Summary:

- Apple’s services segment has grown significantly, increasing to $25 billion per quarter, highlighting its importance to the company’s success.

- AI advancements are expected to shorten the replacement cycle, boost services growth, and strengthen Apple’s ecosystem, increasing demand for AI-capable devices.

- Despite positive growth and AI potential, Apple’s current valuation seems high compared to peers like Microsoft and Alphabet, making it less of a bargain.

- Geopolitical risks related to China and Taiwan are lingering concerns, impacting Apple’s supply chain.

Wachiwit/iStock Editorial via Getty Images

It’s a testament to Apple’s (NASDAQ:AAPL) competitive moat that my last article on the company dates back six years and is still relevant in light of Apple’s earnings call yesterday. At the time I loved 2 things about Apple: 1) The services segment and 2) The huge buyback program.

The buybacks are still on but less consequential as Apple’s market cap went up so much. The first is still a main reason why this company has been so successful.

At the time of my last article, Apple did $9 billion/quarter in services revenue. This quarter it is doing $25 billion. An increase of 170% which is around a ~17% increase. At the time Apple traded at a lower multiple. That’s understandable because services made up only a small part of total revenue and today it’s still a relatively small part of total revenue. But over the same period total revenue compounded only at around ~7%. About half that can be explained by inflation which was, at times, kind of high over this period. Basically, the market may have slightly underestimated Apple’s total business but likely deeply underestimated the runway of services. Here’s what I said:

Services is the key to get the market to re-rate Apple as a company with a sustainable revenue base instead of vulnerable consumer cyclical. I’ve been arguing for years the services growth is extremely important:

The above is freshly relevant because of AI. I think the progress that’s being made in AI is very bullish for Apple for three high-level reasons: 1) It is likely to shorten the replacement cycle, 2) It is likely to reaccelerate services growth 3) This capitalizes on and widens the ecosystem moat significantly.

The shortened replacement cycle (meaning people upgrade to a newer version more quickly) is typical when newer models offer a real advantage over older models. It is also widely expected to occur with the recently released iPhone 16. One Wedbush analyst even dubbing what’s coming a supercycle of upgrades. I agree with this idea but I’m less certain it will peak this year. The advancements suddenly made with AI are in part due to the LLM models making it easier for computers to understand instructions without users requiring any coding skills. But also in part as the computational cost of AI went down enough. That has caused something of an inflection point where billions of dollars are being thrown at AI computational power at scale which set off a cycle of silicon investments that will further reduce this cost.

This is an ongoing process and more and more applications will include AI. Generally, AI compute is performed in the cloud. The latest iPhone can execute AI algorithms locally. That’s very unlikely to be efficient compared to the cloud but it is still likely interesting as a support resource to deal with privacy-sensitive data or when using augmented reality apps on your phone, etc. The more interesting this edge computing will be (it could also be boosted if there’s significant AI regulation), the more likely there will be great demand for smartphones with strong capabilities on this front. Because it is new technology, the development is rapid and it could make sense to buy a new phone after only a year has passed, for example. The latest iPhone is being marketed as having Apple Intelligence (which is how they’re calling their AI boosted features). I believe this won’t spur an immediate tsunami of upgrades. It seems more likely to initiate more frequent upgrading over a sustained period of years as the AI features develop and there are more and more killer apps based on these new capabilities.

Services growth

That leads me into the reason I believe it will spur services growth. Services are incredibly important to Apple because of the double-digit growth rate and the much higher margin profile of 74%. The most important thing AI is doing for smartphones as well as other portable devices is that it makes it much easier for users to use computing power. It is enabling computers to more readily understand what we want out of them without being very exact in our input. Just talking casually to your devices and your wishes being understood has already vastly improved and will continue to improve. This will open up a lot of specialized applications to a much wider audience. It is very likely to increase the time users engage with devices and broaden the kinds of tasks they can perform with these devices as well as enhance productivity. At the same time Apple has been growing subscription-based revenue as per the call (emphasis mine):

Yes, Amit, I’ll take this one. Yes, we are, first of all, very, very happy with — it’s an important milestone. Of course, we’ve got to a run rate of $100 billion. You look back just a few years ago, and the growth has been phenomenal. We’re very pleased. We’ve got a very diversified portfolio of services. And over the years, the amount that is recurring in nature has grown and is growing faster than the transactional piece. We have well over 1 billion paid subscriptions on our platform right now between our own services and third-party services. That continues to grow strong double-digits. So, we feel very, very good. And, essentially, to your question, yes, the recurring portion is growing faster than the transactional one.

