Summary:

- Netflix stock has continued to rally after posting Q3 results, showcasing 15% y/y revenue growth.

- Still, we note that subscriber adds are slowing down, potentially a symptom of the company’s continued price increases.

- Europe in particular is slated for further price increases, and it has been a major contributor to recent net sub adds.

- Now trading at a >30x forward P/E, I believe strong expectations are already priced into Netflix stock and I’m recommending investors to lock in gains and move to the sidelines.

Nanci Santos

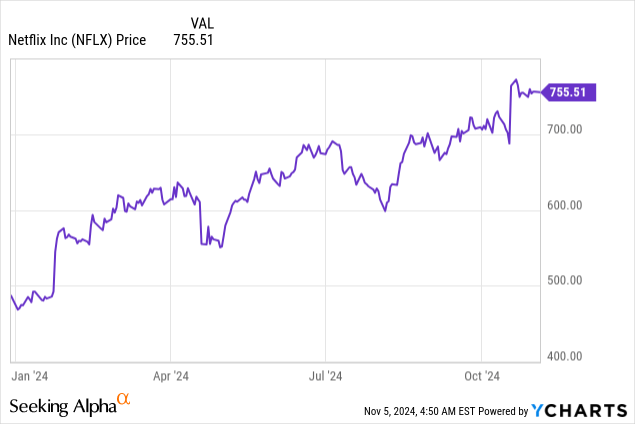

In the blink of an eye, 2024 has nearly passed: and with it, the S&P 500 has discreetly added 22% year to date and kept pushing new record highs. It was also a stock-picker’s market this year, and as has been the case over the past several years, large cap tech has been a winning pick: including and especially Netflix (NASDAQ:NFLX).

The global streaming leader has shaken off investors’ earlier fear of ceasing to provide subscriber numbers. The market honed in on its revenue acceleration, driven by price increases. Gains continued after the company’s well-received Q3 earnings print, sending shares up ~60% year to date.

I last wrote a bullish note on Netflix in August, when the stock was still trading near $650. Since then, I’ve enjoyed double-digit gains in my position, even though the outlook for this stock has remained very constant. In light of Netflix’s recent rally, I’m encouraging investors to take profits on this trade and am downgrading the stock to a neutral rating.

Robust guidance for 2025: but can the party keep going?

Alongside its Q3 results, Netflix put down on paper its first inkling of expectations for the coming year 2025. Broadly, the company is expecting 11-13% revenue growth, which is in line with current growth rates in the low teens. In its Q3 shareholder letter, management wrote as follows:

We’re pleased that we’ve reaccelerated our growth and, as we head into 2025, we expect to deliver solid revenue and profit growth by both improving our core series and film offering while investing in new growth initiatives like ads and gaming. For 2025, based on F/X rates as of 9/30/24, we forecast revenue of $43B-$44B, which would represent growth of 11%-13% off of our 2024 revenue guidance of $38.9B. We expect revenue growth to be driven by a healthy increase in paid memberships and ARM. We’re targeting a 2025 operating margin of 28% (also based on F/X rates as of 9/30) vs. our forecast for 27% in 2024; after delivering outsized margin improvement in 2024, we want to balance near term margin growth with investing appropriately in our business. We still see plenty of room to increase our margins over the long term.”

The core question here is: can Netflix keep this growth streak going? I see a number of risks that threaten to derail the company’s current rally:

- Price increases may slowly push subscribers off their plans. The company has gone through several rounds of price increases recently. Europe is a big worry of mine in particular: it has been a big source of subscriber growth recently, and the company just pushed across further price bumps in Spain (source of the globally popular Elite series, which just ended its run of eight seasons with an eye-popping 494 million cumulative views) and Italy. In the U.S. as well, the company has also ended its cheapest basic plan, which may also spur churn or downgrades to the ad-supported tier.

- Macro pressures. Many companies have echoed comments regarding a more cautious consumer spending environment. Especially amid waves of price increases, subscriptions like Netflix may be on the chopping block.

The company’s core strategy to keep users engaged has been to diversify its content. It refers to this plan as “planting seeds.” Per co-CEO Greg Peters’ remarks on the Q3 earnings call:

Our second set of priorities are about planting seeds, these investments and new initiatives that help us expand and strengthen our entertainment offering and that we believe will be incremental levers for growth in the coming years. We’ve got initiatives like games. We’re excited about games based on Netflix IPs. We got a Squid Game game coming. We’ve got a Virgin River Christmas. We’ve got The Ultimatum. We’ve got games based on storied game classics like Monument Valley 3 that’s coming out. We’re also expanding into live. We’ve got the Tyson-Paul fight NFL in December. We got 52 weeks of WWE coming in January. John Mulaney and more and more. And then we’re also growing advertising as the principal goal here is the more effective way to give members and members to be a lower-priced plan to access all of that great entertainment.”

But my concern is: are these one-off premium events enough to keep subscribers engaged? Is one fight and two NFL games enough to dazzle subscribers with newness when the past year has been impacted by a relative drought of new content stemming from Hollywood strikes? Even if the company keeps up this same pace of live-event attractions, will it be enough? In my view, Netflix’s plans to hit low-teens growth next year after an already-strong 2024 is far from certain.

Valuation checkup

Not only is Netflix’s fundamental path uncertain: but the stock is already pricing in success, making it an even riskier investment from a valuation perspective.

