Summary:

- I initiate Snowflake (SNOW) coverage with a Strong Buy rating due to its strong revenue growth potential and compelling value proposition despite recent share price plunge.

- Snowflake’s unique consumption-based business model, cloud-based platform, and strong R&D focus position it well to capture AI and ML tailwinds.

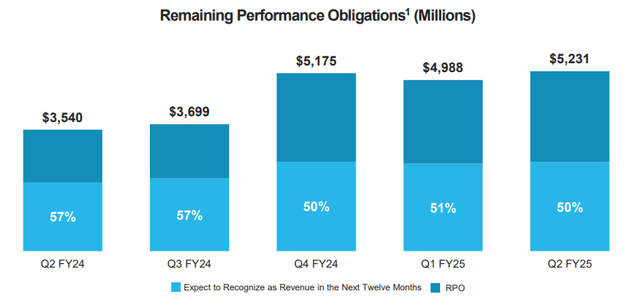

- Key metrics like a 127% net revenue retention rate and $5.2 billion in remaining performance obligations indicate high customer satisfaction and strong revenue growth potential.

- Despite a 41% YTD share price decline and intense competition, Snowflake’s strong fundamentals and management’s aggressive growth strategy make it a promising investment.

dolgachov/iStock via Getty Images

My thesis

I initiate Snowflake (NYSE:SNOW) coverage with a Strong Buy rating. Several key factors indicate that SNOW is positioned well to deliver strong revenue growth over the long-term. Stagnating profitability over the last few quarters does not look bad as the company invests aggressively in growth to make it already compelling value proposition even more compelling. The stock looks conservatively valued, especially after the big YTD drawdown.

SNOW stock analysis

Snowflake is a cloud-based data warehousing and analytics provider. It provides an ecosystem where enterprises can bring together and visualize data from disparate sources. The company’s unique strength is in being able to fuse data together into an analytics-ready ecosystem. This adds value to the customer by enabling businesses to make data-driven decisions. The Snowflake Platform supports structured, semi-structured, and unstructured data.

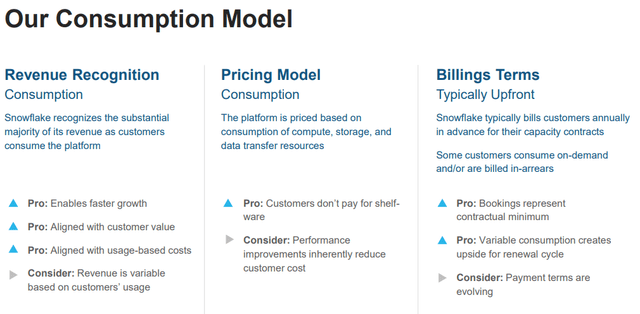

Snowflake’s presentation

Another aspect that makes SNOW unique is its consumption-based business model. This approach differs from the traditional subscription model because customers only pay for what they consume, which is flexible and could reduce costs. Moreover, Snowflake’s platform is cloud-based. This strategy offers scalability and interoperability across Amazon Web Services (AMZN), Microsoft (MSFT) Azure, and Google (GOOGL) Cloud Platform.

