Summary:

- Meta’s Q3 revenue surged 19% year-over-year to $40.6 billion, driven by strong ad performance and AI integration.

- Operating margin improved to 43% from 40% last year, reflecting operational efficiency despite high CapEx guidance of $38-40 billion.

- AI and Reality Labs investments remain central to Meta’s growth, with AI enhancements boosting ad relevancy and user engagement.

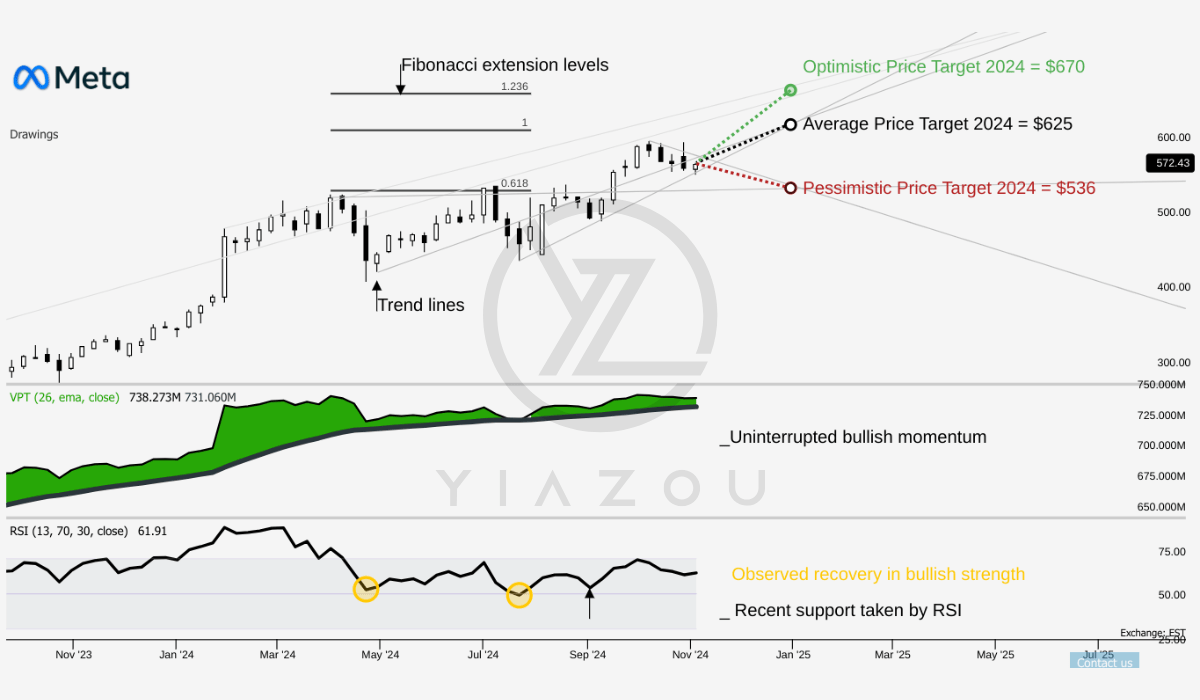

- Meta’s stock target stands at $625, supported by technical levels and improving fundamentals within its core advertising business.

grinvalds/iStock via Getty Images

Investment Thesis

Meta Platforms, Inc. (NASDAQ:META) recently announced surprisingly strong Q3 2024 results, including robust revenue growth, improving operational efficiency, and strategic investing in AI and the metaverse. The earnings show a company busy building out its core ad business while investing in the subsequent phases of technology development.

Despite Meta’s impressive gains, I am holding my full position without any partial profit-taking, as the target price of $625 seems closer than ever. The stock returned 10% since our last coverage and surged another 10% pre-earnings, hitting $608, only to retreat to the $560-570 range amid concerns over high CapEx guidance of $38-40 billion for 2024.