For next year FY25, Wall Street consensus is expecting Netflix to generate $43.73 billion in revenue (+12% y/y, in line with the company’s own guidance statement of 11-13% growth), and $23.76 in pro forma EPS (+20% y/y, a faster pace than revenue growth, also consistent with the company’s expectations of expanding operating margins by one point to 28% next year).

This puts Netflix at a 32x forward P/E ratio. While I won’t disagree that many other large-cap tech stocks with expected earnings growth in the high teens/low 20s trade at similarly bloated multiples, I find few reasons to stay invested in Netflix at such a stark premium versus the S&P 500 when I find that many of its current growth drivers may be transitory. Price increases may be working now, but a tighter consumer economy and a closer look at household expenses may unravel some of these gains.

Q3 download

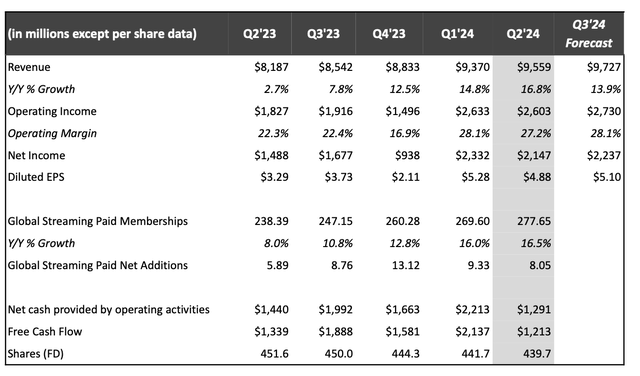

That being said, Netflix did deliver solid Q3 results, but there are some items to watch for. Take a look at the Q3 earnings summary below:

Netflix Q3 results (Netflix Q3 shareholder letter)

Revenue grew 15% y/y to $9.82 billion, ahead of Wall Street’s expectations of $9.76 billion (+14% y/y) by one point. We note that this quarter ends Netflix’s multi-quarter streak of growth acceleration that began in Q4 of last year, driven by price increases. We do acknowledge, however, that the fact that Netflix is guiding to 14.7% growth in Q4 is impressive, signaling no deceleration from Q3 despite lapping tougher comps.

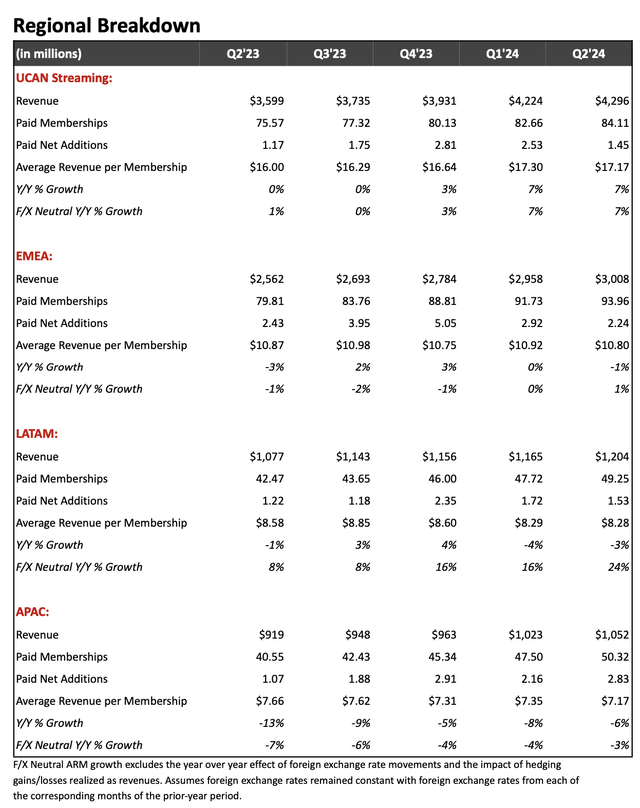

We should, however, be wary of slowing subscriber adds (and remind ourselves that this transparency will cease to exist in FY25). Take a look at the sub trends by market below:

Netflix subscriber trends by market (Netflix Q3 shareholder letter)

Though the company’s average in-period subscribers were 15% higher than last year (the core driver behind 15% revenue growth; average revenue per sub was flat as price increases were offset by mix), net-new adds in the quarter of 5.07 million were down -42% y/y. The company is expecting a sequential bump in Q4, but we note it’s facing a very tough comp in Q4 of last year as well.

Adds of just 0.69 million in the U.S. and Canada were particularly weak, down -61% y/y. The company has been buoyed by Europe, whose 2.17 million in net subscriber adds contributed just under half of the company total. Again, it’s prudent to be mindful of risk here, after the company’s recent slew of price increases. The slowdown in net U.S. adds may finally be an indication of consumer pushback against the sunsetting of the basic plan, price increases for Standard, and the crackdown on password sharing. The other major growth region is APAC with 2.28 million net adds, but here the average revenue per subscriber only clocked in at $7.31, less than half of a UCAN user – and also trending down y/y, even on a constant currency basis.

Profit growth, meanwhile, remains robust, with Netflix’s 29.6% operating margin expanding 720bps y/y (though the company attributed some of this to a favorable shift in expense timing). The company’s pro forma EPS of $5.40 also grew 45% y/y and best Street estimates of $5.13 with 5% upside.

Key takeaways

In my view, Netflix has already had a healthy run this year with ~60% year to date gains. With macroeconomic uncertainty and a rich valuation, I’m more keen to take profits off the table and adopt a “watch and wait” approach on the sidelines here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.