Summary:

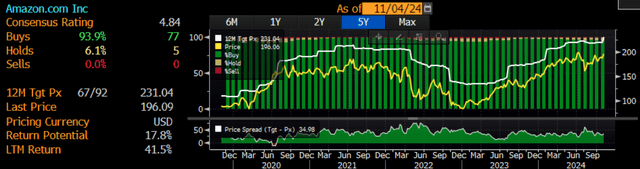

- AMZN is the most loved stock on Wall Street, with 94% buy recommendation and zero sells, as analysts and investors extrapolate out recent strong growth.

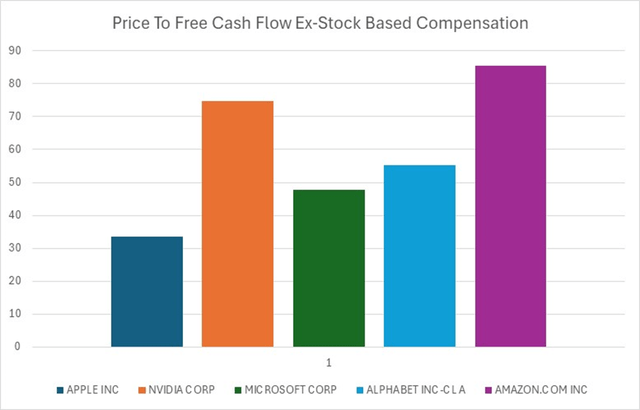

- While the headline PE ratio is 42x, this figure almost doubles when we look at actual free cash flows available to investors.

- The company’s already huge sales and operating income suggest double digit growth unlikely to last, making Amazon a potential growth trap.

hapabapa

Shares of Amazon (NASDAQ:AMZN) have outperformed the market over recent months as the company’s earnings have soared. The rise in earnings has seen the stock’s PE ratio fall to its lowest level since 2009, and its lowest relative to the S&P500 since 2002. It is no wonder why AMZN is the most loved stock on Wall Street, with 94% of analysts giving the stock a buy recommendation. However, the stock remains extremely expensive, particularly when measured based on the actual free cash flow the company can deliver to investors. Meanwhile, revenue growth is on a rapidly declining trend owing to the company’s already huge scale, posing a risk to long term earnings potential.

Analysts Recommendations (Bloomberg)

Growth traps tend to be more risky than value traps, as this article by value investors GMO explains:

- Value traps are facts of life for value managers. A stock suffering from some temporary dark clouds appears temptingly cheap, and like the call of Sirens, it entices the intrepid Value manager. Alas, the company’s fundamentals disappoint yet again. It was a trap. The clouds were not temporary. And the market rightfully punishes the stock price further.

- Cautionary tales of Value traps are taught in finance texts around the world, and the term is a longstanding part of investment lexicon.

- Although most investors have never heard the term, “Growth traps” are even more insidious. The seduction is different, borne from grand narratives of disruptive technologies, hyper-growth, and breathtaking breakthroughs. But Growth stocks are no less prone to disappointment – there’s actually evidence they are slightly more likely to disappoint at certain points in the cycle1 – and their punishment can be even more dire.

We have seen how growth traps have played out in Chinese tech over the past few years after these stocks traded at extremely expensive valuations on the belief that high historical growth rates could be sustained into the future. Alibaba (BABA), for instance, often referred to as the Chinese Amazon, has lost almost 70% of its value over the past four years as its earnings growth, while still strong, disappointed lofty expectations. Amazon’s extreme valuation and already huge level of sales make it a potential candidate for a growth trap.

High Profits Contrast With Low Free Cash Flows

Amazon now trades at a trailing PE ratio of 42x, down from 100x just over a year ago thanks to a rapid increase in profitability. The surge in profits has been largely the result of the rapid expansion in profit margins, which have risen from just 1.5% in early 2023 to a record high 8%. Earnings are widely expected to continue growing rapidly over the coming years. This article anticipates eps growth of 25% annually for the next three years driven by Amazon Web Services, which would take net income to USD97bn by 2027.

