Summary:

- Accenture has a strong moat in the Artificial Intelligence space and capability to generate demand, but its revenues are still growing at a sluggish pace of ~1-2%.

- The company has a rich valuation due to AI-driven optimism and is trading at a P/E of mid-20s and P/S of ~3.

- AI contributes over 5% to revenue, but overall growth remains stagnant despite $6.6 billion spent on acquisitions.

- Profitability for the company has improved, but further expansion in margins might be challenging due to the unique manpower-heavy business model.

HJBC

Over the last one year, the stock of Accenture plc (NYSE:ACN) has had a crazy rollercoaster ride. By April, the stock had risen over 25% compared to its levels in January, driven by an enthusiasm for increased demand from artificial intelligence. However, as the AI wave lost its steam, the stock dropped back and reached around $280. Currently, the stock is up around 20% from its lows in 2024 based on optimism related to an increased prolonged demand for AI-related services.

My investment thesis is that the current enthusiasm around AI-related demand is unlikely to translate into strong overall sales growth for the company. Even though the 2024 earnings of the company saw the share of AI-related projects skyrocket to ~5% of the portfolio, the overall revenue growth was just 1% YoY. Additionally, while the company is increasing its margins on a YoY basis due to efficiencies, the total extractable value from productivity enhancements is limited due to the business model which is heavily dependent on people to deliver consulting & digitization engagements. Lastly, the company is commanding a rich valuation – with a P/E> 26 and P/S> 3- despite a YoY growth of just 1%. This leaves little room for error, and any bad news from the company (be it a revenue miss or generally fading AI enthusiasm) can lead to a sharper correction in the stock price.

2024 performance

Accenture is a world-renowned professional services company, providing services under digital transformation, operations optimization, growth acceleration, and service enhancement. Its business model is extremely manpower heavy, with around 775K individuals catering to clients in 120+ countries. While Accenture has carved out a unique niche for itself in the IT consulting space, it competes with different companies on multiple fronts. It directly competes with McKinsey, BCG & Bain (MBB) & Big 4 firms (EY, PWC, Deloitte & KPMG) for the management consultancy business. It also competes with IT services providers like Infosys Limited (INFY) and Wipro Limited (WIT) for its outsourcing and digitization business. Lastly, at some level, Accenture is also indirectly competing with hyperscalers like Alphabet Inc. (GOOG) (GOOGL), Amazon.com, Inc. (AMZN), and Microsoft Corporation (MSFT), who are increasingly directly offering their clients, not just cloud, but a fully integrated business solution based in the cloud. Although, largely, the hyperscalers are more interested in partnering with the likes of Accenture to tap their clients with cloud offerings.

