Summary:

- Amid market optimism, I recommend rotating into value-oriented stocks like eBay, which has shown strong Q3 results and a promising outlook.

- eBay’s Q3 earnings revealed a re-acceleration in GMV and revenue, boosting my confidence in its short-term potential and leading me to rate it a buy.

- Despite GMV and revenue accelerating in Q3, and the company guiding to continued GMV acceleration in Q4, shares of eBay slid post-earnings, creating a well-timed buying opportunity.

- The stock continues to trade at a <12x forward P/E. In my view, it should be able to re-rate upward to 14-15x in a short/medium-term window for ~20% gains.

Prykhodov

Amid enthusiasm for strong Q3 earnings and the ability of the U.S. macroeconomy to move successfully past the U.S. election, the S&P 500 (SP500) sits near all-time highs and historic valuation levels again. Optimism is the order of the day in the markets, leaving very little room for caution. In my view, however, it has become far more pressing now for investors to deploy more conservative portfolio management and rotate into more value-oriented names.

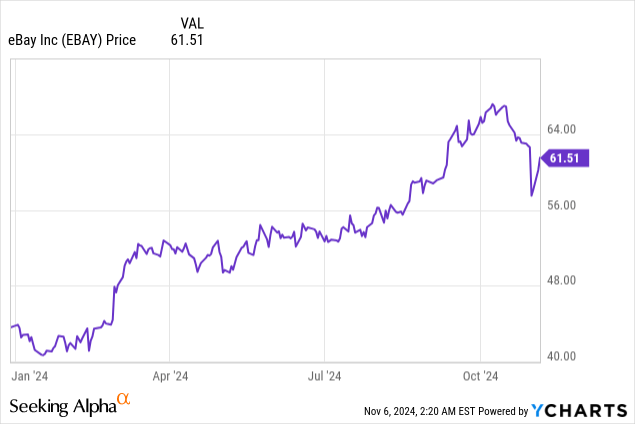

In particular, I favor stocks that have fallen out of the spotlight, but are regaining their footholds: and eBay Inc. (NASDAQ:EBAY) is one strong example here. The auction site has delivered strong Q3 results that featured a re-acceleration in both GMV and revenue, and is pointing to further strength ahead. Year to date, eBay has gained ~40% year to date, its rebound topping the S&P 500: though the stock has dipped somewhat after releasing Q3 results. This, in my view, has finally become an entry point in this stock.

I last wrote a bullish note on eBay in July, when the stock was still trading in the mid-$50s. Since then, I’ve become far more confident in the stock following its Q3 earnings print, which showed strength in GMV in both the U.S. and international segments. On top of double-digit earnings growth, I’m feeling more confident in eBay’s ability to deliver strong gains, alongside a decent dividend of just under 2%. As a result, I’m boosting my rating on eBay to a buy.

This being said, my optimism on eBay is more short-term oriented. I’m betting on a near-term reversion in its valuation multiple and to sell with 10-20% gains (especially as the company is currently ~15% away from YTD highs just shy of $70). Value is the core reason to remain invested here. Currently, Wall Street analysts are expecting eBay to generate $10.6 billion in revenue next year (+3% y/y) and $5.22 of pro forma EPS (+8% y/y), pitching the stock’s valuation at 11.8x FY25 P/E: which is nearly at half of where the S&P 500 is standing. My position is to buy eBay here and wait for an upswing to a 14-15x P/E multiple ($73-$78), and cash out.

Outside of valuation, here are the fundamental reasons to be bullish on eBay:

- Consistent profit growth. The company’s focus on streamlining costs, divesting underperforming divisions, and boosting tertiary revenue sources like advertising have helped eBay expand its operating margins and grow its bottom line faster than its GMV and revenue.

- Focus categories. eBay is no longer trying to be everything for everyone. Focusing its advertising on niche categories like auto parts and collectibles has proven to be a successful strategy for eBay. It may no longer be a world-encompassing e-commerce play like Amazon, but it at least has a defensible moat around these categories.

