Summary:

- Palantir’s Q3 earnings exceeded expectations, driving the stock above $50, but stock-based compensation and slowing customer growth raise concerns.

- Despite impressive US commercial revenue growth, Palantir’s need for specialized labor limits scalability and total addressable market.

- The stock’s recent 40% rally prompts a downgrade to Sell, as high growth and margin expectations may not be sustainable.

- While Palantir remains a strong business, it’s prudent to take profits now, with potential future surprises on growth and margins.

Artur

Thesis Summary

Palantir (NYSE:PLTR) crushed earnings and broke above $50, which is actually at the high end of the short-term target I had based on technical analysis.

The earnings report showed some very encouraging trends, and investors are now catching on to the fact that Palantir’s technology is indeed revolutionary.

However, as price and sentiment reach a fever pitch, I invite investors to focus on Palantir’s weak spots, and perhaps even take some profit at these levels.

The recent advance in the stock price raises an important issue, which is the increased burden of stock-based compensation.

Furthermore, as we dig deeper into the numbers, we can see some problematic trends. While Palantir has done very well to grow US revenues, its customer growth has been slowing down.

It seems like in order to grow further, Palantir will have to keep expanding its workforce of salespeople/engineers. Furthermore, since Palantir is not a plug-and-play solution and comes at a steep price, this will severely limit the TAM and even margins.

In my last Palantir article, I argued the stock could reach $100. This was a more long-term target based on fundamentals.

However, given some of the worrying trends I am seeing, I think this may have been too bullish. Paired with the fact that we have rallied nearly 40% in four weeks, this leads me to downgrade Palantir to a Sell.

Palantir Q3

The Messi of AI just can’t seem to miss. Quite the opposite, in fact, as the company beat on both revenue and earnings estimates in Q3.

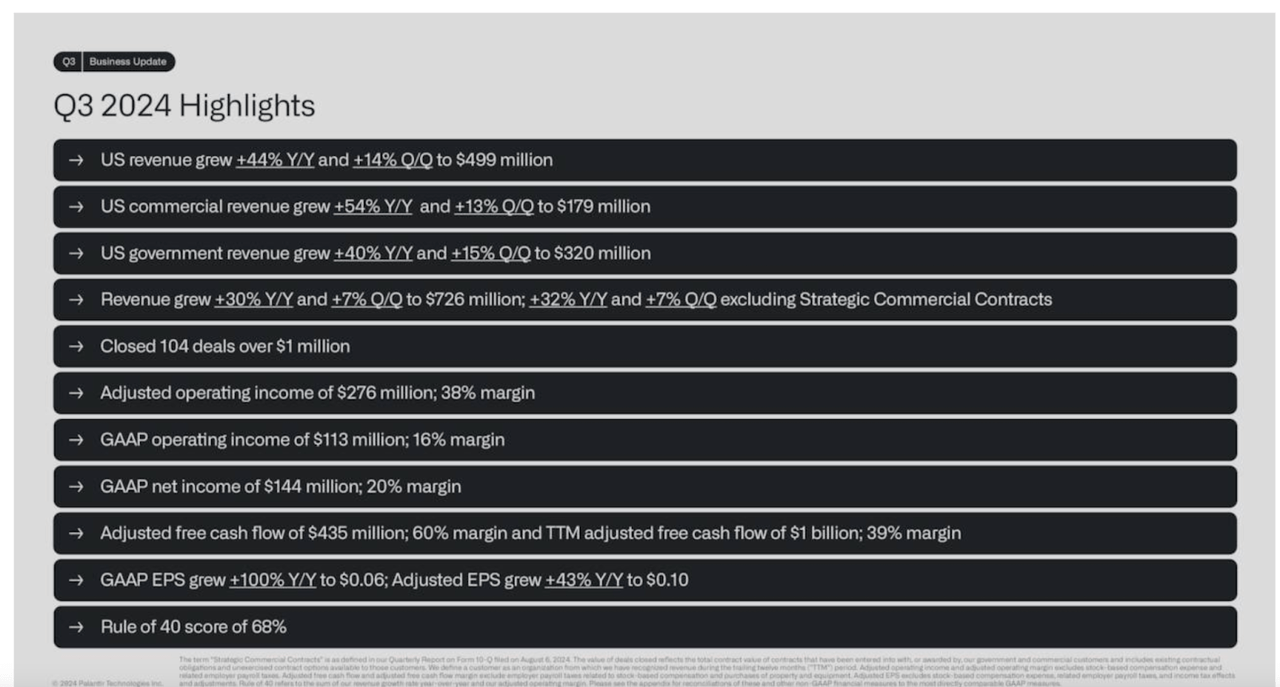

Q3 highlights (Investor slides)

Revenues increased 30% YoY and 7% QoQ. But perhaps what investors were most impressed by was the impressive growth in US commercial revenues, 54% YoY.

