Summary:

- My 10-year valuation model indicates Microsoft could be 40% undervalued with a sustained 15% revenue CAGR and moderate EBITDA margin expansion.

- Q1 revenue from Microsoft Cloud grew 22% and Azure by 33%, driven by AI. Management’s capex in AI offers future ROI, supporting a $10B AI revenue run rate by Q2.

- Satya Nadella’s AI focus, cloud-first strategy, and 100+ acquisitions are crucial to MSFT’s growth. His continuity is vital; a leadership change could threaten Microsoft’s long-term gains.

wacomka/iStock via Getty Images

In my Q1 earnings preview analysis of Microsoft (NASDAQ:MSFT), I outlined a 12-month price target of $480. Since that analysis, the stock has declined by approximately 1.8% in price—though this will be of little concern to long-term investors who are regularly buying Microsoft stock at fair valuations for its robust and consistent free cash flow generation and reliable global technology leadership.

In this Q1 earnings review, I outline a more comprehensive 10-year valuation model for Microsoft, which indicates that the company could be significantly undervalued at present if it continues to achieve aggressive growth rates and expands its margins over the period. Even in my conservative sensitivity analysis, the stock is fairly valued. Given this outlook, I rate Microsoft stock as a Strong Buy.

Q1 Earnings Review: Leading the World in AI

Before we review the main points at hand—AI, Azure, & capital expenditures—let’s quickly recap the headline data from the Q1 report. The company beat the consensus normalized EPS estimate by $0.20 and beat the consensus revenue estimate by $1.03 billion. This is not surprising, given that the company has surpassed consensus estimates for the past five consecutive quarters.

In the Q1 earnings call, management highlighted particular strength in its AI-led segments, with its Microsoft Cloud revenue growing by 22% year-over-year and its Azure revenue growing by 33% year-over-year. Management mentioned that Microsoft’s AI business is on track to reach a $10 billion annual revenue run rate by Q2—this provides a lot of solace for the fact that the company spent $20 billion on capital expenditures in Q1 to meet cloud and AI demands. Thankfully, half of this spending goes towards long-lived assets, supporting monetization over the next 15 years. As I mentioned in my previous analysis, Microsoft’s ROI from its AI capital expenditures is quite clear now; it will just take some time to manifest.

The company also continues to grow its AI-driven Copilot offerings, which has supported M365 commercial cloud revenue to increase by 15%; moreover, Dynamics 365 grew by 18%. Most significantly, GitHub Copilot’s enterprise customers grew by 55% quarter-over-quarter, expanding Microsoft’s developer engagement. The Copilot suite now includes tools for the entire developer workflow.

Despite the markets being heavily oriented toward AI right now, Microsoft has managed to continue to drive growth across its other operating segments as well. For example, its Gaming segment increased by 43%, driven by high engagement with Xbox Game Pass and the record launch of ‘Call of Duty: Black Ops 6’—this growth has been significantly supported by the company’s acquisition of Activision Blizzard King. Microsoft’s gaming portfolio now includes Call of Duty, World of Warcraft, Diablo, and Overwatch, making it definitively the highest-value gaming portfolio in the world.

We have a lot to be excited about here operationally that management outlined in Q1. The conglomerate is so well-positioned in each of its diversified segments that a portfolio without the stock is arguably lacking an opportunity for alpha, relative recession resistance, and long-term revenue visibility. Bookings for Azure and M365 are currently ahead of expectations, with multiple contracts valued at over $100 million for Azure and large enterprise agreements for M365.

Regarding future guidance, management expects Q2 revenue to grow 18% to 20% in the Intelligent Cloud segment and 10% to 11% in Productivity and Business Processes. The consensus Q2 revenue estimate is $69 billion, with my estimate slightly higher, at $69.5 billion, due to AI tailwinds and short-term macroeconomic strength likely to accrue, especially post-election. I estimate the company will deliver $280 billion in full-year 2025 revenue.

Valuation Analysis: Fairly Valued and Worth Buying

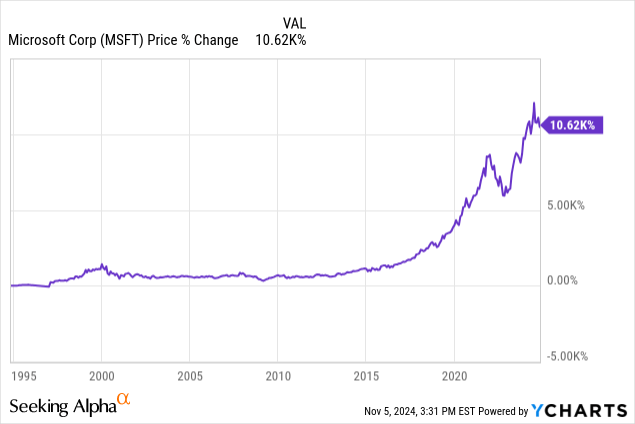

Microsoft is undeniably a portfolio holding worth owning for many decades. Indeed, if one were to have bought Microsoft stock 30 years ago, they would now be sitting on a 10,620% price return.

