Summary:

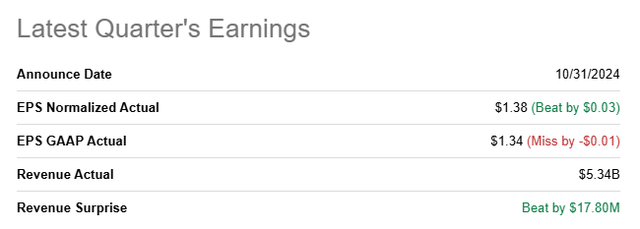

- Altria beat top and bottom line estimates for the third quarter last week, although by small margins.

- The tobacco firm continues to see strong momentum in shipment volumes for its alternative product categories.

- Altria confirmed its EPS guidance for FY 2024, which implies a 128% dividend coverage ratio.

- The shares of the tobacco company are trading above its historical valuation average P/E ratio of 9.0X, and I rate shares a hold.

krblokhin

Altria Group, Inc. (NYSE:MO) submitted a strong earnings report card for the third fiscal quarter last Thursday that showed continual strength in its alternative product portfolio. The tobacco company delivered solid results and managed to beat earnings expectations by $0.03 per share, causing shares to surge 8%. I believe Altria remains an attractive capital return play for investors, especially for those investors that hold the shares for purposes of recurring dividend income. Shares are likely fairly valued, but I like the company’s high dividend coverage ratio and am not prepared to give up a single share.

Previous rating

I rated shares of Altria a hold in August 2024 — 7.7% Yield, But Limited Upside — due to an expanding alternative products portfolio and incremental stock buybacks which were positive factors that were offset by a high valuation. Altria also raised its dividend to $1.02 per share (as I expected) which calculated a 4.1% dividend raise. In my opinion, Altria’s dividend is very well-supported by adjusted earnings and the company has very good dividend coverage. Given the strong increase in price after earnings, I continue to rate Altria as a hold.

Solid Q3 earnings, impressive dividend coverage, momentum in alternative product shipment volume

Altria managed to deliver a small EPS beat for its third fiscal quarter, due to strength in its non-tobacco segment: the firm submitted $1.38 per share in adjusted earnings for Q3’24 which surpassed the average prediction by $0.03 per share. The top line came in at $5.34B which beat the Wall Street estimate by $18M.

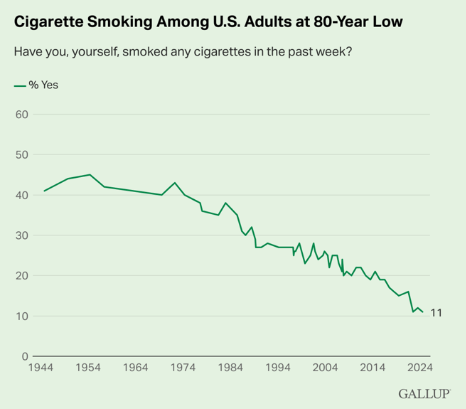

Altria faces considerable challenges in its core market of traditional tobacco products. Cigarette consumption hit a new 80-year low in 2024 which forces tobacco companies to innovate and invest in new products that have higher adoption rates.

Gallup

Because of this trend in declining cigarette shipment volumes, Altria saw a sequential decline in its top line in the third fiscal quarter: in Q3’24, the tobacco company generated $6.3B in net revenue, showing a slight decline of 0.4% year-over-year. While the top line trended down, the picture is not bleak as Altria’s weakness in traditional tobacco products was compensated for by an increase in sales in non-traditional product categories, such as electronic cigarettes or oral tobacco products. Altria generated respectable Q3 adjusted earnings, which were up 7.8% year-over-year to $1.38 per share.

