Summary:

- McDonald’s long-term thesis remains intact: focusing on value products and continuing with its restaurant expansion plan.

- The results have been somewhat mixed, but the actions taken by management are the right ones for the long term. Additionally, many of its competitors are facing the same challenges.

- The consequences of potential fines related to the E. coli outbreak remain to be seen, but they do not jeopardize the thesis, and there are several reasons that differentiate this.

Klaas Jan Schraa

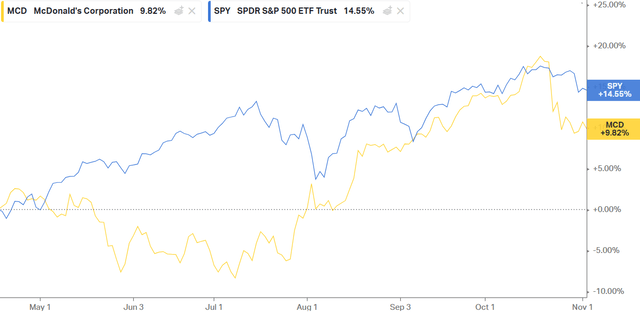

It’s been nearly eight months since I last wrote about McDonald’s Corporation (NYSE:MCD). A lot has happened since then; in fact, the stock’s behavior has been quite erratic, driven by a mix of good decisions and simultaneous negative events that have shaken the company over these months. Despite achieving a return of nearly 10%, the golden arches company has underperformed compared to the index. In any case, I still consider it a company that is better than the average within that index. In this article, I will analyze everything that has happened during this period.

Thesis Review

Before discussing the Q3 earnings, let’s briefly review McDonald’s underlying thesis.

– Owning 80% of the real estate for its locations and 57% of the land allows McDonald’s to use these assets as collateral for debt, enabling them to continue acquiring premium locations in cities. Thanks to their franchise model, this expansion happens more quickly, and franchisees pay them rent and royalties.

– The company plans to have 50,000 restaurants by 2027. As we know, franchised restaurants have significantly higher margins than those operated directly by the company (84% operating margin versus 16% for company-operated locations). Therefore, depending on how many of these types of restaurants they open, the company’s overall operating margins will either increase or decrease.

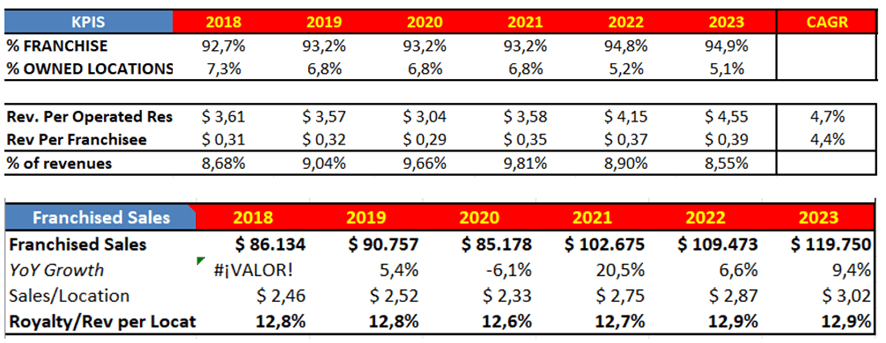

– McDonald’s has barely increased pressure on its franchisees in recent years. This shows a degree of robustness on the company’s part (pricing power over franchisees still remains untapped). This can be observed in the table under Royalty/Revenue per location, where the percentage has remained stable between 12.7% and 12.9% over the past few years.

Source: Author’s Representation

I explain all this in more detail in the article I included in the introduction.

Q3 Earnings

McDonald’s Q3 results have been mixed.