At the same time, however, we can never lose sight of the company’s longer-term risks, which is why I’m not comfortable holding on to eBay for the long haul:

- eBay’s utility beyond its focus categories is limited, and GMV growth is likely to remain tepid in perpetuity. We don’t really buy items via auction when Amazon (AMZN) is omnipresent nowadays. eBay’s survival rests on its ability to maintain interest in its specialized categories of auto parts and collectibles: which makes it more of a niche retailer with a more capped TAM.

- Macro risk. Many companies have signaled weaker consumer spending, which may start to impact eBay’s GMV as well.

- Net debt position. Unlike many large-cap tech stocks, eBay is in a net debt position, which eventually may rein in its ability to run large capital returns programs.

All in all, this is a great play for active traders to pick up on, especially after the recent Q3 earnings dip.

Q3 download

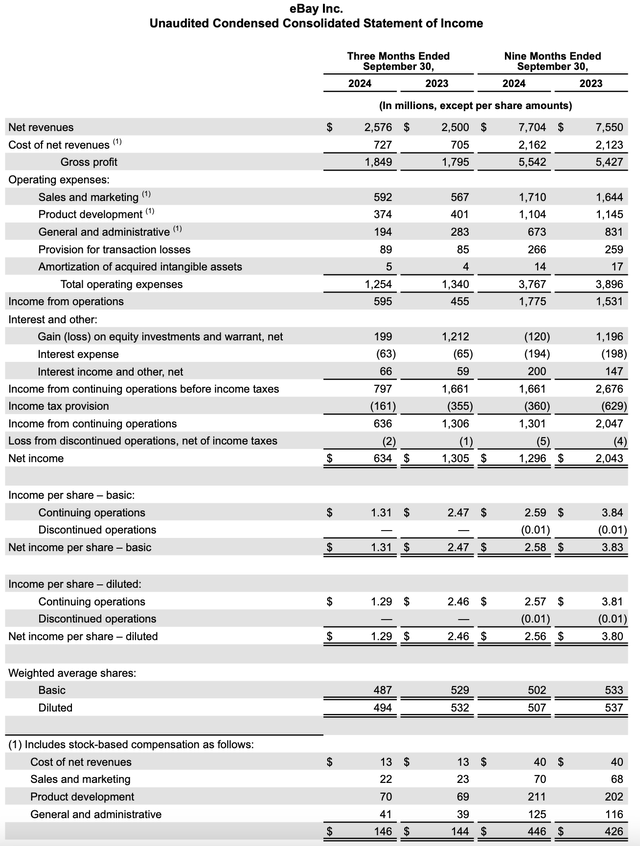

Let’s now go through eBay’s latest quarterly results in greater detail. Take a look at the Q3 earnings summary below:

eBay Q3 results (eBay Q3 earnings deck)

eBay’s revenue grew 3.0% y/y to $2.58 billion, beating Wall Street’s expectations of $2.55 billion (+1.8% y/y) by a one-point margin. Revenue also accelerated one point versus 2% y/y growth in Q2.

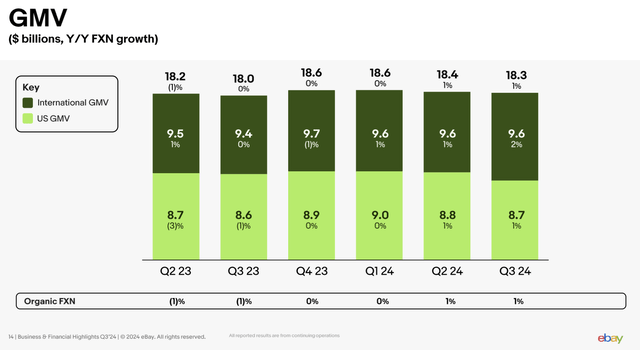

Revenue growth was primarily driven by a pickup in GMV trends. The company’s GMV growth rate on a spot basis (as-reported) rose 2% y/y, versus 1% in Q2, with positive growth in both the U.S. and internationally.

