sales in the United States are seeing a plateau for vehicles that aren’t Teslas. With a potential increased focus on Europe from Rivian and Volkswagen, the two companies should be able to have some success overseas.

Personally, I currently don’t see anything to refute this. For me, it’s very much a wait-and-see approach for Rivian on whether they can fully leverage their VW relationship to be more IP licensing (high margin) vs. vehicle manufacturing. I think this is a key point that management needs to address on the call. For me, given the company’s burn rate, a lot of my future analysis will focus on what we see from the earnings report and how the company manages licensing IP.

Conclusion

Like many current and former shareholders of Rivian, I’m pretty frustrated with the performance of the company so far this year. We’ve been promised a series of strategic pivots, strategic investments and careful prioritization that were all supposed to make the company more efficient in its production and selling of EVs. This was supposed to leave the company ramping EV production at the end of the year and setting up 2025 to be on a high note. Unfortunately, I’m not seeing this.

Rivian continues to face multiple challenges, from losses to supply chain problems, and this quarter will be pivotal to the future of the company.

With this, I have downgraded shares to a hold for this time. I will be watching the earnings closely.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (main account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.