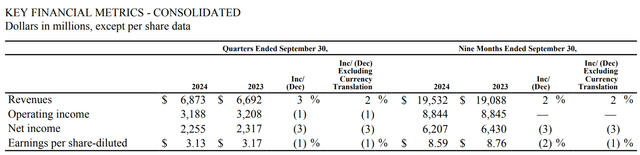

Source: Q3 24 Earnings Release

If we look at sales growth, it has been 3%. Several factors explain this: As I mentioned in the previous article, McDonald’s needs to refocus on being the best value proposition. Let me explain this a bit.

Not long ago, McDonald’s announced that it would be bringing back the iconic McRib to the menu. McDonald’s has always been characterized as one of the best fast-food alternatives in terms of value for money. The direction the company was taking in recent years didn’t make much sense to me (this was confirmed in one of their recent conferences), as they were focusing on introducing more “premium” burgers at higher price points. I don’t believe this is the right strategy for McDonald’s. Perhaps you can have 1-2 premium items on the menu, but the core offerings must stay true to their roots.

It doesn’t make much sense to me for McDonald’s to start charging almost €15 for a burger, mainly because that doesn’t align with its brand image. McDonald’s is associated with being fast and offering acceptable quality at the price paid, which, in my opinion, should be around €10 or less.

In a conference, they confirmed this line of thinking, stating that they would refocus on “value” products to attract customers who used to be regulars but are being affected by the macroeconomic situation. McDonald’s needs to operate on volume, positioning itself as the flagship choice in the fast-food world. Promotions and products like the McRib and cheaper menu items will facilitate this. It’s essential to ensure the survival of franchisees, who represent the bulk of profits for McDonald’s (almost 90%, in fact).

McDonald’s has been executing this “value” approach with the “$5 Meal Deal” in the U.S., the “3 for 3 GBP,” and the Happy Meal at €4 in France. However, they haven’t neglected the launch of premium products, such as the Chicken Big Mac and the Collector’s Edition campaign, which increased the average transaction value. They have also introduced new, slightly more expensive products that are larger, addressing a criticism of the company, like the Big Arch in markets such as Portugal, Germany, and Canada. Additionally, they have carried out successful marketing campaigns, like the Collector’s Edition, attracting new customers with a higher average ticket. On the other hand, the app and the loyalty program continue to improve. We already saw that they partnered with Google Cloud for this.

