Summary:

- Coupang’s stock, despite strong performance and growth potential, saw a dip due to a slight drop in adjusted EBITDA margins and free cash flow burn in Q3 2024.

- Paying 31x forward free cash flow for Coupang is justified by its robust growth, especially in Developing Offerings, and a debt-free balance sheet with $4.2 billion in net cash.

- Coupang’s diverse services, including grocery delivery and luxury products, enhance its appeal, with Developing Offerings growing 146% y/y excluding Farfetch.

- Despite temporary weakness in share price, Coupang’s financial strength and growth prospects suggest a reversal and continued premium valuation.

Richard Drury

Investment Thesis

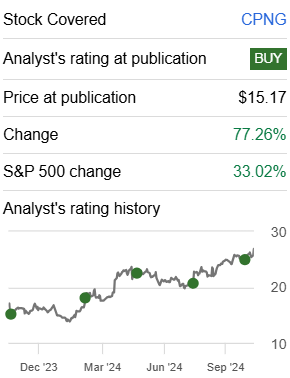

Coupang (NYSE:CPNG) delivered a solid set of Q3 2024 results. But with this stock already up more than 70% y/y, investors weren’t sufficiently awed to give this stock a bid.

Whilst I recognize the main blemishes in this report, I still maintain that there’s a lot to like from Coupang.

What’s more, its valuation is most reasonable. I make the case that investors are asked to pay 31x forward free cash flow for Coupang, a business that is very well managed with different growth opportunities, even as its core business is also very strong.

There’s a lot to like here, so let’s get to it.

Rapid Recap

A few weeks ago, heading into Coupang’s Q3 2024 earnings results, I said,

[…] the market loves simple stories. And simple stories get the highest multiples.

Accordingly, my thesis in a nutshell is that investors are asked to pay 30x forward free cash flow for Coupang’s mature Product segment, and get its rapidly growing Developing Offerings segment completely free.

Author’s work on CPNG

As you’ll see, hidden in that paragraph was the downfall that led to Coupang’s share price falling after hours.

Why Coupang? Why Now?

Coupang is a South Korean e-commerce company known for its customer-centric approach to ecommerce.

Many investors have lazily called it South Korea’s Amazon (AMZN), given that it offers a wide selection of products and fast delivery services through its WOW membership program, which is similar to Prime.

But there’s a lot more in Coupang that sets it apart too. Case in point, Coupang owns Farfetch and continuously expands its offerings across categories like grocery delivery through Rocket Fresh, and now with a new luxury products line called R.Lux, as well as food delivery in Taiwan. This breadth of services makes Coupang appealing to customers who value convenience and speed.

Indeed, if I were to seek to simplify my bull case down to one graphic, it would be this:

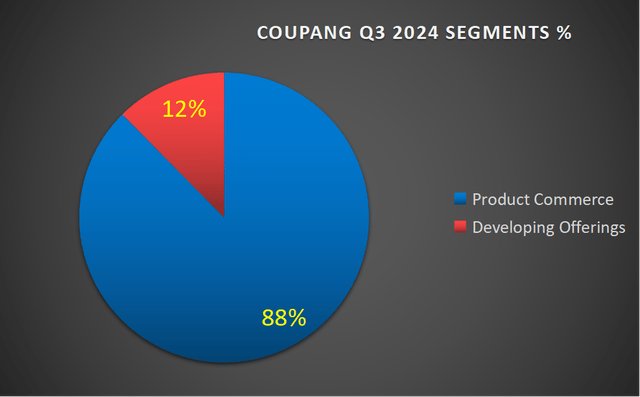

What you see above is that 12% of Coupang’s total revenues now come from its Developing Offerings. In fact, in my previous analysis, I said that I was impressed with the pace of growth of its Developing Offerings, see below:

Naturally, this business unit will slow down in Q3 2024 and beyond. But if it turns out that despite slowing down, it could still deliver approximately 100% y/y revenue growth rates, I believe that investors could soon get a lot more comfortable backing Coupang.

For my part, I had earmarked about 100% y/y growth for Coupang’s Developing Offering in Q3 2024 and into 2025. What did the actual figure turn out to be? Up 146% y/y excluding Farfetch.

This once again reinforces my contention that Coupang is a growth business.

With that in mind, let’s dig further into Coupang’s fundamentals.

Can +15% CAGR in 2025 Still Be on the Cards? I Believe So

I believe I nailed the issue on the head in my previous analysis when I said [emphasis added]:

Allow me to describe the problem and the opportunity. The issue for Coupang is that it acquired Farfetch out of bankruptcy at a cheap price. Why is that a concern? Because it’s going to obfuscate Coupang’s near-term growth rates.

Put more simply, there’s a material amount of inorganic growth rates that has affected Coupang for two quarters thus far, and Coupang won’t lap that acquisition until early in 2025.

And to complicate matters further, Coupang doesn’t provide investors with any sort of guidance.

And then, on top of that, putting aside Coupang’s Farfetch acquisition and related complications, its organic growth rates will be up against a much more challenging backdrop starting Q3 2024 all the way into H1 2025.

Basically, this is the key question that investors need to get super comfortable with: can Coupang be counted on to sustainably grow by +15% CAGR into 2025?

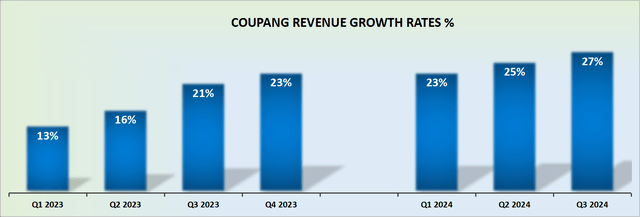

Coupang’s organic growth, excluding Farfetch, which laps in early 2025, was up 20% y/y.