This is continued and definite proof that Palantir is much more than a government contractor. It is carving itself a place in the commercial fabric of the economy.

Specifically, AIP has proven itself to be an invaluable tool, and perhaps one of a kind, at least for the time being.

Our U.S. Commercial business continues to see unprecedented demand with AIP driving both new customer conversions and existing customer expansions in the U.S., as we continue to deploy AI models in production.

Source: Earnings Call

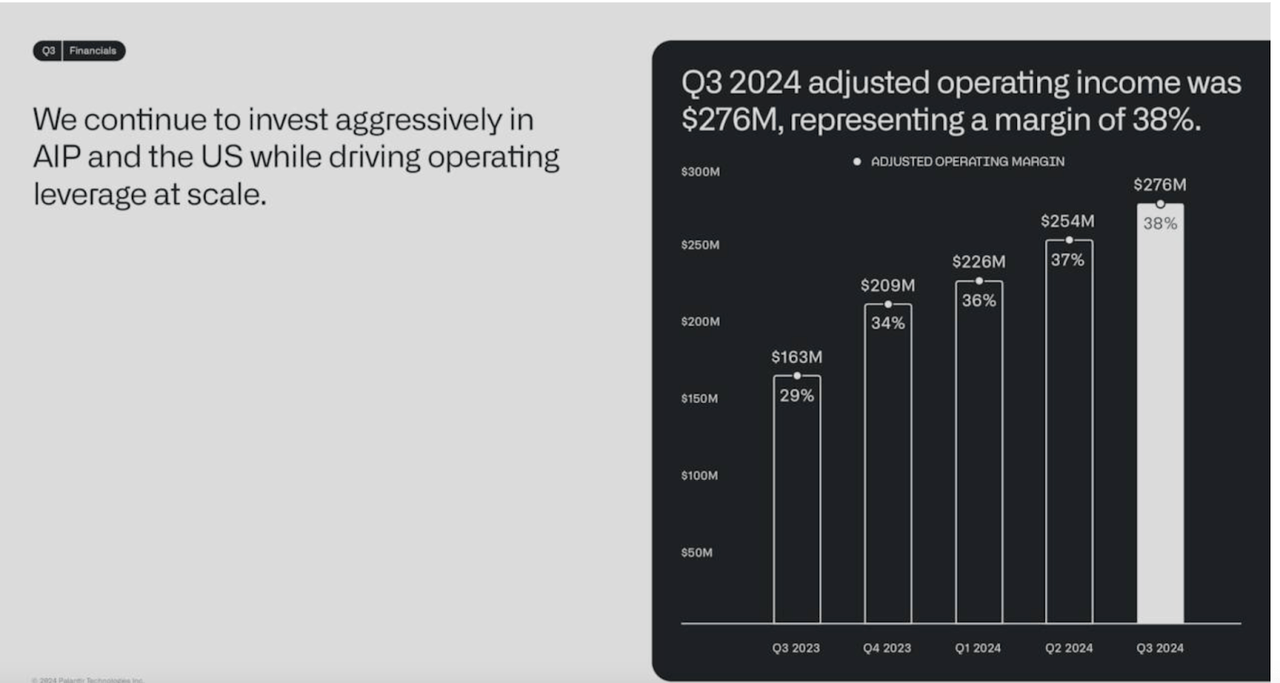

Palantir operating margin (Investor slides)

And of course, we also saw a continued expansion in Adjusted Operating Income, with cash flows projected to come in close to $1 billion for the full year.

Q3 was a victory lap for Palantir, and sentiment has reached a fever pitch.

Which is exactly why it’s time to play devil’s advocate. Palantir has a fantastic business, I’ve made the case many times before. But does it justify the price today?

Too Good For Its Own Good

Ironically, Palantir’s incredible stock performance highlights a challenge moving forward, and that is stock-based compensation.

While this may sound like old news, it is now more important than ever.