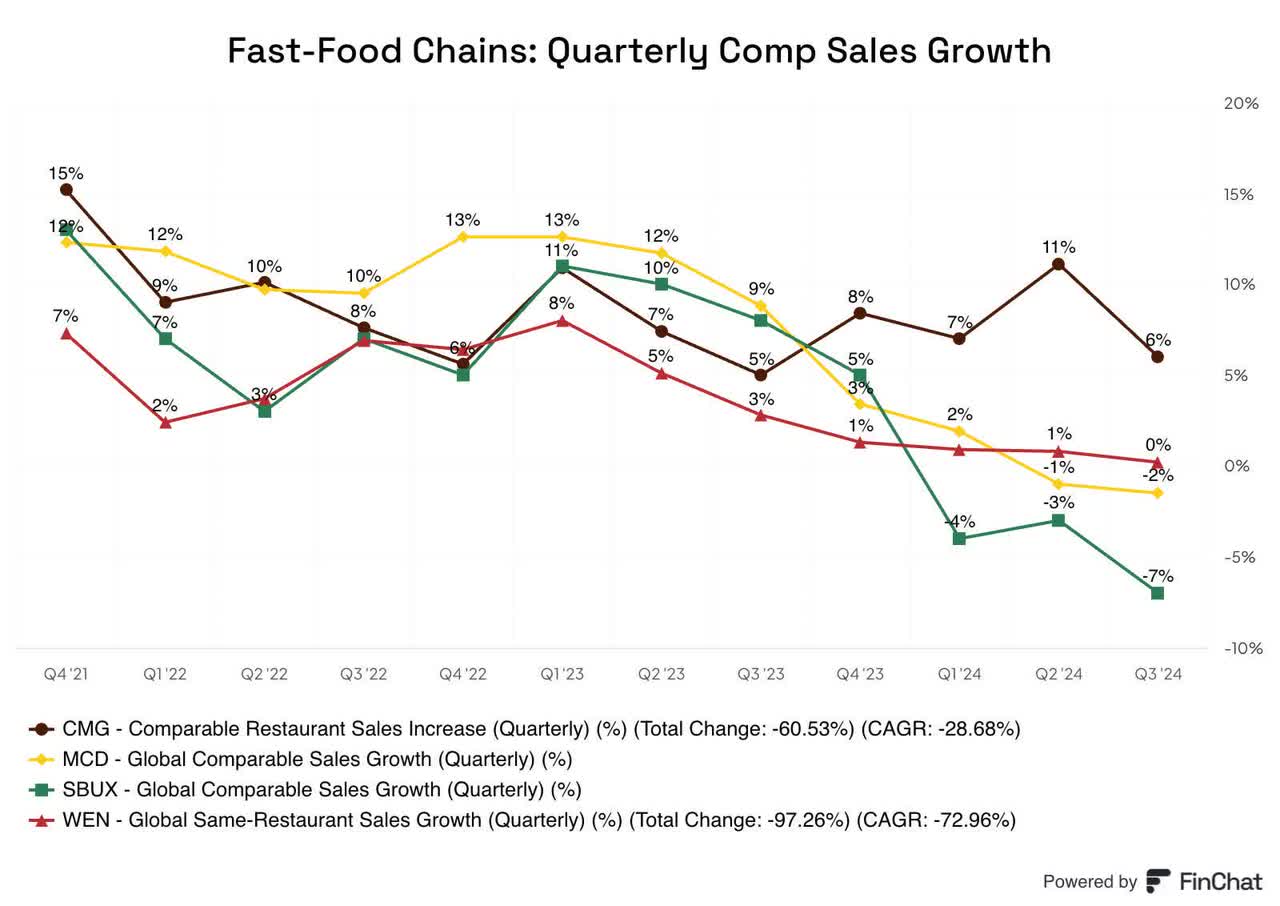

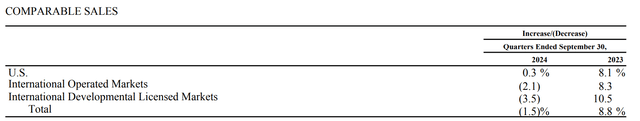

Despite this positive sales growth from all these efforts, comparable sales suffered across all geographies. Although the comparable figures from the same quarter last year were quite challenging.

Source: Q3 24 Earnings Release

In any case, this is something that has affected many diverse companies in the restaurant sector. If we look at McDonald’s Q4 from last year, we can already see a slowdown in this figure, and the comparable should be easier, potentially allowing for a return to positive comparable store sales if the efforts and decisions remain appropriate.

Other data shows that the results are not as bad as indicated by the GAAP results.

“Consolidated operating income decreased 1% (1% in constant currencies). Results included $52 million of pre-tax transaction costs and non-cash impairment charges and $46 million of pre-tax restructuring charges associated with Accelerating the Organization. Excluding these current year charges, as well as prior year pre-tax charges of $26 million, consolidated operating income increased 2% (1% in constant currencies).” Q3 24 Earnings Release.

As usual, it’s best to focus on cash flow, which is the earnings figure that is the least subject to accounting distortions. Although for some reason, McDonald’s tends not to report it in its quarterly reports, so we won’t be able to see the conversion of EBIT to OCF.

The company will maintain its guidance, along with a comment that I really liked, as it encapsulates well the commitment to long-term management while also being mindful of unnecessary cost savings.

“And as you saw, we expect to be able to continue to deliver against our guidance this year. We’re doing that obviously because we’ve got some relief on kind of the incentive-based part of G&A, but we’re also being very disciplined in our current year spending in areas like travel, meetings, professional services, all the things that you would expect us to be doing in the current context while continuing to invest, obviously, in our enterprise transformation efforts and the strategic growth opportunities that we have in areas like digital and technology, which we know are critical to ensure we have a strong growth pipeline as we look forward.” Ian Borden, CFO.

