Summary:

- Despite a Q3 beat-and-raise, Fiverr faces significant risks from AI competition, volatile traffic, and a shrinking active buyer base.

- Fiverr’s growth is driven by take rate expansion, not sustainable long-term drivers, and the SMB buying environment remains cautious.

- Attractive valuation multiples can’t offset the existential risks from AI and declining marketplace activity; I recommend staying on the sidelines.

- Fiverr’s Q3 revenue grew 8% y/y, but active buyers slipped 9% y/y, indicating underlying marketplace challenges despite improved adjusted EBITDA margins.

- The stock trades at attractive valuation multiples (2x FY25 revenue and 9x FY25 adjusted EBITDA), but it’s a value trap for a company that is in secular decline.

10’000 Hours

So far, through the early innings of the Q3 earnings season, investors have tended to take a favorable view of most companies’ earnings prints, especially where top-line revenue trends have bucked macro concerns and shown strength or even acceleration. And yet, we have to be extremely careful: valuations are hovering at historic highs, and not every company’s successful recent trends can be sustained.

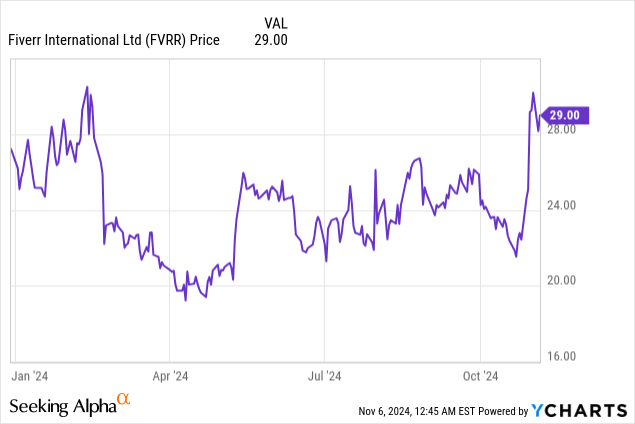

Fiverr International Ltd. (NYSE:FVRR) is one stock where caution is certainly the order of the day. Shares of the freelance marketplace have jumped nearly 20% after reporting a beat-and-raise in Q3. And yet, I continue to find tremendous risk in this stock, especially as it sheds active buyers: a reflection of the very real fact that automation and AI compete directly against many of the use cases for a Fiverr freelancer. Year to date, Fiverr has now gained ~10%, underperforming the S&P 500: but I fear even these paltry gains may reverse.

I last wrote a bearish update on Fiverr in August, when the stock was still trading at $26 per share. Though I didn’t expect the post-earnings upside in Q3, I continue to focus on concerning metrics such as active buyer slippage. And especially amid a richer valuation for Fiverr, I am reiterating my sell rating here.

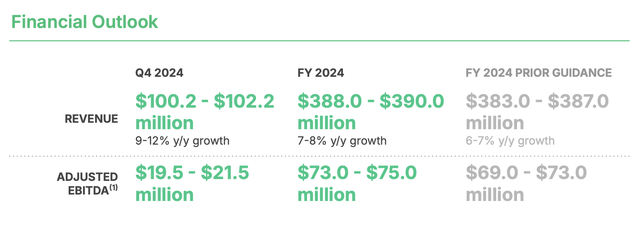

Yes: we will acknowledge that the company delivered a respectable beat-and-raise, and lifted its outlook for the current year by one point of growth:

Fiverr outlook (Fiverr Q3 shareholder letter)

But we have to ask ourselves: how much of this recent uptick in growth is sustainable? The company drove growth in the quarter entirely through take rate expansion, as it has been pushing various initiatives to drive higher seller monetization. Meanwhile, the company notes that the overall buying environment in the SMB space remains cautious.

Here is my full updated bear case for Fiverr:

- Risk of cannibalization from AI: While Fiverr also tries to emphasize the fact that it’s embedding AI across its platform, there can be no doubt that AI’s increasing ease of use is a threat to many core Fiverr functions. Many core Fiverr services, such as language translation, logo design, website setup, and other similar services can conceivably be done better by AI.

- The highly competitive landscape for freelance work: Fiverr is far from the only game in town when it comes to freelance marketplaces, with competition from companies like Upwork, Toptal, Freelancer, and Taskrabbit.

- Volatile traffic metrics: Fiverr itself has noted that traffic trends tend to be quite volatile, and one quarter’s success doesn’t mean that better traffic can be sustained.

- SMB exposure: Fiverr has a heavy concentration of smaller individual and SMB clients, which have been the biggest source of churn across the software industry this year. Fiverr’s own active buyer base is shrinking, a testament to tougher macroeconomic conditions for smaller firms.

Of course, given the recent upside, I do also see some “upside risks” to the bear case here:

- Shift upmarket: Fiverr has been successful at promoting programs that are driving higher spending per buyer (and drawing in higher-spending buyers). Bigger tickets overall can help to offset the gradual bleed-off in active buyers.

- Reasonable bottom-line valuation: As adjusted EBITDA creeps up in both absolute dollar terms and margin, Fiverr continues to trade at reasonable bottom-line multiples (especially amid a rich stock market), which could prompt a multiple re-rating.