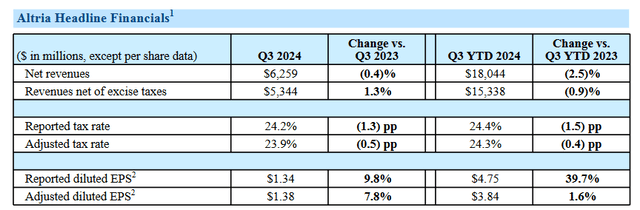

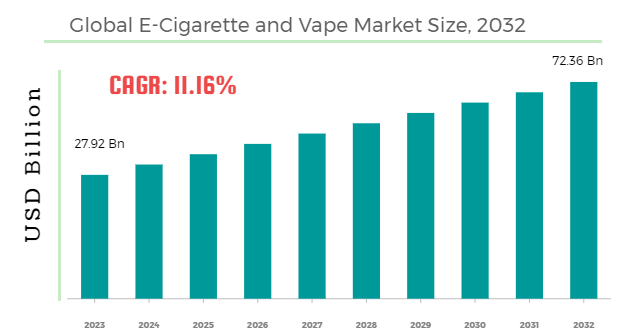

Altria is seeing continual momentum in its non-traditional segments, especially its electronic cigarettes. This momentum, at least in part, is driven by a contraction in the total addressable market for smokers in Western countries and the emergence of new products, like electronic cigarettes, vapes, and heated tobacco products. This non-traditional category is doing really well for Altria: NJOY is a brand that sells electronic cigarettes and vape products which are especially attractive to a younger demographic. In the third quarter, Altria saw its NJOY shipment volumes grow 22% (both devices and content) year-over-year.

Vape products are especially popular with younger users and are seeing growing product uptake. The market for e-cigarettes is also projected to grow continuously over the next decade, at an average annual rate of 11.2%, which creates favorable demand drivers for Altria’s NJOY product portfolio. I believe that e-cigarettes are the most attractive growth opportunity for traditional tobacco companies and I expect Altria to execute well here through product expansion as well as entry into new markets.

FandFResearch

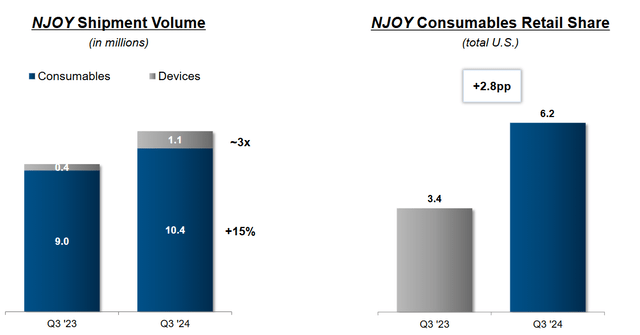

Altria’s oral tobacco brand, on! is also doing quite well and growing significantly faster than the market. Oral tobacco products have been growing in popularity just like electronic cigarettes have in recent years, and other tobacco companies are also seeing positive momentum here: Philip Morris benefited from robust shipment growth for ZYN. ZYN is also an oral tobacco product and is seeing solid product uptake, especially in the U.S. In the third quarter, Altria’s on! shipments surged 46% year-over-year to 41.9M cans.

Capital return potential

Since Altria’s shares are mainly attractive because of their dividend, we need to look at the company’s dividend coverage ratio to determine how safe the dividend is. Last week, Altria confirmed its guidance for FY 2024 adjusted diluted EPS which is expected to fall into a range of $5.07 to $5.15 per share. With Altria paying $4.00 per share in dividends this year, the tobacco company has a full-year dividend coverage ratio of 128% compared to 120% for Philip Morris. Further, Altria’s dividend is growing which makes MO a capital return play for investors.

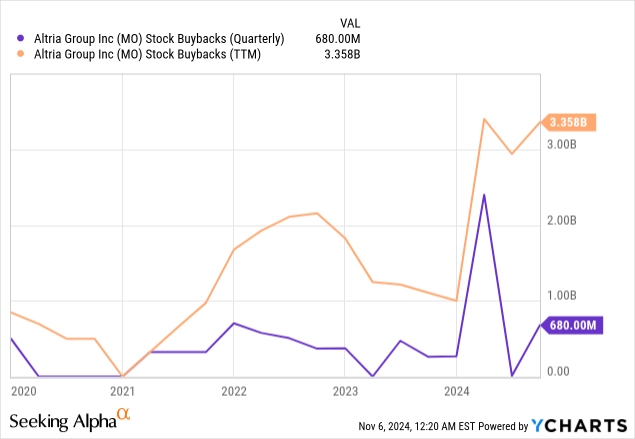

Altria is also buying back more shares which is another lever the company could pull in order to return more cash to shareholders. In the most recent quarter, Altria repurchased $680M worth of its own shares. The tobacco firm has accelerated its stock buybacks lately and repurchased $3.36B of its shares in the last year. Altria had $310M of its stock buyback authorization of $3.4B outstanding as of the end of September and I would expect the company to announce a new stock buyback plan in the neighborhood of $3-4B in the near future.

