Summary:

- Norwegian Cruise Line Holdings (NYSE: NCLH) has seen a bigger price increase than anticipated since late September, when it was last covered, necessitating a reassessment of its prospects.

- In the meantime, the company released Q3 2024 results, which reflect double digit revenue and earnings growth. The company has also raised its earnings guidance once again.

- While a price rise is still expected, prompting a Buy rating, investors might do well to be realistic in the returns possible until at least 2025 earnings guidance comes in.

Michael H/DigitalVision via Getty Images

When I last wrote about cruise company Norwegian Cruise Line Holdings (NYSE:NCLH) in September, a 12% price upside was still visible for 2024 and bigger increases for the two years after. Since then, however, the stock is already up by 20%.

If there hadn’t been any developments for it since, this would appear to be a clear case to booking profits in the stock now. Except that there have been, including the company’s continued robust results for the third quarter (Q3 2024) and first nine months of the year (9m 2024). Here, I take a closer look at the latest update to assess what’s next for NCLH.

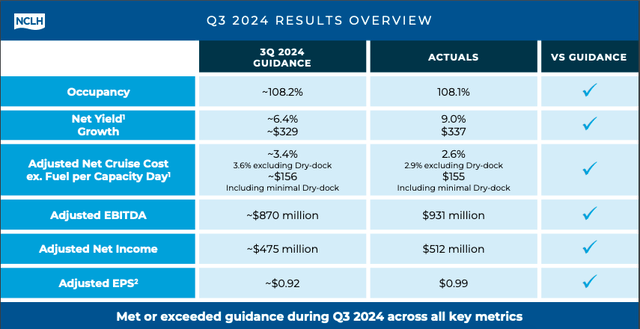

Robust Q3 2024 results

- Revenue growth picks up

The company continued to report positive numbers, with revenue growth at 12.3% year-on-year (YoY) for the first nine months of the year (9m 2024). This is down from the 13.3% YoY for the first six months (H1 2024), but at the same time, revenue growth at 11% YoY in Q3 2024 has encouragingly enough, accelerated from the 7.6% YoY increase seen during Q2 2024.

- Healthy EPS growth

Earnings turned out better than expected, much like in Q2 2024. The adjusted EBITDA came in 7% higher than projected and grew by 24% YoY. The adjusted earnings per share [EPS] coming in 7.6% higher than projections ion Q3 2024. They also increased by a very healthy 31% YoY.

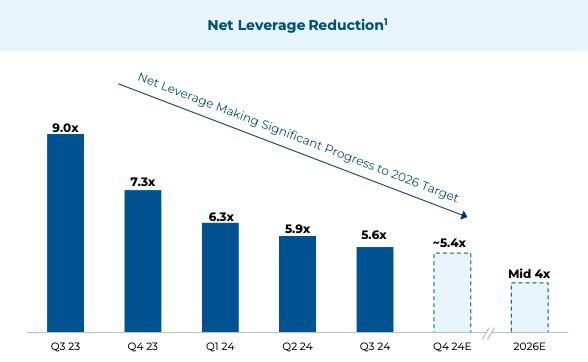

- Smaller cost increases and reduced leverage

Besides healthy revenue growth, the company’s costs have also been supportive in improved earnings. In Q3 2024, the cost of revenues grew by just 3.8% YoY, the slowest in the year. The operating expenses showed bigger growth of 8.8% YoY during the quarter, but this is because of a low base effect. The company saw a 5.7% YoY contraction in Q3 2023.

Importantly, the company continued to reduce its net leverage, which is measured as the ratio of net debt to adjusted EBITDA seen in the last trailing twelve months [TTM]. The latest figure is at 5.6x, down by 3.4x YoY. It’s expected to reduce further to 5.4x in Q4 2024.

Source: NCLH

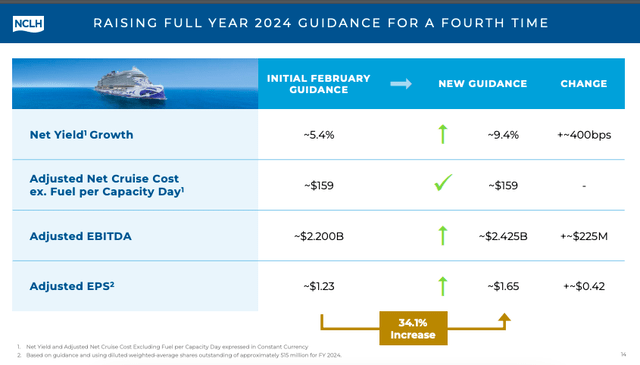

Upgraded guidance for 2024…

With the actual earnings coming in higher than anticipated, the company has raised its full year 2024 guidance for the fourth time this year. It expects adjusted EBITDA to be 10% higher than initially forecast, which will mean a 30.4% YoY increase.

