Summary:

- Intel’s Q3 earnings showed a slight revenue beat but a big earnings miss due to restructuring charges, leading to a mixed market reaction.

- Despite some positive signs in cost-cutting and segment growth, Intel’s lowered guidance and ongoing challenges suggest caution.

- Intel’s Foundry business has potential but remains unproven, with significant investments and some early wins, including a partnership with AWS.

- Given the current uncertainties and technical indicators, I maintain a Hold rating on Intel, seeing no compelling reason to buy or sell.

Sundry Photography

Thesis Summary

Intel (NASDAQ:INTC) just reported Q3 earnings, and the stock popped over 7% following a big miss. Expectations were very low and the market deemed the results better than expected.

But did Intel prove anything that fundamentally justified a big rally in the stock? Or was this just another case of an earnings overreaction?

While I could agree that the worst is now behind Intel, this doesn’t mean investors should pile into the stock.

The company still faces many challenges, and I personally need to see more proof that Intel can deliver.

In my last Intel post, following the last earnings, I outlined key reasons why the stock could be a buy and how sentiment was overly bearish. The reaction to the latest earnings is proof of this, but I don’t think it is proof that Intel is going to crush it from here.

I maintain a Hold rating on the stock.

Q3 earnings

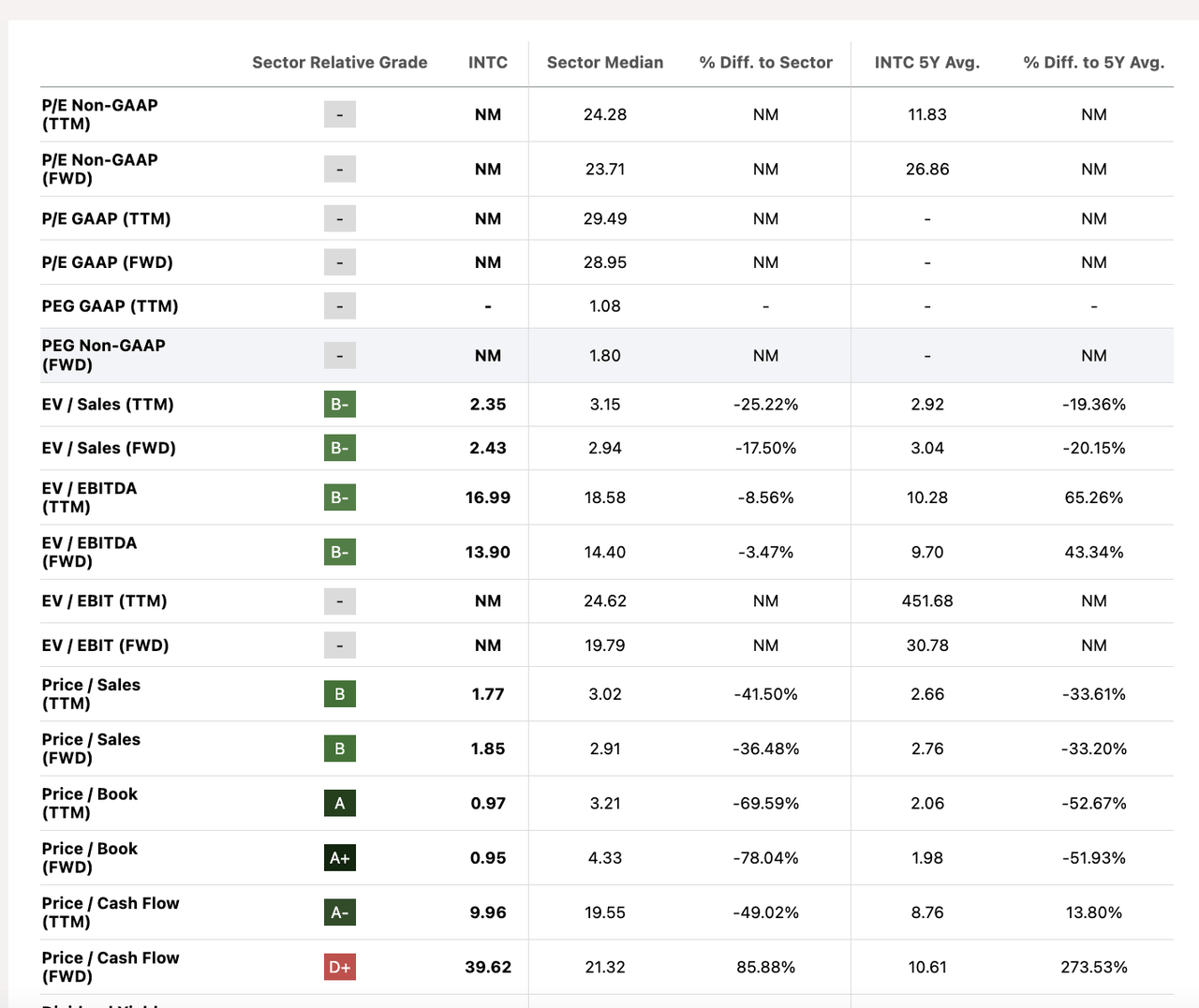

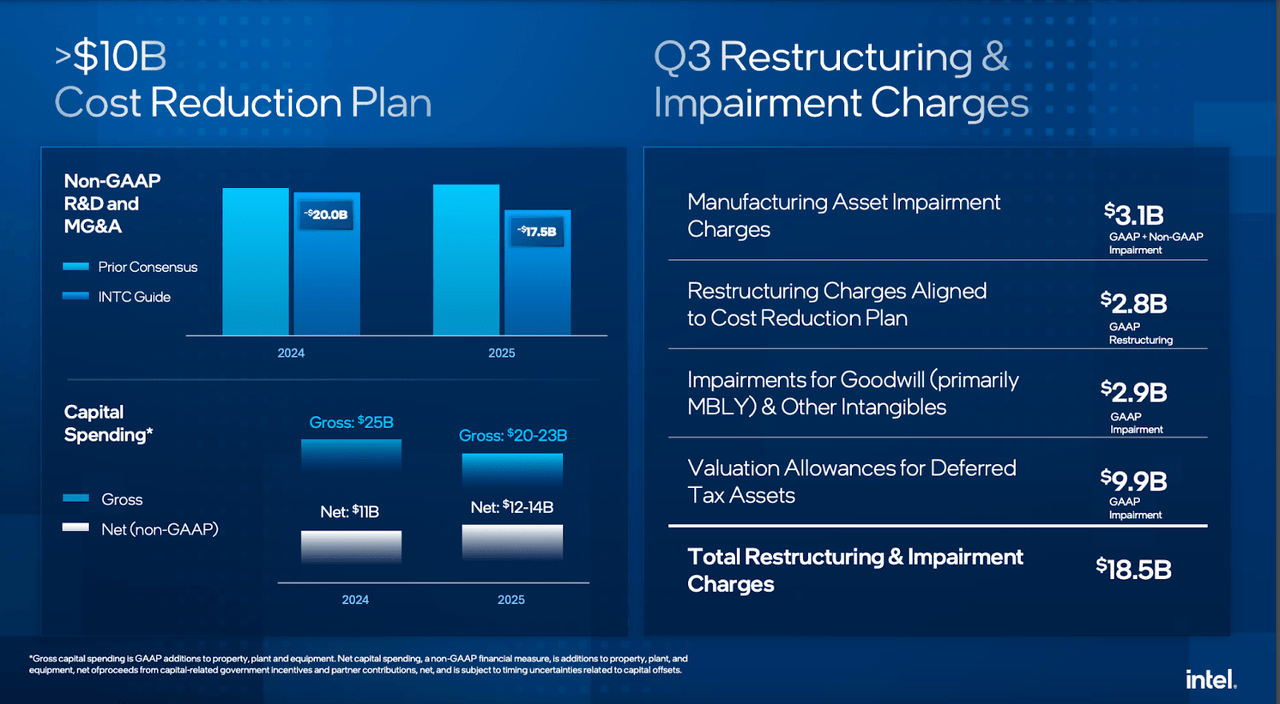

Intel’s Q3 earnings delivered a slight revenue beat and a big earnings miss.

