Summary:

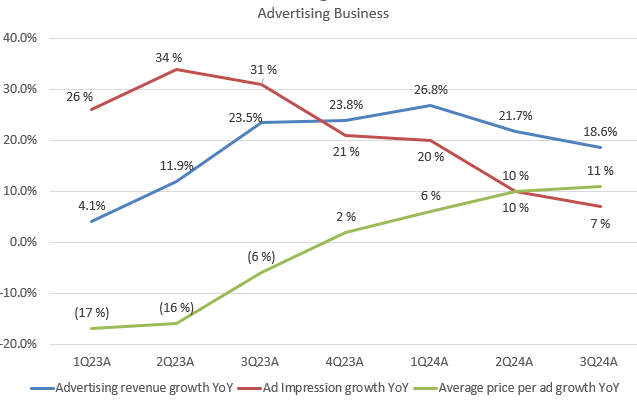

- META is currently in a growth normalization stage, with advertising revenue growth decelerating due to a significant slowdown in ad impression growth.

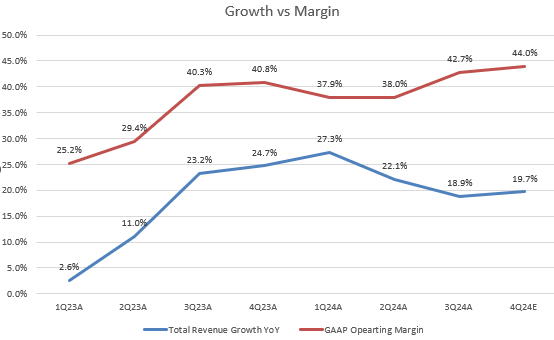

- The company 4Q FY2024 guidance indicates that its revenue growth and operating margin will sequentially improve compared to 3Q.

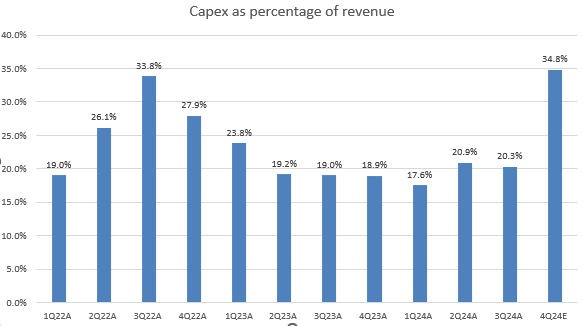

- Management indicated higher capex in 4Q and a significant increase in FY2025, leading to higher depreciation and operating costs, which will impact earnings more than operating cash flow.

- Elevated capex will focus on GenAI, enhancing customer engagement and ad conversion for advertisers.

- The stock is currently trading at 25x forward non-GAAP P/E, a reasonable valuation compared to the broader market, justified by above-average growth and margins.

Derick Hudson

What Happened

Meta Platforms (NASDAQ:META)’s stock experienced a 5% pullback despite delivering solid 3Q FY2024 earnings. As the company enters a phase of growth normalization, investors may be cautious about significant increases in capex going forward. Excluding cyclical effects in the ads business, I believe META will need to increase capex to strengthen its AI capabilities and sustain consistent double-digit revenue growth. However, given its current market share, sustaining over 20% YoY growth may be challenging.

In my previous analysis, I maintained a buy rating on META, emphasizing that the company had raised its capex outlook as advertising revenue growth began to decelerate. Since then, the stock has delivered a 24% return, outperforming the S&P 500 by 14% over the past three months. META’s advertising revenue growth in 3Q is primarily driven by price increases, offsetting a slowdown in ad impressions growth, which reflects strong advertiser demand. The company’s 4Q guidance suggests that a gradual growth normalization process is ongoing, without indicating a sharp slowdown.

Despite substantial infrastructure expenses expected in FY2025, driven by capital investment depreciation and other operating costs, I do not anticipate a significant impact on its operating cash flow, though earnings may be affected. While the stock is trading at valuation multiples above its historical average, this premium could be justified by its above-trend growth momentum. I believe a 25x P/E ratio is reasonable and thus reiterate my buy rating on META.

Advertising Revenue Growth Driven by Price Increases

The company model

Before we dive into META’s revenue performance, I want to highlight META’s two key revenue drivers: customer engagement and monetization of that engagement. A focus on customer engagement may limit immediate monetization in a near-term, while prioritizing monetization efforts could risk dampening user engagement, and vice versa.

META’s 3Q FY2024 advertising revenue growth continues to normalize after peaking at 26.8% YoY in 1Q FY2024, largely driven by sequential growth acceleration on average price per ad. We observed that its ad impression growth has significantly slowed, and the growth was primarily contributed from Asia Pacific and Rest of World segments. Resilient advertising revenue helped the company exceed the upper bound of its revenue guidance, growing 18.9% YoY.