The ecosystem

The Apple ecosystem is famous for locking you in and this has been a very successful business strategy for the company. Not in the least place because the company established and protected a brand that turns it almost into a source of reluctant pride for its users. With AI the ecosystem may be getting a very serious boost over the coming years. For example a general assistant feature, like Siri, will be much more useful if it can talk to and access data across your devices. Although that will likely be replicable without Apple devices, it will be less convenient to set up. In addition it likely won’t work when you combine Apple devices with other brands.

Valuation

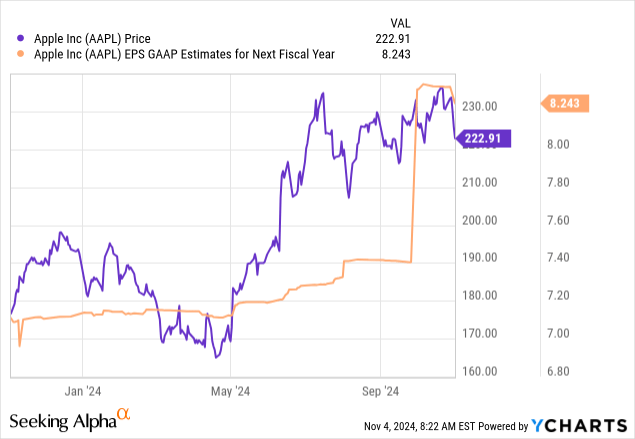

Analysts have definitely been upgrading EPS, sales and EBITDA estimates for next year. The market didn’t wait for it but went ahead and priced some of it in already:

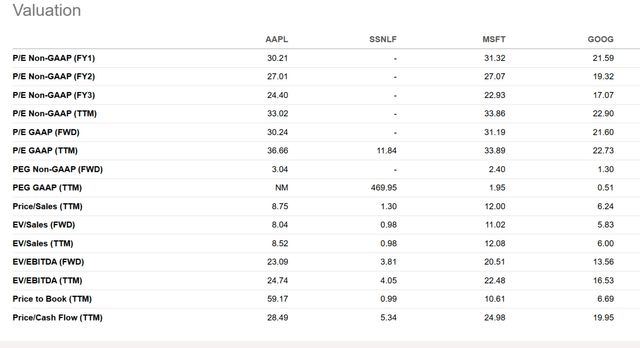

Apple doesn’t really have a comp like a car company has or a construction company. I pulled up the valuation data for Samsung (OTCPK:SSNLF), Microsoft (MSFT) and Alphabet (GOOG) because these companies are huge and definitely share important characteristics as well as compete with Apple.

Apple valuation (seekingalpha.com)

Samsung clearly lags the others in terms of valuation. It trades more like an electronics manufacturer. If Apple didn’t have its highly successful ecosystem and all-important services revenue it might be a good comp. It’s where Apple can trade if the future works out very badly. Microsoft and Alphabet trade in the 20-30x earnings range or 20-24x free cash flow. I think Alphabet is on the more attractive side of things amongst the megacaps (see my earnings take).

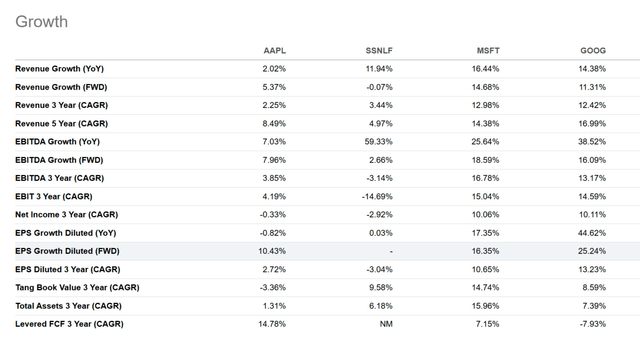

I’ve also pulled up the historical growth over the past few years. I think it is fair to say that Microsoft and Alphabet are a bit ahead of Apple there. Analysts are also expecting more growth out of these two. They also have higher gross margin as there is less money coming in from device sales and more through software revenue. I do believe the developments in AI are likely to help Apple enough that these growth estimates are modest. I don’t think the gap with the other two U.S. megacaps will be as large.

Apple growth (Seekingalpha.com)

Then there’s the geopolitical tension that’s been building around China. The investability of China has decreased in the past few years. Meanwhile, Apple is very dependent on China as well as Taiwan in terms of its supply chain. It isn’t an immediate threat and will be taken less or more seriously by the market depending on the latest current events.

If you consider (forward) growth rates, AI potential, geopolitical risk, an ever-growing percentage of services revenue and its strong competitive advantage I still think Apple trades a bit dear. Maybe it’s a fair price but it’s hard to view it as a bargain here. It was a lot easier to make that case, a few years ago, at a 15x forward P/E. I don’t hate it, in fact, the company’s resilience and success has surprised me year after year, but I’m not going to buy it here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.