Summary:

- While Google Cloud is winning big from the AI revolution, the market has been rightfully concerned about generative AI upending Google’s core Search moat.

- Although the latest earnings report eased fears about the effectiveness of ads around AI Overviews relative to traditional Search, the competitive threats are only getting stronger.

- GOOG is being downgraded to a ‘hold’ given rivals’ remarkable strategies to take market share coupled with concerning market research statistics.

Carsten Koall/Getty Images News

Google’s (NASDAQ:GOOG) Q3 2024 earnings report eased fears about the effectiveness of ads around AI Overviews relative to traditional Search. However, concerns still remain around Google’s ability to sustain its core moat as new Search avenues have arisen, the latest being OpenAI’s official launch of SearchGPT. GOOG is being downgraded to a ‘hold’ as market statistics suggest that the rising competitors should not be taken lightly.

In the previous article, we delved deeply into one of Google Cloud’s biggest strengths over Microsoft (MSFT) Azure and Amazon’s (AMZN) AWS, which is that parent-company Alphabet’s first-party workloads around its smartphone business (primarily Android) have been conducive to the company having the readily-available infrastructure to serve the most important form factor of this AI revolution so far, with top smartphone makers like Apple and Samsung already opting for Google Cloud technology over other cloud providers.

Moreover, with Google Cloud revenue growth rate accelerating to 35% last quarter, the segment certainly remains a key element of the bull case for GOOG.

That being said, Google Cloud still only made up 13% of total revenue last quarter, while ‘Google Search & other’ constituted a heavy 56%, and continues to be the most important driver of stock performance.

Google’s Search dominance is under threat

Google pleased investors with the latest earnings report revealing that the broader rollout of AI Overviews is not hurting its Search ads revenue business, delivering a year-over-year growth rate of 12.17%.

The tech giant’s approach so far has been to offer sufficient information to answer a user’s query, without allowing for follow-up questions, and instead directing people to relevant source links or showing ad products below any commercial queries.

So until now, Google has resisted the pressure to evolve Search into a back-and-forth chatting experience, while offering its Gemini chatbot as a completely different service.

However, Google may eventually have to embrace a chat-based Search experience, particularly as competitors move increasingly in that direction, and users’ preferences for chatbots accentuates.

Almost 60% of U.S. consumers used a chatbot to help research or decide on a purchase in the past 30 days, according to a survey by New Street Research.

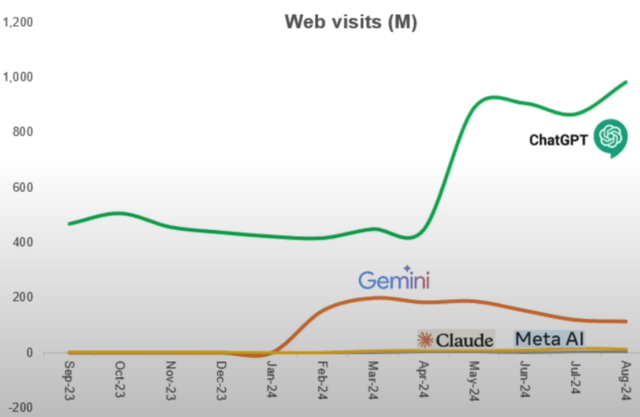

OpenAI’s ChatGPT remains the most frequently visited chatbot web page, benefitting from a first-mover advantage despite new entrants in the space, with Google’s Gemini in a very distant second place.

Capitalizing on the popularity of its chatbot, OpenAI recently launched SearchGPT, and has opportunely built-in the new Search feature as part of the existing ChatGPT interface, powered by Microsoft’s Bing and other Search providers, stepping up its challenge against Google.

ChatGPT’s built-in Search feature (OpenAI)

Investors were already apprehensive about Google becoming vulnerable to losing Search market share amid the ongoing antitrust litigation woes.

The way that the Google versus DOJ search trial is going, there’s a decent likelihood that the Apple ISA contract and some of the Android pre-install contracts are going to be voided out at some point in the future.

– Ross Sandler, analyst at Barclays, on the Q3 2024 Alphabet earnings call

The tech giant no longer being able to secure deals that make Google the default Search engine inevitably opens the door for new rivals to gain visibility and prevalence.

In fact, AI search start-up Perplexity has already been growing in popularity, thanks to its appealing user-interface.

Both Perplexity and SearchGPT allow follow-up questions that enable users to naturally dive deeper with their curiosity, a key differentiating attribute from Google’s AI Overviews.

Some 46% of Perplexity queries in the U.S. lead to follow-up questions… The company said it processed 340 million queries in September. Google doesn’t provide a specific measure of how many searches it handles, saying only it is in the trillions per year.