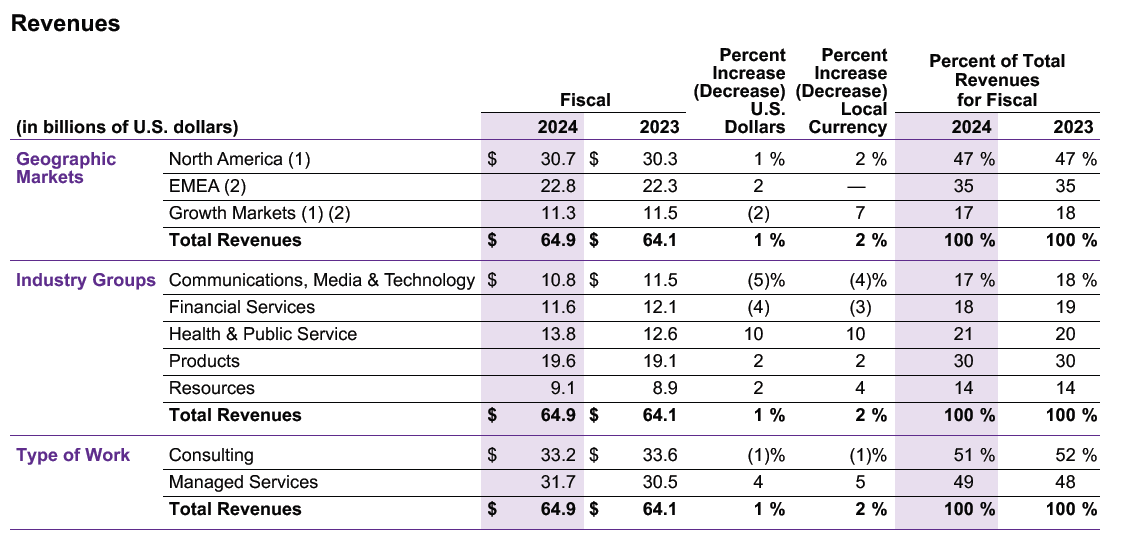

For 2024 Accenture’s revenue of $64.9 billion reflected just a 1% increase in USD terms and a 2% increase in local currency equivalent. The trend was consistent across geographies with North America growing at 1%, EMEA growing at 2%, and growth markets declining 2% in USD terms. It is noteworthy to mention that North America and EMEA are the largest revenue contributors for Accenture and contribute around 82% of its total revenue. In my opinion, despite the glaring optimism in the market about a new wave of artificial intelligence related to demand, Accenture has not seen this demand clearly getting translated to revenue. This is the first red flag and indicates the tricky nature of Accenture’s business, where it has to constantly balance between demand and supply (available consultants/ researchers), and faces some lag as it cannot quickly hire or fire its people.

Accenture revenue split by segment (Annual Report)

On analyzing Accenture’s revenue from different industry groups, we see a similar trend. Accenture’s revenue from different industries is well diversified, as you can see from the table above. However, it is important to note that certain segments like the Communications, Media & Technology segment & Financial Services actually de-grew by ~4-5% YoY. I believe this is not typical of a traditional growth company, which would consistently see a sharp increase in its revenue on a YoY & QoQ basis – and should ideally be reflected in the valuation multiple.

Last, but most importantly, it is interesting to see the evolution of Accenture’s revenue contribution from consulting and managed services segments, respectively. The consulting segment revenue was $33.2 billion and actually declined slightly from last year. The decline was driven by reduced discretionary IT spending by clients. At the same time, the managed services segment generated $31.7 billion and increased YoY due to an increased demand for cloud transformation and digital initiatives. I emphasize this split because, from my experience, I am aware that most S&P 500 companies look at their budgets for IT and Digitization as a whole. These organizations have an annual budgeting exercise and usually earmark a part of their annual revenue for these spends on IT/ Consulting/ Digitization at the corporate level. Given the budget allocation to the segments is usually limited, it is very common for the companies to allocate more projects in the digitization space and then reduce some projects from the consulting or outsourcing division. Since revenue of Accenture is completely dependent on their share of wallet within this budget, in my opinion, it would be very tricky for Accenture to be able to exponentially increase its revenue, unless the clients allocate an exponentially higher budget for their consulting and digitization segments together. This should keep the overall revenue growth in low-to-mid single digits, unless Accenture aggressively acquires new clients.

Profitability analysis

Accenture’s Net Margin in 2024 was 11.2%. This is good positive news and the margin has improved by around 60 basis points from 2023. The main reason for margin enhancement is lower labor costs, which is driven by better utilization of its existing employee base and strategic hiring in lower-cost regions like India. In 2023, Accenture had a large number of staff, some of whom were on the bench and were not getting utilized. The company fired over 19,000 employees, like most other companies in the consulting space, and was able to also lower fresh hiring in regions like the US and Europe. At the same time, the company strategically hired in lower-cost regions like India, helping it expand the overall margin.

Consequently, Accenture’s EPS increased to $11.57 from $10.9 last year. This is good news for Accenture. However, I do not expect this to be sustainable in the very long run. I say that because Accenture is an inherently client-focused business with a high dependence on manpower. Given it is generating over 80% of its business from North America & EMEA, there is only a particular limit to which it can offshore its back-end operations (Like research) to countries like India, and it would still need to maintain a large client-facing base of employees in North America and Europe to interact with the clients and generate revenue.

