Summary:

- Apple has seen slowed product growth and a higher valuation, making buybacks less attractive.

- Berkshire Hathaway continues to reduce its stake in Apple, given these prospects but isn’t necessarily a guide for everyone.

- Apple’s FY 2024 results show significant growth in the capital-light Services segment, boosting gross margins and free cash flow.

- Services, potentially benefiting from generative AI, counters some reservations about Apple’s future, leveraging wide product adoption for revenue growth.

- With a mix of good and bad factors, most sign point to AAPL being a Hold for the long-term investor.

J Studios/DigitalVision via Getty Images

I discussed Apple (NASDAQ:AAPL) in September, with particular attention to half the stake in Berkshire Hathaway’s portfolio (BRK.A)/(BRK.B) being sold throughout 2024 by Warren Buffett. I concluded by rating the stock a Hold. With Buffett selling even more shares and FY 2024 results out last week, I figured it was time to follow up.

Based on the results and remarks by the new CFO, I continue to think AAPL is fairly valued and maintain my Hold rating.

Summary of Previous Thoughts

In the the first piece, I noted how AAPL traded at a single-digit multiple, had rising free cash flow, and had started regularly giving dividends and buybacks when Buffett first bought. Today, product growth has slowed, and the wider multiple makes the buybacks less attractive. I ended by writing:

Are we getting a good price for AAPL by buying today? I don’t think so. I think today’s price may only be close to a fair value, depending on one’s required rate of return. Buffett himself didn’t squirm at the valuation to the point that he shed the entire position in Q2, but a sale of that magnitude highlights what his upper limits may be.

Overall, while I touted the strength of the business, I doubted AAPL’s potential for similarly good returns as the past decade, taking into account both the operations and the capital allocation.

Buffett’s New Sales

Berkshire had disclosed a reduction in its APPL position from about $84B to $70B during Q3. Based on prices, it’s estimated the stake declined another 25% from when I last wrote about Berkshire’s Q2 activity.

YTD Quarters’ Price History (Seeking Alpha)

As the price of AAPL in Q3 was generally higher than in Q2, it’s not surprising that Buffett chose to sell more, especially because cash is more valuable to him than it is to most of us. Speaking about his parallel sales of Bank of America stock (BAC), I also wrote:

This is incentive for him to trim, not us. When he trims, he can build a pile of cash and wait for companies on his radar. Some may need financing under terms that almost guarantee strong returns (exactly as he did with BoA in the first place), and so Buffett gets more value from his cash position than most of us can.

Thus, it isn’t necessarily the case that continued selling of AAPL means that we should follow. Berkshire can do much more with its cash and structure entirely unique investment opportunities. Why not accumulate?

FY 2024 Results

With fiscal years that end in September, we have another quarter’s and a full year’s financial results to observe. For the most part, they point to deceleration of the business as we know it.

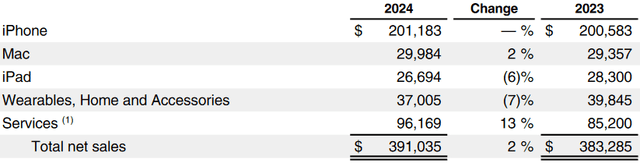

Revenue Growth (FY 2024 Form 10K)

Total net sales only grew 10%. As most of their hardware products stagnated or lagged, this was made up by huge gains in the Services segment, which reflects more of the business as we don’t know it.

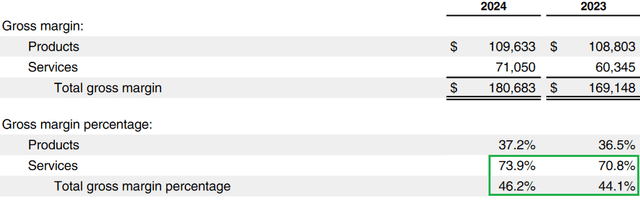

FY 2024 Form 10K

As the Services segment is more capital-light (unlike their manufactured products), the growth of this segment balanced by shrinkage in Products has led to a growth of gross margins.

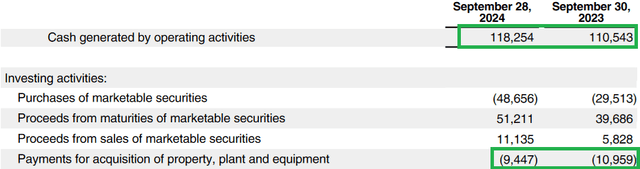

FY 2024 Form 10K

Similarly, this has enabled modest growth in free cash flow since last year, as higher margin supports increased operating cash flows. Meanwhile, Apple has managed to keep its capex costs under control.

Future Outlook

It is the Services segment, therefore, that seems to counter whatever reservations the Buffett types may have about Apple. This is not only because it grew but because it’s the segment that can ride the wave of generative AI.