On the other hand, in order to continue returning money to shareholders, the company is having to incur debt to do so. In fact, interest expenses are expected to grow by 11% this year, according to management. This will clearly compress margins somewhat.

E. Coli Problems

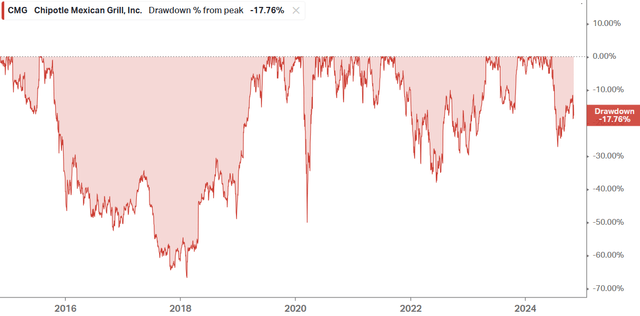

Just two weeks ago, news broke that caused the stock price to drop by 10% in after-hours trading, reporting that up to 75 people in 13 states (22 of whom were hospitalized and one death) had been infected by an E. coli outbreak linked to onions in McDonald’s Quarter Pounders. The reaction was swift, although I believe it was less severe than many expected. If you remember, Chipotle Mexican Grill (CMG) faced similar issues in 2016 and 2018, but I think the situations were quite different.

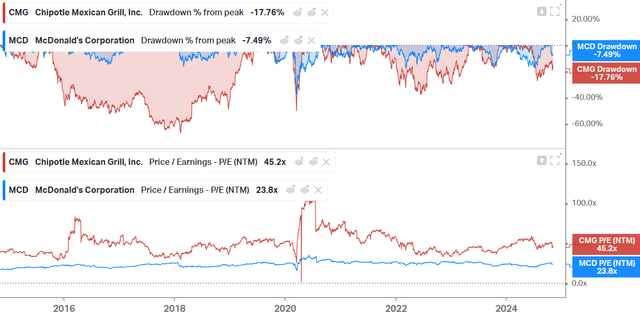

Firstly, Chipotle’s main value proposition is to offer fresh products at a good price. That’s why it’s not surprising that an E. coli outbreak might be more common in that company; therefore, the fears were better founded and would directly undermine this value proposition. This is why the declines were so significant compared to the 10% drop that McDonald’s has experienced from its highs. However, it should also be noted that this happened just two weeks ago, and it is still too early to declare victory.

Another aspect that lessens the severity of the issue is that the problem occurred with the “Quarter Pounder” product. If it had happened with the Big Mac, I believe the problem would have been much greater. For those who may not know, the Big Mac, McNuggets, and fries account for 65% of product sales in stores.

Another different point between the two situations is the valuation. Before the significant drops in 2016, Chipotle was trading at over 40x. Currently, McDonald’s is around 23x. Given McDonald’s quality and the fact that it rarely drops more than 15% from its highs, I find it to be a much more robust company, and investors hold it in higher regard than Chipotle back then.

Does this mean that McDonald’s cannot fall? Not at all, but I believe that if this happens, rather than representing a risk, it will be a great opportunity for long-term investors in the company. Chipotle has multiplied by ten times since its fall.

Conclusion

For me, the company’s valuation doesn’t change much from my first article. Once the potential fine is known, it will be necessary to model it. There are no new risks, although the risk of food contamination is something I didn’t mention in my previous article because I assumed it; it’s always a risk for this type of business.

In conclusion, McDonald’s has had a tumultuous few months, but I believe the measures and steps being taken by management are headed in the right direction. This reassures me while also keeping me alert for potential opportunities that may emerge as more is learned about the possible fines against the company.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MCD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.