Given the growing user-trend of asking follow-up questions, it is fair to assume that Google will eventually evolve towards facilitating a back-and-forth conversation as well to stay competitive, as the current format of AI Overviews is not set in stone.

While we’ve rolled out AI Overviews to over 1 billion users, there is a lot more innovation there we are actively working on. So I expect search to continue to evolve significantly in 2025, both in the search product and in Gemini.

– CEO Sundar Pichai on the Q3 2024 Alphabet earnings call

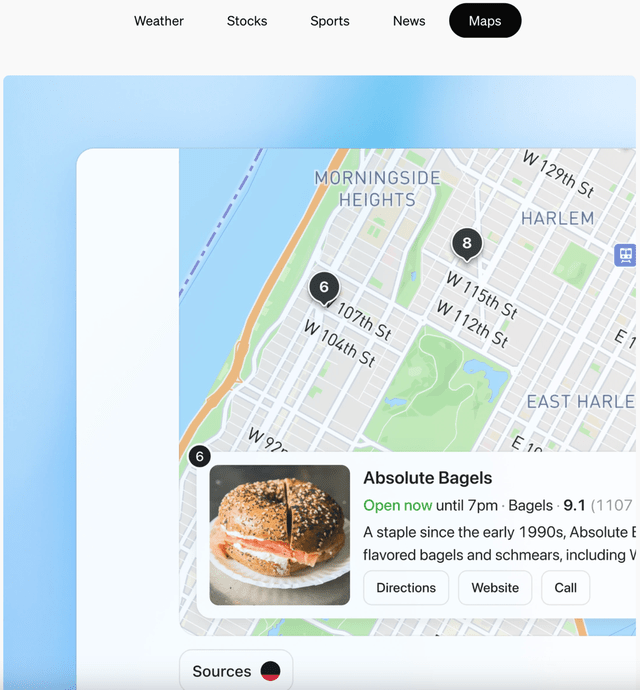

Nonetheless, the intensifying encroachment of OpenAI onto Google’s territory should not be taken lightly, particularly given how it is extending the functionalities of its chat interface, covering categories like ‘Maps’ for travelling, ‘Sports’ games scores and ‘Stocks’ for investors, by partnering with various data providers.

ChatGPT’s extended functionalities (OpenAI)

OpenAI is aggressively stepping up its challenge against Google by facilitating more common, adjacent Search use-cases and going beyond just offering summarized information on various subjects.

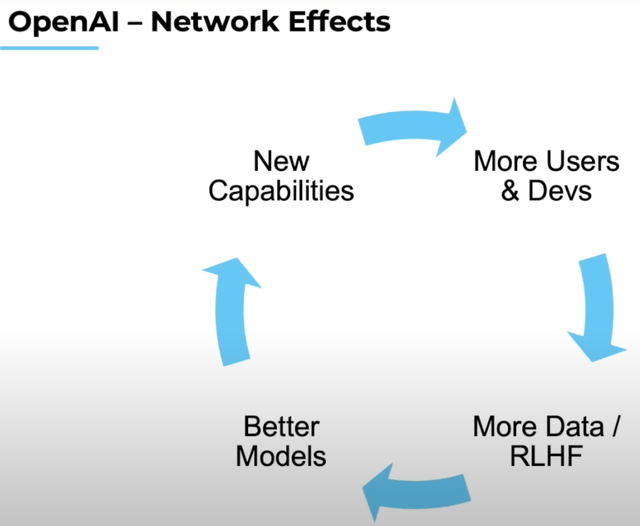

Now the bulls may argue that simply offering these additional functionalities hardly poses a threat to Google given that the tech giant’s own services are much more established with massive user-bases that are habitually accustomed to using apps within the Google ecosystem. While it is true that changing user behaviors will be a challenge for OpenAI, the threat must not be underestimated given the network effect that OpenAI is already benefitting from in the background.

BG2 Podcast, Altimeter Capital

Moreover, given the fact that ChatGPT is already the most popular chatbot, reaching over 200 million active weekly users just over two months ago, it not only grants the company more data for training new models (as long as users stay opted-in), but also attracts more developers to build for OpenAI and continuously extend the capabilities of ChatGPT into new areas, in turn attracting even more users to the platform, and so forth.

So while OpenAI is starting off with the five categories indicated above, one should not be surprised as it expands into other commercial areas like shopping, travel, or even entertainment to potentially challenge YouTube with its highly-anticipated text-to-video model ‘Sora’.

Furthermore, Google’s two-decade reign over the Search engine market meant that digital business/ website owners barely had any alternatives through which they could reach consumers, having to accept the terms that Google sets for them.

In fact just recently, the crowd-sourced reviews platform ‘Yelp’ once again sued Google over anticompetitive practices.