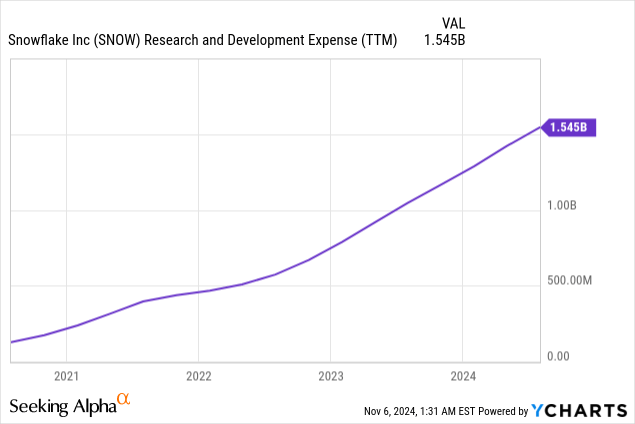

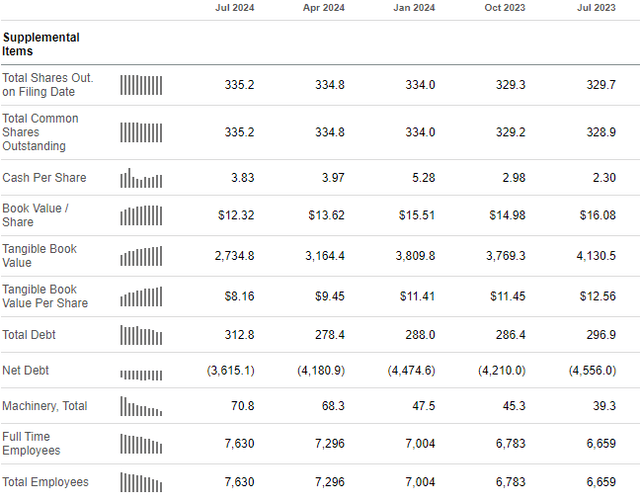

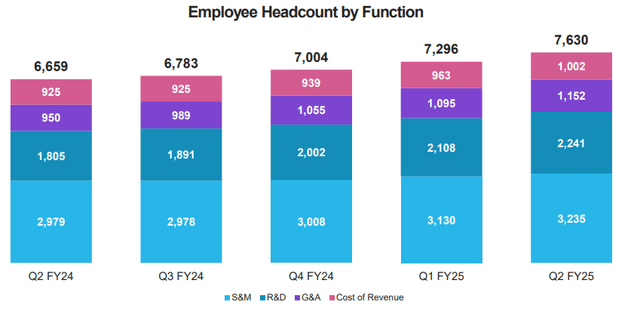

The company’s emphasis on innovation, particularly in areas like AI and ML, positions it well to capture secular tailwinds. Snowflake’s R&D budget has been expanding rapidly by tripling over the last three years, and the company is in a solid financial position to remain aggressive in its innovation endeavors. SNOW does not only possess a solid $3.6 billion net cash position, but also delivers positive free cash flow (FCF) margin.

Seeking Alpha

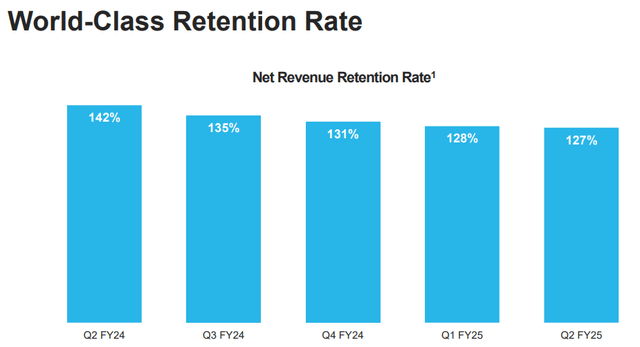

I think that multiple business metrics clearly indicates that Snowflake’s value proposition is compelling for customers. Readers can get acquainted with the detailed data in the latest earnings presentation, and I want to highlight the most crucial of them. A 127% net revenue retention rate is a strong indication of high customer satisfaction. The downtrend which is seen below is natural as the company’s operations expand and revenue increases.

Snowflake’s presentation

Solid growth in the remaining performance obligations metric (RPO) is also a crucial indication of Snowflake’s ability to sell its services to customers. As of the end of the last quarter, SNOW had $5.2 billion in RPO. This is around 65% higher compared to the TTM revenue and indicates that there is a strong near-term revenue growth potential.

Snowflake’s presentation

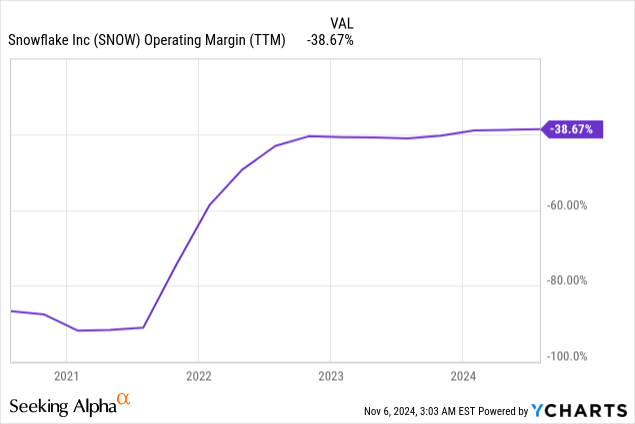

The company’s operating margin has improved significantly over the last five years. Investors might consider the stagnation between 2023 and 2024 as a red flag, but I disagree. In one of the above charts, we saw that SNOW has ramped up R&D spending significantly over the last few years, which is certainly a headwind for the operating margin. But the company invests in the future to make its compelling value proposition even more attractive for customers.

While lots of tech companies were cutting their staff, SNOW has been hiring. The headcount grew by around a thousand over the last five quarters, which indicates the management’s confidence in SNOW’s ability to drive more growth and innovation. I think that such an aggressive approach of the management is sound given strong AI tailwinds.

Snowflake’s presentation

To wrap up, SNOW looks like a very interesting company. The business expands rapidly, and the management appears very confident in the company’s near-term growth prospects. Two key metrics indicate high customer satisfaction and strong revenue pipeline.

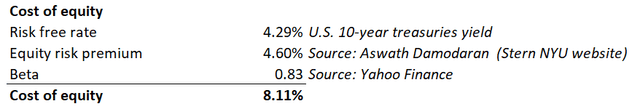

Intrinsic value calculation

Snowflake’s total debt is just $312 million, which makes the WACC calculation useless for this company. The company mostly relies on equity, meaning that the cost of equity should be the discount rate for my DCF model. The cost of equity is 8.11%, which is calculated in the below working.