As the company has a robust history of revenue CAGR expansion, from 13% as a 10-year annual rate to 16.4% in the last trailing 12 months (‘TTM’), I am optimistically estimating that the company will achieve a 15% revenue CAGR over the next decade, given the limitations from how saturated the company’s core markets now are (despite the advent of AI). Starting with TTM revenue of $254.19 billion, this will therefore increase to $1.028 trillion by November 2034.

Considering that Microsoft has a TTM EBITDA margin of 53.72%, and this has been expanding over time, I anticipate an EBITDA margin of 60% in 2034—given the efficiency gains the company is likely to achieve from automation with AI and robotics in the next decade. Therefore, my November 2034 EBITDA estimate is $616.8 billion.

The company’s 10-year median EV-to-EBITDA ratio is 17.4, but its five-year average is 23.2. The median of these two figures is 20.3, which is the terminal multiple I will be using in my discounted EBITDA model.

Therefore, my November 2034 enterprise value estimate for Microsoft is $12.52 trillion. The company’s current enterprise value is $3.06 trillion, so this indicates a 309% upside potential.

For my discounted present-day intrinsic value estimate, I will be using the company’s weighted average cost of capital (‘WACC’) as the discount rate. Microsoft’s WACC is 9.92%, based on a 97.57% equity weight with a cost of 10.08% and a 2.43% debt weight with a cost of 3.92%, adjusted for an 18.29% tax rate.

Discounting my November 2034 enterprise value estimate for Microsoft of $12.52 trillion back to the present day at a discount rate of 9.92% gives an intrinsic enterprise value of $4.86 trillion. This indicates a 37% margin of safety against the current enterprise value of $3.06 trillion. Therefore, Microsoft is a Strong Buy.

Risks Analysis: Nadella Is Key to Growth

Satya Nadella has been incredibly instrumental to Microsoft’s rise. When Nadella took over as CEO of the company in February 2014, it had a market cap of approximately $381 billion. Under his leadership, the valuation surged to $3 trillion by 2024. Nadella has made pivotal investments in AI, opting for a “cloud-first” strategy and leading the multi-billion investment in OpenAI through 2019 and 2023. Nadella has overseen more than 100 acquisitions, including LinkedIn ($26 billion), GitHub ($7.5 billion), and Activision Blizzard ($75 billion). Therefore, I consider one of the greatest risks to the long-term investment thesis to be who will replace Nadella if and when he eventually decides to step down. As fast as he has made the company grow, with the wrong management replacing him and his close executive team, the company’s market cap could deteriorate just as quickly.

Thankfully, for now, Nadella appears to be deeply engaged in leading Microsoft through its next phase of growth—it certainly would be counterproductive to both Nadella’s fortune and that of the company for the visionary leader to step down from his position at this nascent stage of AI. Based on my research and analysis, the CEO is unlikely to step down from the company in the next five to 10 years, providing further robustness to my discounted EBITDA model, which contains high-growth convictions, largely supported by continued AI accretion under the current management’s direction.

That said, for sensitivity analysis, we may consider how appealing Microsoft is if it achieves a revenue CAGR of just 12.5% over the next decade and a terminal EBITDA margin of 55%. Its terminal EBITDA value would be $453.99 billion. At a terminal EV-to-EBITDA multiple of 17.4 (its 10-year median), the company’s 2034 enterprise value would be $7.9 trillion. If we discount this back to present-day value at its WACC of 9.92%, the company’s present intrinsic enterprise value is $3.07 trillion. With the company’s current enterprise value of $3.06 trillion, this indicates that it is fairly valued. Therefore, even under conservative standards, Microsoft stock is a Buy.

Conclusion: Strong Buy

There are very few companies I feel comfortable owning at a large weight in my portfolio in the technology industry. However, Microsoft is one of them. The other company of note is Google (GOOGL), but Microsoft is currently leading in AI by comparison.

Given my discounted EBITDA model with high-growth rates and margin expansion indicating a 40% undervaluation at present, if Microsoft aggressively consolidates its position in AI, the stock is a Strong Buy. However, the company needs to maintain good management and keep Nadella as CEO for as long as it can.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.