However, Meta’s operating margins improved to 43%, offsetting these concerns and underscoring operational efficiency in its core advertising business. The increased spending targets AI infrastructure and Reality Labs, which are critical to Meta’s long-term growth in AI-driven engagement and metaverse expansion.

Meta Stock in Technical Sweet Spot: Targeting $625

Based on the technicals for Meta’s stock, the current price of $572.43 is positioned between Fibonacci-based target ranges. The average price target for 2024, $625, aligns with the 3-point Fibonacci level (1), suggesting a baseline resistance or support level that Meta might revisit. An optimistic target of $670 aligns with the Fibonacci extension level 1.236, potentially marking an upper resistance zone. In contrast, the pessimistic target of $536 aligns with the Fibonacci retracement level (0.618), indicating a potential lower support area if the price faces downward pressure.

Moreover, examining the RSI, the value stands at 61.91, reflecting a moderately bullish momentum without reaching overbought conditions. The sideways trend in the RSI, coupled with the absence of bullish or bearish divergence, suggests a consolidation phase with neither strong upward nor downward momentum. The RSI line’s positioning near the “long setup” level of 50 suggests potential dips could prompt buying interest around this level.

Lastly, the Volume Price Trend (VPT) line is similarly neutral, with a value of 738.27 million. It closely tracks its moving average of 731.36 million, reinforcing a sideways volume trend that aligns with the price’s lack of clear directional momentum.

