Summary:

- Nike’s Q1 FY25 earnings report showed a 10% revenue decline and a 26% drop in earnings, driven by lower unit sales and traffic declines.

- Despite ongoing headwinds, the management is optimistic about performance in the second half, focusing on newness and innovation in Performance Sports.

- I have upgraded Nike to a “hold” rating with a price target of $80, as comps should improve as long as it sticks to its long-term strategic plan of Performance Sports innovation and powerful storytelling.

Robert Way

Introduction & Investment Thesis

I last covered Nike (NYSE:NKE) in June, where I initiated a “sell” rating on the stock after the management projected for sales to decline in the mid-single digits in FY25 as the company refocuses their innovation efforts on Performance products while simultaneously optimizing its product portfolio and reigniting its brand momentum. In the post, I had claimed that given the set of headwinds, the stock’s valuation multiple seemed extended, and since then, the stock has climbed less than 3%, underperforming the S&P 500.

The company reported its Q1 FY25 earnings in early October, where revenue and earnings declined 10% and 26% YoY, respectively, from lower unit sales across Nike Direct and Nike Wholesale across product categories and geographies. With Elliott Hill transitioning to the role of CEO last month after being at the company for 32 years, the management has withdrawn its FY25 guidance under the leadership of its previous CEO, John Donahoe.

While the management expects continued headwinds from its portfolio optimization process, they are slightly more optimistic about performance in the second half of the fiscal year, with its newer and more innovative Performance Sports contributing a higher share to Total Revenue.

Over the last three months, Nike has faced a slew of downward revisions to revenue and earnings expectations for FY25 and beyond as there has been growing uncertainty about its growth trajectory, along with macroeconomic and competitive headwinds.

However, I believe that if Nike sticks to its long-term plan of driving superior innovation in Performance sports while making strategic investments in re-building its brand narrative to resonate with its audience across geographies along with forming partnerships to expand retail presence, it should face easier comps moving forward, which could help stabilize the stock.

While the new management has a massive task ahead in turning the fate of the company around, I believe that the downside risk has minimized since my previous write-up. As a result, after assessing both the “good” and the “bad”, I have decided to upgrade the stock to a “hold” rating with a price target of $80.

The bad: Weakness across Direct, Wholesale, and Geographies with softness in traffic and portfolio optimization; FY25 guidance withdrawn.

Nike reported its Q1 FY25 earnings, where it saw its revenues decline 10% YoY to $11.6B, missing analyst estimates, driven by lower unit sales as traffic declines across Nike Direct were more significant than anticipated, along with weakness in their Wholesale partners requiring higher levels of promotional activity to drive conversion. Meanwhile, the company reported diluted earnings per share of $0.70, which declined 26% on a year-over-year basis. Although Nike reduced its overall SG&A expenses by 2%, driven by lower wage-related expenses, it was not sufficient enough to hold its profit margins steady given the magnitude of the revenue decline.

When it comes to Nike Direct, it saw its revenues decline 13% YoY to $4.7B. This was driven particularly by softness in traffic on Nike Digital that fell 20% on a YoY basis, while partner stores in Greater China continued to struggle as well. Plus, as Nike continued to take action to shift their product portfolio to create better balance in their business, they intentionally reduced the proportion of their business driven by Footwear franchises, such as Air Force 1, Air Jordan 1, and Dunk. As a result, Nike revenue from these franchises decelerated in Q1 as they tightened marketplace supply. Moving forward, the management outlined that they expect to see declines throughout FY25 for men’s and women’s lifestyle businesses as well as the Jordan brand, which were planned down double digits in Q1.

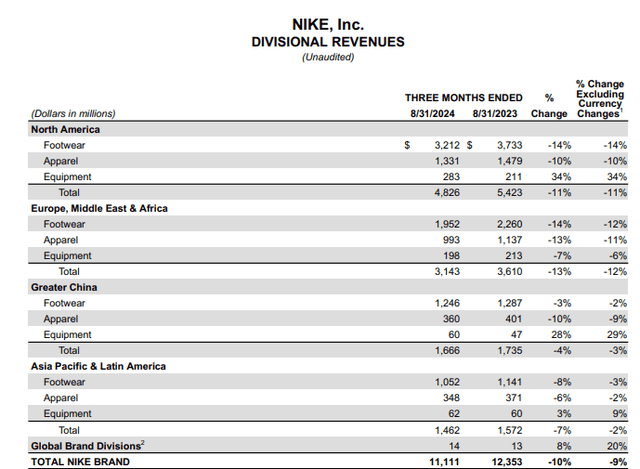

Meanwhile, the company also saw weakness across all its geographic segments across the Footwear and Apparel categories, as can be seen below. Particularly, when it comes to its Chinese market, Nike saw elevated inventory levels in the marketplace from retail weakness, leading to higher than expected promotional activity. This could be attributed to the competitive landscape, where there are emerging competitors that are growing at a faster rate than Nike, particularly Deckers Outdoors (DECK), that is expected to grow in low to mid-teens over the next few years compared to low to mid-single digit growth projections for Nike.