Artificial intelligence

As mentioned previously, Accenture has been riding a new wave of optimism driven by its artificial intelligence offerings. I do see some merit in this because Accenture has been an early adopter/ integrator of artificial intelligence and has been providing these services to different S&P 500 companies for over a decade. Artificial intelligence already contributes more than 5% to Accenture total business and has been growing at a massive rate. Given its leadership position in the industry, I anticipate Accenture will keep getting a good share of clients’ wallets. Additionally, I believe that Accenture is also likely to get a larger share of clients’ overall consulting spend and will win some projects which would have previously been assigned to Big 4 consulting firms or MBB consulting firms.

Another added AI advantage for Accenture is its ability to leverage AI to reduce its own costs and improve efficiency. Accenture has traditionally been in a very people-heavy business and requires a large number of researchers and consultants to deep dive into the industries and provide recommendations to clients. Since Accenture has been in the space for long, it has already built a very vast database of domain knowledge and captured it well internally in their knowledge portals to enhance efficiency. It would be very easy for the company to apply large language models on their existing database to gather data and insights for delivering solutions to clients at a much faster base than traditional consulting firms would be able to do.

Having said that, it is noteworthy to mention that in 2024 Accenture generated $3 billion in new bookings specific for generative AI. This is roughly 5% of its total bookings this year, but their annual revenue grew only by 1%. This is a clear red flag and indicates that while clients are spending more on generative AI-related projects, they are doing so at the cost of traditional projects such as outsourcing or management consulting engagements. From a customer perspective, this makes sense. I would either spend $100 million on outsourcing my customer service operations to Vietnam or spend $100 million on building artificial intelligence capabilities and replacing them with a chatbot. However, I would ideally not do both of them at the same time.

Acquisitions

In 2024, Accenture spent $6.6 billion on 46 strategic acquisitions. Particularly, it has been focusing on niche areas that are high growth like cybersecurity, cloud, data, AI, and industry-specific applications that provide Accenture with the domain expertise in these areas. Accenture in turn has access to a large network of client connections and can cross-sell and upsell these capabilities to its different clients.

While this strategy should be a win-win in the long run, the market usually underestimates the integration complexities. In a large and complex organization like Accenture, it is very challenging to integrate different acquisitions into the main business, especially because of the high number of acquisitions that the company is undertaking. Even within Accenture, there would be a complex revenue-sharing agreement for the revenue generated by cross-selling. These projects would be shared amongst different internal stakeholders in predetermined ratios, leading to some friction in the seamless deployment of the solutions due to incentive misalignment.

Despite the aggressive spending by Accenture on these acquisitions, which are usually categorized as capital investments, and are captured in the balance sheet, (Not Profit & Loss) – we do not see a significant rise in Accenture revenue, which is still growing at only a 1% annual rate. Hence, I anticipate at some point Accenture may have to write off its investments in some of these companies and currently the street has limited oversight on the specific revenue generated by different investments.

Valuation

As per Seeking Alpha, Accenture is currently trading at a P/E of 26.92. For a company which has grown revenue by just 1% last year and has a three-year CAGR of 8.7% and five-year CAGR of 8.47%, I believe the multiple is very high. The company has a price-to-sales ratio of 3.34. This also seems very high given that its net margin is only ~10-11%.