Intel Q3 Results (SA)

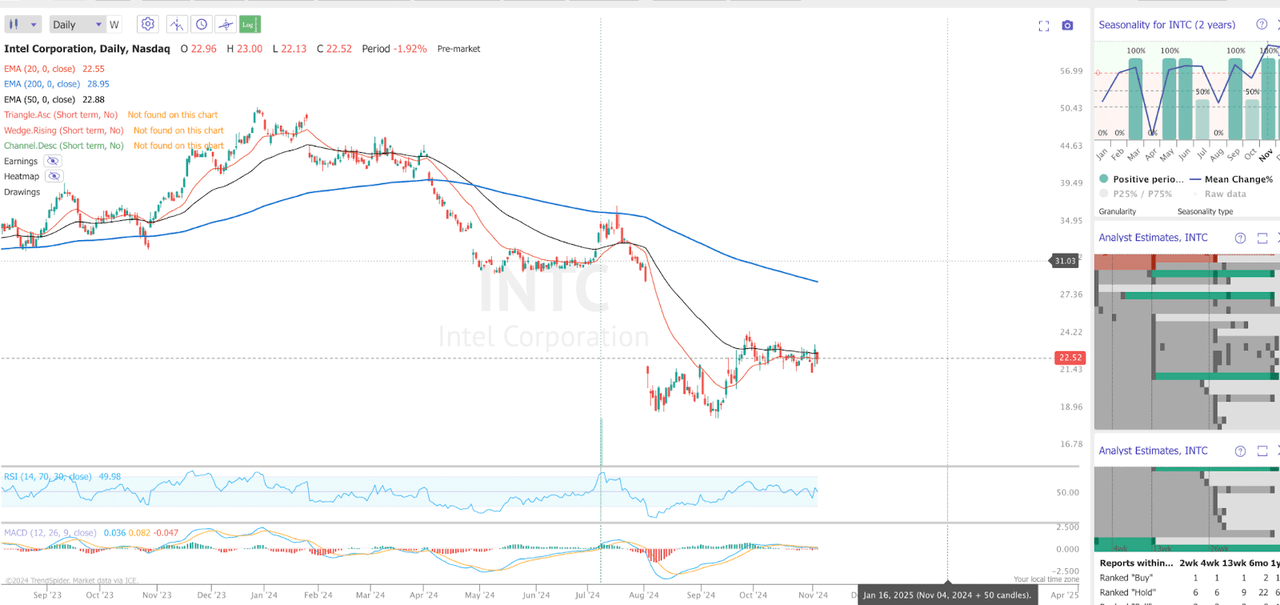

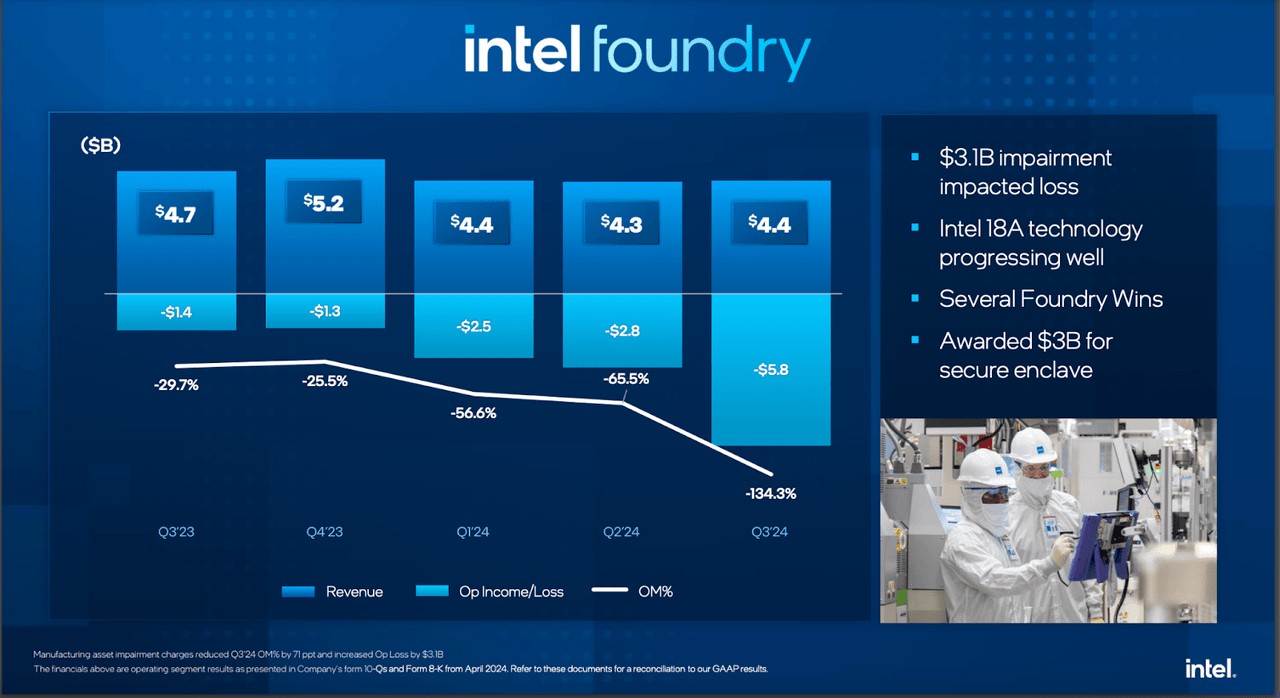

The miss was attributed to a $2.8 billion restructuring charge. The company also had a further $3.1 billion in charges that were accounted for as cost of sales. We can learn more about this and Intel’s restructuring plan in the slides below.

Intel Impairments (Investor slides)

As we can see, Intel is looking to cut significant spending across R&D and Capital Spending. But we must take into account that it could still be a few quarters until we see tangible benefits from this.