Rather than compete on the merits with companies like Yelp, Google has so effectively self-preferenced its offerings that an increasing volume of searches result in zero clicks, meaning users never leave Google’s search results page. And even when searches do result in a click, 30% of those go to another Google property. In other words, Google abuses its monopoly power in general search to keep users within Google’s owned ecosystem and prevents them from going to rival sites. This anticompetitive conduct siphons traffic and advertising revenue from vertical search services, like Yelp

– Yelp

Yelp is certainly not the only digital business that has been fighting Google’s alleged “self-preference” practices.

Now amid the rise of new Search rivals like Perplexity and SearchGPT in this new era, business owners that are fed up with Google’s allegedly unfair business practices, or simply want to reduce reliance on the single-largest Search engine, will undoubtedly embrace the opportunities to partner with these new upcoming, alternative avenues for reaching consumers. This would help rivals like SearchGPT and Perplexity advance the value proposition of their platforms, and thereby undermine Google’s moat.

Furthermore, OpenAI is not just incorporating Search capabilities into ChatGPT, but is also taking the challenge to Google a step further by encouraging users to make ChatGPT the default Search service within Chrome browsers.

You can set search on ChatGPT as your Chrome browser’s default search by downloading and installing our Chrome Extension…

Once ChatGPT has been set as your default search engine, you can search directly via your browser URL bar. This will automatically start a conversation in ChatGPT that contains your search query and ChatGPT search’s response.

– OpenAI

Now it remains to be seen how successfully OpenAI can actually convince users to make ChatGPT the default search over the long-trusted Google search engine, but the threat should certainly not be undermined given the growing popularity of OpenAI’s chatbot over Google’s Gemini.

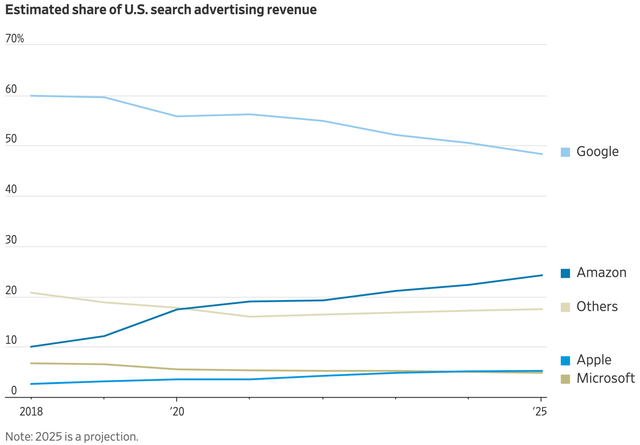

In fact, despite the nascency of these new search avenues, Google’s share of Search advertising revenue in the U.S. is projected to fall below 50% in 2025, according to eMarketer.

eMarketer, The Wall Street Journal

Over the past few years, Google had already been losing Search market share amid the rise of Amazon, and this eroding dominance is expected to accentuate amid the rise of new Search rivals in the era of generative AI.

Bull case for Google

Having addressed the big risks facing Google’s Search moat, the tech giant does boast some significant advantages as well.

Since we first began testing AI Overviews, we have lowered machine cost per query significantly. In 18 months, we reduced cost by more than 90% for these queries through hardware, engineering and technical breakthroughs while doubling the size of our custom Gemini model.

– CEO Sundar Pichai, Q3 2024 Alphabet earnings call

Google’s accelerating computing cost efficiencies continuously advance its competitiveness, strengthening its ability to offer new generative AI-powered services at a low cost to consumers, or even for free.

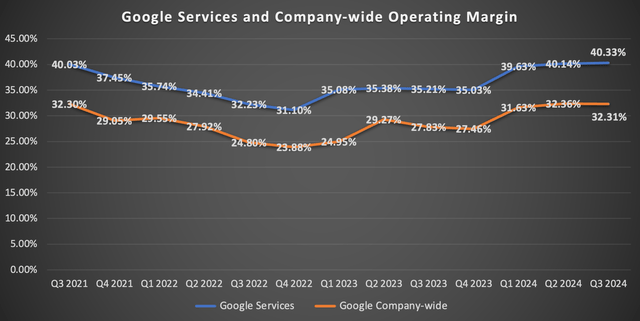

The company already offers AI overviews and certain other generative AI services for free, while impressively still expanding the operating margin for its ‘Google Services’ segment last quarter to 40.33%, and subsequently sustaining the company-wide operating margin at around 32%, despite the rise in depreciation costs from the growing AI-related capital expenditures.

Nexus Research, data compiled from company filings

The fact that Google is in complete control of its technology and infrastructure throughout the value chain not only yields cost advantages, but also fosters accelerated innovation to lead the AI revolution.