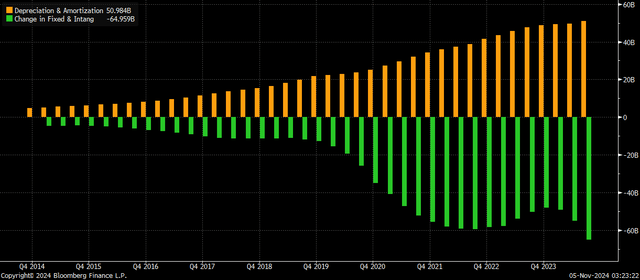

However, the rise in Amazon’s net income has been driven by an acceleration in both capital expenditure and talent expenditure. Over the past 12 months capex has amounted to USD65bn, compared to reported depreciation expenses of USD51bn. This helps explain why Amazon’s trailing 12-month free cash flow is USD43.0bn, significantly below its USD49.9bn reported net income. When using free cash flow rather than reported earnings, the valuation multiple rises to 48x.

Stock Based Comp and Capex (Bloomberg)

If we then add in the cost of the company’s USD18.6bn in annual stock based compensation, the cash available to return to investors falls to USD24.3bn, resulting in an earnings multiple of 85x. The chart below shows the big 6 tech companies valuations based on this metric, with Amazon standing out as being expensive even among this group.

Bloomberg

Sales And Profit Growth To Continue Their Long Term Decline

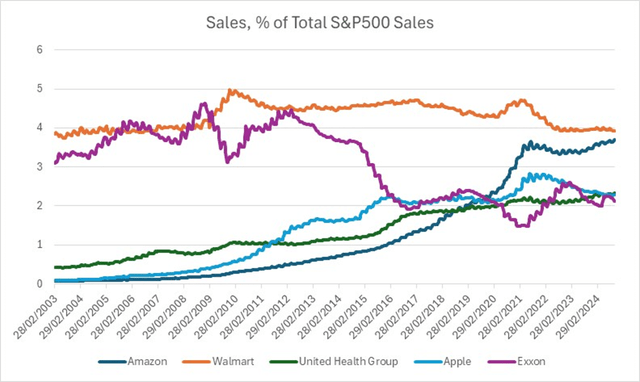

Amazon is already the second largest US company by sales behind Walmart (WMT), with USD620bn in revenues, equivalent to 3.7% of entire S&P500 revenues. Companies with extremely large sales tend to grow more slowly than average, and we have already seen Amazon’s sales per share growth fall to 10%. Assuming 4% nominal S&P500 sales growth, if Amazon sales were to continue growing at a 10% rate for 10 more years, they would reach 6.5% of the entire market, dwarfing the 5% share held by Walmart (WMT) in 2010.

Bloomberg

It is highly likely that Amazon’s sales growth will slow to the pace of the overall market over the coming years. Even if we assume 10 more years of 10% growth before it slows to 4%, and that profit margins remain at current levels. Investors therefore require a significant further expansion in Amazon’s profit margins to justify current valuations, and appear to be banking on AWS to deliver this. Growth in AWS operating income grew 50% year on year in the last quarter, and it now accounts for over 60% of total operating income. However, after generating USD36.4bn in operating income over the past 12 months, continued double digit growth rates will be difficult to achieve. This represents around 2% of total S&P500 profits, and 5% of Nasdaq 100 profits. The combined cloud business of Amazon, Microsoft (MSFT), and Google (GOOGL) is around 6% of S&P500 profits and 14% of Nasdaq 100 profits. Even if AWS profits were to double, Amazon’s overall profit would rise to USD86bn, all else equal, resulting in free cash flow ex-SBC of around USD42bn, and a free cash flow yield of little more than 2%.

The main risk to my bearish thesis comes from the potential for Amazon to continue to grow operating income while controlling capex and staffing costs. In the above example, if we assume that capex and SBC remain fixed instead of rising in line with revenues, a doubling of AWS income would drive free cash flow ex-SBC to around USD60bn. However, even then it would leave the stock trading at a FCF yield of less than 3%.

Summary

While Amazon’s earnings multiple has contracted significantly, it remains extremely expensive, particularly when we take into account surging capex and huge stock based compensation. Investors extrapolating the recent rise in earnings may be disappointed as the company’s huge scale makes double digit growth unlikely to last. With just 6% of analysts rating the stock a hold and the rest rating it a buy, these risks appear underappreciated by the market.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.