Summary:

- Snap exceeded top and bottom line estimates for the third-quarter last week.

- The social media company reported solid Q3 earnings with all major platform metrics like revenue, users, ARPU and EBITDA developing in the right direction.

- Snapchat+ users exceeded 12M in the September quarter, doubling year-over-year.

- Shares of Snap are cheap compared to other social media companies and they have considerable upside potential in case the platform can grow into consistent profitability.

Klaus Vedfelt

Snap (NYSE:SNAP) reported better than expected earnings for the third fiscal quarter with the top line also growing faster than expected. The social media company is growing its average revenue per user and the subscriber numbers for the paid subscription service as well as for the free platform look very solid. Snap also saw a nice bounce in its adjusted EBITDA in the third-quarter, indicating that the platform’s profitability profile is improving. Snap has suffered from weak profitability throughout its history, but I believe the social media company is on a good path. Snapchat+ users reached more than 12M in the last quarter and the company here clearly has considerable momentum. Shares of Snap are expensive relative to other social media platforms, but shares have revaluation potential in case Snap can improve its profitability metrics!

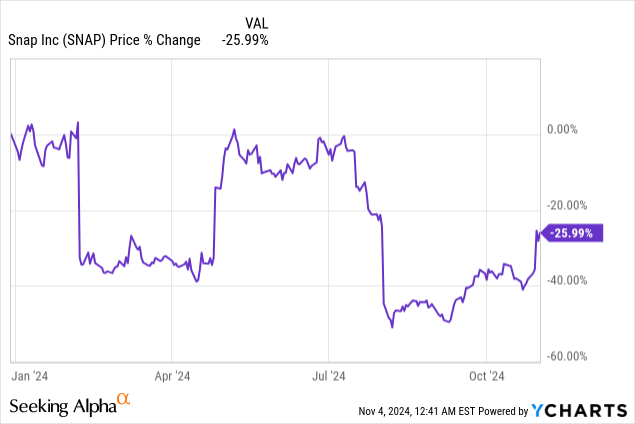

Previous rating

I rated shares of Snap a strong buy and recommended to buy the fear after the company’s second-quarter earnings disappointed. Snap is known for significant earnings-related volatility which at the time opened up an engagement opportunity for investors seeking exposure to a promising social media company: since my last recommendation we have seen a solid recovery, with Q3 earnings being a catalyst, and shares are now trading 47% higher. In the third-quarter, Snap saw continual momentum in its paid subscription service Snapchat+ and the EBITDA trajectory improved. I maintain my strong buy rating and continue to see Snap as one of the most attractive platforms for growth investors.

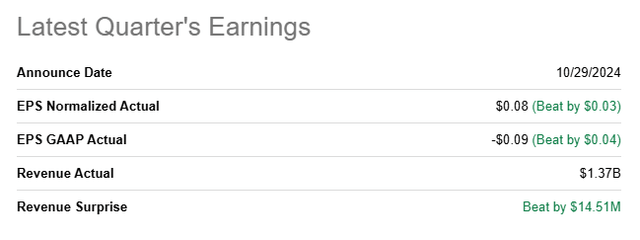

Snap beats earnings

Snap reported adjusted earnings of $0.08 per-share for the third fiscal quarter which surpassed the average prediction by $0.03 per-share. Due to strong digital advertising spending tailwinds, Snap’s top line grew at a healthy rate in Q3’24 and came in at $1.37B, beating estimates by $14.5M.