Our Research and Infrastructure leadership means, we can pursue an in-house strategy that enables our product teams to move quickly. Combined with our model building expertise, we are in a strong position to control our destiny, as the technology continues to evolve. Importantly, we are innovating at every layer of the AI stack, from chips to agents and beyond, a huge strength.

– CEO Sundar Pichai, Q2 2024 Alphabet earnings call (emphasis added)

Google is undoubtedly more self-reliant than the likes of Amazon, Microsoft, OpenAI and Perplexity, granting it greater control over the future path of product innovation. Most recently, this faster innovation pace led to the first-to-market release of NotebookLM, enabling users to turn any text into a podcast format, and CEO Sundar Pichai alluded to more such exciting product releases over the next year.

teams internally are now set up much better to consume the underlying model innovation and translate that into innovation within their products. So now all the seven products, which have 2 billion users each have done their first versions of incorporating Gemini, and there is aggressive road map ahead for 2025.

…

we are also enabling smaller teams to ship newer experiences and Notebook LM was the first instantiation of those types of efforts

The point is, Google’s expedited pace of innovation could indeed cultivate into new monetization avenues, buoying top-line revenue and bottom-line EPS growth for shareholders in the face of greater competition in the Search market.

The investment case for Google

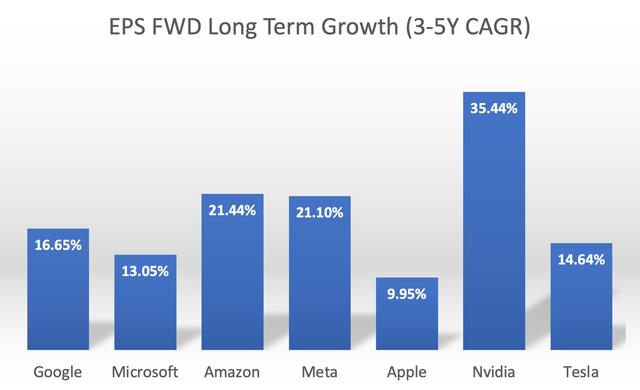

GOOG currently trades between 21-22x forward earnings. Though a preferred valuation metric is the Forward Price-Earnings-Growth (Forward PEG) ratio, which adjusts the Forward PE multiple by the anticipated EPS growth rate.

Nexus Research, data compiled from Seeking Alpha

Relative to the other Magnificent 7 stocks, Google’s expected EPS growth rate of 16.65% is rather mediocre, especially considering that rivals Amazon and Meta Platforms (META) are anticipated to deliver 20%+ growth rates over the next 3-5 years.

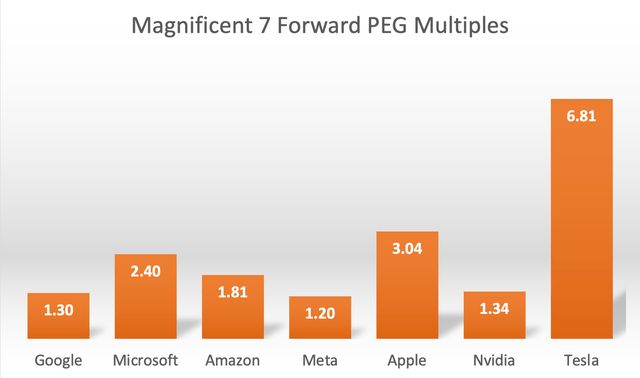

Now adjusting each stock’s Forward PE multiple by these projected EPS growth rates gives us the following Forward PEG ratios.

Nexus Research, data compiled from Seeking Alpha

Now while GOOG appears to be one of the cheapest Magnificent 7 stocks trading at 1.30x Forward PEG, there is a good reason why the market has assigned such a low valuation multiple to the tech giant relative to other AI winners.

It essentially comes down to EPS uncertainty, whereby market participants are hesitant over what Google’s actual EPS growth rate will be amid intensifying competition from Gen AI start-ups like OpenAI and Perplexity, depending on how aggressively these rivals are able to take market share. As mentioned earlier, projections from eMarketer are already suggesting that Google’s share of U.S. Search advertising revenue could fall below 50% next year, aggravated by concerns that the broader Search market worldwide could follow a similar trend.

Therefore, these notable risks subdue the argument that GOOG is dirt-cheap. Instead, the stock may actually be reasonably valued at these levels until the outlook for the core business improves.

The bull case for buying GOOG is further undermined by the fact that other key Magnificent 7 stocks, most notably Nvidia (NVDA) and Meta Platforms, trade at similar Forward PEG multiples, while offering higher expected EPS growth rates, and arguably more certainty around the prospects achieving these projections.

Google stock has been downgraded to a ‘hold’ rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.