yiazou.com

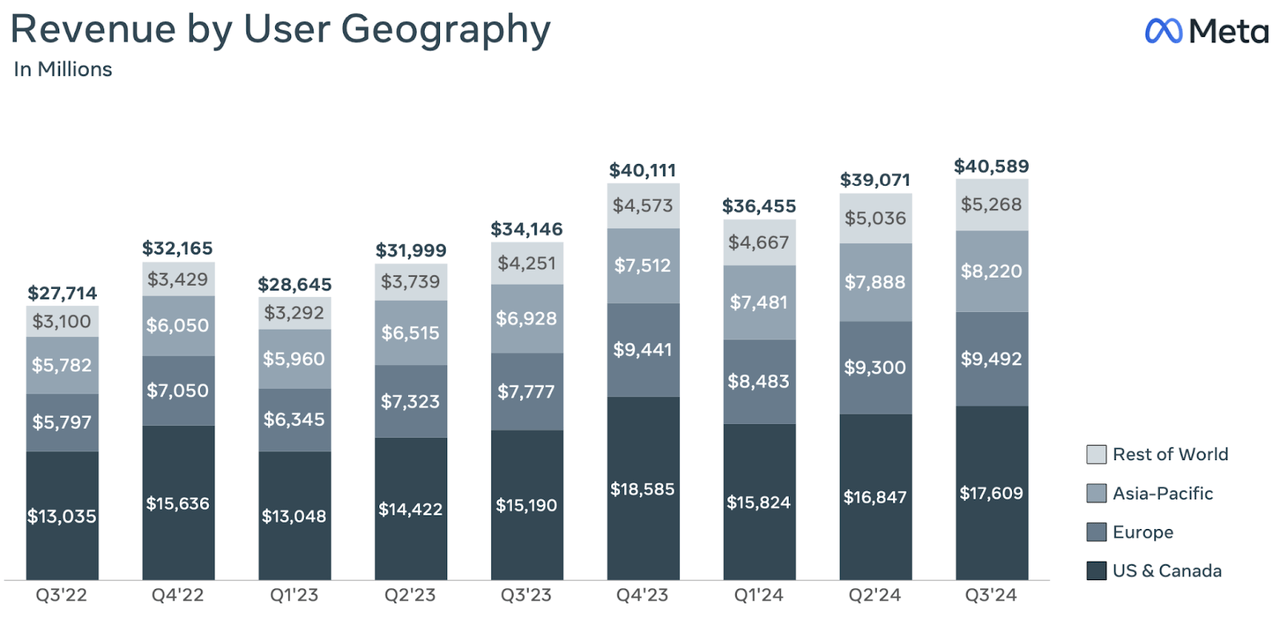

Revenue Growth Driven by Ad Business and Geographic Expansion

Meta’s core advertising business remains the foundation of its financial performance, generating $40.3 billion in revenue for the quarter—a 19% increase year-over-year (YoY). Advertising revenue is the most significant part of the Meta Family of Apps ((FoA)) segment. It has increased handsomely in Asia-Pacific and the Rest of the World, where ad impressions have gone through the roof. Both regions benefit from the spillover effects of Meta’s reach into mobile-first markets, where a swelling user base gives way to ad demand.

The U.S. and Canada are still Meta’s biggest revenue-generating markets, but growth here is softer due to market saturation. The company generated healthy gains from both Europe and the Rest of the World, in large part because of a better average price per ad and superior ad targeting. These regional results reflect Meta’s strategic focus on localizing content and improving ad relevancy, enabling the company to scale in emerging markets while sustaining commanding positions in mature ones.

Meta Earnings Presentation Q3 2024

Operational Efficiency and Cost Management

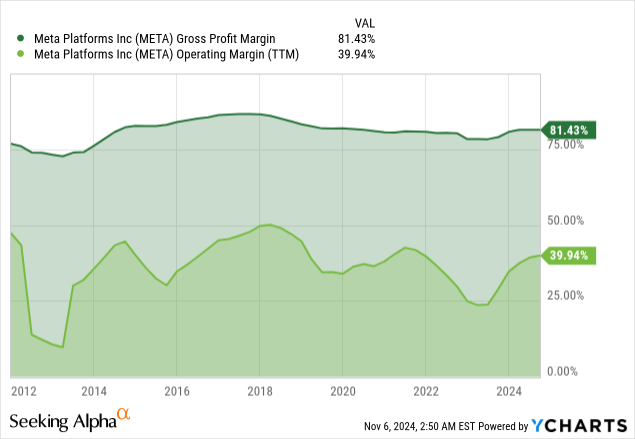

Meta’s work to control expenses has paid off, with a respectable operating margin of 43%, up from 40% one year ago. While overall expenses increased due to heavy investments in AI and Reality Labs, Meta did manage to reduce administration and general costs relative to revenue.

Nevertheless, research and development expenses remain high as the company invests in advanced AI infrastructure and projects for its Reality Labs. Offsetting those operating losses, the profitability of the FoA segment has helped underscore Meta’s commitment to balance innovation with fiscal discipline.

In sum, management has noted that capital expenditures for Q3 reached $9.2 billion, primarily invested in infrastructure to further AI-driven features across Meta’s platforms. So far, AI is proving to be a lucrative business, as the integral technology leads to better user engagements, personalization, and ad performance for all of Meta’s FoA.

Reality Labs: A Long-term Metaverse Bet

Reality Labs-Meta’s segment focused on virtual and augmented reality technology, an operating loss of 4.4 billion dollars for Q3 2024. Reality Labs generated a modest $270 million in revenue, a small fraction of Meta’s total earnings, highlighting the significant financial investment required to bring its metaverse vision to life.

CEO Mark Zuckerberg has continued to emphasize that Reality Labs is a long-term investment that will replace how people interact with friends, perform tasks, and conduct transactions virtually. However, near-term losses from Reality Labs will likely remain a drag, with the segment far from profitability.

The high development costs of the metaverse, including hardware, software, and content, reflect Meta’s ambition to establish a leading foothold in immersive technology. With Reality Labs, though immediate profitability is sacrificed, Meta is forging ahead to lead the next evolution in digital experiences.

