Summary:

- Microsoft’s stock has depreciated since its summer highs and is currently underperforming against its Big Tech peers, YTD.

- The potential worsening of the macro environment along with the mixed guidance for the cloud business make us question Microsoft’s current valuation.

- Microsoft’s stock is a SELL for us.

hapabapa/iStock Editorial via Getty Images

Microsoft (NASDAQ:MSFT) for us is a wonderful business that trades at an expensive price and is not worth investing in right now. Although the generative AI revolution is expected to continue to boost sales and earnings, the stock itself has risen to levels at which it’s questionable to justify a long position. The slowdown of the cloud business and the rising macro risks are also creating a scenario where Microsoft’s shares might pull back to even lower prices as investors look for safer assets with a better valuation.

AI Dominates The Narrative

Let’s start with the good stuff first. Microsoft showed a good performance in recent quarters and its overall revenues in Q1 were up at a double-digit rate Y/Y. One of the biggest drivers of growth in recent quarters was the company’s generative AI tool Copilot, which has been integrated inside various personal and enterprise products within Microsoft’s ecosystem. The reveal and the subsequent launch of the paid version of Copilot last year have also made it possible for Microsoft’s shares to reach all-time high levels this summer.

Nearly a year after its reveal, Copilot continues to help Microsoft show an impressive performance to this day. In the latest earnings call for Q1, the management even stated that Copilot’s MAUs across its CRM and ERP portfolio increased 60% Q/Q. Thanks to the tool’s ability to transform workflows for workers within different industries, Microsoft will likely be able to increase its customer count in the coming quarters.

Also, the adoption of different generative AI tools and platforms is on the rise and the expected rise in global IT spending is about to reach record levels this year partially due to AI. Thanks to this, Microsoft will likely be able to meet the consensus and grow its revenues and earnings above 10% in the coming years.

Major Challenges Ahead

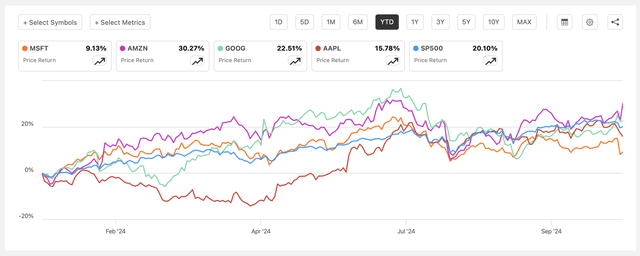

Despite hopping early on the generative AI train and benefiting from the release of Copilot in recent quarters, Microsoft’s stock nevertheless underperformed against its Big Tech peers since the start of 2024.

Microsoft’s stock performance against peers (Seeking Alpha)

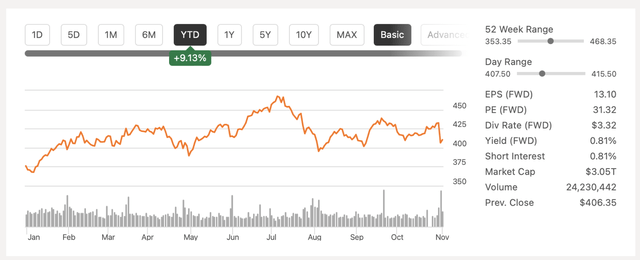

After reaching its all-time high price in late July, Microsoft’s stock has briefly fallen to below $400 per share levels and currently trades around $410 per share levels. The massive depreciation of shares that occurred in August shows that despite all the growth opportunities, Microsoft’s overall growth story has its flaws.

Microsoft’s YTD stock performance (Seeking Alpha)

Despite the growth of Copilot, the mixed Q2 outlook for Azure made Microsoft’s stock tumble in the recent week. While the company’s cloud business will likely continue to perform well in the coming quarters, the question at this stage is whether the expected growth rate justifies Microsoft’s’ current valuation.

Currently, Microsoft trades at 32 times its forward earnings and 11 times its forward sales. For comparison, the sector’s median forward earnings multiple is 24x, while its forward sales multiple is only 3x.

At the same time, the size of the generative AI market in 2024 is expected to be $137 billion, while the size of the global software market this year is forecasted to be $736.96 billion. Since Microsoft currently trades at a market cap of over $3 trillion, which is several times higher than the expected combined size of the generative AI and software markets in 2024, it’s hard to justify a long position in the company, especially when the recent guidance has been mixed.