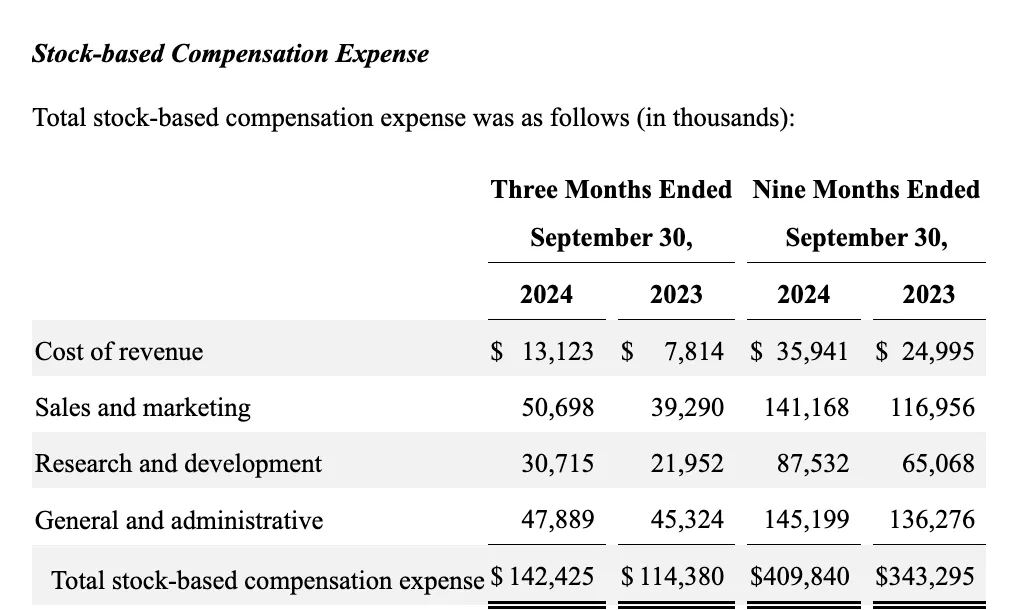

SBC (10Q)

Firstly, because SBC has been increasing substantially in the last nine months and this is a trend that is likely going to continue. It was even addressed as a headwind by Alex Karp in the earnings call.

On the back of the company’s strong performance, our inclusion in the S&P 500 and the increase in our stock price, we will continue to monitor if we become required to accelerate stock-based compensation expenses if certain market-based vesting criteria are achieved earlier than expected

Source: Earnings Call

Yes, there’s some real demand for AIP, but this means that Palantir is also having to increase its workforce. Which brings us to another key question.

Is Palantir Really A SaaS?

That’s the real issue here. Palantir has for a very long time been known as a government contractor. It has a very specialized offering, which it tailors to very specific contracts and use cases by employing a large team of engineers.

Gotham or Foundry are not plug-and-play solutions, and neither is AIP. Yes, the company has run numerous boot camps and offered a limited free version for developers, but when it comes to real commercial applications, AIP needs to be sold together with man-hours.

This presents us with two issues:

-

Palantir’s long-term margins could be limited since it will require an ever-expanding workforce to meet increased demand.

-

Palantir isn’t as scalable as investors might think, and the TAM isn’t actually that large

What’s Palantir’s Real TAM?

This is an important question, and in fact, we can already see a rather concerning trend.