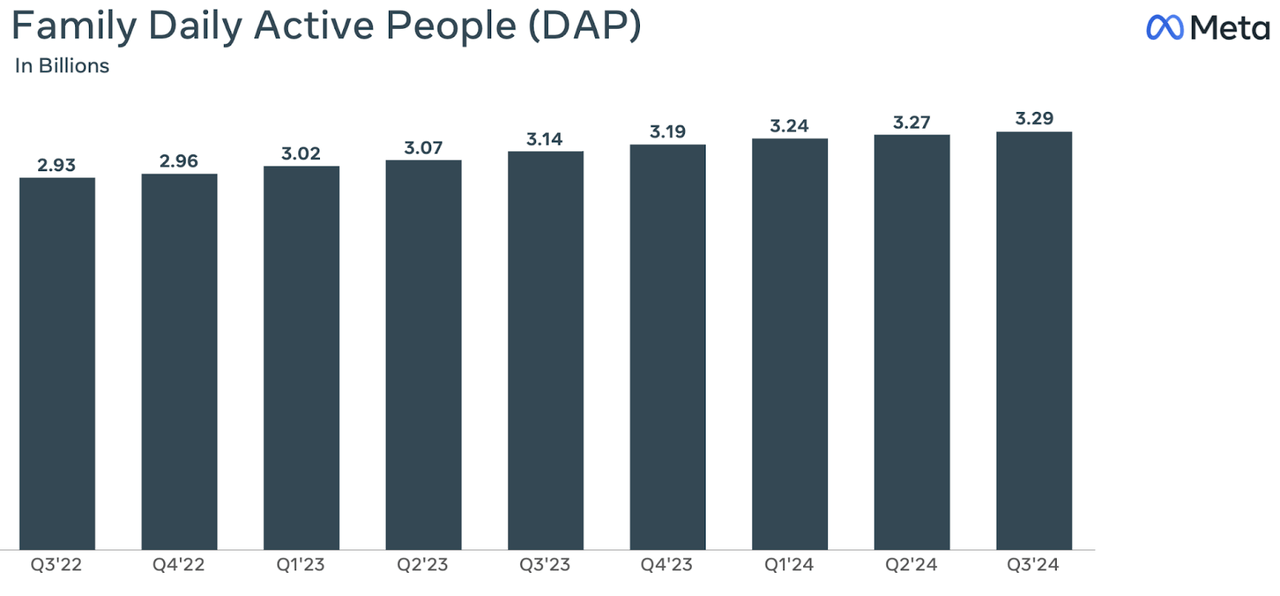

Meta’s AI Boosts Engagement: Record User Growth, Higher Revenue Per Person, and Strong Q4 Forecast

Meta’s commitment to user engagement saw impressive metrics in Q3, as Family Daily Active People (DAP) across its FoA reached 3.29 billion, up 5% YoY. The growth in DAP underlines the power of personalization driven by AI. As experiences become more relevant for each user, there is more interaction with the apps.

Average Revenue per Person (ARPP) also reached $12.29, showing that Meta could monetize its users more efficiently, as expected from high-value markets like the U.S. and Europe. Again, this monetization success is partly due to Meta’s strategic use of AI, which optimizes ad relevance and ensures higher ad impressions at competitive prices. AI has provided Meta with a far better understanding of user preferences, enabling the company to increase engagement and revenue per user.

Looking ahead, Meta predicts Q4 revenues of $45-48 billion, assuming continued ad impressions and pricing growth. That said, significant regulatory risks-relational, particularly around data privacy and AI oversight-threaten operational costs and revenue potential. Meta’s commitment to high-capital projects, such as Reality Labs, risks a squeeze on free cash flow if regulatory hurdles raise compliance costs.

