Summary:

- After the close of Tuesday’s session, beleaguered high-performance server and storage solutions provider Super Micro Computer or “Super Micro” provided an eagerly awaited business update.

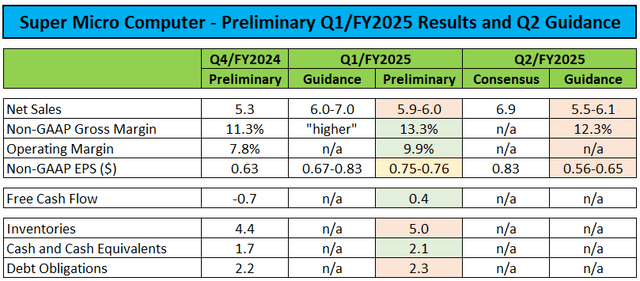

- Preliminary Q1/FY2025 results came in mixed, as weaker than expected, sales were offset by improved margins and decent cash generation.

- The company also provided disappointing second quarter guidance, with sales and earnings per share expected to come in way below consensus expectations.

- On the conference call, management attributed the weak sales outlook to limited availability of Nvidia’s next-generation Blackwell GPUs.

- Without audited financials and considering the risks associated with a potential near-term delisting, the stock is likely to remain in the penalty box for the time being.

- With shares down almost 50% from my initial “Sell” recommendation two months ago and liquidity concerns having been proven unfounded, I am upgrading Super Micro Computer’s stock to “Hold”.

Erik Isakson

Note:

I have covered Super Micro Computer, Inc. (NASDAQ:SMCI) previously, so investors should view this as an update to my earlier articles on the company.

After the close of Tuesday’s session, beleaguered high-performance server and storage solutions provider Super Micro Computer or “Super Micro” provided an eagerly awaited business update.

While preliminary Q1/FY2025 revenues are now expected to come in at or even below the low-end of management’s original $6.0 billion to $7.0 billion guidance range, better than expected gross margins will result in Super Micro’s non-GAAP earnings per share coming in above the mid-point of the company’s previous guidance range of $0.67 to $0.83.

As already projected on the Q4/FY2024 conference call, higher gross margins were mainly the result of improved product and customer mix as well as better manufacturing efficiency.

Despite inventories increasing by 14% sequentially to approximately $5 billion, Super Micro surprisingly managed to generate almost $0.4 billion in free cash flow and finished Q1/FY2025 with cash and cash equivalents of approximately $2.1 billion as well as $2.3 billion in debt.

During the questions-and-answers session of the conference call, the company’s CFO attributed a meaningful portion of the $1 billion quarter-over-quarter improvement to a material increase in accounts payable.

The company also provided disappointing second quarter guidance, with sales and earnings per share expected to come in way below consensus expectations:

Company Press Release / Conference Call

On the conference call, management attributed the weak sales outlook to customers waiting for availability of Nvidia’s (NVDA) next-generation Blackwell GPUs, which are reportedly sold out for the next twelve months. As a result, revenues are likely to remain well below previous projections until Blackwell availability improves.

Gross margins are expected to decrease by approximately 100 basis points quarter-over-quarter due to less favorable product and customer mix. However, management stated that gross margin guidance could prove conservative.

Super Micro also provided an update on the Special Committee’s investigation (emphasis added by author):

The Special Committee has completed its investigation based on a set of initial concerns raised by EY. Following a three-month investigation led by Independent Counsel, the Committee’s investigation to date has found that the Audit Committee has acted independently and that there is no evidence of fraud or misconduct on the part of management or the Board of Directors. The Committee is recommending a series of remedial measures for the Company to strengthen its internal governance and oversight functions, and the Committee expects to deliver the full report on the completed work this week or next. The Special Committee has other work that is ongoing but expects it to be completed soon.

However, following the surprise resignation of the company’s audit firm last week over concerns regarding the reliability of “Management’s and the Audit Committee’s representations” and unwillingness “to be associated with financial statements prepared by management“, market participants aren’t likely to put much weight on the Special Committee’s report.

As the company is yet to appoint a new auditor, Super Micro won’t be in the position to file its annual report on form 10-K anytime soon.

As a result, the company might be required to further amend the terms of its various credit facilities, which might result in additional prepayments or the introduction of tighter covenants.

Adding insult to injury, a potential near-term delisting would constitute a “Fundamental Change” according to the indenture governing the company’s $1.7 billion convertible notes thus providing holders the opportunity to put back the notes to Super Micro “at a price equal to the principal amount of the Convertible Notes being repurchased plus any accrued and unpaid special interest and additional interest“.

While the company has stated its intent to submit a plan for regaining compliance until the November 16 deadline, the lack of an auditor might very well result in Nasdaq rejecting the plan and commencing delisting proceedings.

However, on the conference call, management expressed confidence in its ability to access the capital markets going forward.

In addition, management denied recent press reports of Nvidia having changed its GPU allocation in favor of competitors.

At least in my opinion, market participants are likely to scrutinize management’s explanations for the sales shortfall as Taiwanese competitors like Gigabyte Technology or ASRock having reportedly raised expectations as of late.

Considering the much weaker than expected Q2 guidance, I would expect analysts to make substantial revisions to their models and lower estimates and price targets accordingly.

On the flip side, slower growth should translate into lower working capital requirements, thus putting concerns regarding additional near-term capital needs to rest for the time being.

In sum, with slower growth, no near-term prospects for audited financials and the resulting threat of a Nasdaq delisting, I would expect another round of downgrades and price target reductions over the next couple of sessions.

However, with the stock down another 15% in after hours and my concerns regarding further elevated cash usage having been proven unfounded, I am upgrading Super Micro Computer’s shares to “Hold” from “Sell“.

Bottom Line

Super Micro Computer reported mixed preliminary Q1/FY2025 results and provided a disappointing second quarter outlook, with slower growth attributed to limited availability of Nvidia’s next-generation Blackwell GPUs.

However, the combination of ballooning inventories and reports of Nvidia allocating chips to competitors will likely result in market participants assuming market share losses as the most likely reason behind the weaker outlook.

Without audited financials and considering the risks associated with a potential near-term delisting, the stock is likely to remain in the penalty box for the time being.

That said, with shares down almost 50% from my initial “Sell” recommendation two months ago and liquidity concerns having been proven unfounded, I am upgrading Super Micro Computer’s stock to “Hold”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.