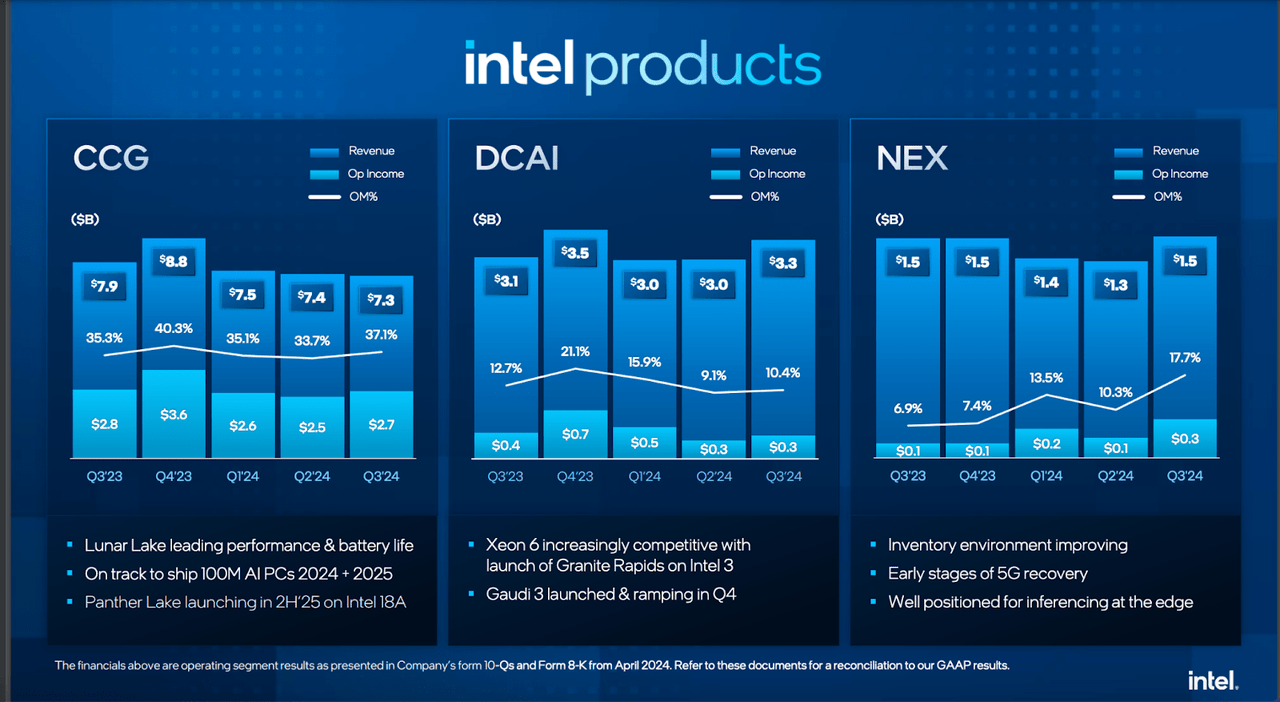

Now, let’s look at how Intel is performing in each of its product segments.

Intel Products (Investor slides)

Client Computing Group (CCG) revenues fell QoQ and YoY, though we did see an encouraging increase in the operating income margin.

Data Center and AI (DCAI) which is perhaps the most interesting of Intel’s segments grew 10% QoQ, though the segment was down YoY.

But despite what looked like a good quarter, the company’s guidance was lowered.

While the Gaudi 3 benchmarks have been impressive and we are pleased by our recent collaboration with IBM to deploy Gaudi 3 as a service on IBM Cloud. The overall uptake of Gaudi has been slower than we anticipated as adoption rates were impacted by the product transition from Gaudi 2 to Gaudi 3 and software ease of use.

Source: Earnings Call

Lastly, Network and Edge (NEX) grew to $1.5 billion and margins expanded to 17.7%.

What’s happening with Foundry?

The other big question when it comes to Intel is; what’s going on with Foundry?

Intel Foundry (Investor slides)

As expected, the company is still putting money into the operation. Losses came in at $5.8 billion, but the company did score some wins and has been awarded more government grants.

Most recently, as announced, we are finalizing a multiyear, multibillion dollar commitment by AWS to expand our existing partnership to include a new custom Xeon 6 chip on Intel 3 and the new AI fabric chip on Intel 18A. Beyond AWS, we added two additional 18A wafer design wins this quarter from compute centric companies and our pipeline of potential wafer designs has grown nicely over the quarter.

Source: Earnings Call

I still think Foundry has a lot of potential here, but it has yet to prove its worth.

What’s Next For Intel?

The company expects revenues of $13.3-$14.4 billion in Q4, with a gross margin of 39.5%. This means we will see Intel grow marginally sequentially, but margins will contract down from around 41%.

And additionally, we’re going to have more start-up costs in the fourth quarter associated with 18A than we did in the third quarter. So that’s going to put a little pressure on the gross margins. But I do think the 39.5% guide at the midpoint for the fourth quarter is a pretty clean guide.

Source: Earnings Call

Meanwhile, we’d expect EPS to rebound strongly as the impact of impairments should be much lower next quarter.

Is Intel A Buy Right Now?