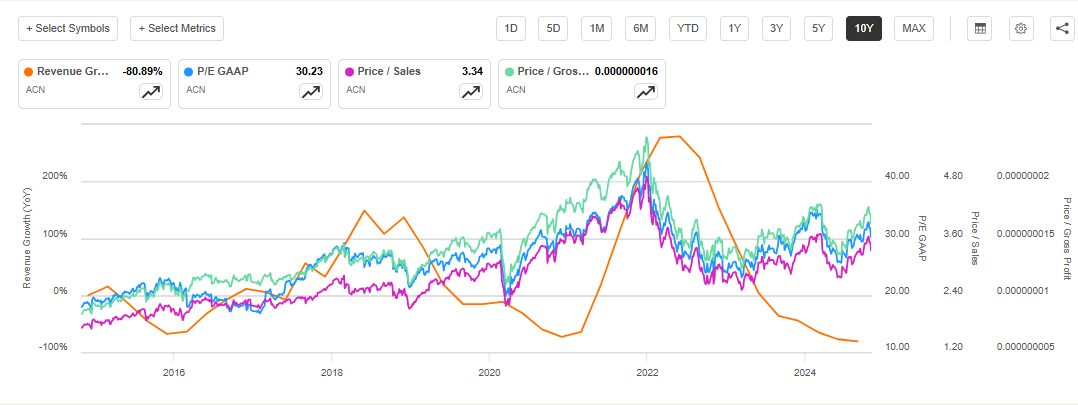

On undertaking a time series analysis of the company, we see that most valuation metrics like P/S, P/E & P/GP are all at elevated levels compared to the last 10-year average. When we plot the revenue growth of the company, in the same graph, we see that this is despite the fact that revenue growth is at an historical all-time low. The only period in the last 10 years when revenue multiples were higher than current levels was in 2021 and 2022, as the company was seeing a post-COVID uptick in revenue and was growing at astronomical levels on a low base. I believe that the current multiples are not sustainable, and I do not see a clear path on how the company will be able to grow its revenue at a double-digit level next year, making me believe that a correction in the stock price is imminent.

Accenture valuation multiples & Revenue growth (Seeking Alpha)

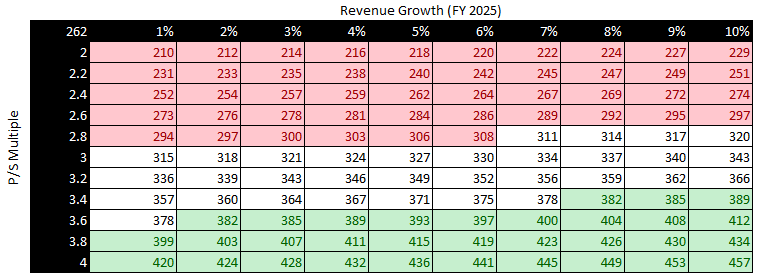

On undertaking a sensitivity analysis of the expected growth rate and valuation multiple, we see that for the company to generate more than 10% shareholder return the company will have to either grow its revenue over 8% at the current P/S valuation multiple (which seems very less likely), or it will have to further expand its P/S multiple to over 3.8 over the next year. At the same time, if the company continues to grow at the current run rate of 1% to 2% any drop in the multiple closer to its 10-year average below 2.8 is likely to destroy shareholder value by more than 10%.

Target 2025 Fair Value at different Growth rates & Multiples (Author estimates, using Seeking Alpha data)

In my base case, I anticipate the revenue to grow at ~ 1% and the multiple to converge near its 10-year average to somewhere at ~ 2.5 giving me a conservative fair value of 262.

Conclusion

To conclude, I believe that right now, Accenture is definitely a bit overvalued. I foresee Accenture is likely to disappoint in future quarterly earnings, leading to a multiple normalization near the 10-year average.

Another scenario which may pan out is that the hype around artificial intelligence fizzles out over the next 12 Months, but the company continues to deliver on top/ bottom line. Even in that case, there is a clear risk that the multiple of Accenture may contract purely based on sentiment (assuming revenue growth will be a beat vs expectation, but not be in the high-single digits).

Having said that, if we do see a new wave of AI-related enthusiasm in the markets over the next year, valuation multiples could continue to increase.

Given the strong business model and strategic positioning of the company, I would recommend long-term investors wait for a better entry point and not initiate any new positions in the company as of now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.