Summary:

- AT&T recently provided guidance for its free cash flow target and also its deleverage plan.

- Given the updated guidance, I expect its growth CAPEX allocation to drastically improve in the next 1~2 years.

- I further expect such an improvement to be an inflection point for its stock prices.

- The improvement could fundamentally change the prevailing market sentiment and T’s growth CAPEX allocation.

jojje9999/iStock via Getty Images

T stock: Q3 review

My last article on AT&T stock (NYSE:T) stock focused on its DirecTV divestiture as reflected in its title “AT&T: DirecTV Divestiture Creates More Upside Potential”. In that article, I argued for a BUY rating as this move creates another immediate catalyst in my view. More specifically,

T recently decided to divest its DirecTV segment. In the near term, I anticipate the DirecTV deal to catalyze further margin expansion. In the longer term, I anticipate it will improve its cash flow and spur growth in its core areas such as fiber and wireless.

Since then, the company has reported its FY Q3 2024 earnings report (ER). As a popular stock on the Seeking Alpha platform, the ER quickly triggered multiple review articles. These articles have pretty much covered many aspects of the company’s financials, ranging from dividend payouts, valuation, profit margins, etc. As a result, in this analysis, I won’t delve into what has been discussed already. Instead, I will focus on two issues that, I think, are crucially important but have not been carefully examined in existing articles. These issues involve AT&T’s free cash flow target for the full year and also its deleverage plan. In the remainder of this article, I will explain A) why I expect the company to meet the guidance, and B) why meeting the guidance could mark an inflection point for the company’s business and stock prices. These considerations have led me to upgrade my rating to STRONG BUY.

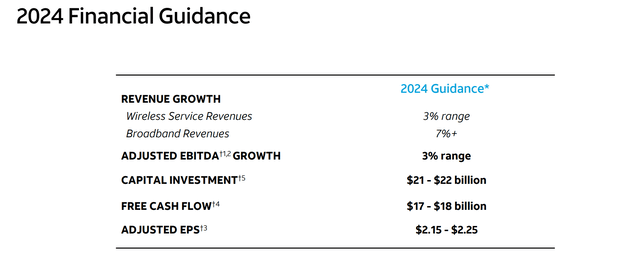

With this overview, now let’s dive into the specifics. As you can see from the following slide taken from T’s Q3 ER, the CAPEX for 2024 is expected to be around $21B-$22B and FCF (free cash flow) is expected to be in the $17B-$18B range. Moreover, the company also continues to expect to achieve net debt-to-adjusted EBITDA in the 2.5x range in the first half of 2025.

Next, I will elaborate on the implications of these expected ranges.

T 2024 Q3 ER slide

T stock: the implications of the FCF guidance

Achieving the above FCF and deleverage goals marks an inflection point for T in my mind for several reasons. The top reason on my list is market psychology. My view is that the market has been treating the company as a “show me” stock in the past ~2 years or so – for good reasons. Delivering a strong FCF target thus has the potential to reverse the market’s perception of T from a turn-around stock to a growth stock.

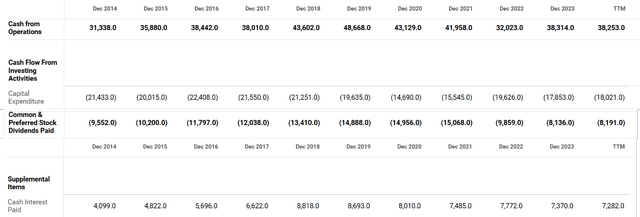

And of course, achieving the FCF and deleveraging targets should indeed give T the capital allocation flexibility to resume growth. To illustrate this point, let’s walk through its cash flow obligations in recent years. Overall, AT&T’s cash flow situation has been very strained in the past 2~3 years in my view, leaving little breathing room for growth investments. As seen, in terms of cash from operations, the company experienced a drastic decline in recent years. The figure dropped from about $42 billion in 2021 to about $38 billion in 2023.

In the meantime, the company’s operation requires consistently significant capital expenditure. As an example, CAPEX expenditures were almost $18 billion for 2023. The company also paid a total of $8.1 billion in dividends in 2023. Due to the combination of heavy debt and elevated borrowing rates, the cash interest paid has remained relatively high in recent years. In 2023, the figure stood at $7.3 billion. Thus, the sum of these three obligations (CAPEX, dividends, and interests) is already more than $33 billion. Given the $38 billion of operating cash flow in 2023, this only leaves about $5 billion of cash flow for the company to allocate freely.

Seeking Alpha

As aforementioned, the FCF is expected to be in the $17-$18B range for 2024. As such, assuming the same level of interest expenses as 2023 (i.e., about $7.3 billion), the company would still have about $10 billion of cash flow that it can allocate (e.g., towards growth initiatives, dividend growth, etc.), doubling what it used to have in 2023.