During the 3Q FY2024 earnings call, management highlighted that Meta AI and other GenAI tools are driving higher YoY daily usage across its platforms, with improvements in AI algorithms and predictive systems enhancing content recommendations. The company is now incorporating cross-surface data to train its large language models, enabling them to learn user preferences from one app and recommend relevant content across other apps.

In addition, the company is also focused on expanding ad supply in video format, which has lower monetizing surfaces, and improving marketing performance by tracking audience reactions to video ads. The management noted that they have seen 2%-4% increase in conversions.

Resilient Growth and Margin in 4Q FY2024

The company model

META has guided 4Q FY2024 revenue to a range of $45 to $48 billion, with the midpoint beating the consensus of $46.2 billion. Based on recent performance, I believe META can top the high end of this guidance, implying a sequential acceleration in YoY growth to 44% in 4Q, up from 42.7% in 3Q. Additionally, the company has lowered the high end of its FY2024 “total costs and expenses” by $1 billion, now expected to range from $96 to $98 billion. Assuming the midpoint of this cost guidance, we estimate 4Q FY2024 GAAP operating income at approximately $21.1 billion, translating to a GAAP operating margin of around 44%. This indicates a sequential expansion from 42.7% in 3Q. Despite the growth normalization stage, it’s encouraging to see both growth rebounding and margin expansion expected in the upcoming quarter, which should support EPS growth.

Elevated Capex on Infrastructure Will Persist into FY2025

The company model

As discussed in my last analysis, META has been raising its capex outlook to boost user engagement by expanding its AI infrastructure and enhancing computing capabilities, which could also reduce advertisers’ cost per conversion. Starting in 4Q FY2024, we can expect a big jump on “capex as a percentage of revenue”. The company has slightly raised the lower bound of its FY2024 capex guidance to a range of $38 billion to $40 billion. Based on a midpoint of $39 billion, this implies 4Q capex growth of 120% YoY, reaching approximately 34.8% of total revenue. This is a substantial increase from 20.3% in the prior quarter.

Management has signaled “significant capital expenditure growth in 2025,” suggesting a potential acceleration from FY2024 levels. Capex as a percentage of revenue is anticipated to rise by 400 bps YoY to 24.2% in FY2024. I estimate it could exceed 28% of total revenue in FY2025, even though the company has yet to provide FY2025 revenue guidance.

Furthermore, they have noted that FY2025 will see “a significant acceleration in infrastructure expense growth,” driven by increased capital depreciation and rising operating expenses. These higher operating expenses will pressure META’s operating margin, and, combined with higher depreciation and amortization (D&A), are likely to significantly impact earnings growth in FY2025. My consensus is that META’s EPS growth will be lower than its revenue growth next year. However, since D&A is a non-cash expense, it will not affect cash flow. Therefore, I expect that META will face more pressure on earnings than on operating cash flow in FY2025.

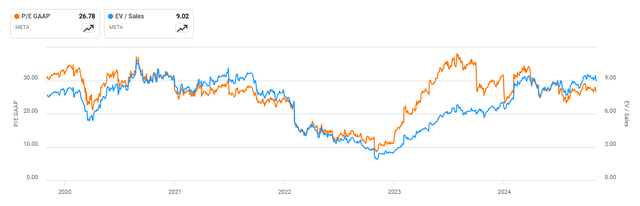

Valuation

META’s P/E multiple currently appears more attractive than its EV/sales multiple. On a TTM basis, META’s GAAP P/E is close to its 5-year average, while its EV/sales multiple is slightly elevated. This difference largely reflects strong earnings growth driven by significant margin expansion over the past 12 months. On a non-GAAP forward basis, META’s P/E is trading at 25x, above Google’s (GOOGL) 21x. This premium is supported by META’s above-trend revenue growth and higher margin expansion compared to GOOGL, resulting in stronger anticipated EPS growth (META expects 51.4% vs. GOOGL’s 37.8% in FY2024), justifying the higher multiple for META. Additionally, META’s forward P/E is slightly higher than the S&P 500 index’s 24x, suggesting that its valuation is not excessively stretched. I do not currently see a significant global slowdown in advertising business in the near-term. Particularly, U.S consumer spending remains resilient. This reinforces my bullish view on META. I believe the elevated capex will support META’s long-term growth outlook beyond FY2025.

Conclusion

META is poised for a slight rebound in revenue growth and an expansion in operating margin in 4Q FY2024, despite ongoing normalization. To counter the growth slowdown in ad impressions and boost engagement across Family of Apps, the company plans a significant boost in capex for FY2025. While concerns about rising costs and capital depreciation may pressure earnings next year, the resilient consumer spending environment and steady advertising revenue support my cautiously bullish outlook. Therefore, I maintain a buy rating on META, confident that its elevated capex will eventually enhance growth beyond FY2025 and sustain its competitive edge in the advertising market.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.