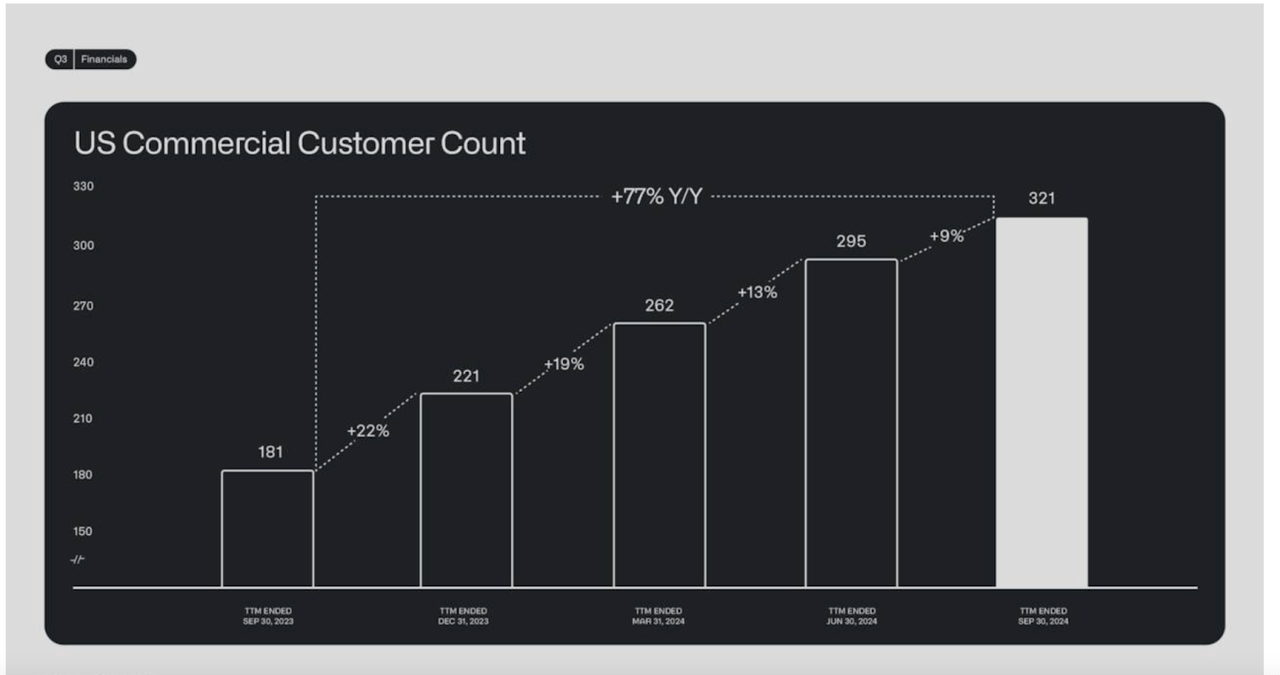

US commercial customer count (Investor slides)

Sure, commercial revenues are increasing, but growth in US commercial customer count is actually slowing down. Palantir only added 26 new customers in Q3, a 9% QoQ increase.

This somewhat conflicts with claims that AIP is seeing very high demand. Or, perhaps, it proves that Palantir can’t, in fact, service all of this demand, because of the limitations posed by labour.

It seems like a lot of the growth in commercial revenues is coming from increasing the value of existing contracts.