DT Invest

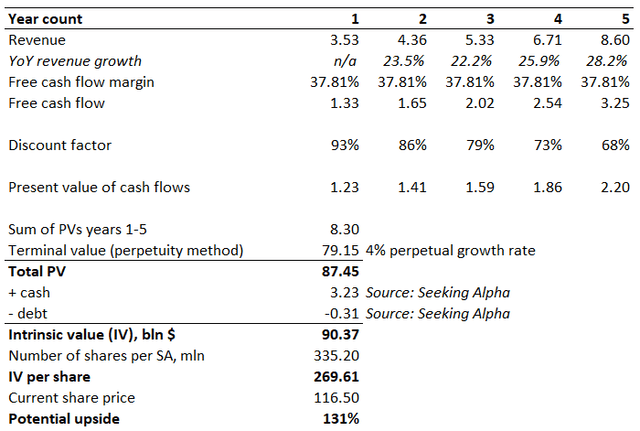

For an aggressive innovator like SNOW with AI exposure, I believe that a 4% perpetual growth rate is a sound choice. The revenue growth trajectory for years 1-5 relies on consensus estimates. The levered TTM FCF margin is 37.81%. The FCF margin is already high, and incorporating further expansion might be too optimistic. Therefore, I leave it flat for the entire horizon.

DT Invest

The intrinsic value per share is 131% higher than the last close. The upside potential looks too good to be true, to be honest. The reason behind such a big gap is due to the FCF margin assumption. According to the cash flow statement, SNOW’s TTM stock-based compensation is $1.3 billion while the levered FCF is $1.2 billion. With that being said, SNOW’s FCF is slightly negative if we do not add back the stock-based compensation.

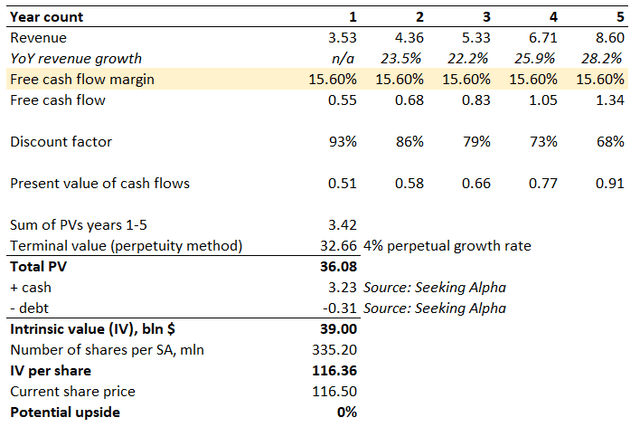

It is quite difficult to forecast how the SBC will behave over the long-term, but I can test another scenario to understand the average FCF margin the market factors in.

DT Invest

With the same consensus-based revenue projections for years 1-5 and a 4% perpetual growth rate, it looks like the market factors in a 15.6% average FCF margin. The level does not look unrealistic, especially if we look at the below EPS growth projections from consensus.

Seeking Alpha

Therefore, I consider a 15.6% FCF margin priced in by the market to be prudent. I do not give my target price due to high unpredictability of swings in the SBC, but I believe that the stock is not overvalued.

What can go wrong with my thesis?

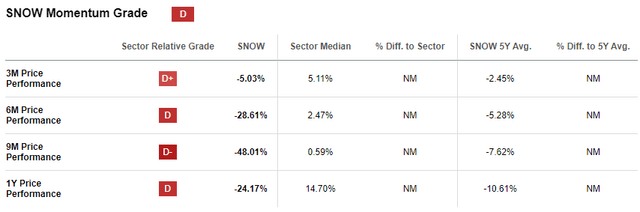

The stock does not perform well so far in 2024. The YTD share price decline is 41%, and the momentum is quite weak. The stock price soared to around $387 in late 2020, and now is several times cheaper. It appears that the stock market is disappointed in the stock and only a massive catalyst can break the unfavorable trend. The company’s earnings surprise history has been almost perfect over the last several quarters, but beating consensus estimates was not enough to spur a sustainable rally. Therefore, it might take several quarters before confidence about SNOW returns to investors.

Seeking Alpha

The weak sentiment surrounding the stock might also be attributed to significant competition risks. Snowflake’s competitive landscape is marked by intense rivalry with other cloud data warehousing solutions, including Amazon Redshift, Google BigQuery, and Microsoft Azure Synapse. It is clear that Snowflake’s financial and brand strength does not match that of these tech giants. While Snowflake aims to differentiate itself by focusing on ease of use, performance, and its ability to handle diverse data types, the competition with these three cloud giants remains an ‘elephant in the room’.

Summary

SNOW is a promising business with a compelling value proposition for its customers. Strong RPO and retention metrics indicate that SNOW is well-positioned to deliver solid revenue growth over the next few years. From a secular perspective, it is certain that the management is working really hard to further differentiate the company.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SNOW, over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.