CapEx in a Heavy Investment Era: Meta’s Strategic Push in AI Infrastructure Amid Broader Industry Trends

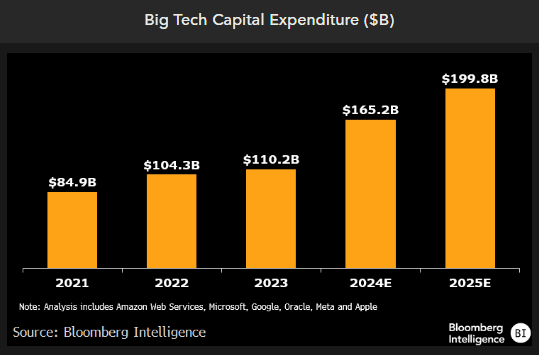

Meta’s capital expenditure push is part of a much larger wave of tech industry spending dedicated to scaling up generative AI infrastructure, with an estimated $200 billion CapEx in 2025. Companies like Microsoft (MSFT), Google (GOOG)(GOOGL), AWS (AMZN), and Meta are leading this surge, driven by the need to support advanced AI capabilities, data center expansion, and GPU acquisition to meet the growing demand for generative AI services.

For Meta, this surge represents a shift from its metaverse focus toward AI infrastructure. It aligns with broader trends in enterprise tech spending and aims to enhance user experience and ad relevance through sophisticated AI-driven insights.

Meta’s capital expenditures in 2024 are projected to be $38-40 billion, with a substantial portion allocated to building the infrastructure necessary for AI applications and cloud expansion. This aligns with industry-wide trends, as seen in Microsoft’s planned capital outlay of $53 billion for 2024 and $62 billion for 2025, primarily to support OpenAI workloads and cloud services. While Microsoft and Google lead in absolute spending, Meta’s investment reflects a strategic pivot toward AI-focused CapEx, with a back-end-weighted distribution across the year expected to accelerate infrastructure spending in 2025.

This level of spending highlights the high demand for generative AI solutions, suggesting that Meta is positioning itself alongside these cloud giants as a significant player in the AI infrastructure space. Meta’s investments in AI—specifically to support its models like Llama and Meta AI applications—allow it to serve advertisers better and enhance personalization, aligning AI with its revenue-generating core.

Bloomberg

Like its tech peers, most of Meta’s CapEx is likely tied to procuring GPUs, specialized hardware, and expanding or retrofitting data centers to support generative AI workloads. According to AWS’s data center estimates, building new data centers or retrofitting existing ones to accommodate AI hardware typically requires 18-24 months, underscoring the long-term nature of these investments. By focusing on large-scale data center expansions and securing GPU supplies, Meta can increase its AI models’ speed, efficiency, and capacity, a necessary step to keep up with surging AI-driven demands on its platforms.

Like other major tech players, Meta has been building its infrastructure and leasing computing capacity from smaller providers, offering the flexibility to adjust resources as demand fluctuates. This leasing strategy provides a buffer against the cyclical nature of tech demand, allowing Meta to scale without the full financial commitment of physical infrastructure should market conditions change.

Copilots and LLM Licensing as Emerging Revenue Streams

In addition to its advertising business, Meta could explore revenue from copilots and large language model (LLM) licensing. Like Microsoft’s GitHub Copilot and other similar tools, Meta has the potential to develop copilots that leverage its AI models for use cases ranging from business assistance to content generation.

These could be offered as subscription-based services or through usage fees, creating diversified revenue streams beyond ad sales. As AI becomes more embedded in user experiences, Meta’s investments could position it to compete in the expanding market of AI-based consumer and business applications, where it could potentially offer on-demand AI-driven insights, language support, and more.

In summary, Meta’s AI-focused CapEx reflects a broader trend of tech giants betting heavily on generative AI. By aligning its infrastructure investments with industry leaders, Meta establishes a robust foundation to capitalize on AI-driven growth opportunities in advertising and beyond. Its strategic focus on GPUs, data centers, and flexible infrastructure solutions speaks to a long-term commitment to AI and positions Meta to compete in an AI-first digital future.

Takeaway

Meta’s Q3 2024 results reflect strong revenue growth, improved operating margins, and strategic investments in AI and the metaverse. Despite high CapEx concerns, Meta’s operating efficiency has improved, with a target price of $625 within reach.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.