There are also questions about the future performance of Microsoft’s cloud business. Some Wall Street analysts now believe that the company’s lead in the cloud business is diminished, as competitors are adding as much business as Azure. There are also reports, that state that Microsoft’s backed OpenAI is expected to incur $44 billion in losses from 2023 until 2028 before becoming profitable in 2029. With Microsoft expecting to continue to expand its AI infrastructure this year, there’s a risk that it will take a while before those efforts pay off.

Finally, the macro environment has the potential to worsen and also undermine Microsoft’s growth prospects. The potential increase in the corporate tax rate in the United States from 21% to 28% could damage Microsoft’s ability to generate impressive profits in the future. In FY24, Microsoft paid $19.65 billion as an income tax expense on the $107.79 billion in earnings before taxes. This translates to an effective tax rate of 18.23%. The rise of the corporate tax rate will certainly harm Microsoft’s bottom-line performance.

In addition, the potential escalation of the Sino-American trade war could negatively affect the global economy and also have a direct impact on Microsoft’s performance over time.

As challenges mount, they will likely limit Microsoft’s upside. This makes us believe that it could be hard for Microsoft’s stock to once again appreciate to its all-time high levels, which were achieved this summer, anytime soon.

The Intrinsic Value of Microsoft

All of the issues and challenges described above make us question Microsoft’s current valuation. Below is our valuation model, which shows that the company is overvalued and opening a position at the current price is too risky.

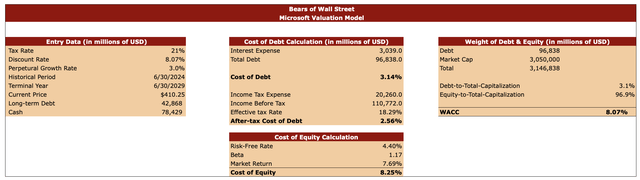

For the model, we used the tax rate of 21%, which is the corporate rate in the United States. We made this model when Microsoft was trading at $410.25 per share, and we forecast the company’s performance for the next five years. The long-term debt and cash data was taken from the recent earnings report, while the perpetual growth rate in our model is 3%, which is close to the GDP growth rate.

The discount rate in our model is 8.07%. We found the discount rate by figuring out what is Microsoft’s current after-tax cost of debt and cost of equity. To figure out the cost of debt, we used Microsoft’s data for the trailing twelve months. To figure out the cost of equity we used a risk-free rate of 4.4%, beta of 1.17, and the market return rate of 7.69%.

Microsoft’s valuation model (Bears of Wall Street)

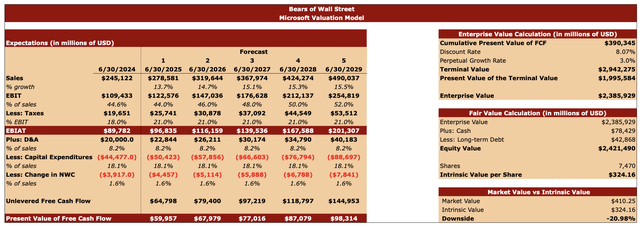

In our forecast, we expect Microsoft to continue to grow its sales and EBIT despite the major risks. This is mostly because we expect the business to retain the generative AI momentum and continue to capitalize on the ongoing generative AI revolution thanks to being one of the early adopters of AI tools and platforms. The consensus is currently similar to ours. All the other assumptions are similar to Microsoft’s historical performance.

By completing our forecast table, we were able to figure out Microsoft’s cumulative present value of FCF, terminal value, present value of the terminal value, and enterprise value. In our case, Microsoft’s enterprise value is $2.39 trillion. We were then able to figure out Microsoft’s equity value, which is $2.42 trillion, and divide it by the number of outstanding shares. This helped us find out Microsoft’s intrinsic value, which is $324.16 per share, below the current market price by roughly 20%.

Microsoft’s valuation model (Bears of Wall Street)

Final Thoughts

Microsoft is a great company, but its stock at the current price is not a great investment in our opinion. The company is overvalued, and its P/E and a number of other metrics are greater than the sector’s median, which is a bad signal for us in the current environment. Although the business is expected to continue to benefit from the generative AI revolution, various risks make Microsoft’s stock a SELL for us.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.