Summary:

- Palantir’s stock has surged by 700% since its 2022 low, prompting a shift from a strong buy to a buy rating, preferably on pullbacks.

- Despite stellar earnings and strong U.S. commercial growth, Palantir’s valuation is now high, making it less of an obvious strong buy.

- I reduced my Palantir stake by 50% but remain bullish long-term, planning to buy more on future pullbacks or corrections.

- Palantir’s future growth hinges on maintaining its AI leadership and exceeding sales and EPS estimates, despite risks from its high valuation and macroeconomic factors.

Michael Vi

I’ve been bullish on Palantir (NYSE:PLTR), making it my most significant portfolio holding when it was still in the single digits. I recognized that Palantir was a unique company that provided a valuable service to government and commercial entities globally, with enormous potential market share gains ahead. Also, in addition to its unique product and service offering, Palantir’s valuation was very cheap. In late 2022/early 2023, it became evident that the stock would likely get repriced higher soon.

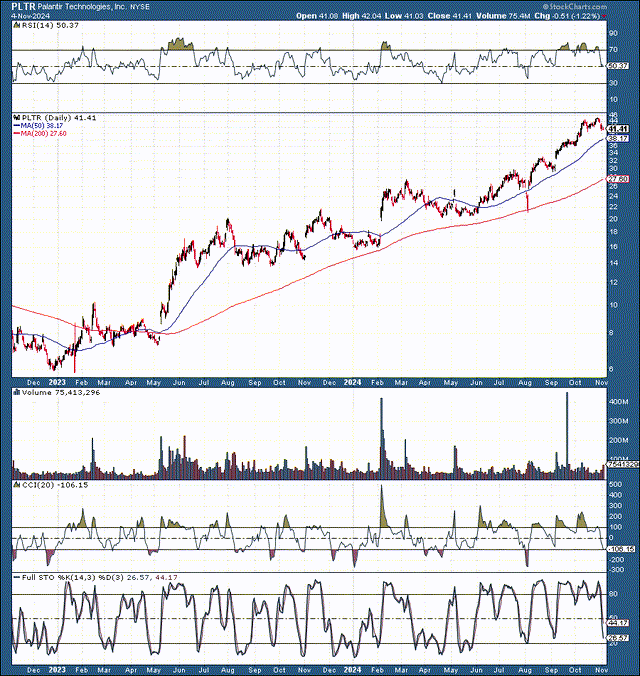

Palantir 2-Year Chart

PLTR (StockCharts.com | Advanced Financial Charts & Technical Analysis Tools)

The last time I wrote about Palantir, we discussed adding more shares as the stock underwent a significant correction during the July/August “flash crash.” While Palantir’s stock cratered by around 33%, the rebound was highly robust, and Palantir has now appreciated by over 100% since its summer bottom was achieved.

Considering the pre-market gains this morning (November 5th), Palantir is around $47, illustrating about a 700% gain since its approximate $6 bottom in 2022. The sharper-than-expected price appreciation has caused me to drop my strong buy Palantir rating in favor of a buy, preferably on a considerable pullback.

Palantir pulled back before its recent earnings, providing a solid opportunity to purchase more shares before the most recent pop. This dynamic also enables Palantir’s stock to continue appreciating without becoming considerably overbought from a technical perspective. Nonetheless, Palantir is a $100+ billion company now, and a logical question is whether it’s worth the hefty valuation and what could come next.

I would refrain from chasing the stock at around $50 here. Conversely, if the stock pulls back in future weeks, I will consider increasing Palantir for the intermediate and long-term in the $40-35 range.

Were Earnings Really That Good?

First, I believe the “easy money” has been made in Palantir. After appreciating by about 8x and reaching a valuation of around 30 times sales, the stock is not cheap anymore, and it’s no longer such an apparent strong buy. Still, earnings were excellent, so let’s dissect the results.

Also, I should disclose that I’ve recently reduced my Palantir stake. It is no longer my most significant position, and I may trim more, intending to repurchase shares at lower levels.

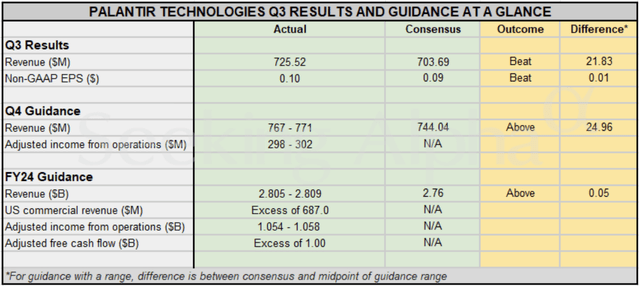

Palantir delivered $725M in revenues and 10 cents in non-GAAP EPS. The results were better than expected, as sales surpassed the consensus estimate by about $22M, and EPS outperformed by one cent.

Earning results (Stock Market Analysis & Tools for Investors)

More importantly, Palantir announced better-than-anticipated guidance, roughly $25M above the consensus $744M estimate. 2024 FY sales estimates were also increased to about $2.81B, approximately $50 million higher than the consensus estimate.