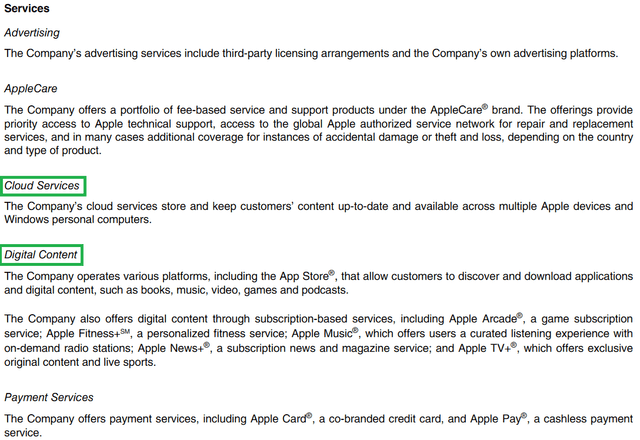

Services Segment Components (FY 2024 Form 10K)

This issue here is understanding how exactly AI benefits this segment over the long-term. This is where we get to the business “as we don’t know it.” (This might also explain more of why Buffett sold, as he’s famously not a tech guy, and slowing sales of the hardware might be additionally concerning to him.)

Services revenue is enjoyed by virtue of their wide product adoption. This is certainly true of their advertising and Apply Pay revenues, for example. There isn’t much ground to break for these, but I suspect the Cloud Services and Digital Content will benefit most from AI.

I think Cloud speaks for itself. We all know that the future of AI is not one that always occurs locally for its users, and so leading cloud services, like Apple’s, will have an important role to play.

Similarly, the next generation of apps (being supported by AI) will be capable of increasingly complex features and should continue to be a driver of app sales and revenue here, quite possibly growth.

One thing I mentioned before is that the Services segment grew and became more complex in the time that passed since Buffett bought AAPL. There’s always room for this to continue, for Apple to spawn entirely new lines with the possibilities created by AI.

One should not limit their imagination to the lines in that screenshot, but one should still keep in mind that Apple will need to make additions fit into the current ecosystem. That’s exactly how the Services segment developed into what it is now.

We also want to keep in mind what happens with the capital allocation, as AAPL hovers around its highest price ever. The new CFO, Luca Maestri, was asked squarely during the FYQ4 earnings call about whether or not more cash could be put into the business, given the amount that goes towards dividends and buybacks. He answered:

Well, obviously, as you’ve seen, our OpEx has gone up over the years. We’ve also seen at the same time a significant expansion in gross margin, maybe to a level that I would have not expected a few years ago, but we’ve done a very good job on a number of fronts. And so, I would say we — when we plan — every time we plan for the upcoming year, we think about all the different areas where we can deploy our resources and we make them available to grow the business. I think we’ve done very well over the long term and — but our fundamental philosophy is to look after the business first. And then, if we have excess cash, we will continue to return it to our shareholders and the plan has worked quite well so far.

It doesn’t strike as a particularly informative answer, essentially repeating what is already know from the financial history.

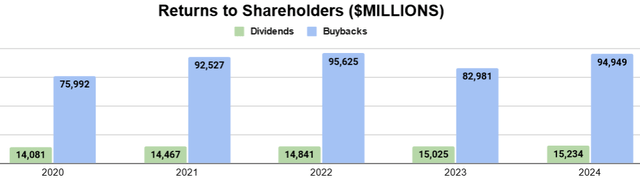

Author’s display of 10K data

Most of free cash flow (nearly all of it) is spent on buybacks instead of on the business. Operating expenses for FY24 equaled about 60% of the buybacks, at $57B. I also mentioned previously that Apple has managed to keep capex around the $10B range. If management isn’t putting more money to work, it isn’t for lack of available cash.

As the new CFO summarized old policies in capital allocation, I interpret this as a signal that he supports continuing to do the same. As such, the long-term returns of Apple will be heavily driven by those of the buybacks, which is influenced by price.

This may speak to why AAPL has continued to go up even after Buffett started selling. In addition to those who believe in an AI future, Apple’s appetite for its own share drives demand, at least in the short-term.

Valuation

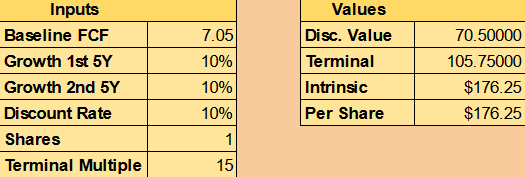

Returning to my valuation, I maintain many of my similar assumption as before. The primary change is my adjustment to baseline FCF per share, which I used in a Discounted Cash Flow model. Previously it was $6.57, and I’ve raised it to $7.05. This is because of the lower shares outstanding and because I used complete 2024 results to produce a three-year FCF average as my numerator.

The other assumptions were:

- 10% CAGR for the decade

- Terminal multiple of 15

Last time, I mentioned that a rate of about 10% was my more optimistic estimate, given how most of revenue is still in their Products and that any boost to Services is a smaller source of cash flow for now, one that does not wholly benefit from AI so drastically.

Similarly, a terminal multiple of 15 is a middle value: about half the current one but higher than when Buffett bought.

Author’s calculation

With a 10% discount rate (typical return of the market), that gets us to a fair value of about $176. This puts APPL in a range to produce positive returns over time, but it lacks the obviously attractive discount for me to rate it a Buy.

Conclusion

Apple continues to be an important company and a major leader in tech. Buffett’s new sales follow better prices to do on the market, the unique options he enjoys with cash, and full-year results showing declines the in the part of the business he is likely to understand better. Similarly, with massive buybacks on a high multiple of free cash flow, long-term of their capital allocation come into question.

Yet, the higher-margin growth of their Services segment is a sign of hope, and the possibilities of AI make it so that new fonts of cash may pour out of this segment for a company with an import cloud service and a dominant presence in app sales.

Given all of these factors and the price we get on the current market, I consider AAPL fairly valued as a long-term Hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.