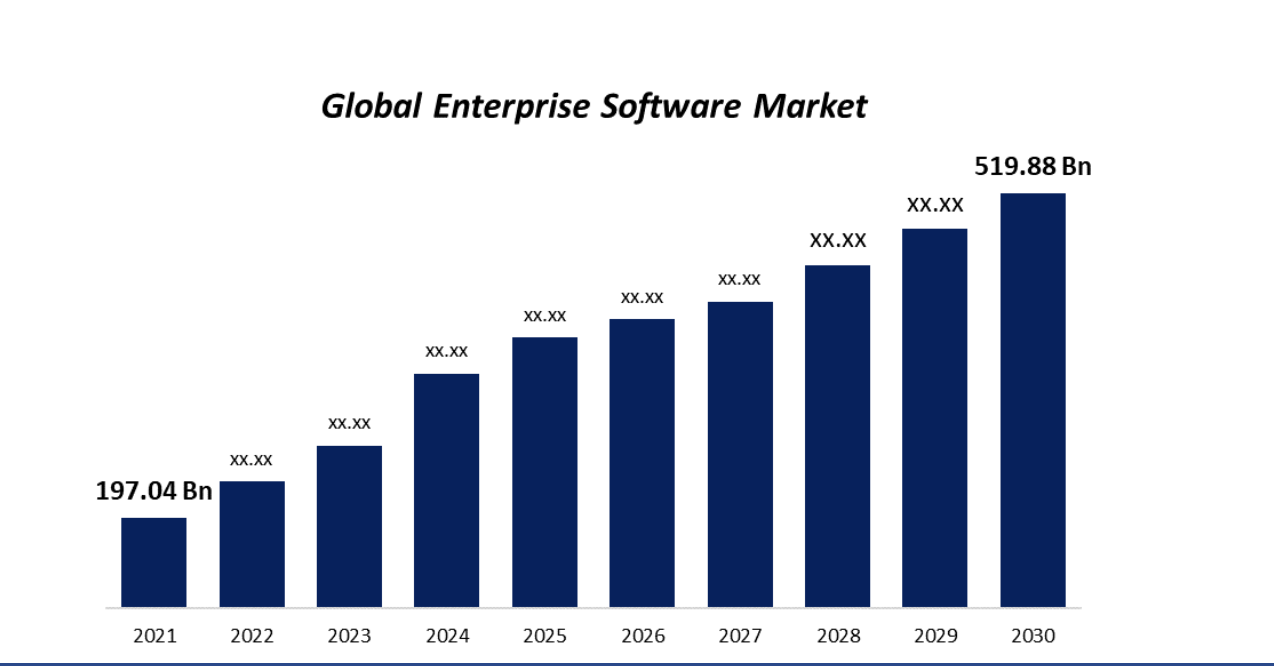

Now, in my previous article, I argued that Palantir could target the $500 billion enterprise Software Market.

Global Enterprise Software (Spherical Insights)

However, this may not be quite true at the moment. Given the expenses associated with using Palantir and the need for highly specialized labour, Palantir’s AIP may only be suited for very large enterprises, which makes sense if we think of AIP as an extension of what the company does for the government.

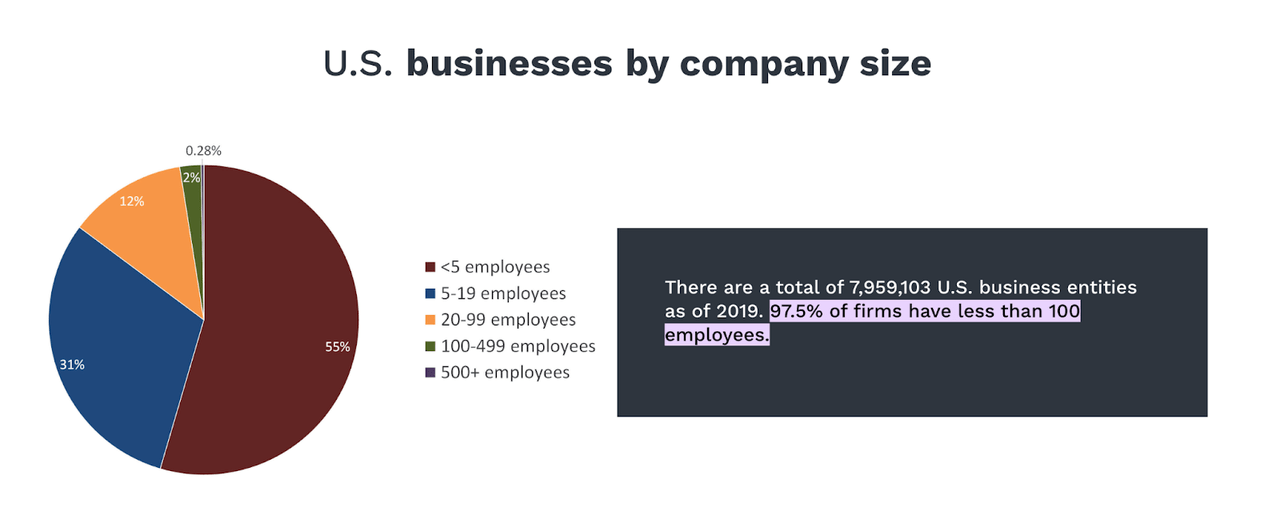

Us Business By Company Size (datapops)

In reality, Palantir may only be targeting around 2.5% of US businesses, which would be those businesses with over 100 employees. Start-ups and smaller businesses simply won’t be suitable clients for Palantir.

Final Thoughts

Where does this leave us, then?

I argued in my last article that Palantir could reach a price target of $100. This was based on long-term projections and very bullish assumptions. Now, barely a month later, we are trading close to $60.

Plus, I think we may see some nasty surprises in the future, by which I mean Palantir may not be able to deliver the high growth and margins a lot of people are expecting.

This is still a great business, but it’s run too far. I also said a few months ago I would sell Palantir for around $50, and I stand by that decision. It’s time to take profits, though I will keep some exposure.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This is a high-risk/high-reward opportunity, which is exactly what I look for in my YOLO portfolio.

Joint the Pragmatic Investor today to get insight into stocks with high return potential.

You will also get:

– Weekly Macro newsletter

– Access to the End of The World and YOLO portfolios

– Trade Ideas

– Weekly Video