Summary:

- Beyond Meat’s 2024 net revenues may be down -29% from its 2021 peak.

- It has also struggled with negative gross profit margins, although that has been improving.

- Beyond Meat’s $1.15 billion convertible notes due 2027 is trading at 22 cents on the dollar.

- There doesn’t appear to be a path to deal with that note maturity other than giving control of the company to noteholders.

- However, there is also no real hurry for Beyond Meat to restructure due to its limited obligations before 2027.

Sundry Photography

I looked at Beyond Meat (NASDAQ:BYND) around five years ago and noted that it was greatly overvalued, even if things went well for it in terms of rapid revenue growth.

Things have not gone well for Beyond Meat, though, with the meat alternative category peaking in mid-2021 and then seeing significant declines since then. Beyond Meat has also lost market share within this declining category, resulting in 2024 net revenue expectations that are down -29% from its 2021 peak.

Based on its 2024 guidance, Beyond Meat should technically have enough cash to last through the year without issuing equity under its ATM program. However, it also seems likely to have continuing cash burn in future years, and its 2027 note maturity looks extremely challenging to deal with.

I rate Beyond Meat a sell due to the lack of intrinsic value for its equity. However, the high cost to borrow and Beyond Meat’s potential ability to survive a couple more years makes it challenging to short as well. Thus, I view it primarily as a trading vehicle with a downward trend.

Revenues And Category Growth

After significant growth (and hype) around meat alternatives for a few years, the category has now seen noticeable declines. Year-over-year growth stalled out in 2021 and since then, there have been double-digit declines.

As an example, refrigerated meat alternative sales (in pounds) were down -26% during the 52-week period ending July 2023 compared to calendar year 2021.

While the prior hype around meat alternatives resulted in many people trying Beyond Meat (and its competitors) at least once, consumer perceptions around taste, texture and price have contributed to meat alternatives remaining a niche category. TD Cowen noted that Beyond Meat has been losing market share even as the overall category has been declining.

As a result, Beyond Meat’s sales have gone down significantly since peaking at $465 million in 2021. It reported $419 million in net revenues in 2022 and $343 million in net revenues for 2023. Beyond Meat’s guidance for 2024 involves a range of $315 million to $345 million.

| $ Million | 2020 | 2021 | 2022 | 2023 |

| Net Revenues | $407 | $465 | $419 | $343 |

Notes On Profit Margins

Beyond Meat reported a -24% gross profit margin in 2023. Some of this was due to $67.5 million in non-cash charges (such as write-offs) that affected cost of goods sold. Even adjusting for this, though, Beyond Meat would have reported a -4% gross profit margin in 2023.

Beyond Meat’s gross margin did improve incrementally to approximately +5% in Q1 2024, and it reaffirmed its expectations for full year 2024 gross margins to be in the mid-to-high teens, with 2H 2024 showing improvement versus 1H 2024.

Beyond Meat reported approximately 25% to 30% gross margins in 2020 to 2021 when revenues were significantly stronger. Given the challenges it is currently facing in stabilizing its revenues (at a lower level), I believe Beyond Meat is more likely to end up with gross margins below its full-year guidance range for 2024, though.

2024 Outlook

Beyond Meat currently expects $315 million to $345 million in net revenues for 2024. It reported $75.6 million in net revenues in Q1 2024, which was a bit better than its guidance range for $70 million to $75 million. Beyond Meat will need to generate some year-over-year growth in 2H 2024 to get to $330 million in net revenues for the full year, though.

If Beyond Meat can generate $330 million in net revenues with 12% gross margins, it will end up with around $40 million in gross profit for 2024.

Beyond Meat expects approximately $180 million in 2024 operating expenses, excluding $7.5 million accrued for a consumer class action settlement ($7.25 million of which will be paid out in 2025). Also, excluding items such as depreciation and amortization and share-based compensation may result in Beyond Meat having around $130 million in cash operating expenses.

Beyond Meat’s 2024 capex is expected to be around $20 million, resulting in an estimate of $110 million in cash burn (excluding working capital changes) in 2024.

| $ Million | |

| Gross Profit | $40 |

| Less: Cash Opex | $130 |

| Less: Capex | $20 |

| Free Cash Flow | -$110 |

Beyond Meat started 2024 with around $193 million in cash on hand (including a small amount of restricted cash), so it would end the year with around $83 million in cash in this scenario if there are no working capital changes.

Potential 2025 Outlook

Here’s a relatively positive scenario for 2025 for Beyond Meat, in which it grows net revenues by 9% year-over-year to $360 million and increases its gross margin to 25%. This results in $90 million in gross profit.

If Beyond Meat’s base cash operating expenses are reduced to $115 million, it would end up with around $122 million in cash expenses, including the $7.25 million it is scheduled to pay out in 2025 for the consumer class action settlement.

If capex remains at $20 million, it would then have $52 million in cash burn for 2025.

| $ Million | |

| Gross Profit | $90 |

| Less: Cash Opex | $122 |

| Less: Capex | $20 |

| Free Cash Flow | -$52 |

This would leave it with $31 million in cash at the end of 2025 if it didn’t raise money with an ATM equity offering.

Notes On Valuation

The intrinsic value of Beyond Meat’s stock appears to be zero. It seems likely to continue to generate negative EBITDA and negative free cash flow and also has a large amount of debt coming due in 2027.

Beyond Meat has $1.15 billion in 0% convertible senior notes due in March 2027. The conversion price for these notes is $206 per share, close to 29x its current price. These notes are currently trading at around 22 cents on the dollar.

The trading price of the notes indicates that noteholders do not expect to be paid back in full at maturity. Beyond Meat is extremely unlikely to be able to deal with its notes, and the most likely option is that Beyond Meat eventually restructures, with the convertible noteholders owning Beyond Meat’s new equity.

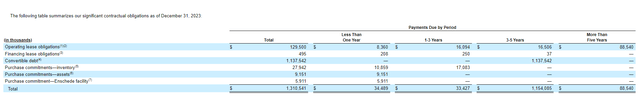

There doesn’t appear to be any hurry for Beyond Meat to restructure, though. It doesn’t pay interest on the convertible notes and has quite limited obligations until its convertible notes mature.

Beyond Meat’s Obligations (beyondmeat.com (10-K))

Conclusion

Beyond Meat has struggled over the past few years with declining meat alternatives category sales and its own challenges with market share within that category.

This has left it looking at continued negative EBITDA and cash burn. Beyond Meat’s last year with positive EBITDA was 2020.

Beyond Meat does have the ability to survive for a couple years utilizing its cash on hand (and its ATM equity program if needed). However, I don’t see an effective path for it to deal with its 2027 convertible notes other than handing ownership of the company to the noteholders.

I rate Beyond Meat as a sell due to its lack of intrinsic value. However, I’d also note that shorting Beyond Meat doesn’t look attractive with the cost to borrow its stock currently at around 80%, and the potential for Beyond Meat to survive over two years before restructuring.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Free Trial Offer

We are currently offering a free two-week trial to Distressed Value Investing. Join our community to receive exclusive research about various companies and other opportunities along with full access to my portfolio of historic research that now includes over 1,000 reports on over 100 companies.