Q1 FY25 Earnings Report: Revenue breakdown by product categories and geography

Furthermore, as Elliott Hill joined as the new President and CEO, starting last month, the company has withdrawn its previous guidance. As opposed to its previous guidance, where it expected revenue to decline in the mid-single digits for the full year FY25, the management provided non-specific commentary where it now expects a slight second-half improvement in revenue trends compared to their first half as they introduce and scale newness and innovation across the marketplace. Specifically for Q2, Nike now expects revenues to decline in the 8-10% range, which could indicate some degree of bottoming, while gross margins are expected to decline 150 basis points from higher promotions, channel mix headwinds, and supply chain deleverage, along with flat year-over-year SG&A expenses.

It should be noted that it is not uncommon for new management to scrap old guidance and start with a clean slate, especially given his 32-year track record with Nike in leading global teams and delivering growth. However, given the slew of downward revisions to revenue and earnings over the three months, investor sentiment will likely remain dampened for quite some time.

The good: Newness and Innovation driving pockets of strength in Performance

In my previous post, I had discussed the company’s strategic priority to reposition in Performance sport with a superior focus on innovation. During the earnings call, the management further noted that they are seeing clear indications of progress in accelerating newness and innovation, with revenue from new footwear products up strong double digits compared to the previous year. For example, in the performance franchise, Sabrina has grown 5x, Kobe has quadrupled, and Alphafly has almost tripled, while the company’s two largest performance franchises, Mercurial and Global Football, and the G.T. Series in basketball also grew double-digits across all channels.

Plus, the management also elaborated further, saying that they are seeing growth in multiple sport dimensions, led by men’s fitness, men’s global football, and men’s and women’s running footwear. Particularly, they are encouraged by the momentum building in their Running category, with men’s and women’s running footwear delivering positive growth in Q1, with North America up double digits this quarter, with strong order books indicating growing consumer engagement and brand momentum as they launch Pegasus 41, which will be accompanied by Peg Trail, Peg Plus, and Peg Premium as they scale the franchise in the coming seasons.

As the management expects newness and innovation to take a significant step forward in their total footwear mix, helping the segment to grow sequentially and on a year-over-year basis, it is also investing across marketing and partners to display bolder storytelling that resonates with its audience and expand its footprint with partnerships with companies such as DICK’S Sporting Goods (DKS), Foot Locker (FL), and more.

Revisiting my valuation: Downside is limited

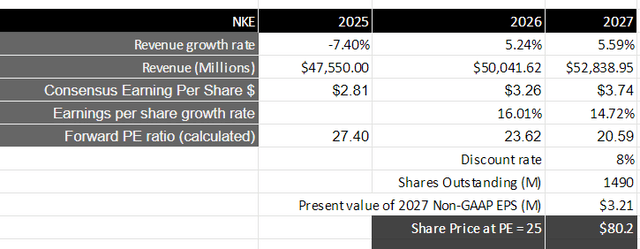

Taking the current consensus analyst estimates into consideration, Nike is expected to see its revenues decline over 7% in FY25, which is more or less in alignment with the management’s commentary on expecting to see a slight recovery in the second half of the fiscal year, as they see a higher contribution from newer and innovative products driving growth across channels and geographies, while headwinds from their ongoing portfolio optimization will minimize. Assuming Nike is able to start growing in the mid-single digits starting next year, as the new management doubles down on Performance sports, it should see a total revenue of approximately $52.8B by FY27.

From a profitability standpoint, taking the consensus estimates for non-GAAP EPS of $2.74 in FY27, we can see that it will be growing more than double the rate of revenue growth, which, I believe, will be made possible by a combination of the management’s investments in demand creation and product innovation yielding results in the form of higher ASPs (Average Selling Prices) and units sold across channels and geographies, leading to higher operating leverage and expanding profitability. This will be equivalent to a present value of $3.21 in non-GAAP EPS when discounted at 8%.

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period, with a price-to-earnings ratio of 15-18, I believe that Nike should be trading at 1.5 times the multiple given the growth rate of its earnings during this period of time. This will translate to a PE ratio of 25 or a price target of $80, which is roughly 2% higher than where the stock is currently trading at.

Author’s Valuation Model

My final verdict and conclusions

There is no doubt that Nike is yet to get its footing back.

With John Donahue retiring and Elliott Hill transitioning to the CEO position, there is a lot of uncertainty with the company’s growth trajectory ahead.

Although the Q1 FY25 earnings report was not encouraging at a high level, I believe that there are some early signs of hope arising when it comes to the newness and innovation in Performance sports, where certain sports categories and franchises are significantly outperforming.

While the outperformance from pockets in Performance Sports is not enough to offset the weakness from unit sales and portfolio optimization in the short run, amid a backdrop of macroeconomic uncertainty and growing competitive threats, I believe the company will should easier comps moving forward, especially if it sticks to its long-term plan of doubling down on innovation in Performance Sports while investing in powerful brand narratives and strategic partnerships to expand retail presence.

Assessing both the “good” and the “bad,” I believe that while the new CEO has a massive task ahead to turn the fate of the company around, the downside risk of the stock may have minimized since my previous “sell” rating. As a result, I will upgrade the stock to a “hold” rating with a price target of $80.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I am Amrita and I write primarily about growth software stocks.

I recently joined The REIT Forum and if you are looking for more investment ideas like this one, get them exclusively at The REIT Forum with access to our subscriber only portfolios.