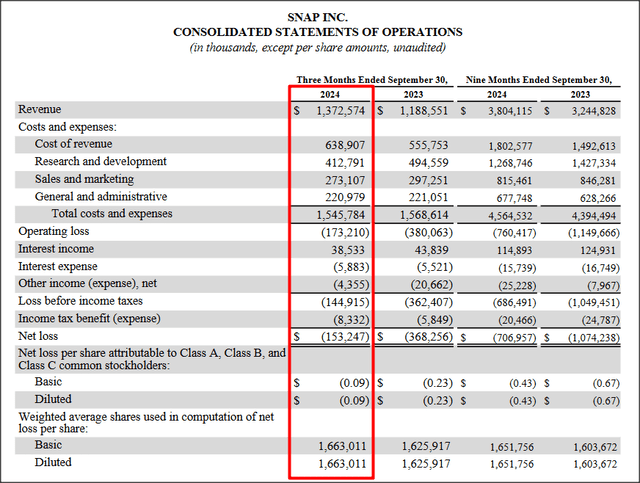

Snap generated 15% top line growth in the September quarter and had total revenue of $1.37B. The social media company, however, continued to lose a lot of money in the third-quarter: Snap ended Q3’24 with a net loss of $153.2M, showing a decline of 58% year-over-year. The lack of profitability remains the single biggest issue for Snap and is the main factor that could be holding back the share price from a revaluation going forward, in my opinion.

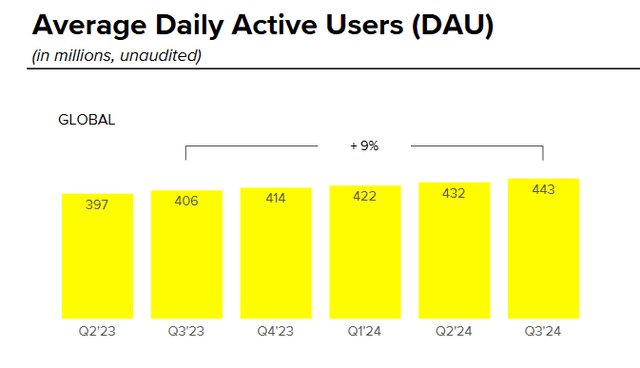

There were a couple of important takeaways from Snap’s third quarter earnings sheet, especially as it relates to user growth. Snap benefited from continual growth in daily active users in the September quarter as well as increases in average revenue per user/ARPU. Global average daily active users surged 9% year-over-year to 443M, meaning in the last year Snap added a massive 37M new users. Additionally, Snap is seeing some solid momentum with its paid subscription offer. Snapchat+ users reached 12M as of the end of the September quarter, meaning the social media company added ~1M subscribers quarter-over-quarter and more than doubled its subscribers year-over-year. Snapchat+ momentum is the main reason why I would recommend shares of Snap as the company has considerable momentum here.

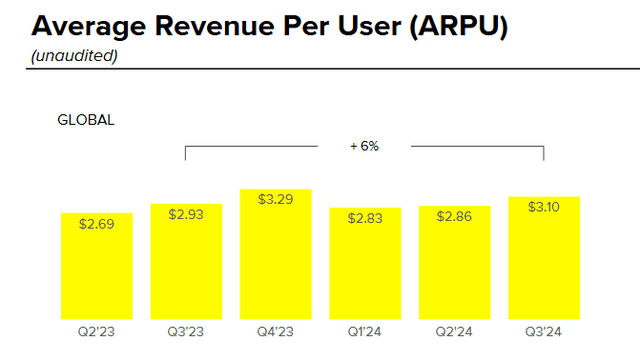

Snap’s average revenue per user/ARPU, which is the most important metric for me when it comes to the evaluation of social media companies, increased 6% year-over-year to $3.10 per-share. This growth was backed by general strength in the digital advertising market during the third-quarter which saw positive tailwinds from election-related spending. Snap’s average revenue per user also saw two consecutive quarters of growth, indicating that the market situation is currently favorable. Meta Platforms (META) was another social media company that reported strong Q3’24 results and double-digit top line growth, in part due to election-related spending.