Further, its deleverage efforts should also lower its interest obligations and thus make the capital allocation picture even brighter, as elaborated on immediately below.

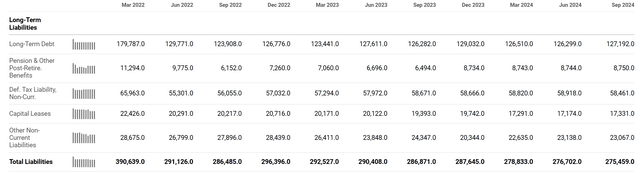

T stock: deleverage in focus

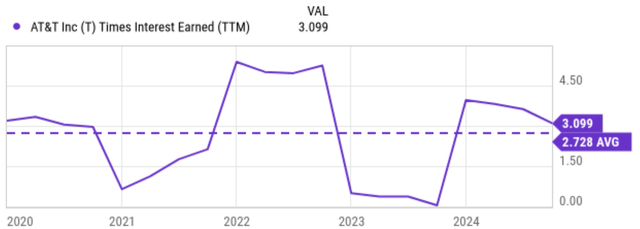

To provide a context, the next chart shows the liabilities section from AT&T’s balance sheet, showing its total liabilities over the past few quarters. As seen, the company was burdened by significant liabilities in recent years, with total liabilities hovering around $390 billion in early 2022. Since then, the company has made efforts to reduce its debt burden, and the figured dropped to about $275 billion as of Q3, about $11 billion below the level a year ago as seen. Thanks to these deleverage efforts, the company’s financial standing has improved materially in the past few quarters. As an example, the next chart displays AT&T’s interest coverage ratio (in terms of times interest earned). As seen, the ratio has fluctuated over the years, with notable declines in 2021 and also 2023 due to earnings headwinds and also disruptions caused by the pandemic. The ratio has since improved and currently sits at 3.1x, noticeably above its historical average of 2.7x as seen.

Looking ahead, T aims at achieving a net debt-to-adjusted EBITDA in the 2.5x range in 2025 as aforementioned. In the meantime, I also expect the borrowing rates to decline as the Fed continues to lower interest rates. These developments should reduce T’s interest expenses substantially and further enhance its financial flexibility.

Seeking Alpha

Seeking Alpha

Other risks and final thoughts

The current valuation is another upside risk. The current consensus EPS estimates for T stock projects a moderately positive growth outlook, as you can see from the next chart below. To wit, the estimates show a gradual increase in EPS over the next 5 years. The estimate projects an EPS of $2.21 for FY 2024, and this figure is expected to grow steadily to $2.74 by FY 2028. This growth translates into a compound annual growth rate (CAGR) of 5.5% in the next five years.

Seeking Alpha

In my view, these above estimates are on the conservative side because I don’t think they factored in the increased growth capital flexibility as argued above. However, even assuming a CAGR of 5.5%, T’s current valuation is still very attractive from a growth-adjusted perspective. Considering the company’s leading position in a relatively mature and stable industry, I think the following Graham’s P/E is a very suitable valuation approach:

The formula as described by Graham originally in the 1962 edition of Security Analysis is as follows: P/E = 8.5 + 2*g, where g is a greasonably expected growth rate for the next few years.

With the 5.5% growth rate implied by the above consensus estimates, the Graham P/E for T worked out to be 19.5x (i.e., 8.5 + 2 * 5.5). In contrast, the forward P/E ratio is only about 9.9x of the current stock price as of this writing. Such a large discrepancy suggests an extremely wide margin of safety under current conditions.

In terms of downside risks, the telecommunications industry is highly competitive and capital heavy. As such, both T and its peers in the sector face intense competition risks, not only from each other but also other potentially disruptive technologies. As an example, its business wire line service revenues continued its decline this quarter. The company also faces some operational challenges such as churn rates, as you can see from the report below.

Seeking Alpha report: In the third quarter, the telecom added 403,000 net new monthly wireless phone subscribers, ahead of Bloomberg estimates of 394,600. Business wireline service revenue and declines in mobility equipment revenue were driven by lower sales volumes, which were mostly offset by higher mobility service and consumer wireline revenues, the company said… Postpaid phone churn in Q3 was 0.78%, down 1 basis point year-over-year, but was ahead of the consensus estimate of 0.77%.

All told, the overall picture I see is a positive one. In particular, I expect AT&T’s capital allocation flexibility to drastically improve in the next 1~2 years given its FCF and deleverage targets for 2024 and 2025. Such an improvement could be the inflection point to change the prevailing sentiment, its growth CAPEX investment, and also dividend payouts. These catalysts, when combined with its current single-digit P/E, offer outsized return potential.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.