Altria’s valuation

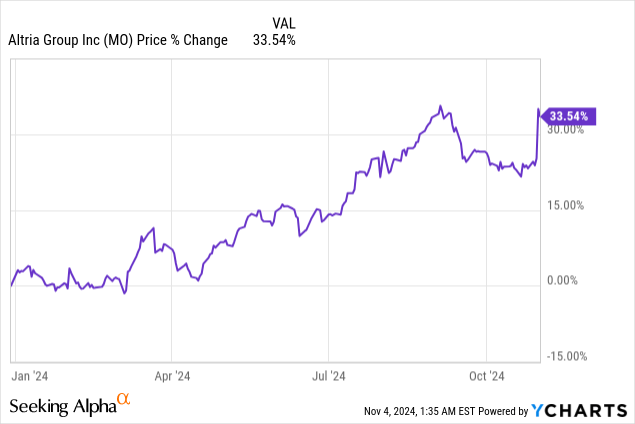

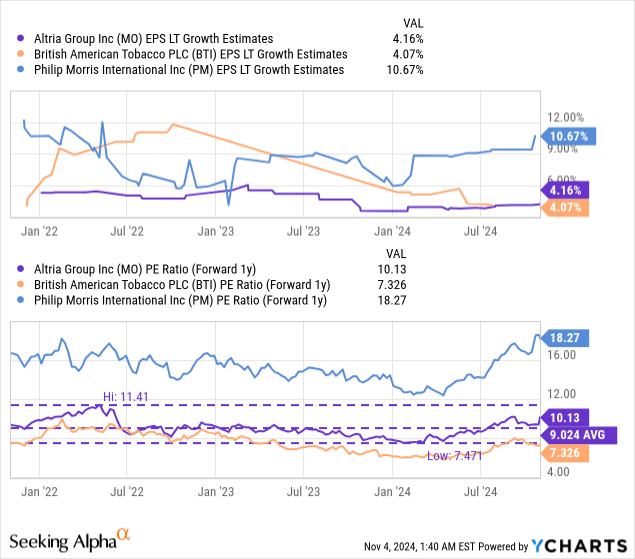

Shares of Altria have revalued 34% higher in FY 2024 and surged after Q3’24 earnings. Altria’s shares are priced at a FY 2025 P/E ratio of 10X which is about 12% above the company’s historical valuation average. British American Tobacco p.l.c. (BTI) is valued at a price-to-earnings ratio, also based on next year’s consensus earnings, of 7.3X while Philips Morris has the highest forward P/E ratio of 18.3X.

Philip Morris is focused chiefly on emerging markets which is why the company is also expected to grow the fastest: PM’s long-term estimates for annual EPS growth are about 2.6X higher than estimates for either Altria or BTI. From a mere valuation and yield perspective, I believe British American Tobacco is by far the most attractive tobacco stock for investors to own right now.

In my last work on Altria, I calculated a fair value of $49, based on the historical valuation average of ~9.2X P/E. Currently, EPS consensus estimates for FY 2025 stand at $5.32 per share and a 9.2X fair value multiplier continues to translate to a $49 per share stock price target. Therefore, I am not revising my fair value estimate for Altria after Q3’24 earnings and may buy more shares of Altria below this stock price target.

Risks with Altria

The biggest risk for Altria is a slowdown in sales in the important non-traditional product segments that include electronic cigarettes and oral tobacco products as they are critical in offsetting weakness in the traditional tobacco segment. What would change my mind about Altria is if the tobacco company saw a serious slowdown in its shipment volumes for NJOY or on!-branded products or if it were to suffer a deterioration in its dividend coverage ratio.

Final thoughts

All the noise about falling cigarette shipment volumes and a contraction of the traditional tobacco market aside, Altria still delivers impressive financial results. The company is seeing some real momentum in its non-traditional product categories. While I am not a buyer at this valuation level, I believe the tobacco company is a solid hold for investors that look for attractive capital return potential. Investors now receive $4.08 per share annually and the dividend will continue to grow. In my opinion, Altria’s dividend is about as safe as it gets with a dividend coverage ratio of 128%. With the dividend being as safe as it is, holding on to every single share I have really is a no-brainer.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO, BTI, PM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.