Hence, to answer the question highlighted in red above, yes, I think that Coupang can grow in 2025 by +15% CAGR.

And this should have been enough to give investors peace of mind that this is a growth business. And a business that should carry a premium valuation.

And yet, evidently, this strong revenue growth rate potential wasn’t enough to satisfy investors and investors took the opportunity to take profits off the table. Why? That’s what we discuss next.

CPNG Stock Valuation — 31x 2025 Free Cash Flow

Before getting to the bearish aspect, allow me to give you further context.

As an Inflection investor, you need to see if a company’s balance sheet is going to contribute or detract from your investment thesis. Is the balance sheet an asset to the bull case, or is the balance sheet inflexible?

I make the case that with $4.2 billion of net cash, Coupang’s balance sheet provides it with substantial maneuverability. Indeed, this accounts for 9% of its market cap (including the after-hours sell-off). This is demonstrably supportive of the bull thesis.

Now, allow me to highlight the main blemish from this earnings report. Back in Q2, 2024, Coupang’s adjusted EBITDA was 5.3% excluding the Farfetch acquisition.

That was the sort of profit margin that investors had got comfortable with. Particularly, since Q1 was 4.6% for its adjusted EBITDA margins excluding Farfetch, investors were rallying behind Coupang as a growth business that was rapidly becoming more profitable. Investors love those stories!

But what investors did not take too well was that Q3 2024 saw its adjusted EBITDA margin excluding Farfetch drop to back to 4.6%.

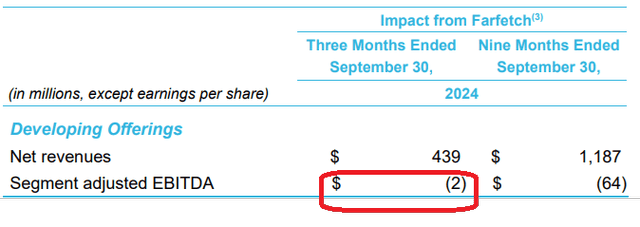

For their part, management pointed to the fact that Farfetch has reached near break-even earlier than planned, see below.

For anyone who has followed the whole Farfetch saga for some time, I would have believed that investors would be astounded to see Farfetch nearly at breakeven. However, it appeared that the market wasn’t willing to give Coupang’s management team a massive kudos for this tremendous execution.

Next, consider the following question I had previously put forth [emphasis added]:

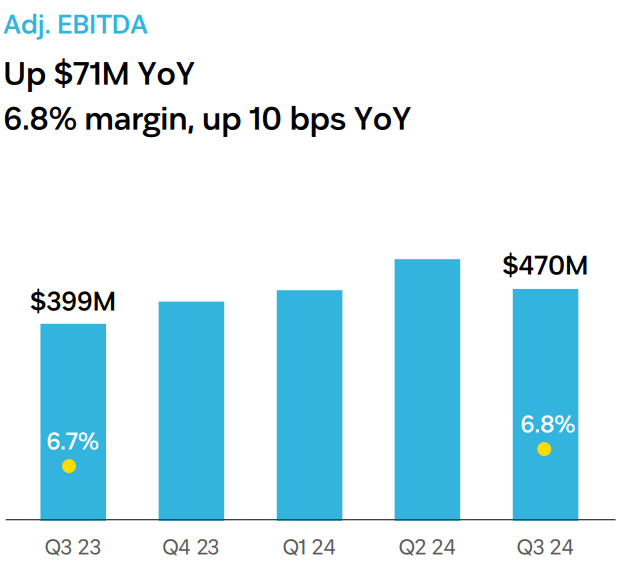

This is what I’m looking for in Coupang’s Q3 2024 results. Can I see enough evidence that Coupang can be on a path toward $2 billion of adjusted EBITDA from this segment?

As you can see from the graphic that follows, yes, Coupang can be counted to be on a path towards $2 billion of adjusted EBITDA from its product segment.

CPNG Q3 2024

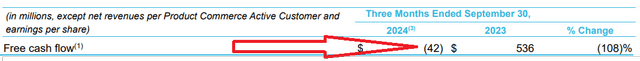

But even as this $2 billion of adjusted EBITDA from its product segment seems to be on the cards for me, we must also observe the sequential decline in Coupang’s adjusted EBITDA profile.

And this goes back to my contention of what has dampened investors’ spirits, as this slight drop in sequential adjusted EBITDA translated into a free cash flow burn in Q3 2024.

Nevertheless, for my part, I continue to believe that Coupang could reach $2.5 billion as a forward run-rate at some point in 2025. Consequently, even if we put aside about $1 billion for its capex requirements in 2025, this should still see Coupang’s free cash flow in 2025 reach $1.5 billion.

Investment Risks to Consider

Coupang is an International business, and therefore it may be susceptible to risk-off sentiment or geopolitical uncertainties. This could significantly impact its multiple.

Also, Coupang’s bull thesis is based on Coupang continuing to grow its profitability profile. But as we’ve just seen this quarter, it’s not guaranteed that Coupang can grow its profitability profile every quarter to reach my $2.5 billion EBITDA in 2025 estimate.

The Bottom Line

Paying 31x next year’s free cash flow for Coupang makes sense to me because of its impressive growth potential and financial strength. Coupang has demonstrated robust growth, with its core product segment showing healthy gains and its Developing Offerings growing at over 146% y/y excluding Farfetch.

Additionally, its debt-free balance sheet, with $4.2 billion in net cash, provides significant flexibility to invest in strategic opportunities without financial strain. For a company with such growth prospects and operational resilience, I believe that the market called this earnings result wrong. And this temporary weakness in its share price will be reversed.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.