This being said, overall, I see an uncompelling risk-reward profile here as Fiverr continues to trudge along with meager growth rates and loses buyers. Steer clear here and invest elsewhere.

Q3 download

Let’s now go through Fiverr’s latest quarterly results in greater detail. The Q3 earnings summary is shown below:

Fiverr Q3 results (Fiverr Q3 shareholder letter)

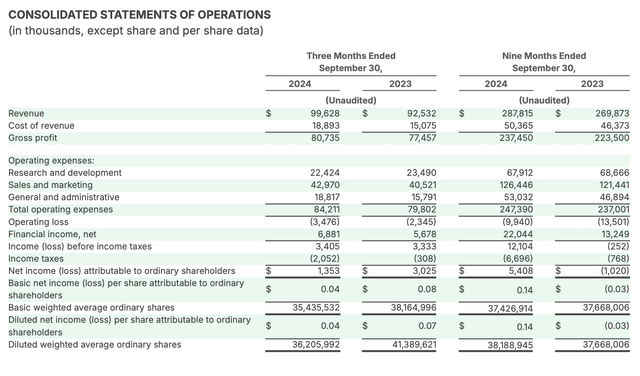

Revenue grew 8% y/y to $99.6 million, ahead of Wall Street’s expectations of $96.3 million (+4% y/y) by a wide four-point margin. The company drove revenue growth primarily through take rate expansion (take rate is the amount that Fiverr generates in revenue as a percentage of the dollar total of services transacted on its platform), which jumped 260bps y/y to 33.9%. The company is expecting further acceleration in revenue growth in Q4, where it has guided to 9-12% y/y top-line growth.

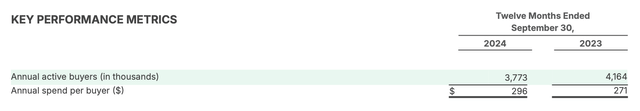

Still, we continue to note degradation in the company’s active buyer base, which it defines rather liberally as a person who has completed a transaction over the past year. Active buyers in Q3 slipped to 3.77k, -9% y/y (offset by a 9% y/y boost in annual spend per buyer), and a loss of 115k buyers relative to Q2.

Fiverr buyer counts (Fiverr Q3 shareholder letter)

Furthermore, though Fiverr doesn’t explicitly highlight GMV or total marketplace sales, we can back into the math using revenue and take rates. Dividing the company’s $99.6 million in revenue by its 33.9% take rate, we can deduce that in Q3, $293.9 million was transacted on the Fiverr platform: and in the year-ago quarter, with $92.5 million in revenue and 31.3% in take rate, it was $295.5 million. Therefore, Fiverr’s platform itself appears to only be holding flat or shrinking. The company is only managing to grow revenue by pushing value-added services that generate more revenue for the company, or is otherwise increasing its pricing on sellers: which I don’t view to be longer-term growth drivers that can be sustained.

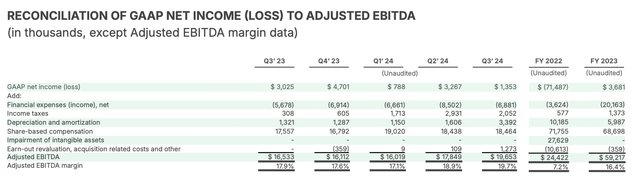

On the profitability front, we do acknowledge that the company’s adjusted EBITDA grew 19% y/y to $19.7 million, with a margin of 19.7% that improved 180bps y/y.

Fiverr adjusted EBITDA margins (Fiverr Q3 shareholder letter)

Overall, management’s view is still that the buying environment remains cautious, though it has passed recent bouts of volatility. To me, this is an indication that we shouldn’t bank on revenue acceleration or continued margin expansion. Per CEO Micha Kaufman’s remarks on the Q3 earnings call:

On the macro level, we have seen some level of stabilization in trends since the volatility we experienced in June and July, however, the overall SMB sentiment remains weak, and the overall hiring environment continues to be challenging. We expect GMV will still take some time to recover, in the meantime, we believe our strategy to lean into products to drive wallet expansion, and our work to unlock new addressable markets continues to be the right strategy to generate growth catalysts.”

Valuation and key takeaways

At current share prices near $29, Fiverr trades at a market cap of $1.02 billion. After we net off the $663.7 million of cash and $457.2 million of convertible debt on the company’s latest balance sheet, its resulting enterprise value is $813.5 million.

Meanwhile, for the next fiscal year FY25, Wall Street analysts are expecting Fiverr to generate $2.61 in pro forma EPS (+8% y/y) on $421.0 million in revenue (+8% y/y). And if we assume a 20% adjusted EBITDA margin on that revenue profile (equivalent to the company’s Q4 guidance margin, and a slightly richer margin than what Fiverr generated in Q3), adjusted EBITDA would be $84.2 million (+14% y/y). This puts Fiverr’s valuation multiples at:

- 1.9x EV/FY25 revenue.

- 9.8x EV/FY25 adjusted EBITDA.

- 11.1x FY25 P/E.

To be sure, these are attractive valuation multiples in an expensive stock market: but it’s for a company that, in my view, faces existential risk from AI and whose expanding take rates are masking weaker marketplace activity and a declining buyer base.

In my view, it’s best to be on the sidelines for Fiverr and invest elsewhere.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.