Summary:

- Beyond Meat stock has been one of the market’s worst performers, losing over half its value due to revenue growth troubles.

- The company’s Q2 report showed a smaller than expected revenue decline and improved margins, but also more losses and cash burn.

- With a debt heavy balance sheet, management has a lot of work to do to keep the company afloat moving forward.

Guido Mieth/DigitalVision via Getty Images

Over the last year, one of the worst performing stocks in the market has been Beyond Meat (NASDAQ:BYND). The plant-based meat company has seen its shares lose more than half of their value as revenue growth troubles have continued. With the company continuing to lose large sums of money, the weak balance sheet has this name getting closer to the brink.

Previous coverage of the stock

It was a little more than three months ago when I covered the name at its first quarter report. At that time, the company had just missed revenue estimates for the period, while giving weak guidance for Q2. Despite continuing to draw down on its inventory balance, cash burn continued at an alarming rate, putting working capital at its lowest point in several years.

With that article, I continued to reiterate a sell rating on the stock. The company had a very small cash balance as compared to its large debt pile, and even an open equity sale program wouldn’t be enough to close the gap before the 2027 debt maturity date hit. With an unappetizing valuation, I figured either shares would go lower on their own, or management would need to dilute investors quite substantially just to keep things here going.

The Q2 report

Last week, Beyond Meat announced its second quarter results. The company reported revenues of $93.2 million, which did beat significantly reduced street estimates thanks to that weak guidance mentioned above. However, the sales figure was still down by nearly 9% over the prior year period, with US revenues down almost 10% thanks to a nearly 19% drop in the foodservice segment. Overall, the volume of products sold was down by 15% over Q2 2024, but the company was able to raise prices a bit to keep the revenue decline in the single digits, percentage wise.

As the company works on its production plan and inventory balances, gross margins did soar to 14.7%, as compared to just 2.2% in the year ago period. Management has also brought down operating expenses rather nicely, resulting in an operating loss of $34 million in the period, a nearly $20 million year over year improvement. However, that still means that operations are losing more than 36 cents for every dollar of revenue generated, which is not a sustainable business model.

When it comes to guidance for the year, the revenue forecast range was narrowed from $315 million to $345 million to $320 million to $340 million, with no number given for the current period. Management trimmed its gross margin forecast from the mid to high teens to just the mid-teens, while hiking the bottom end of its operating expense forecast by $10 million, and trimming its capital expenditures forecast by $5 million at the top end of the previous range.

The balance sheet weakens further

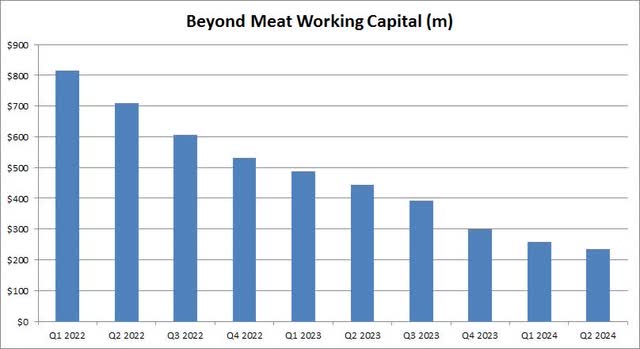

With the company continuing to report large net losses, the financial situation is only getting worse. Cash on the balance sheet declined from $158 million at the end of Q1 to less than $145 million at the end of June. As the chart below shows, overall working capital continues to come down quarter after quarter. The end of Q2 figure was just $234 million, which was almost halved in the past twelve months.

Beyond Meat Working Capital (Company Filings)

The company has $1.15 billion in principal debt coming due in just over 2.5 years, a borrowing it cannot pay back at this moment. Since the conversion price on the notes is several times what the stock currently trades for, an equity swap is not likely at this point. Management continues to say that it is working to address this major financial problem, but it also hasn’t yet sold any shares under its $200 million equity sales plan, either.

With a market cap of just about $400 million today, there are not a lot of good options here. Selling shares will heavily dilute investors, and that won’t even come close to plugging the debt deficit. At the same time, even refinancing say $500 million of the borrowing might result in a new interest rate that could be 10% or more, whereas the current notes pay no coupon interest. Adding tens of millions of dollars in yearly interest expenses would make the net loss and cash burn situation even worse in the near term.

Valuation just doesn’t work here

As of last Friday’s close, Beyond Meat shares were trading for 1.2 times their expected sales for 2025. If we look at some other larger players, Tyson Foods (TSN) went for just 0.41 times its expected revenues for its September 2025 fiscal year, while Hormel Foods (HRL) went for 1.42 times its October 2025 fiscal year expected revenues. It’s hard to argue investors should pay above the average of those two names for Beyond Meat, when you can easily invest in those other two more stable companies.

As for the street, analysts saw this name as worth $5.28 going into this week. That number represented considerable downside from last week’s finish, and analysts have cut their average by nearly 50% over the past year. The street average peaked about five years ago at around $165, just a little while after shares had surged past $230 a share, but it has been all downhill ever since.

Final thoughts and recommendation

In the end, another mixed report from Beyond Meat has put even more pressure on the company’s long-term future. Revenues did beat significantly reduced estimates, but still dropped over the prior year period. Management was able to show solid margin and expense improvement, but losses and cash burn remain quite high. The balance sheet continues to weaken by the quarter, with the 2027 debt mountain remaining the biggest issue here.

With a major restructuring needed for this company, I am continuing to rate the stock a sell today. Either management is going to have to dilute investors substantially just to remain afloat, or it will need to get a lot of help from creditors to avoid filing bankruptcy in the next few years. While the company may be able to work with lenders to get its debt balance down, it likely will result in interest expenses that will only make the near term situation worse. Every day that goes by seemingly increases the chances of bankruptcy, which could wipe out equity holders completely.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.