The latest outlook also upgrades the adjusted EPS forecast by 7.8% from the previous guidance and a 34.1% increase from the initial guidance (see Slide 1 below). This translates into a 135.7% YoY EPS increase, up from 118% YoY expected the last time.

… but remains unchanged for the medium-term

However, the company’s medium term guidance, for up to 2026, remains unchanged, with the adjusted EPS expected to land at USD 2.45 in 2026. Going by the latest guidance upgrades, there’s a possibility that the medium term target figure will also be upgraded, but it’s also essential to consider the possibility that it might not be, as the cruises sector normalises from its accelerated post-pandemic growth.

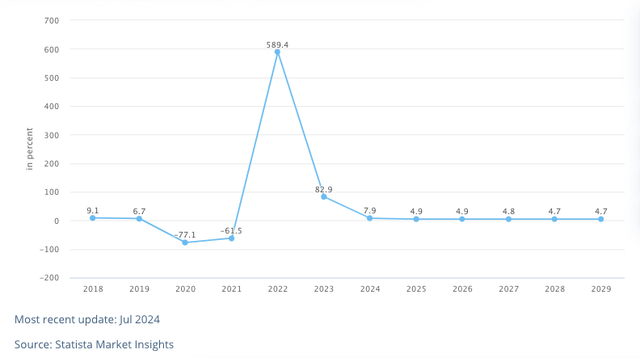

In 2022 and continuing into 2023, the sector saw massive revenue growth of 590% and 83% respectively. In fact, the spillover is expected to continue even this year, with a somewhat elevated increase in the sector’s revenues (see chart below). But between 2025 and 2029, the figure is seen slowing down to a lower CAGR of 4.8%. This could have implications for NCLH as well.

Cruise sector revenues, YoY, % (Source: Statista)

Still competitively priced

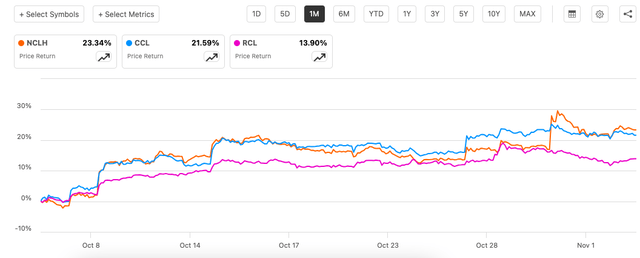

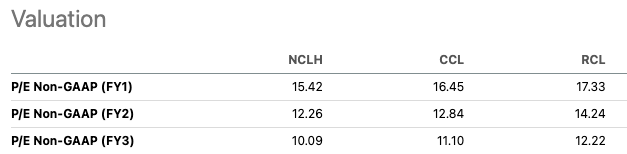

For now though, with the latest guidance, the stock’s forward non-GAAP price-to-earnings (P/E) ratio is at 15.3x. With the price rise in the interim though, the ratio is higher than the 13.7x level the last I checked. But here’s the catch. NCLH isn’t the only cruise stock to see a price rise in the past month. Its peers Carnival Corporation (CCL) and Royal Caribbean Cruises (RCL) have seen double digit increases too (see chart below).

Price Returns, 1m, NCLH, CCL, RCL (Source: Seeking Alpha) Source: Seeking Alpha

As a result, NCLH remains competitively placed (see table above) compared to the average forward P/E for its peers. Note that the forward P/E for 2024 as per analysts estimates is slightly higher than that indicated by the company’s guidance. For the sake of this analysis, however, it’s assumed that the adjusted EPS comes in as per guidance. Based on the average of peers’ ratios, this indicates that there’s still a 10% upside to the stock for this year.

Conversely, as per the company’s guidance for 2026, the forward P/E ratio for the year is at 10.3x compared to analysts’ estimate of 10.1x. This indicates a 13.1% increase in price by then.

What next?

The NCLH story has altered significantly in the past month. At that time, there was a “strong case” for a price rise, but with the rise seen since, the upside has subsided significantly despite upgrades to the company’s earnings outlook.

While it would be tempting to consider the past as an indication for future guidance upgrades, I’d be cautious. In recent years, the cruise industry has recovered from the pandemic, resulting in significantly improved numbers. As it normalises, the gains might not come in thick and fast.

For now however, there’s still some upside left to the stock and for that reason I’m maintaining a Buy rating. If it sees another 10% uptick in price before the release of its full year results in February 2025, this rating would flip into Hold, assuming all else remains unchanged.

If the company’s guidance for 2025 comes in better than anticipated, then there could further upside to NCLH. But we still have almost four months until then. So the actionable steps ahead would be to buy with realistic expectations of how much it can rise in the next months. Hold if it rises beyond 10% and wait for the next guidance.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—