Summary:

- Advanced Micro Devices is discounted due to its inability to compete directly with NVDA’s AI chip dominance, as observed in the former’s underwhelming forward guidance.

- This is on top of the ongoing hyperscaler transition to custom ASICs, with AMD potentially missing out on the generative AI capex boom.

- Despite promising double-digit growth through FY2026, AMD’s impacted operating margins imply its lack of pricing power and delayed AI monetization.

- While AMD’s refreshed PC cycle and Enterprise contract wins offer some optimism, we believe that investors should observe the company’s execution for a little longer.

Don Farrall/DigitalVision via Getty Images

AMD’s Long-Term AI Prospects Remain Mixed, As Growth Headwinds Intensify

We previously covered Advanced Micro Devices, Inc. (NASDAQ:AMD) in August 2024, discussing its mixed prospects attributed to the lackluster FQ2 ’24 earnings results and underwhelming FQ3 ’24 guidance, worsened by the July/August 2024 market correction observed in high growth/generative AI stocks.

With their AI chip offerings likely to continue being relegated as the second best, we had preferred to maintain our Hold rating then.

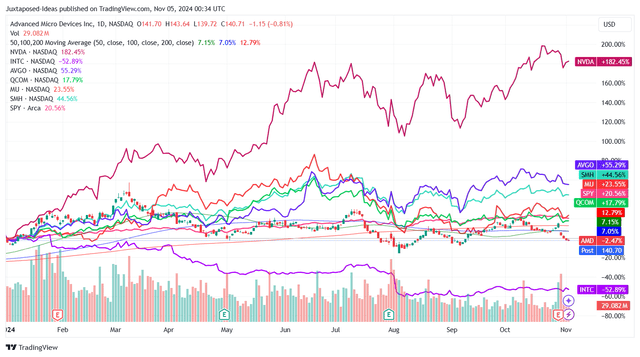

AMD YTD Stock Price

Since then, AMD has mostly traded sideways at +4.6%, compared to the wider market at +6.7%, as it underperforms most of its semiconductor peers, aside from Intel (INTC).

Much of the pessimism is naturally attributed to its inability to directly compete with Nvidia’s (NVDA) undisputed leadership in the data-center GPU shipments at 98% share as of 2023. That is up 85% on a YTD basis, compared to AMD’s minimal gain from 0% to 5%.

The same has been observed in AMD’s Q3 ’24 data center revenue of $3.54B (+25% QoQ/+122.6% YoY), which is naturally underwhelming compared to NVDA’s Q2 ’24 data center revenues of $26.3B (+16% QoQ/+154% YoY).

While Nvidia is only scheduled to report their Q3 ’24 earnings on November 20, 2024, it is undeniable that NVDA’s AI chip offerings remain the top choice for most hyperscalers, including Microsoft (MSFT) and Google (GOOG). Nvidia’s CEO highlights that the “demand for Blackwell is insane.”

With AMD only guiding FY2024 data center GPU revenues of over $5B albeit up from the original guidance of $2B, it goes without saying these numbers remain underwhelming, as the gap between the market leader and the second fiddle widens.

If anything, the bar remains relatively low for FY2025, with analysts only expecting a data center GPU revenue of $9B – remaining well below the market leader.

At the same time, Broadcom (AVGO) has highlighted the growing demand for Custom Application-Specific Integrated Circuits (ASIC) from the global hyperscalers, with it contributing to the segment’s 3.5x YoY sales growth while comprising 70% of its AI-related revenues in FQ3 ’24.

Much of the transition toward custom silicon is attributed to the “compelling price performance” ratio, as Amazon (AMZN) reports “significant interest in these chips, and we’ve gone back to our manufacturing partners multiple times to produce much more than we’d originally planned,” with the same trend observed in GOOG, Meta (META), and MSFT.

This development implies AMD’s uncertain long-term prospects as it misses out on the first wave of the AI chips boom, worsened by the fact that deep-pocketed hyperscalers are increasingly developing custom ASICs better suited for their propriety LLM platforms.

While the AI/data center chip market remains big enough to accommodate multiple players, it is painfully apparent that AMD may continue to play catch up to NVDA moving forward – along with it, the former’s potentially underwhelming long-term AI prospects.