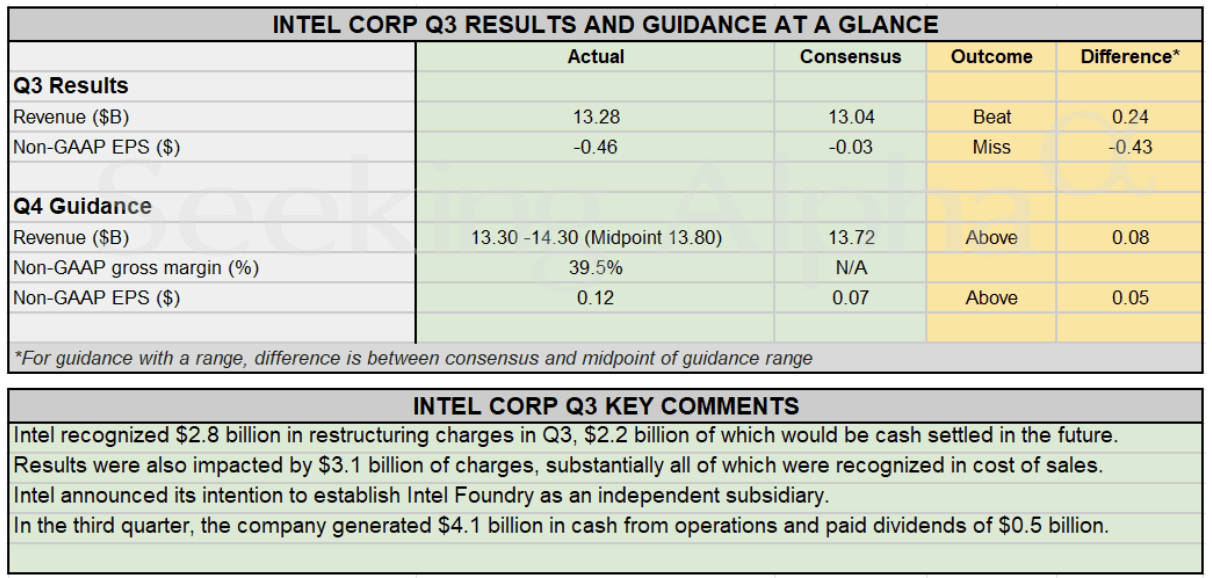

Intel popped on earnings, but the stock is actually almost flat over the last 5 days. This is why I think the market’s reaction on earnings could be misleading to some investors.

Intel certainly showed some encouraging signs. The company is working hard to cut down costs, it is growing nicely in DCAI and despite its large impairment charges it still paid a small dividend.

However, it’s hard to take out anything remarkably good from the earnings, as we simply don’t have enough information yet regarding the performance and ramp-up of the 18 and the Foundry business as a whole. Furthermore, we saw lowered guidance for the Gaudi 3.

This is perhaps why we have actually seen Intel lose ground after the earnings pop. In reality, I’d say not that much has changed.

So would I buy Intel right now?

Yes, the Price/book is close to 1 and the Price/Cash flow is below 10. This may seem attractive, but there’s still a lot of uncertainty surrounding Intel’s future. I’d actually expect weaker cash flows in coming quarters as margins continue to be under pressure.

And looking at the chart despite the earnings bounce, we haven’t broken out from any meaningful technical resistance. The stock is range-bound and trading down, with a bearish MACD and the upside capped by the 50 EMA.

Final Thoughts

Ultimately, I don’t see a compelling reason to buy, but, likewise, at this price, I don’t see a compelling reason to sell. Yes, the worst may be behind us, but what do we actually have to look forward to? The latest earnings didn’t offer much to get excited about.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Macro moves markets, and this is what I do at The Pragmatic Investor

Join today and enjoy:

– Weekly Macro Newsletter

– Access to our Portfolio

– Deep dive reports on stocks.

– Regular news updates

Start your free trial right now!