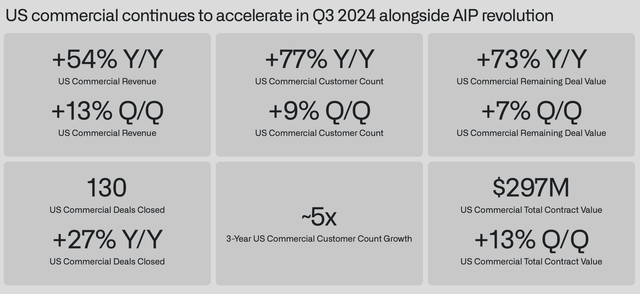

U.S. Commercial Segment Continues to Shine

U.S. commercial segment (Stock Market Analysis & Tools for Investors)

Palantir put up more excellent numbers, especially regarding its accelerating commercial U.S. segment. U.S. commercial revenues surged by 54% YoY and 13% QoQ. U.S. commercial customer count grew by 77% YoY and 9% QoQ. U.S. commercial customer value increased to $297M, 13% QoQ.

This stellar growth dynamic illustrates the extraordinary commercial demand for Palantir’s AIP. Here’s what Palantir’s CEO and co-founder Alex Karp said about the results:

We absolutely eviscerated this quarter, driven by unrelenting AI demand that won’t slow down. This is a U.S.-driven AI revolution that has taken full hold. The world will be divided between AI haves and have-nots. At Palantir, we plan to power the winners.

U.S. total growth was 44% YoY and 14% QoQ, increasing to $499M from $345M last year. Therefore, we witnessed a solid 40% YoY growth in Palantir’s U.S. government segment. Total revenue accelerated to 30% YoY, implying that Palantir could return to its more robust 30%+ sales growth in future quarters.

Valuation Perspective – Now Priced For Perfection

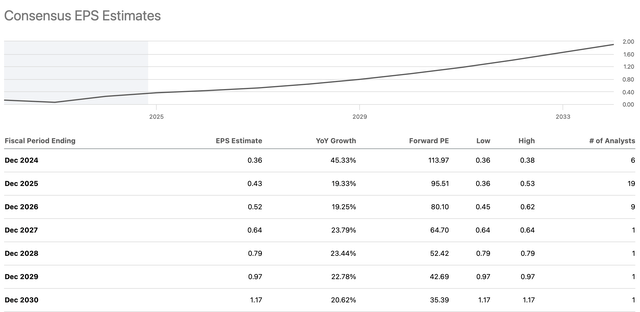

EPS estimates (Stock Market Analysis & Tools for Investors)

Palantir will likely earn about 36 cents this year and could report EPS in the 45-55 cent range in 2025. This dynamic puts Palantir’s forward P/E multiple at about 100, which is not cheap. Conversely, Palantir’s EPS could continue improving, potentially delivering higher growth than even the higher-end estimates may imply. Nonetheless, Palantir is now priced for perfection, and the stock could retreat considerably if the constructive earnings trend breaks down.

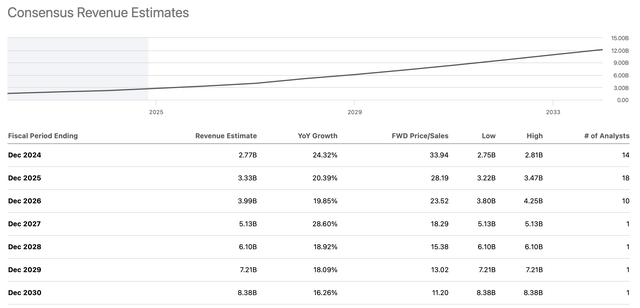

Sales estimates (Stock Market Analysis & Tools for Investors)

Let’s also consider its P/S multiple, around 34 times this year’s revenue estimates and roughly 28 times 2025 consensus sales estimates. While Palantir’s market cap has hit around $100 billion, its sales will only be about $3.3-3.5B next year. Therefore, unless Palantir increases its sales much more rapidly than anticipated, its near-term upward stock price potential may be relatively limited, for now.

The Bottom Line

Palantir is an excellent company. Moreover, its stock likely has a bright future, and I remain bullish despite the stellar 8x performance since the stock bottomed in 2022. Still, with Palantir achieving my $40-50 2024 year-end target range, the upside may be limited in the near term. Therefore, I took additional profits this morning, cutting my Palantir position by 50%. Despite this near-term reduction, I maintain a buy rating on Palantir’s stock and plan to increase my position on a pullback or a correction in Palantir’s stock.

Where Palantir’s Stock Could Be In The Future

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $2.8 | $3.5 | $4.5 | $5.7 | $7.3 | $9.1 | $11.3 |

| Revenue growth | 26% | 27% | 28% | 28% | 27% | 26% | 25% |

| EPS | $0.38 | $0.50 | $0.62 | $0.78 | $1.05 | $1.35 | $1.70 |

| EPS growth | 52% | 32% | 24% | 26% | 35% | 29% | 24% |

| Forward P/E | 100 | 90 | 85 | 80 | 75 | 70 | 65 |

| Stock price | $50 | $56 | $66 | $84 | $101 | $119 | $133 |

Source: The Financial Prophet

Palantir has a rich valuation now, and the stock’s near-term upside potential may be limited. However, the intermediate and long-term potential remains. Palantir should continue expanding revenues and EPS, which could enable its stock to stay on an upward trajectory for the long term. We may also see better-than-expected sales and profitability growth, which could expedite its move toward $100.

Risks to Palantir

Palantir is firing on all cylinders, and its most significant risk now could be its frothy valuation. To remain ahead of the curve, Palantir must continue leading the AI market, surpassing EPS and sales estimates and providing better-than-anticipated guidance. Risks concerning macroeconomic factors, including a slower-than-expected global economy and other challenges, competition risks, and the potential for alternatives regarding Palantir’s products and services, also exist. Investors should examine these and other risks before investing in Palantir.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return) and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Join The Financial Prophet And Become A Better Investor!

Join The Financial Prophet And Become A Better Investor!

Don’t Hesitate! Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!