Summary:

- RIVN may potentially see more retracements ahead, with the projected terminal rates of over 5% and 70% chance of a recession in 2023.

- The automaker’s margin remains compressed with hindered production output, due to its reduced manufacturing efficiency and outsourcing strategy.

- With an uncertain macroeconomic outlook, I think RIVN may need to raise more equity financing by potentially diluting shareholders once its cash runs out, most likely by 2025.

zhudifeng/iStock via Getty Images

The RIVN Investment Thesis Is Too Speculative In Current Market Conditions

As a testament to its historical performance, early investors such as Amazon (AMZN) and Ford (F) have lost approximately -80.7% and -90.2% of their investments in Rivian Automotive (NASDAQ:RIVN) thus far, down to $5.2B and $1B of carrying values by the latest quarter. This is drastically lower, indeed, from the original IPO valuations of $27B and $10.3B, respectively.

At the time of writing, RIVN lost another -55.3% of its value over the last three months, similarly declining by -53.9% in its P/E valuations at the same time. This may result in further impairments on AMZN and F’s FQ4’22 balance sheets as well.

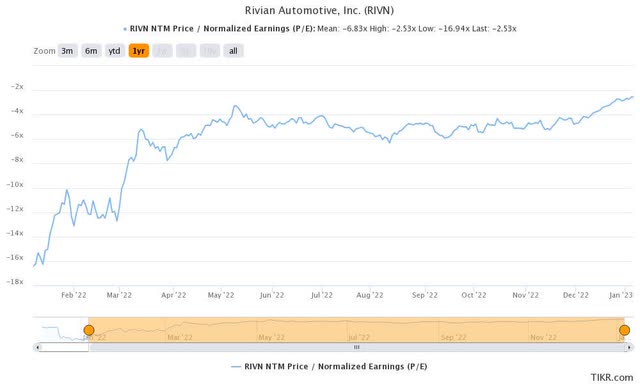

RIVN 1Y P/E Valuations

RIVN is currently trading at a NTM P/E of -2.53x, drastically lower than its all-time peak of -19.95x and 1Y mean of -6.83x. Due to its lack of meaningful profitability through FY2026, it is naturally hard to place a price target on the stock. Market analysts remain optimistic about RIVN’s eventual recovery, with a price target of $46.86, suggesting a tremendous 185.73% upside potential from current levels.

However, we choose to be more bearish here, since the macroeconomic environment does not look promising in the intermediate term. The Fed’s meeting minutes suggest a terminal rate of over 5%, with market analysts pessimistically projecting a 70% chance of a recession in 2023.

The situation is further worsened by RIVN’s R1T expensive starting price of $73K before incentives as of December 2022, with the premium package costing over $100K. While those prices may have worked during the heights of auto demand in 2021, things are different at a time of tightened discretionary spending. In addition, the consumer index for new truck sales has been decelerating to 0.1% by November 2022, against 0.6% in September. Moreover, trucks had to remain below $80K to qualify for the $7.5K IRA EV tax credit, suggesting moderate headwinds to truck consumer demand.

While it is not reflective of the market situation in the US, even Tesla (TSLA) had to offer further discounts by up to -24% for Model Y and Model 3 in China, Japan, South Korea, and Australia. This is likely attributed to the unexpectedly lower demand against Shanghai’s increased output. The automaker also offered a rare -$7.5K discount and free 10K miles of supercharging for American buyers in December 2022, presumably attributed to growing inventory and reduced backorders. With the TSLA CEO expressing concerns about lower profit in light of sustained volume growth, it is no wonder that the whole EV industry has been tremendously impacted since December 2022.

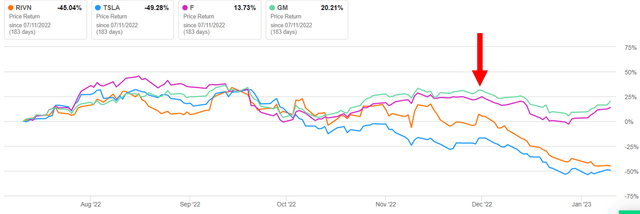

RIVN, TSLA, F, and GM 6M Stock Prices

RIVN has subsequently plunged by another -48.6% and TSLA by -38.9% since early December 2022, suggesting peak pessimism levels for the automakers. On the other hand, Ford and General Motors (GM) have moderately recovered by 17.2% and 14.1% at the time of writing, despite similarly declining by -22.2% and -19.7% by end-December. These may be attributed to their excellent December deliveries, allaying market analysts’ concern about demand destruction.

As America’s best-selling truck for the 46th consecutive year, the F-150 model continues to be in high demand, and Ford raised production output of the electric F-150 by 960.4% to 150K in FY2023. The growing backlog of 200K vehicles mildly suggests F’s ability to eat RIVN’s lunch moving forward. This is significantly worsened by the latter’s inability to ramp up production against the management’s original guidance of 25K, leading to the delivery miss for FY2022.

In addition, the likelihood of RIVN improving its profit margins or profitability is relatively slim in the near term. This is because the company relies on third-party manufacturers for critical components, such as semiconductor chips, battery cells, electric motors, and commercial software, among others. While this strategy has reduced its immediate capital expenditures, it has also placed the company at the mercy of its partners and suppliers as inflationary and margin pressures rise. Notably, the management reported a lack of long-term supply agreements with key suppliers and manufacturers in its latest quarterly earnings report, triggering further headwinds in its forward execution.

This may be why RIVN vehicles needed to be priced much higher to break even, with market analysts projecting an average cost of $220K per vehicle triggering a massive loss of -$139K per unit in the latest quarter. However, with the rising inflationary pressure impacting big-ticket spending, it is no wonder that the company had to backtrack on EV price increases, to retain existing customers.

Combined with the lack of manufacturing scale and efficiency, RIVN naturally records a much higher cost of goods sold, with gross margins of -171.1% and EBIT margins of -331% in FQ3’22. The company also reported elevated Stock-Based Compensation at $1.42B over the last twelve months, triggering further headwinds in its operating income. GM has fared better, with automotive gross margins of 12.9% and automotive EBIT margins of 6.5% in the latest quarter. TSLA naturally reigned supreme with 26.3% and 16.8%, respectively. Consequently, it is painfully apparent that RIVN’s margin and manufacturing performance are comparatively lacking, compared to accomplished automakers with greater technical and financial resources.

While the RIVN management has guided sufficient capital for operating expenses through 2025, market analysts are less optimistic. Particularly after pausing its joint venture with Mercedes-Benz Vans to focus on positive cash flow in the US. While the cash/equivalents remained robust at $13.2B in FQ3’22, its current cash burn is unsustainable at $1.6B per quarter. Therefore, I think the company may need to raise more capital through stock sales likely by 2025, potentially diluting shareholders then.

While RIVN has also impressed with a 16.3% increase in reservations to 114K in FQ3’22 and 37.8% in quarterly output to 10.2K in FQ4’22, it remains to be seen how the stock will perform moving forward due to the factors mentioned above. Therefore, we continue to rate the RIVN stock as a Hold. Interested investors would be well advised to wait a little longer, since the stock may still underperform in H1’23. This dip is not worth buying yet.

Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.