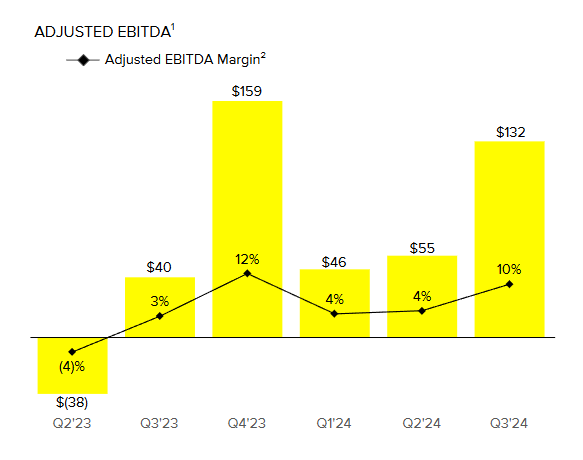

Positive adjusted EBITDA momentum

The biggest accomplishment for the social media company in Q3’24 happened on an EBITDA level. Snap generated $132M in adjusted EBITDA in the third-quarter, showing 229% Y/Y growth. Snap has struggled with profitability for a long time, amid high operating expenses and heavy competition in the digital advertising market, so it is good to see some real momentum building here: in Q3’24, Snap’s adjusted EBITDA margin surged 150% to 10% which drastically improves the company’s profitability profile.

Snap

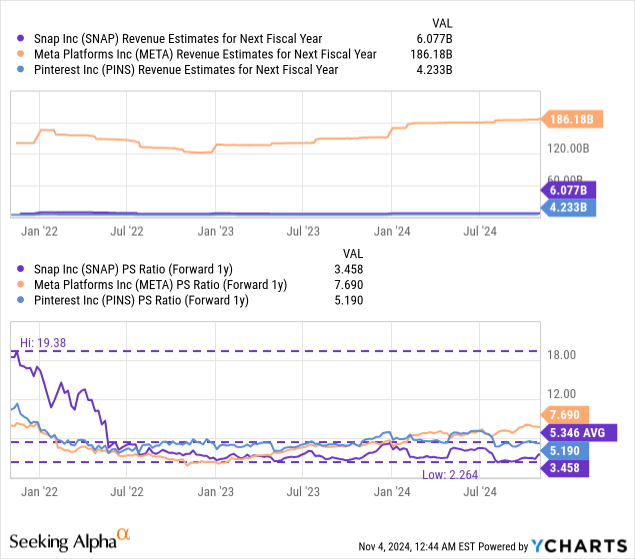

Snap’s valuation

Snap is not profitable on a net income basis yet and therefore can only be evaluated either on a revenue or EBITDA basis. Snap is currently valued at a price-to-revenue ratio of 3.5X which makes Snap one of the cheapest social media platforms in the market. Snap’s rivals are Meta Platforms or Pinterest (PINS) which trade at forward P/S ratios of 7.7X and 5.2X, but both companies are also widely profitable. The industry group average price-to-revenue ratio is 5.5X.

There is a potential for Snap to expand its valuation multiplier if the company manages to diversify its revenue streams and builds out its subscription service Snapchat+. Ultimately, however, a revaluation will depend on Snap improving its profitability picture and achieving positive net income. If Snap were to revalue merely to the industry group average P/S ratio, shares could have a fair value of $20/share. If shares revalued to the historical P/S ratio of 5.4X, shares could have a fair value in the neighborhood of $19.40/share.

Risks with Snap

The biggest problem for Snap is that the social media platform is not yet profitable which has often made the company vulnerable to spikes in volatility, especially around times of earnings releases. This is turning off a lot of investors which have much more earnings visibility, and therefore less risk, with larger-scale social media platforms like Meta Platforms. What would change my mind about Snap is if the social media company were to see a decline in its ARPU growth or if the company failed to sustain its EBITDA (margin) growth.

Final thoughts

Snap remains an attractive social media company for high-risk investors that is seeing solid momentum for its daily active user count (in its free business) as well as in its paid subscription service offer Snapchat+. Snapchat+ users have doubled year-over-year and the business has real momentum, now having 12M paying customers. The paid monthly subscription especially has a lot of potential for Snap. The social media company is now quite cheap relative to other social media companies, in part because Snap is not yet profitable, but the firm also has more potential for growth. I believe the risk profile here is skewed to the upside and I maintain my favorable strong buy rating after Snap submitted its third-quarter earnings sheet last week.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNAP, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.