For now, the only silver lining to AMD’s investment thesis is the refreshed PC cycle, as observed in the stable x86 market share at mid-30% and the robust client segment revenue growth to $1.88B (+26.1% QoQ/+29.6% YoY).

This is attributed to the robust Ryzen 9000 series processors sales at a “significant double-digit percentage” in the quarter, with the launch of the next-gen Ryzen 9000 X3D processors in November 2024 likely to be a further recovery tailwind.

Readers must also note AMD’s numerous Enterprise contract wins in the commercial PC market, significantly aided by the launch of the new AI capable/CoPilot Plus PCs in 2024, with 2025 likely to bring forth robust sequential growth.

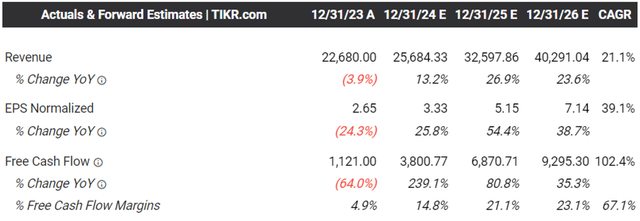

The Consensus Forward Estimates

These developments may also be why the consensus forward estimates remain promising, with AMD expected to generate robust top/bottom-line growth at double digits through FY2026, after the painful PC demand destruction in FY2023.

Even then, these numbers continue to paint a significantly different picture to NVDA’s triple-digit growth observed in FY2024 and its projected growth in FY2025 – which is also why the stock has underperformed thus far.

So, Is AMD Stock A Buy, Sell, Or Hold?

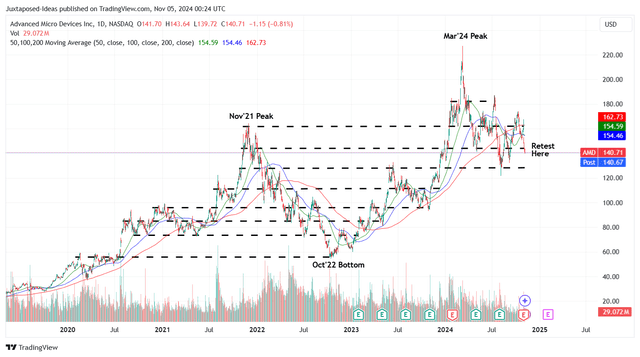

AMD 5Y Stock Price

For now, AMD has continued to chart lower highs and lower lows after the March 2024 peak, with it appearing to breach the previous support levels of $145s and likely to continue retracing to its next support levels of $130s.

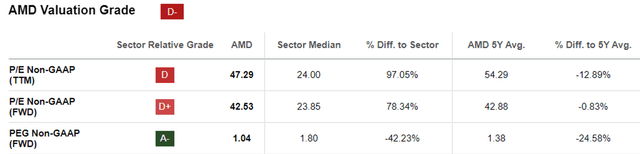

AMD Valuations

On the one hand, we believe that AMD appears to be reasonably valued at FWD P/E non-GAAP valuations of 42.53x, compared to its 5Y mean of 42.88x and 10Y mean of 343.60x.

The same has also been observed in its FWD PEG non-GAAP ratio of 1.04x, compared to its 5Y mean of 1.38x and 10Y mean of 6.56x.

Even if compared to its fellow AI chip players, including NVDA at FWD PEG non-GAAP ratio of 1.34x, INTC at 1.74x, and AVGO at 1.77x, it is undeniable that AMD appears to be a value Buy at current discounted levels.

Based on the consensus lowered FY2026 adj EPS estimates from $7.30 to $7.14 and the 1Y P/E mean of ~33x, we are looking at an updated long-term price target from $240.90 to $235.60, with it still implying an excellent upside potential of +67.4% from current levels.

On the other hand, while we typically would rate any oversold stock with a high-growth investment thesis as a Buy, this is where we beg to differ.

AMD is cheap for a reason, as observed in its underwhelming operating margins of 10.6% in FQ3 ’24 (+6 points QoQ/+6.8 YoY), compared to NVDA at 66.3% in Q2 ’24 (-3 points QoQ/+8.8 YoY) – with the impacted bottom-lines signifying its lack of pricing power and delayed AI monetization.

As a result, we maintain our belief that AMD’s long-term prospects remain mixed, as discussed above, with investors well advised to observe the company’s execution before deciding – resulting in our reiterated Hold (Neutral) rating here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.