eBay Q3 GMV (eBay Q3 earnings deck)

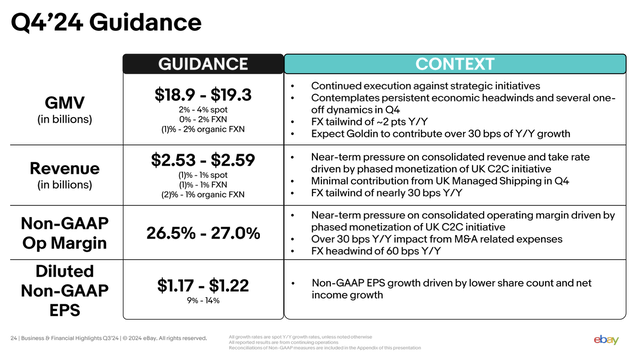

Furthermore: the company is expecting its current strength to bleed over in Q4 as well. The company is expecting GMV to keep taking off to a 2-4% y/y growth rate in Q4 (though with two points of FX tailwind).

eBay guidance (eBay Q3 earnings deck)

The company noted that strength in Collectibles drove GMV in the quarter, but eBay is also working to expand into new focus categories as well, including fashion apparel. Per CEO Jamie Iannone’s remarks on the Q3 earnings call:

Collectibles had a particularly strong quarter as trading GMV accelerated to double-digit growth in Q3, driven by strength in sports trading cards and collectible card gains both on the eBay platform and through our subsidiary, TCGplayer […]

Fashion is also a critical entry point for us. As nearly one in five new sellers and buyers come to eBay through fashion category. During Q3, we launched a new creative campaign called Things People Love to raise awareness of eBay’s value proposition in pre-love fashion. We focused on driving relevance with key audiences like GenZ by highlighting eBay’s breadth and depth of quality pre-loved inventory backed by truck.

Our full funnel marketing strategy has been instrumental in driving continued momentum in focused categories and healthier trends in active buyers, which grew nearly 1% to $133 million in Q3.”

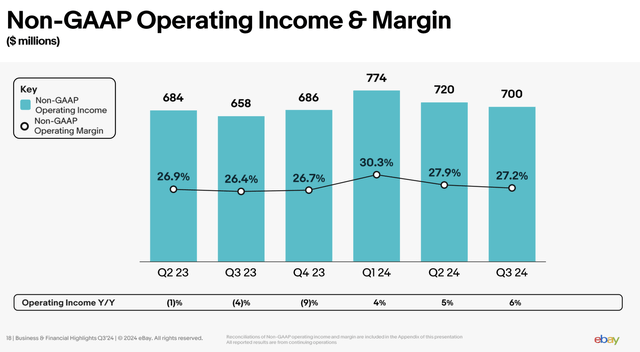

On the profitability side, eBay also boosted its pro forma operating margins by 80bps y/y to 27.2%. Raw operating profit dollars, meanwhile, rose 6.3% y/y to $700 million, as shown in the chart below:

eBay margins (eBay Q3 earnings deck)

The company’s pro forma EPS of $1.19 also slightly edged out over Wall Street’s $1.18 consensus expectations.

Key takeaways

In my view, eBay’s post-earnings slide is unjustified and creates a great short/midterm buying opportunity. Active investors can take advantage of a company that continues to trade at an advantageous price, and yet is also accelerating its GMV and revenue trends while breaking into new categories like fashion. Over the long haul, I have doubts about eBay’s staying power amid the dominance of rival e-commerce platforms that don’t have the legacy-brand baggage that eBay does. However, in my view, we’ll be able to score gains on this stock long before those issues become a concern.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in EBAY over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.